A 51% attack Bitcoin is a looming threat that has caught the attention of experts in cryptocurrency security. Rather than focusing solely on futuristic concerns like quantum computing, Duke Professor Harvey Campbell highlights that a non-trivial risk exists when a single entity gains majority control over the network’s mining power. This type of attack could effectively undermine Bitcoin’s integrity and stability, raising serious Bitcoin security risks that stakeholders need to consider. Campbell estimates that executing such an attack could be achieved for merely $6 billion, a fraction of Bitcoin’s current market economic status. As investors and institutions explore Bitcoin, understanding the vulnerabilities in its network becomes essential to ensure trust and reliability within this revolutionary financial ecosystem.

The threat of a dominant force seizing control of the Bitcoin network, commonly referred to as a majority attack, is drawing increased scrutiny from crypto enthusiasts and analysts alike. Instead of overlooking tangible risks in favor of speculative threats posed by advancements like quantum computing, Harvard Professor Harvey Campbell emphasizes the urgency of addressing the potential for market manipulation in the Bitcoin realm. This scenario, where one entity monopolizes mining resources, could lead to catastrophic implications for the cryptocurrency’s valuation and investor confidence. Understanding the underlying vulnerabilities within the Bitcoin framework is crucial as it garners recognition as a secure asset for institutional investment. As discussions surrounding Bitcoin policies and strategies continue to evolve, acknowledging such threats could redefine the future of digital currency.

Understanding 51% Attack Risks in Bitcoin

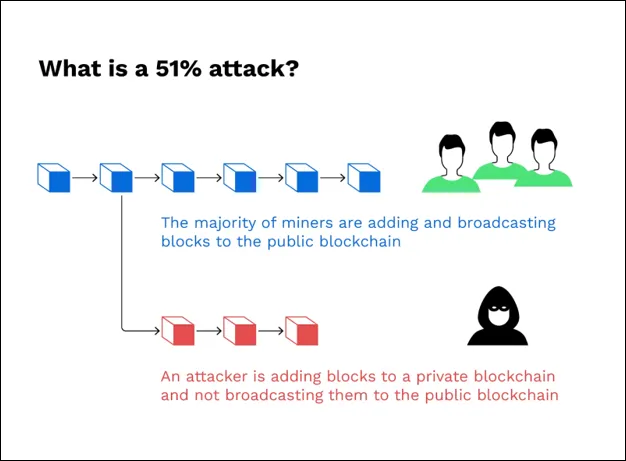

A 51% attack on Bitcoin represents a significant risk to the network’s integrity and overall security. In simple terms, a 51% attack occurs when a single entity or group of colluding miners gains control of more than half of the total mining power of Bitcoin. This gives them the power to manipulate transactions, double-spend coins, and undermine the consensus of the network. Harvard Professor Harvey Campbell highlights that the potential for such an attack poses a more immediate threat than other speculative risks associated with quantum computing.

The implications of this kind of attack can be devastating, leading to a severe drop in Bitcoin’s price and a loss of trust among users and investors. Given the current economic estimates presented by Campbell, executing a 51% attack could cost around $6 billion, representing only 0.26% of Bitcoin’s market capitalization. This cost makes it highly feasible for a determined adversary to attempt a hostile takeover of the network, particularly as Bitcoin grows in adoption and market relevance.

Market Manipulation and Bitcoin’s Vulnerability

The intersection of Bitcoin’s network vulnerabilities and market manipulation is particularly alarming. A successful 51% attack could be strategically executed by an entity looking to capitalize on Bitcoin’s price movements. Whether manipulating the market to increase profits on short positions in futures trading or exploiting the trust deficit created by an attack, the motivations are troubling. Harvey Campbell suggests that the volumes traded in Bitcoin futures and perpetual contracts are substantial enough to enable profitable manipulation, which could offset the costs incurred by conducting a 51% attack.

This scenario raises significant ethical and legal questions regarding market practices and the very nature of Bitcoin as a decentralized asset. While traditional markets are regulated, Bitcoin’s largely unregulated status allows for potential exploitation. If traders can take advantage of the situation post-attack, it would not only harm the Bitcoin community but also tarnish its reputation. The awareness of these risks should lead to greater scrutiny of both market practices and the underlying technology enhancing Bitcoin’s security.

Quantum Computing Hazards: Overestimated Threats?

While discussions around Bitcoin and quantum computing often dominate headlines, Harvey Campbell posits that these fears may be overstated when compared to the risks posed by a 51% attack. Quantum computing could theoretically crack Bitcoin’s cryptographic security measures, leading to grave consequences for the blockchain. However, the reality of attaining sufficient quantum computing power remains a distant scenario, one fraught with technical challenges.

In contrast, the immediate risks of a 51% attack are much more palpable and actionable. As industries and governments assess the potential vulnerabilities in Bitcoin’s adoption for strategic reserves, the focus should shift to tangible threats that can be realized today rather than overwhelming concerns about a future where quantum computing is prevalent. By recognizing that the current technology might be maliciously exploited by an adversary today, the discussion around safeguarding Bitcoin’s integrity becomes crucial.

Financial Implications of a 51% Attack on Bitcoin

The financial implications of a successful 51% attack on the Bitcoin network could be catastrophic, not just for individual investors but also for larger institutions that have begun to acknowledge Bitcoin as a legitimate asset. The essence of Bitcoin’s value lies in its perceived security and decentralization, and any compromise to this foundation could incite broader economic repercussions. As highlighted by Harvey Campbell, a 51% attack could lead to immediate declines in Bitcoin’s market price, eroding confidence across financial markets engaging in Bitcoin derivatives.

In a scenario where trust is breached, recovery might not just be a matter of regaining lost capital but could also involve legal ramifications and financial instability in markets reliant on Bitcoin transactions. The potential economic damage raises questions about how Bitcoin should be treated within financial frameworks and how risks should be managed. This situation emphasizes the urgency for regulators, users, and investors to be cognizant of the underlying security vulnerabilities present in blockchain technology, especially as Bitcoin transitions to more mainstream adoption.

The Role of Institutional Investors in Bitcoin Security Risks

The rise of institutional investors in Bitcoin markets has been both a blessing and a curse, adding liquidity and legitimacy while heightening the stakes of a potential 51% attack. These entities bring substantial capital, which can inadvertently amplify risks associated with network vulnerabilities. When substantial financial interests are at play, the temptation for adversarial actions like a 51% attack becomes greater as the potential for profit increases. Harvey Campbell contends that institutional investors might find ways to exploit the resulting chaos and volatility following such an attack, manipulating Bitcoin-related trades to further their financial interests.

Thus, the way institutional players interact with Bitcoin markets demands scrutiny. As more businesses and nations adopt Bitcoin as part of their reserves, the need for secure mechanisms that protect the network from malicious actors will be paramount. Since institutional adoption is driven partly by Bitcoin’s promise of security, any failures in this realm could jeopardize the reputation of Bitcoin as a whole, creating an environment of distrust that could have long-term implications for its use as a global asset.

Geopolitical Consequences of Bitcoin’s Security Breaches

The geopolitical landscape is impacted by Bitcoin’s rise as a reserve asset, particularly in the context of global financial systems. If a 51% attack were to succeed, it could reshape national security policies regarding cryptocurrency usage and regulation. Nation-states are increasingly considering Bitcoin for their reserves; thus, a widespread understanding of such vulnerabilities might lead to tensions between nations, as some may view Bitcoin’s decentralized nature as an opportunity to assert financial independence, whereas others see it as a threat.

In this light, a potential 51% attack could incite political unrest and challenge the status quo of traditional banking systems. Countries that heavily invest in Bitcoin could find their economic strategies undermined, leading to a call for greater regulatory oversight or even international agreements to prevent malicious actors from exploiting Bitcoin’s weaknesses. The implications reach far beyond financial loss; they touch upon issues of sovereignty, national security, and geopolitical stability.

Mitigating Bitcoin Network Risks Through Collaboration

To combat the risks of a 51% attack and restore faith in Bitcoin’s infrastructure, collaboration within the community is essential. Miners, developers, and exchanges must work cohesively to implement robust security measures that mitigate the risks associated with network vulnerabilities. Initiatives such as pooled mining, where miners collaborate to share resources and reduce the likelihood of a singular entity gaining control, are one way to enhance the security of the Bitcoin network. Additionally, the development of more decentralized mining algorithms could also serve as a countermeasure.

Community awareness and transparency regarding potential attacks are critical. By openly discussing risks and sharing information on security advancements, the Bitcoin community can foster a culture of vigilance and preparedness. As Campbell points out, the low cost of a 51% attack should not deter efforts to address the problem but should instead galvanize the community to adopt innovative solutions that reinforce Bitcoin’s resilience against such threats.

The Future of Bitcoin: A Security Perspective

The future of Bitcoin remains intertwined with its ability to combat potential security risks, particularly the threats posed by a 51% attack. As Bitcoin becomes more integrated into institutional portfolios and accepted as a digital asset by countries, understanding and addressing these vulnerabilities becomes a matter of urgency. Bitcoin’s ability to maintain and enhance its security infrastructure will determine its long-term viability as a trusted financial instrument.

Furthermore, the intersection of technology and legislation will likely shape the landscape of Bitcoin security. As new technologies emerge and conversations around regulatory practices evolve, stakeholders must engage with the underlying issues that could jeopardize Bitcoin’s stability. By prioritizing security and risk management, Bitcoin can aspire to become a trusted currency for both individuals and institutions, solidifying its place in the global financial ecosystem.

Frequently Asked Questions

What is a 51% attack on Bitcoin and why is it a significant security risk?

A 51% attack on Bitcoin occurs when a single entity or group controls more than half of the network’s mining power. This majority control allows them to manipulate transaction confirmations and potentially double-spend coins. The risk is significant because it undermines Bitcoin’s core principle of decentralization, impacting trust in the network’s security and reliability.

How does a 51% attack compare to quantum computing threats in terms of Bitcoin security risks?

While quantum computing is often discussed as a potential threat to Bitcoin, Harvey Campbell suggests that a 51% attack presents a more immediate and economically feasible security risk. The ability for an attacker to control over half of the mining power could disrupt the network more effectively than quantum threats that, as of now, remain theoretical.

What is the estimated cost of executing a 51% attack on Bitcoin?

According to Duke Professor Harvey Campbell, a 51% attack could be executed for approximately $6 billion, which is about 0.26% of Bitcoin’s market capitalization, making it a concerningly affordable risk for potential attackers.

Can a 51% attack on Bitcoin lead to market manipulation?

Yes, a successful 51% attack on Bitcoin could provide opportunities for market manipulation. Rogue traders might take short positions in Bitcoin before the attack, profiting from the subsequent decline in price, which could expose vulnerabilities in Bitcoin’s market integrity.

What are the implications of a 51% attack for Bitcoin’s future as an institutional asset?

If the costs associated with a 51% attack are low, as Campbell suggests, it could affect Bitcoin’s adoption as a reserve asset by corporations and governments. The feasibility of such attacks raises concerns about the long-term security and stability of Bitcoin, which might dissuade institutional investment.

How would the Bitcoin network respond to a successful 51% attack?

If a 51% attack were successful, the Bitcoin network could face significant challenges in restoring trust and security. The community may propose changes to the network’s consensus mechanism or activate emergency measures to mitigate the attack’s effects, but restoring confidence after such a breach could take years.

What is Harvey Campbell’s view on the relationship between Bitcoin vulnerability and geopolitical stability?

Harvey Campbell posits that as Bitcoin becomes more entrenched in global markets, the low cost of executing a 51% attack raises concerns about geopolitical stability. Entities with the means to orchestrate such an attack could disrupt financial systems, highlighting Bitcoin’s intersection with national security.

What preventive measures can be taken to protect Bitcoin from 51% attacks?

Preventive measures against 51% attacks include promoting decentralized mining practices, encouraging more miners to join the network, and implementing updates to the Bitcoin protocol that increase difficulty or change consensus mechanisms, thereby making it more expensive and complicated to execute such attacks.

| Key Points | Details |

|---|---|

| 51% Attack as a Primary Risk | Duke Professor Harvey Campbell identifies a 51% attack as a more immediate threat to Bitcoin than quantum computing. |

| Economic Feasibility | The estimated cost of executing a 51% attack for one week is about $6 billion, which is 0.26% of Bitcoin’s market value. |

| Cost Breakdown | – Hardware: $4.6 billion – Data Center Construction: $1.34 billion – Electricity: $130 million per week |

| Market Manipulation Potential | The attack can be leveraged through financial markets, allowing traders to profit by shorting Bitcoin, thus making the attack economically viable. |

| Future Implications | Increased adoption by institutions could motivate a malicious actor to attempt a 51% attack, raising concerns about Bitcoin’s stability and security. |

Summary

A 51% attack on Bitcoin poses a significant threat that cannot be overlooked. As outlined by Duke Professor Harvey Campbell, the potential for such an attack is not only economically feasible but also presents broader implications for Bitcoin’s credibility and security in the financial landscape. Understanding the risks associated with a 51% attack Bitcoin is crucial for stakeholders to ensure the integrity and trust in this digital asset.