As we delve into the Bitcoin Q4 Outlook, the anticipation among investors is palpable. Recent insights from Coinbase and Glassnode indicate a cautiously optimistic sentiment among market participants, buoyed by improving liquidity and favorable macroeconomic conditions. In a survey conducted among investors, a significant 67% of institutional respondents expressed a bullish forecast for Bitcoin, underlining a growing confidence in its resilience during the final quarter of the year. This positive investor sentiment has been further reinforced by potential regulatory advancements and Federal Reserve actions that could stimulate market dynamics. As Bitcoin approaches the end of the year, careful crypto market analysis reveals that long-term holders are stabilizing, setting the stage for potentially exciting developments ahead.

When examining the future of Bitcoin in Q4, it’s essential to consider the shifting landscape of cryptocurrency investments and the overall economic climate. The latest reports from Coinbase and Glassnode reveal that a majority of institutional players are leaning towards a favorable forecast for Bitcoin, suggesting an intriguing intersection of digital finance and traditional economic factors. Investors are closely monitoring macro indicators and policy shifts that might catalyze increased market engagement. Furthermore, the analysis highlights a broader trend among retail and institutional participants, with rising optimism hinting at an impending upward trajectory for Bitcoin as we transition into the new financial quarter. This critical period will likely showcase a complex interaction between investor behavior, regulatory changes, and market performance in the cryptocurrency arena.

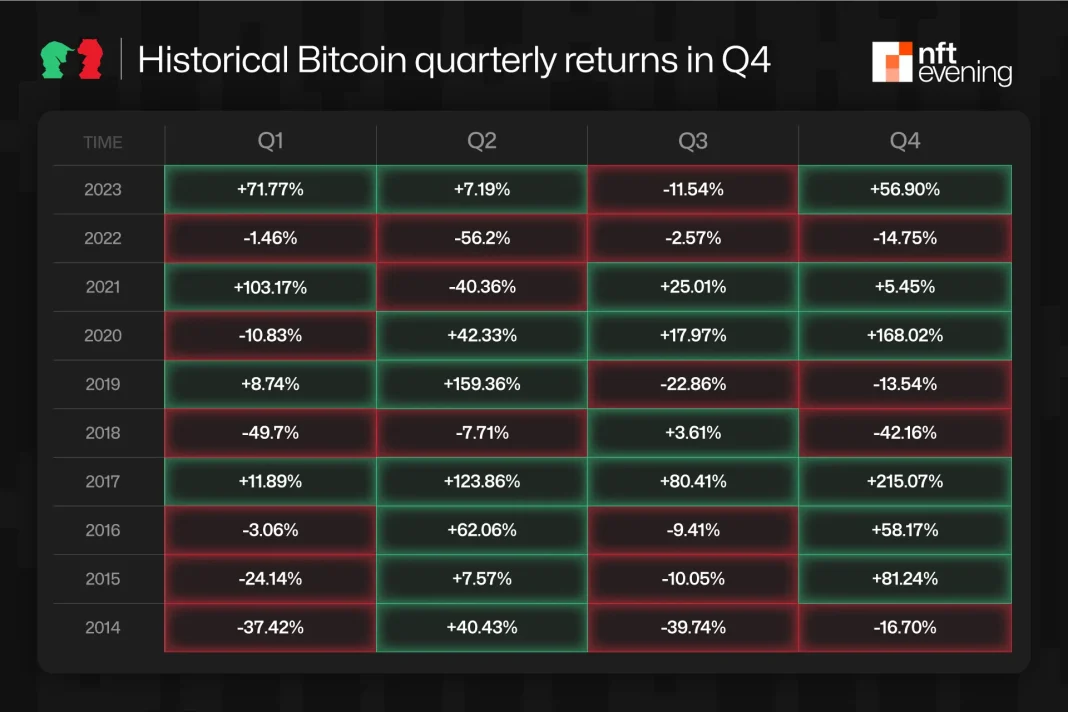

Bitcoin Q4 Outlook: Investor Sentiment Boosts Optimism

Heading into Q4, investor sentiment surrounding Bitcoin exhibits a notable shift towards cautious optimism. According to a recent analysis by Coinbase and Glassnode, a significant majority of both institutional (67%) and non-institutional (62%) investors harbor a positive outlook for Bitcoin’s performance in the upcoming quarter. This sentiment is bolstered by improving macroeconomic conditions and regulatory advancements that promise to uplift the crypto market. As market dynamics shift, the findings suggest that Bitcoin may have a distinct advantage, primarily due to resilient liquidity and reduced barriers to entry for new investors.

Moreover, the survey reflects different perspectives on the prevailing market cycle, with a considerable 45% of institutions believing it is in a late-bull phase. In contrast, only 27% of non-institutional investors share this viewpoint. These insights underline the importance of monitoring investor sentiment, as understanding the psychological tendencies in the market can provide valuable context for anticipating Bitcoin’s performance this quarter. As Q4 unfolds, the cautious yet optimistic outlook may become a driving factor in Bitcoin’s trajectory.

Macroeconomic Factors Influencing Bitcoin Performance

The macroeconomic landscape is expected to play a pivotal role in shaping Bitcoin’s performance as we enter Q4. Coinbase and Glassnode predict that potential interest rate reductions by the Federal Reserve, anticipated to occur twice during the quarter, may flood market liquidity. This may unlock substantial capital investments in Bitcoin and other cryptocurrencies, as approximately $7 trillion in money-market funds could find its way into the digital asset space. Such a development could invigorate the overall crypto market, leading to enhanced participation from both retail and institutional investors.

On a more granular level, the analysis indicates that both institutional and retail investors are primarily concerned with macroeconomic tail risks. For instance, 38% of institutional respondents acknowledge these risks, while 29% of non-institutional respondents mirror similar sentiments. As the market looks towards policy changes in the U.S. and abroad, closely observing these economic indicators will be crucial for understanding the momentum of Bitcoin and determining the foreseeable impacts on investor sentiment.

Market Dynamics: Long-Term Holding Trends

Recent trends in Bitcoin’s market dynamics suggest a troubling yet stable environment for long-term holders. The findings indicate that long-term holders are maintaining their positions, despite the fluctuations in Bitcoin’s price reaching unprecedented levels. In Q3, the illiquid supply of Bitcoin only saw a marginal reduction of 2%, while liquid supply surged by 12%. This behavior reflects the conviction of seasoned investors who believe in Bitcoin’s potential for long-term appreciation, contributing to overall market stability.

Furthermore, the current market structure is a reflection of confidence among long-term holders. With stable holdings among this group, the outlook for Bitcoin becomes increasingly resilient against short-term volatility, as these seasoned investors may be less susceptible to panic selling. This dynamic reinforces the narrative that for many investors, Bitcoin presents a valuable opportunity that extends beyond mere speculative trading—further solidifying its position as a prominent asset in crypto portfolios.

Understanding Institutional Demand in the Crypto Market

Institutional demand continues to be a critical factor in shaping Bitcoin’s market narrative. The phenomenon of Digital Asset Treasuries (DATs) has amplified interest, with Bitcoin DATs currently holding around 3.5% of the total circulating supply. Such holdings indicate a robust endorsement of Bitcoin’s value proposition among large-scale investors. As institutional players increasingly allocate funds to Bitcoin, expectations grow for sustained demand in the unfolding quarter, particularly if market dynamics continue to favor the asset.

In light of these trends, the overall demand from institutional investors appears to present favorable conditions for Bitcoin’s price appreciation. The recent decline in valuations for many DATs might raise concerns; however, the long-term trend appears to show a strong alignment with Bitcoin’s historical performance. Therefore, as Q4 progresses, understanding how institutional players adapt to market fluctuations will be integral to deciphering Bitcoin’s trajectory and broader crypto market dynamics.

The Role of Regulatory Progress in Crypto Adoption

Regulatory developments are set to play a significant role in influencing Bitcoin’s adoption trajectory as Q4 unfolds. As noted in the Coinbase and Glassnode report, timelines regarding market-structure legislation in the U.S. and international regulatory frameworks in Europe and Asia will be vital to the pace of crypto adoption. Positive regulatory signals can foster more confidence among investors, enhancing Bitcoin’s perceived legitimacy as a financial asset by reducing uncertainties surrounding compliance and market operations.

Moreover, the potential for clarity in regulations could result in increased institutional participation in the crypto markets. Heightened regulatory transparency often leads to a more structured investment approach, thereby attracting a wider range of investors looking to enter the market. As Bitcoin’s future hinges on favorable legislative measures, stakeholders should closely monitor these developments, which could act as catalysts driving Bitcoin’s mainstream adoption and overall market growth.

Crypto Market Analysis and Prospective Trends

As Q4 begins, a comprehensive crypto market analysis reveals various trends that could influence overall market performance, especially for Bitcoin and ether. The influx of capital into crypto assets is often viewed through the lens of emerging investor behavior, particularly as liquidity conditions remain favorable. With tools like Coinbase’s custom global M2 index indicating a compelling liquidity environment, investors are likely to look towards Bitcoin as a preferred asset during this period of optimism.

Additionally, with enhanced participation in the Ethereum network—evidenced by spot ETF inflows exceeding those of Bitcoin for the first time—there is a potential for rotational market dynamics. The shift in investor focus from Bitcoin to ether may affect investor sentiment as the market navigates through Q4. Understanding these shifting preferences is essential for predicting future price momentum for both Bitcoin and altcoins within the crypto landscape.

Comparative Analysis of Bitcoin and Ether Trends

A comparative analysis between Bitcoin and ether reveals significant shifts in market trends as we approach Q4. Notably, inflows into U.S. spot ETH exchange-traded funds have outpaced those into BTC spot ETFs in recent months. This distinction showcases a growing interest in ether as more investors seek diversification within their crypto holdings. Such developments suggest that ether is gaining traction not only as a competitor but as a complementary asset to Bitcoin, potentially reshaping the hierarchy in the crypto market.

Furthermore, the dynamics surrounding Ethereum’s layer-2 solutions and the overall reduction in gas fees have created an environment conducive for increased transaction activity. As the utility and adoption of ether rise, Bitcoin must enhance its value proposition to maintain investor interest. Assessing these evolving comparisons between Bitcoin and ether offers valuable insights into how investor behavior may adjust, thereby affecting market capitalization and price movement for both assets in Q4.

Anticipating Market Corrections and Strategic Positioning

As Q4 progresses, investors must remain vigilant about potential market corrections due to shifts in investor sentiment and macroeconomic factors. The enduring caution among institutional participants suggests that while the outlook is optimistic, strategic positioning is integral to mitigating risks. As indicated by the survey results, many investors are focusing on ensuring that their portfolios are resilient enough to weather volatility, especially given the potential for macroeconomic tightening in November.

In order to navigate these challenges effectively, adopting a well-rounded investment strategy that includes both Bitcoin and altcoins like ether could provide better coverage against market swings. Investors should prioritize liquidity and responsiveness to market changes, allowing them to capitalize on opportunities while safeguarding against downside pressures. Continuous evaluation and adaptation of these strategies will be essential as Q4 unfolds and market conditions evolve.

Final Thoughts on the Q4 Bitcoin and Crypto Landscape

In conclusion, the outlook for Bitcoin as we advance into Q4 appears cautiously optimistic, driven by favorable liquidity conditions and positive market sentiment. The insights derived from the Coinbase and Glassnode report emphasize the importance of regulatory clarity and macroeconomic indicators in shaping the trajectory of Bitcoin and related assets. By leveraging these insights, investors can make informed decisions aimed at optimizing their exposure to the crypto market.

Ultimately, with institutional interest on the rise and Bitcoin maintaining its prominence, the forthcoming months are poised to offer various opportunities for investors. However, remaining agile and aware of the evolving market factors will be essential for navigating the complexities inherent in the crypto landscape. As we look ahead, fostering a balanced investment approach could yield fruitful results amid the uncertainties and potential shifts in investor sentiment.

Frequently Asked Questions

What is the Bitcoin Q4 outlook according to Coinbase and Glassnode?

The Bitcoin Q4 outlook is cautiously optimistic as indicated by reports from Coinbase and Glassnode. They highlight strong institutional interest, with 67% of institutions and 62% of individual investors expressing a positive sentiment towards Bitcoin. Key factors influencing this outlook include improved liquidity, favorable regulatory progress, and positive macroeconomic conditions that could benefit Bitcoin prices.

How do investor sentiment trends affect the Bitcoin Q4 forecast?

Investor sentiment plays a crucial role in the Bitcoin Q4 forecast. Both institutional and retail investors are showing a tilt towards bullish sentiments, which could lead to increased demand and prices. The reports from Coinbase and Glassnode reveal that 45% of institutional investors believe the market is in a late-bull phase, indicating a general readiness for Bitcoin growth.

What are the macroeconomic conditions impacting Bitcoin’s Q4 outlook?

The macroeconomic conditions impacting Bitcoin’s Q4 outlook include anticipated interest rate cuts by the Federal Reserve and a supportive overall economic environment. According to Coinbase’s analysis, these factors could lead to more liquidity flowing into Bitcoin and broader markets, enhancing its attractiveness as an investment in Q4.

Which factors are considered risks in the Bitcoin Q4 outlook?

In the Bitcoin Q4 outlook, the primary tail risks identified are macroeconomic conditions, with responses highlighting a 38% concern among institutions and 29% among non-institutional investors. This indicates that external economic factors could heavily influence Bitcoin’s performance in the quarter.

How do institutional investments shape the Bitcoin Q4 landscape?

Institutional investments significantly shape the Bitcoin Q4 landscape, with Bitcoin digital asset treasuries (DATs) now holding about 3.5% of the circulating supply. The optimism reflected in Coinbase and Glassnode’s reports shows that institutional support is likely to bolster Bitcoin’s position as demand increases through this quarter.

What is the significance of liquidity in the Bitcoin Q4 outlook?

Liquidity is a vital factor in the Bitcoin Q4 outlook as it facilitates investment flows into Bitcoin. The report by Coinbase and Glassnode notes resilient liquidity conditions as a supporting factor, with expectations that over $7 trillion in money-market funds could potentially shift towards Bitcoin and crypto markets due to favorable macroeconomic signs.

Are there any notable trends in Bitcoin supply dynamics for Q4?

Yes, the Bitcoin supply dynamics for Q4 show stability among long-term holders, with liquid supply increasing by 12% and illiquid supply only decreasing by 2% in Q3. This stability suggests that seasoned investors continue to hold their Bitcoin, which may contribute positively to its outlook for Q4.

What role does ETF performance play in the Bitcoin Q4 outlook?

ETF performance is crucial in the Bitcoin Q4 outlook, as the inflows into U.S. spot Bitcoin ETFs reached $8 billion, alongside increasing competition from Ethereum spot ETFs that saw higher inflows. This growing interest in ETFs indicates a reinforcing of positive investor sentiment towards Bitcoin and enhances its potential for growth in Q4.

How does Glassnode’s analysis enhance understanding of the Bitcoin Q4 outlook?

Glassnode’s analysis enriches the understanding of the Bitcoin Q4 outlook by providing detailed insights into market dynamics, including the behavior of long-term holders and institutional investment trends. Their careful tracking of liquidity and regulatory progress offers a comprehensive picture of what to expect in the coming quarter.

| Key Point | Details |

|---|---|

| Investor Sentiment | 67% of institutions and 62% of non-institutions are optimistic about Bitcoin in Q4. |

| Market Cycle Views | 45% of institutions believe the market is in a late-bull phase, compared to 27% of non-institutions. |

| Macroeconomic Risks | Primary risks include macroeconomic conditions, with institutions citing this at 38% and non-institutions at 29%. |

| Liquidity and Policy Signals | Positive macroeconomic environment and liquidity support noted, especially favorable signals from the U.S. |

| Federal Reserve Actions | Anticipated two interest rate cuts in Q4 might redirect money-market funds to investment markets. |

| Bitcoin Supply Dynamics | Illiquid supply decreased by 2%, while liquid supply increased by 12% in Q3, showing stability amongst long-term holders. |

| Ether Participation | U.S. spot ETH ETFs saw $9.4 billion inflows, surpassing BTC ETFs at $8.0 billion in Q3. |

| Digital Asset Treasuries (DATs) | Bitcoin DATs hold 3.5% of circulating supply; Ether DATs hold 3.7%. Demand expected to continue. |

| Global M2 Index | Indicates favorable liquidity but hints at potential tightening by November. |

| Policy Progress | U.S. and global policy advancements will significantly influence adoption and market dynamics. |

Summary

Bitcoin Q4 Outlook indicates a period of cautious optimism as investor sentiment grows stronger heading into the final quarter of 2025. The favorable macroeconomic environment, coupled with anticipated monetary policy shifts and resilient liquidity, sets the stage for potential price increases in Bitcoin and Ether. This quarter promises to be pivotal for institutions and retail investors alike, as the digital asset landscape continues to evolve.