Real World Assets (RWA) are rapidly gaining traction in the evolving landscape of tokenized finance, with the RWA market now valued at over $34 billion following a remarkable 10.58% growth in the past month. This surge reflects a burgeoning interest in blockchain technology, as investors increasingly recognize the potential of tokenized assets to provide liquidity and ease of transfer. With more than 489,000 holders participating in this expanding sector, cryptocurrency investments in RWAs are reshaping traditional trading paradigms. Ethereum dominates the space, accounting for 58.24% of the market share with a total tokenized value around $12.4 billion, underscoring its critical role in blockchain growth. As the appeal of RWAs continues to rise, the potential for transformative changes in financial markets becomes increasingly clear.

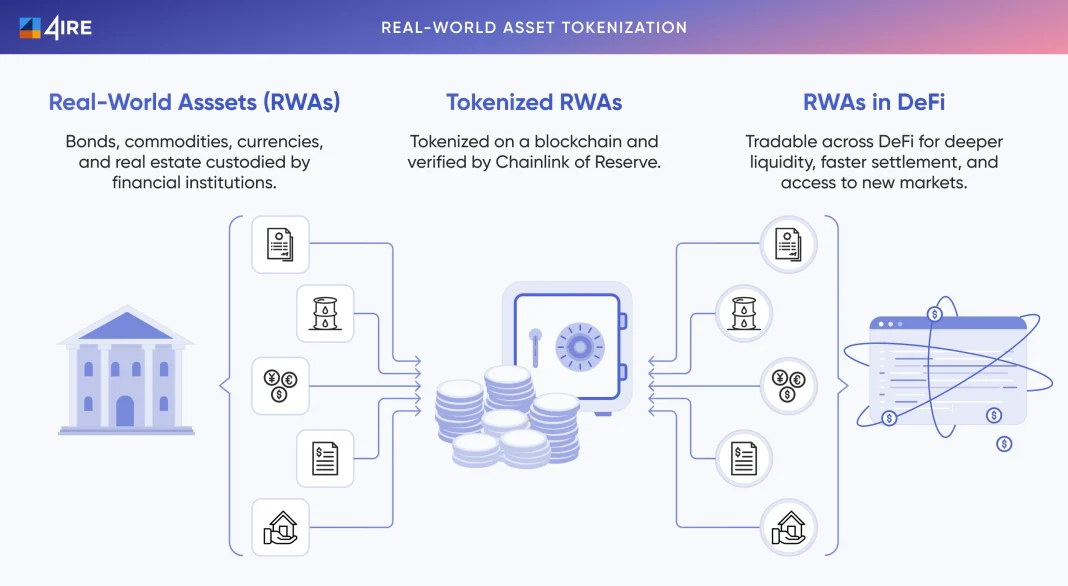

The concept of tokenized real-world assets, often referred to as tangible digital commodities, bridges the gap between physical and digital economies. This innovative approach to asset management enables individuals to invest and trade in fractions of physical goods like real estate and commodities, elevating standard investment practices. With institutional assets gaining popularity within the decentralized finance realm, the prospect of incorporating them into blockchain infrastructure is becoming more feasible. The increasing market adoption reflects a significant shift, characterized by the infusion of liquidity and the democratization of access to diversified investment opportunities. As the RWA ecosystem matures, it promises to redefine how we understand ownership and value in a digital world.

Understanding the Growth of Real World Assets (RWA)

The category of Real World Assets (RWA) is rapidly evolving, with its market capitalization now nearing an impressive $35 billion following a significant 10.58% monthly growth. This growth is largely attributed to the increasing adoption of blockchain technology, which allows these assets to be tokenized and transacted on various platforms. Tokenized assets offer a unique advantage by enabling 24/7 transferability, fast settlement times, and the ability to seamlessly integrate with on-chain applications. As a result, investors are gravitating towards RWAs, recognizing their potential to unlock global liquidity while avoiding the frictions typically associated with legacy financial systems.

Moreover, the expanding base of RWA holders—now surpassing 489,000—demonstrates growing trust among investors and institutions alike. The diversification of the RWA market includes a range of asset classes, from Treasuries to commodities and non-U.S. sovereign debt, further enhancing its appeal. As traditional finance increasingly converges with digital finance, RWAs stand poised to play a pivotal role in the evolution of cryptocurrency investments, contributing to the ongoing blockchain growth narrative.

Tokenized Assets: The Innovators of the Financial Landscape

Tokenized assets represent a groundbreaking innovation that is reshaping the financial landscape. By converting physical assets into digital tokens on a blockchain, they enable unprecedented levels of liquidity, transparency, and access to investment opportunities. This innovation not only simplifies the investment process but also allows a wider range of investors to participate in markets previously dominated by institutional players. Through mechanisms such as fractional ownership, tokenized assets have opened doors for retail investors to gain exposure to high-value assets.

The implications of tokenized assets on the broader cryptocurrency landscape are profound. As the RWA market continues to grow, driven by rising interest and participation, platforms like Ethereum are likely to fortify their market share, currently leading with $12.476 billion in tokenized value. The Ethereum infrastructure supports the issuance and management of these assets, paving the way for more complex financial products and strategies. This symbiosis of traditional assets and blockchain technology not only facilitates easier access to assets but also enhances the resilience of financial systems globally.

The Impact of Blockchain on Cryptocurrency Investments

Blockchain technology has fundamentally transformed how cryptocurrency investments are made and managed. With the rise of tokenized real-world assets, investors now have access to a broader array of investment options that include physical goods, real estate, and financial instruments—all represented as digital tokens. This development enhances the investment landscape by making asset ownership more accessible and affordable, thereby democratizing finance. The efficiency brought about by blockchain reduces transaction costs and settlement times, further incentivizing the shift toward these digital assets.

Moreover, the strengthening of the RWA market resonates with the overall growth of the blockchain ecosystem. In a climate where investors are seeking out secure, transparent, and efficient investment avenues, the convergence of blockchain and cryptocurrency innovations becomes increasingly vital. As one sector flourishes, it invariably supports the others—making it an ideal time for investors to explore opportunities in tokenized assets, which are solidifying their positions as key players in the evolution of finance.

Ethereum’s Dominance in the RWA Marketplace

Ethereum, with its robust smart contract capabilities, has emerged as the leading platform for tokenized real-world assets, boasting an impressive market share of 58.24% and a total tokenized value of $12.476 billion. The recent 20.73% growth within the past month underscores Ethereum’s central role in the RWA market. The platform’s ability to facilitate complex transactions and its growing ecosystem of decentralized applications are attracting both individual and institutional investors, solidifying its status as the backbone of the blockchain revolution.

Furthermore, as Ethereum continues to innovate and adapt, its influence on the RWA marketplace is expected to grow, attracting even more projects and investments. This dominant position lays the foundation for further blockchain growth, where other ecosystems like Zksync and Polygon are also making strides but remain behind in market share. The collaborative yet competitive environment within Ethereum’s infrastructure stimulates innovation, ultimately benefiting the entire cryptocurrency ecosystem as more assets move onto the blockchain.

Market Dynamics Driving RWA Value

The dynamics of the RWA market are influenced by several factors, including regulatory developments, advancements in blockchain technology, and investor sentiment. As the market nears the monumental $35 billion mark, the index of participation and active issuers continues to rise, reflecting a bullish outlook among stakeholders. Accountable for this growth are institutional products and Treasuries, which lead the total value in tokenized assets, further underlining their importance in attracting investment capital.

Additionally, the diversification of the RWA market is vital to its sustainability. The inclusion of various asset classes—ranging from corporate bonds to commodities—provides stability and mitigates risks associated with market volatility. As more investors recognize the potential of tokenized assets to offer steady returns and lower entry barriers, the RWA market is likely to maintain its upward trajectory, underscoring its relevance in the current investment climate.

The Rise of Active Issuers in the RWA Market

The expansion of active issuers in the RWA market is a positive signal of the sector’s growth and maturation. Currently, there are 225 active issuers contributing to the tokenization of real-world assets. This rise in issuers indicates a burgeoning interest from companies looking to leverage blockchain technology to enhance their capital-raising efforts. Each issuer brings innovative solutions and applications that increase the variety of assets available to investors, resulting in a more dynamic marketplace.

Moreover, as competition among issuers intensifies, investors can expect a wider range of options and potentially more favorable terms. The influx of active issuers not only boosts the volume of transactions but also encourages the development of novel financial products that cater to diverse investment strategies. This innovative spirit, coupled with advanced blockchain infrastructure, is likely to stimulate further growth in the RWA market and foster an environment ripe for cryptocurrency investments.

Global Liquidity and the RWA Ecosystem

One of the most advantageous features of the RWA ecosystem is its ability to provide global liquidity. Thanks to blockchain technology, tokenized assets can be traded 24/7 across various platforms, ensuring that investors can access markets at any time without the traditional barriers associated with geographic or temporal limitations. This immediate access to liquidity not only increases the attractiveness of tokenized assets but also enhances market efficiency.

Additionally, the global liquidity offered by RWAs enables greater participation from a diverse range of investors, including those from emerging markets. Such accessibility fosters inclusivity within the investment landscape and contributes to a more balanced financial framework. As the RWA market continues to grow and attract new participants, the benefits of global liquidity will in turn drive further adoption and innovation across the blockchain and cryptocurrency sectors.

Exploring the Future of Real World Assets

The future of Real World Assets (RWA) appears promising as the market evolves in response to consumer needs and technological advancements. With the RWA market currently hovering around $35 billion, the prospects for growth are encouraging, fueled by the increasing adoption of blockchain technologies. As more assets are tokenized and brought onto public blockchains, we can expect an ongoing trend of innovation that redefines investment paradigms and expands the types of assets available.

As we look towards the future, it is crucial for stakeholders to continue investing in education and understanding of blockchain technology’s implications. The continued growth of tokenized assets hinges on the ability to navigate regulatory landscapes, gain institutional acceptance, and attract diverse investor profiles. With these factors in mind, the RWA market is well-positioned to harness the potential of cryptocurrency investments, poised for a future marked by growth and transformation.

The Synergy Between RWA and Decentralized Finance (DeFi)

The integration of Real World Assets with Decentralized Finance (DeFi) platforms is fostering a new wave of financial innovation. As RWAs gain traction, they are increasingly being incorporated into DeFi applications that enable lending, borrowing, and trading without intermediaries. This synergy not only enhances the liquidity of tokenized assets but also brings traditional finance concepts into the decentralized ecosystem, making financial services more accessible and efficient.

Furthermore, the collaboration between RWAs and DeFi solutions represents a significant shift in how assets can be utilized within the financial system. Investors can leverage their tokenized assets as collateral for loans or participate in yield farming offerings, thus maximizing the utility of their holdings. As this trend continues to develop, we may witness an even broader acceptance of tokenized real-world assets, marking a transformative period for both the RWA market and the DeFi landscape.

Frequently Asked Questions

What are real-world assets (RWA) and how do they relate to tokenized assets?

Real-world assets (RWA) refer to physical or tangible assets that can be tokenized on a blockchain. Tokenized assets represent ownership of these RWAs in a digital format, enabling efficient trading and transferability. As the RWA market approaches $35 billion, it showcases the growing demand for these innovative financial instruments.

How is the RWA market performing in terms of growth and participation?

The RWA market has experienced significant growth, reaching $34.14 billion with a monthly gain of 10.58%. Participation is also rising, with over 489,000 holders of tokenized assets, highlighting the increasing interest in cryptocurrency investments linked to real-world assets.

What advantages do tokenized real-world assets provide over traditional asset management?

Tokenized real-world assets offer several advantages including 24/7 transferability, faster settlement times, and the ability to access global liquidity without the need for legacy systems. These attributes make tokenized assets more efficient for investors looking to diversify their portfolios in the thriving RWA market.

Why is Ethereum significant in the tokenized assets space?

Ethereum holds a commanding position in the tokenized assets space with $12.476 billion in value, representing 58.24% of the RWA market share. Its robust infrastructure supports the growth of tokenized assets and ensures seamless integration with various blockchain applications, making it a preferred platform for cryptocurrency investments.

What other blockchains are contributing to the growth of the RWA market?

Beyond Ethereum, blockchains like Zksync Era, Polygon, Arbitrum, and others contribute to the RWA market’s diversification. For instance, Zksync Era has $2.365 billion in tokenized assets, while Arbitrum has seen a remarkable monthly increase, demonstrating the expanding landscape for tokenized real-world assets.

How do tokenized assets enhance access to global liquidity?

Tokenized assets enhance access to global liquidity by allowing assets to be traded around the clock on public blockchains, reducing the friction associated with traditional asset transactions. This democratization of finance increases opportunities for individuals and institutions to invest in the RWA market.

What are the main types of assets driving the growth in the RWA market?

The growth in the RWA market is primarily driven by Treasuries and institutional products. Additionally, commodities, corporate bonds, and non-U.S. sovereign debt contribute to the market’s depth, offering a diverse range of investment opportunities in the expanding landscape of tokenized real-world assets.

| Key Metric | Value | Change (30 Days) |

|---|---|---|

| Total RWA Market Value | $34.14 billion | +10.58% increase from last month. |

| Number of RWA Asset Holders | 489,037 | +6.71% increase from last month. |

| Active Issuers | 225 | |

| Primary Blockchain (Ethereum) Value | $12.476 billion | +20.73% increase from last month. |

| Top Blockchains by Tokenized Value |

Summary

Real World Assets (RWA) continue to gain traction as the market approaches the $35 billion milestone, driven by an increase in value and participation among asset holders. The impressive 10.58% monthly growth signifies a robust demand fueled by the benefits of transferability, quicker settlements, and global liquidity. As this sector evolves, it is clear that RWAs are positioning themselves as a significant component of the blockchain landscape, enabling broader access to diverse asset classes for investors.