Bitcoin stockpiling by governments has emerged as a significant trend in the ever-evolving landscape of digital currencies. As various nations begin to recognize the potential economic advantages of cryptocurrency, U.S. authorities have notably taken the lead, amassing over 325,000 BTC, making it the largest holder of Bitcoin among nation-states. This growing trend raises important questions about government Bitcoin holdings globally, with other countries also engaging in substantial acquisitions. For instance, the U.K. government holds approximately 61,245 BTC, while Bhutan and the UAE are actively mining and accumulating further reserves. Understanding how much Bitcoin does the U.S. hold and analyzing Bitcoin reserves by country sheds light on the increasing influence of state stakeholders in the cryptocurrency market.

The phenomenon of state-backed Bitcoin acquisitions illustrates a shift in how sovereign nations perceive cryptocurrencies. Instead of dismissing Bitcoin as a mere speculative asset, governments such as those in the U.S. and the U.K. are strategically investing in digital assets to bolster their national reserves. Nation-state Bitcoin stockpiles are becoming a focal point for policy discussions, and Bitcoin mining by governments is adding another layer of complexity to the economic landscape. With each government varying in how they approach cryptocurrency—from hoarding to mining—this trend signifies a newfound recognition of Bitcoin as a formidable economic tool. As the global financial systems embrace this technology, the implications of government involvement in Bitcoin cannot be overlooked.

The U.S.: The Largest Nation-State Bitcoin Holder

As of October 2025, the United States has solidified its position as the leading nation-state holder of Bitcoin, possessing over 325,447 BTC, which is an astonishing figure worth more than $34 billion. This accumulation represents roughly 1.55% of the total supply of Bitcoin, highlighting its large market influence. The substantial increase in Bitcoin reserves is significantly attributed to the seizure of 127,271 BTC linked to criminal activities, which raises questions about the role of governments in possessing and managing cryptocurrencies. This growing trend of government Bitcoin holdings is leading to broader conversations about regulations, potential market impacts, and the secure storage of cryptocurrencies on a national scale.

The prominence of the U.S. in the Bitcoin landscape is not just a reflection of its crypto-assets but also its strategic positioning in the global financial system. This vast stockpile enables the U.S. government to implement policies affecting the cryptocurrency marketplace, including potential stabilization measures during times of volatility. Furthermore, as governments worldwide begin stockpiling Bitcoin as part of their economic strategy, the implications for financial sovereignty and the changing dynamics of currency systems will be profound, making the U.S. reserves a focal point in discussions about global economics and cryptocurrency regulation.

Government Bitcoin Holdings: A Growing Trend

Governments around the world are increasingly recognizing the significance of Bitcoin as an asset class, leading to a surge in government Bitcoin holdings globally. Not only are these assets perceived as a hedge against inflation, but they also serve as potential instruments for financial innovation and national security. Countries like the United Kingdom and El Salvador demonstrate a calculated approach to Bitcoin acquisition; with the UK holding approximately 61,245 BTC and El Salvador investing in Bitcoin to bolster its economy. This trend is reflective of broader governmental acceptance of cryptocurrencies and their potential roles in the global economy.

In addition to financial incentives, the involvement of nation-states in Bitcoin can enhance their geopolitical stance. By holding substantial Bitcoin reserves, governments can leverage these assets in international negotiations or use them as a buffer in economic crises. Furthermore, this stockpiling behavior challenges traditional financial systems and introduces complexities that regulatory bodies must navigate. As more governments engage in cryptocurrency stockpiling, understanding the driving forces behind these decisions becomes crucial for investors and analysts alike.

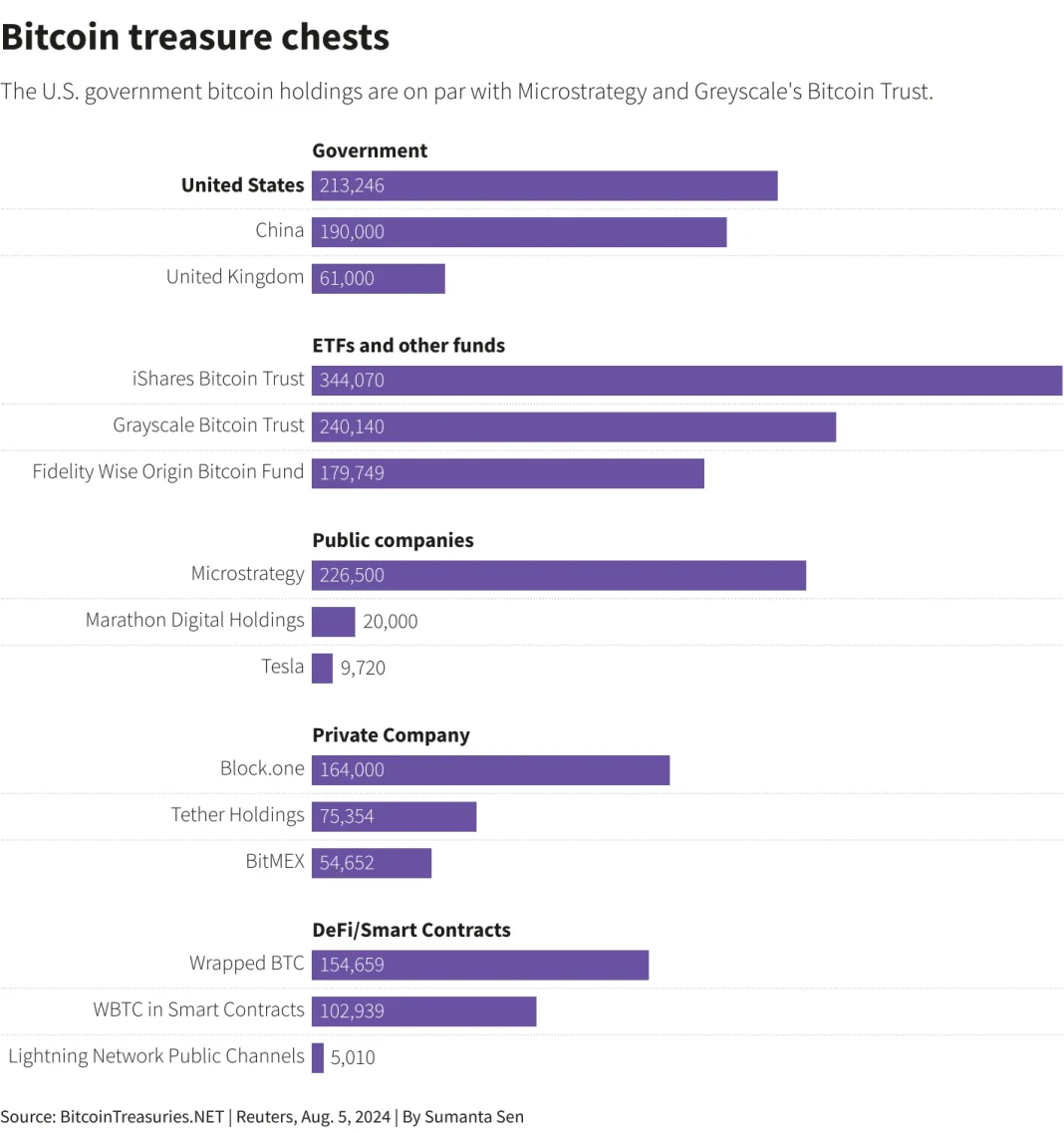

Bitcoin Reserves by Country: A Comparative Look

An analysis of Bitcoin reserves by country reveals interesting dynamics in how nations are approaching this digital currency. The U.S. leads the pack, but other nations are not far behind. The UK, with its 61,245 BTC, is followed closely by smaller but strategic accumulations in countries like Bhutan and the UAE, who hold 6,370 BTC and 6,465 BTC respectively. These reserves not only illustrate the varying scales of national investments but also showcase differing strategies—such as Bhutan’s partnership with mining firms which allows it to build reserves organically.

The comparative analysis of Bitcoin holdings showcases the growing acceptance of digital assets at a state level. Countries that are investing in Bitcoin are likely doing so with an eye toward future financial stability and innovation. Understanding how much Bitcoin different governments hold will also shape competitive strategies in international trade and influence cryptocurrency’s role in the global market. As nations accumulate Bitcoin, the implications for monetary policy, economic stability, and global finance present a fascinating narrative that is unfolding rapidly.

The Debate on National Bitcoin Stockpiles

The debate surrounding national Bitcoin stockpiles has intensified as more governments begin to engage in cryptocurrency acquisition. For instance, the U.S. government’s reported holdings have faced scrutiny due to significant discrepancies in official statements versus blockchain data, leading to questions about transparency and accountability. The estimates suggest that the U.S. holds an impressive amount of Bitcoin that not only reflects its stance on crypto regulation but also raises ethical questions on the nature of state involvement in decentralized currencies.

Moreover, the discussion goes beyond mere statistics; it delves into the implications of state buildings on Bitcoin stockpiles. Critics argue that significant government holdings could influence market dynamics, while proponents assert that such reserves stabilize the asset class. Whether through outright acquisition or through regulations that promote national stockpiling, the evolving relationship between governments and Bitcoin will likely lead to new frameworks for understanding the role of cryptocurrencies in societal infrastructure.

Understanding Bitcoin Mining by Governments

Bitcoin mining by governments presents an intriguing intersection between state resources and cryptocurrency production. Several nations, including Bhutan and the UAE, have actively engaged in Bitcoin mining, collaborating with specialized firms to increase their reserves. This strategic approach not only allows these states to accumulate Bitcoin but also positions them as players in the global crypto landscape. For Bhutan, working with Bitdeer creates opportunities to utilize renewable energy sources for mining, showcasing a blend of economic and environmental considerations.

On a broader scale, government involvement in Bitcoin mining poses questions about the future of energy consumption and environmental impact across the cryptocurrency sector. As energy-intensive activities like mining ramp up, policymakers face the dual challenge of fostering an innovative financial technological landscape while simultaneously addressing concerns over sustainability. This dynamic underlines the necessity for regulations that can balance the benefits of Bitcoin mining with the commitments to reducing carbon footprints and promoting responsible resource management.

The Role of Blockchain Analysis in Government Holdings

Blockchain analysis has emerged as a critical tool for understanding government Bitcoin holdings and their implications for the broader crypto market. By leveraging advanced analytics, blockchain firms can track government transactions and holdings, shining a light on the often opaque landscape of national Bitcoin reserves. This transparency is essential for investors and regulators alike, as it enhances understanding regarding how much Bitcoin—specifically linked to governmental operations—exists and its potential impacts on the market.

Through blockchain analysis, discrepancies, such as the conflicting reports about the U.S. government’s actual Bitcoin reserves, can be identified and scrutinized. The analytical insights generated from blockchain technology not only promote a more informed public discourse but also instill confidence among users and investors in digital currencies. As the scrutiny on government holdings increases, the role of blockchain analytics will become even more pivotal in navigating the complexities of Bitcoin in national contexts.

The Impact of Bitcoin on National Policies

The increasing stockpiling of Bitcoin by governments is shaping national policies and regulatory approaches to cryptocurrencies. As nations accumulate Bitcoin reserves, there is a noticeable shift in how governments view digital currencies—from mere speculative assets to integral components of their financial strategies. Countries like El Salvador, for example, have made headlines by adopting Bitcoin as legal tender, indicating a groundbreaking approach to integrate cryptocurrency within their economic frameworks.

This transformation necessitates a reevaluation of existing financial policies, as regulators work to adapt to the advanced dynamics of digital currencies. Countries now face the challenge of creating a competitive yet safe environment for both users and investors. Bitcoin stockpiling correlates with a broader acceptance of its implications on monetary policy, economic strategy, and collaboration between cryptography and traditional finance, emphasizing the need for adaptive legislation.

Geopolitical Considerations of Nation-State Bitcoin Stockpiling

Geopolitics plays a crucial role in the decision-making process for countries stockpiling Bitcoin. As more nations recognize Bitcoin not just as an asset but as a strategic tool, the implications stretch well beyond economic benefits. For instance, countries with significant Bitcoin reserves could leverage these holdings in international negotiations, potentially altering power dynamics and creating new avenues for diplomacy. The stockpiling of Bitcoin may also represent a means to circumvent traditional economic sanctions and establish financial independence.

These geopolitical considerations provide a lens through which analysts can assess future conflicts and alliances in an ever-evolving global landscape. As nation-states accumulate Bitcoin, the potential for both economic growth and tension escalates, implying that the management of these digital assets will be a key point of focus for international relations in the coming years. Understanding how crypto assets influence geopolitical strategies will be critical for comprehending the future of global economics.

Future Trends in Government Bitcoin Holdings

Looking ahead, the trend of government Bitcoin holdings appears set to increase as more countries explore the financial possibilities that cryptocurrencies present. With states like the U.S. and the UK already leading the charge, it remains to be seen how other nations will respond. The reactions could range from complete integration of Bitcoin into national currencies to cautious engagement focused on regulatory compliance and economic stabilization efforts. The outcomes of these experiments in digital currency holdings will likely shape the future landscape of the global financial system.

Moreover, the potential for an increase in institutional investments and larger government reserves may also catalyze greater market volatility and innovation in cryptocurrency. Governments may develop more formal processes for managing their Bitcoin holdings, ultimately leading to the establishment of policies that further legitimize cryptocurrencies in the eyes of the public. As this dynamic continues to unfold, the future of government Bitcoin stockpiling will undoubtedly play a crucial role in defining both national and global economic trajectories.

Frequently Asked Questions

What are the latest updates on government bitcoin holdings in the U.S.?

As of October 2025, the U.S. government reportedly holds around 325,447 BTC, valued at over $34 billion. This amount positions the U.S. as the largest nation-state holder of Bitcoin, reflecting significant stockpiling efforts.

How much bitcoin does the U.K. government stockpile?

The United Kingdom government currently maintains a stockpile of approximately 61,245 BTC, which is valued at around $6.56 billion, making it the second-largest holder of Bitcoin among nations.

What is the significance of Bitcoin reserves by country?

Bitcoin reserves by country illustrate the growing interest of governments in cryptocurrencies. These stockpiles can influence market dynamics and showcase the strategic financial maneuvers of nation-states.

Is it true that the Chinese government holds large amounts of bitcoin?

While there were speculations about China holding 190,000 BTC, blockchain analyses have debunked this, revealing those coins were sold off by 2020. Thus, the current status of government bitcoin holdings in China is unclear.

How is Bhutan involved in Bitcoin mining and stockpiling?

Bhutan, through Druk Holdings, is actively engaged in Bitcoin mining and currently holds about 6,370.64 BTC, valued at approximately $682 million, showcasing its proactive approach to cryptocurrency.

What role does North Korea play in government bitcoin holdings?

North Korea’s Lazarus Group had substantial Bitcoin holdings but saw a decrease from over 14,000 BTC in March 2025 to around 803.93 BTC today, raising concerns over cybercrime and state-sponsored hacking.

What implications do nation-state Bitcoin stockpiles have on global markets?

Nation-state Bitcoin stockpiling can lead to fluctuating market conditions as large holdings might be leveraged for economic gains or strategic initiatives, highlighting the increasing intertwining of state finance and cryptocurrencies.

How does the U.S. government’s Bitcoin stockpile compare to other countries?

With an estimated 325,447 BTC, the U.S. government significantly surpasses all other countries, including the U.K. and others, reflecting its leading role in global Bitcoin holdings.

Are there legal aspects tied to government Bitcoin mining operations?

Yes, government Bitcoin mining operations, such as those by Bhutan and the UAE, involve legal considerations regarding energy consumption, regulatory frameworks, and potential impacts on domestic economies.

What future trends can we expect in government Bitcoin stockpiling?

Future trends may include increased transparency regarding government Bitcoin holdings, potential legislation on cryptocurrency management, and more countries exploring Bitcoin mining and stockpiling as part of their economic strategies.

| Country | Bitcoin Holdings (BTC) | Value (USD) |

|---|---|---|

| United States | 325,447 | $34 billion |

| United Kingdom | 61,245 | $6.56 billion |

| UAE Royal Group | 6,465 | $692 million |

| Bhutan (Druk Holdings) | 6,370.64 | $682 million |

| El Salvador | 6,354.18 | $680 million |

| North Korea (Lazarus Group) | 803.93 | $86.13 million |

Summary

Bitcoin stockpiling by governments has emerged as a significant trend, exemplified by the United States leading with over 325,000 BTC. The motivations behind these accumulations range from economic strategy to national security. The United Kingdom follows with its substantial reserves, indicating a global interest from sovereign entities. As these countries engage more in the cryptocurrency arena, it is clear that their bitcoin reserves will play crucial roles in shaping market dynamics and influence.