The USDT market cap recently surged to approximately $182 billion, reflecting the rapidly growing adoption of Tether’s stablecoin. Tether CEO Paolo Ardoino heralded this milestone, emphasizing that USDT is on a remarkable journey towards reaching 500 million users. This growth not only positions USDT as a leader in the world of cryptocurrencies but also underscores its pivotal role in the evolution of programmable money. As the stablecoin market expands, Tether’s dominance continues to shape the landscape by facilitating seamless transactions and solidifying its status as a critical asset for trading and settlements. In the wake of this impressive market capitalization, the conversation surrounding Tether’s future and its impact on financial inclusion is more fervent than ever.

Tether, a key player in the cryptocurrency realm, has witnessed significant developments as its dollar-pegged token reaches new heights in market value. With a strong emphasis on the innovative concept of programmable finance, USDT is increasingly regarded as a vital instrument for digital transactions. Tether’s robust market capitalization reinforces its position as the leading stablecoin, showcasing its potential to revolutionize how value is conveyed digitally. Meanwhile, discussions around Tether’s user base approaching half a billion highlight the growing interest in digital currencies and their role in contemporary financial systems. As the stablecoin sector thrives, Tether remains at the forefront, shaping the narrative of digital money’s future.

Tether’s Remarkable Market Capitalization Growth

Tether has seen extraordinary growth, achieving a market capitalization of approximately $182 billion as of October 21, 2025. This impressive figure not only reflects the rising demand for stablecoins but also underscores Tether’s critical role in the cryptocurrency ecosystem. With USDT leading the way, Tether is effectively positioned among the most influential players in digital currency. In the broader context, the growth of Tether’s market cap has paralleled the increasing acceptance of cryptocurrencies by mainstream financial institutions, signifying a shift toward a more decentralized financial infrastructure.

The rapid growth of Tether’s market cap can be attributed to several factors, including its established reputation as a reliable stablecoin among traders and investors. The solid backing by reserves and frequent transparent reporting has built trust, contributing to the user base swelling to 500 million. As stablecoins gain traction in various sectors, Tether’s growth serves as a benchmark, illustrating how digital currencies can achieve remarkable traction in a traditionally fiat-dominated landscape.

Frequently Asked Questions

What is the current market cap of USDT?

As of October 21, 2025, USDT’s market capitalization is approximately $182.1 billion, solidifying its position as the largest stablecoin in the crypto market.

How has Tether’s market cap evolved over the years?

Tether’s market cap has significantly expanded since its launch in 2014 as Realcoin, transitioning to USDT. The growth was especially rapid from 2017 to 2018 due to increased exchange activity and later advancements across multiple blockchain networks.

What does Tether CEO Paolo Ardoino say about USDT’s user growth?

Tether CEO Paolo Ardoino recently highlighted that USDT is on a trajectory toward 500 million users, positioning it as ‘the ultimate social network for programmable money,’ which underscores its impact on the financial ecosystem.

Why is USDT considered a leading stablecoin?

USDT is considered the top stablecoin due to its substantial market capitalization and its extensive usage for trading and settlement across crypto markets, complemented by Tether’s robust reserves and governance practices.

What are some factors influencing USDT’s market cap?

Factors influencing USDT’s market cap include its adoption across exchanges, the strategic management of Tether’s reserves towards cash-equivalent assets, and its dominance in the evolving stablecoin landscape.

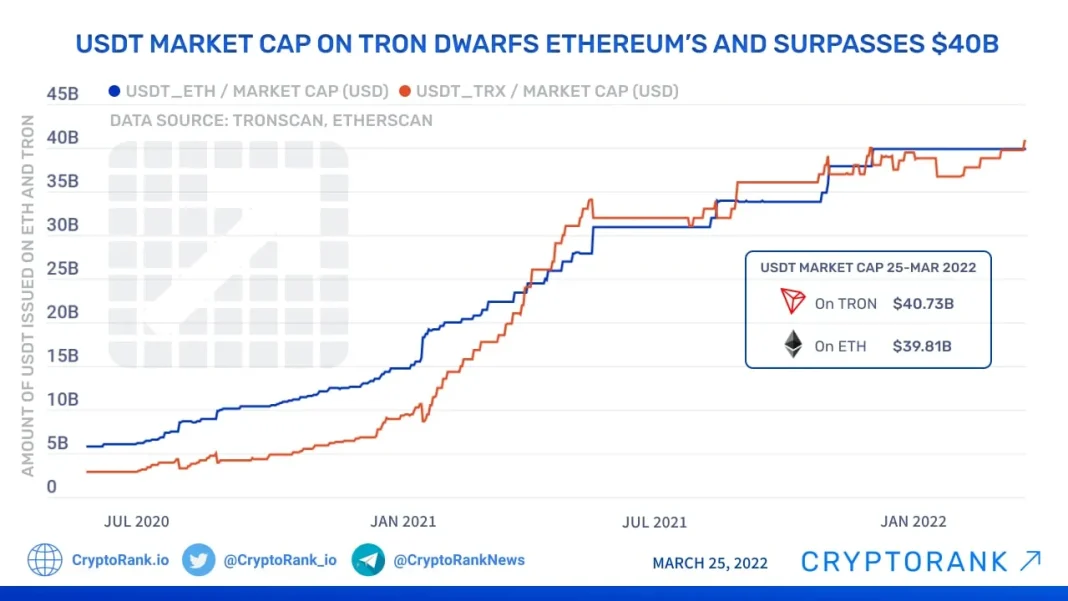

What are the key networks where USDT is issued?

As of 2025, Ethereum has reclaimed the top position for USDT issuance, surpassing Tron, reflecting the ongoing shifts in on-chain distribution and user preferences due to lower fees and higher liquidity.

What roles do Tether’s reserves play in its market cap?

Tether’s reserves play a crucial role in its market cap by ensuring liquidity and stability. The company’s recent shift toward heavier investments in U.S. Treasuries enhances confidence among users and investors.

How does programmable money relate to Tether’s market cap?

Programmable money, as articulated by Paolo Ardoino, positions USDT as a versatile financial instrument that mirrors the growth of its market cap and user base, reflecting an innovative approach to value and information exchange.

What challenges does USDT face as a leading stablecoin?

As the stablecoin sector expands, USDT faces challenges from emerging competitors like USDC and PYUSD, which are trying to capture market share and influence users through unique features and financial services.

What does the future hold for USDT and its market cap?

The future of USDT’s market cap will likely depend on its ability to adapt to regulatory changes, maintain reserve transparency, and innovate within the landscape of programmable money as competition intensifies.

| Key Points |

|---|

| Tether’s CEO Paolo Ardoino announced USDT’s path to 500 million users, positioning it as ‘the ultimate social network’ for money. |

| The current market cap of USDT is approximately $182 billion as of October 21, 2025. |

| USDT has grown significantly since its 2014 inception, now being the largest stablecoin in terms of market value. |

| By March 2024, circulating USDT surpassed 100 billion, highlighting its importance in crypto markets. |

| Tether’s governance has improved, with quarterly reserve attestations and a shift in asset allocation towards US Treasuries. |

| In 2025, Ethereum regained the top position for USDT issuance, overtaking Tron. |

| Despite competition from other stablecoins, USDT remains the leading dollar-pegged token. |

Summary

The USDT market cap currently stands at approximately $182.1 billion, reflecting its dominance as a stablecoin in the cryptocurrency market. This impressive figure echoes Tether’s significant growth since its launch in 2014 and underscores its pivotal role in financial inclusion. With over 500 million users now, USDT is not just a digital currency; it is a programmable money network that integrates information and value transfer effectively. As Tether develops its ecosystem and adapts to challenges from emerging competitors, its strong governance and market strategies will be key to maintaining its position in the evolving landscape of digital finance.