Argentina exchange rate stabilization has become a focal point of economic strategy as the nation navigates turbulent financial waters. Recently, the Central Bank of Argentina (BCRA) secured a pivotal $20 billion agreement with the U.S. Treasury, aimed at reinforcing the dollar-peso exchange rate amidst ongoing uncertainty. This deal is part of a broader commitment to bolster Argentina’s economic stability and enhance investor confidence, particularly as the midterm elections loom. With the BCRA emphasizing the importance of this agreement to support price stability and sustainable growth, the stakes are undeniably high. As detailed negotiations unfolded, the potential outcomes of this agreement could profoundly impact Argentina’s financial health and its citizens’ access to credit—increasingly crucial in the current economic climate.

In recent discussions surrounding Argentina’s financial future, we see a crucial effort towards currency stabilization taking center stage. The recently established pact with the U.S. Treasury signifies a strategic move to optimize the fiscal landscape and address the vulnerabilities of the dollar-peso exchange mechanism. As negotiations progress, the agreements and interventions led by the BCRA aim to solidify Argentina’s economic resilience, particularly crucial before the impending midterm elections. The intersection of international support and local economic policy is creating a significant narrative on how Argentina aims to tackle its monetary challenges. Moreover, the implications of this agreement resonate beyond national borders, illustrating the challenges and opportunities faced by emerging economies in times of political and economic shifts.

Understanding Argentina’s Economic Stability Through Exchange Rate Stabilization

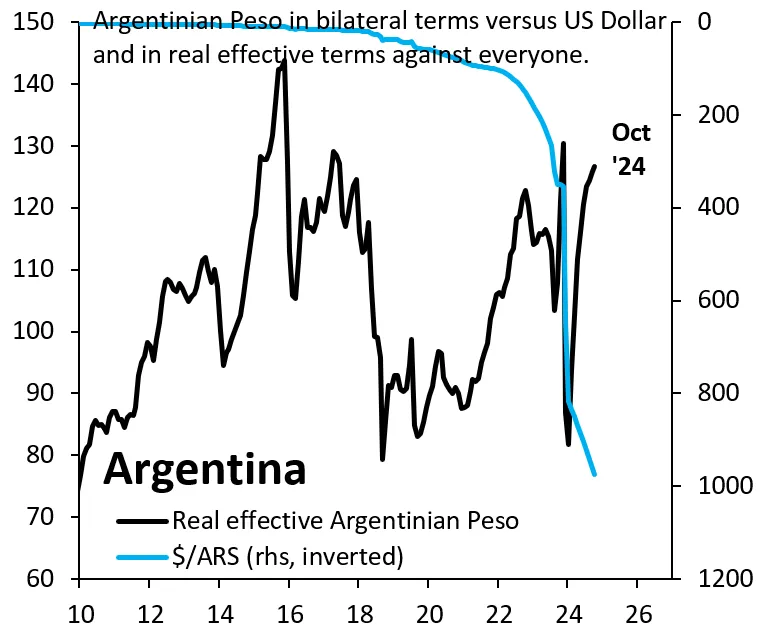

Argentina’s economic landscape has long been marred by inflation and instability, making measures for exchange rate stabilization critical. The recently inaugurated $20 billion agreement with the U.S. Treasury, facilitated by the Central Bank of Argentina (BCRA), aims to enact a much-needed control over the volatile dollar-peso exchange rate. By establishing this framework, the agreement is designed not only to stabilize currency value but also to restore investor confidence, which is crucial for Argentina’s long-term economic stability.

The importance of this exchange rate stabilization goes beyond mere currency values; it encompasses the broader theme of economic recovery and growth. As Argentina grapples with its economic challenges, successfully implementing this agreement could signal a new phase of macroeconomic stability, attracting foreign investments and fostering a conducive environment for sustainable economic growth. By curbing rampant inflation and providing a sense of security to investors, Argentina can shift its focus toward structural reforms essential for stabilizing its economy.

Frequently Asked Questions

What does the recent Argentina exchange rate stabilization agreement with the U.S. Treasury entail?

The Argentina exchange rate stabilization agreement involves a $20 billion deal between the Central Bank of Argentina (BCRA) and the U.S. Treasury aimed at stabilizing the dollar-peso exchange rate. This agreement will enhance Argentina’s economic stability through bilateral currency swap operations, providing essential support to mitigate country risk and encourage sustainable economic growth.

How will the BCRA currency agreement affect the dollar-peso exchange rate?

The BCRA currency agreement is designed to provide a framework for intervention in the currency markets, thereby stabilizing the dollar-peso exchange rate. By securing up to $20 billion in U.S. support, the agreement aims to lower volatility, make the currency more predictable, and instill investor confidence in Argentina’s financial landscape.

What role does U.S. Treasury support play in Argentina’s economic stability?

U.S. Treasury support plays a critical role in ensuring Argentina’s economic stability, especially through the recent exchange rate stabilization agreement. This support not only aids in maintaining a stable dollar-peso exchange rate but also reduces country risk, lowers interest rates, and facilitates better access to credit for the Argentine populace.

How might the midterm elections impact Argentina’s exchange rate stabilization efforts?

The upcoming midterm elections in Argentina could significantly impact exchange rate stabilization efforts, as the political outcomes will determine continued U.S. support. A favorable election result for President Milei’s party may cement the $20 billion agreement, while a loss could threaten financial generosity from the U.S., destabilizing the already fragile dollar-peso exchange rate.

What are the potential risks associated with the dollar-peso exchange rate in Argentina following this agreement?

Despite the $20 billion exchange rate stabilization agreement, potential risks remain. If economic conditions deteriorate, reliance on U.S. Treasury support could exacerbate vulnerabilities. Furthermore, the political fallout from the midterm elections could also create uncertainty around the dollar-peso exchange rate, maintaining risks for investors and the general economy.

| Key Points | Details |

|---|---|

| Agreement Signed | Argentina’s Central Bank (BCRA) signed a $20 billion agreement with the U.S. Treasury. |

| Purpose | To stabilize the dollar-peso exchange rate, enhance macroeconomic stability, and promote sustainable economic growth. |

| US Involvement | The U.S. Treasury will conduct bilateral currency swap operations and has been purchasing pesos in the currency exchange market. |

| Political Implications | The agreement’s success could heavily influence the outcome of Argentina’s upcoming midterm elections. |

| Future Outlook | The agreement could lead to either a successful stabilization of the economy or a prolonged debt crisis for Argentina. |

Summary

Argentina exchange rate stabilization is set to be significantly impacted by the recent $20 billion agreement with the U.S. Treasury. This deal aims to enhance monetary stability in the nation and reduce economic risks. With the upcoming elections, the stability of the dollar-peso exchange rate is critical for investor confidence and the country’s overall economic health. How this agreement plays out will be pivotal in shaping both Argentina’s domestic policies and its relationship with international stakeholders, reflecting broader concerns about U.S. influence in Latin America.