Bank tokenization is ushering in a transformative era for the financial landscape, allowing traditional banking systems to harness the power of blockchain technology. As U.S. regional banks increasingly adopt this innovative approach, they can now integrate tokenized deposits and stablecoins into their everyday operations, promoting enhanced security and efficiency in transactions. This evolution is not only reshaping how financial institutions manage their assets, but it also boosts customer confidence in digital finance solutions. With the rise of blockchain banking, these banks are poised to offer a seamless bridge between traditional funds and modern digital assets, ensuring compliance and regulatory clarity. As the adoption of tokenization grows, it enhances the overall stability of banking systems while ensuring that financial institutions remain competitive in an ever-evolving market.

The concept of bank tokenization has emerged as a revolutionary method for modernizing financial transactions and bolstering security within banking frameworks. This innovative practice incorporates features from digital currencies and stablecoins, allowing institutions to streamline deposit management more effectively. As banks increasingly pivot towards blockchain integration, the need for secure and efficient tokenized deposits becomes ever more pressing. With this approach, financial entities can facilitate rapid transactions while maintaining full regulatory oversight, an essential aspect of today’s dynamic digital finance landscape. By leveraging advanced technologies, regional lenders are not only improving their operational efficiency but also enhancing the overall customer experience in a rapidly changing economic environment.

Understanding Bank Tokenization and Its Impact on Digital Finance

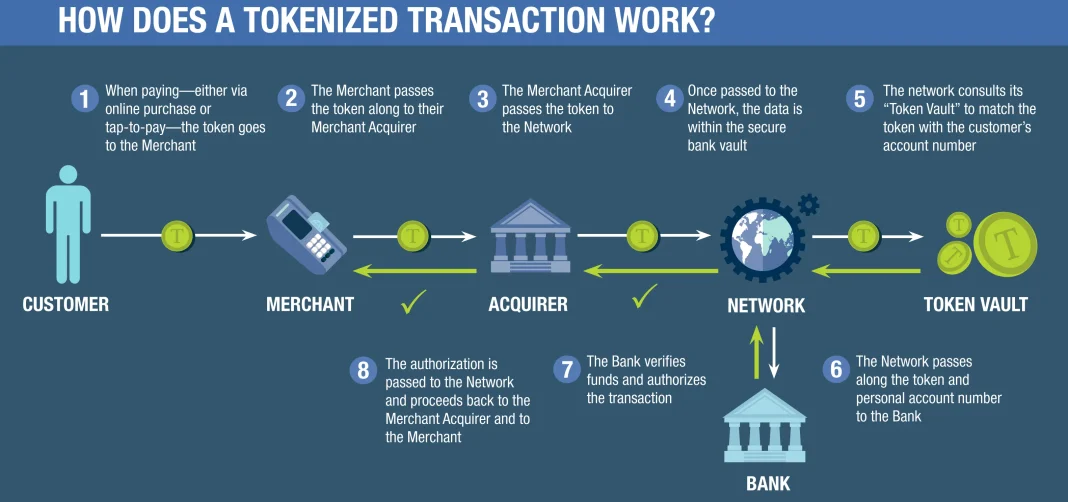

Bank tokenization represents a revolutionary shift in how financial institutions manage deposits and transactions. By converting traditional currency, like U.S. dollars, into digital tokens on a blockchain platform, banks enhance the security and efficiency of transactions. This new approach alleviates risks associated with disintermediation, offering a safe environment for both customers and institutions. As financial institutions integrate tokenized deposits into their traditional banking systems, they usher in a new era of digital finance characterized by transparency and speed.

Moreover, the integration of bank tokenization into everyday banking is not merely about adopting new technology; it’s about reimagining the banking landscape. Financial institutions are now more than ever in a position to leverage stablecoins for various applications, such as cross-border payments and supply chain settlements. This advancement can help regional banks compete with larger institutions by providing more efficient services that align with customer expectations in a digital-first world.

The Role of Tokenized Deposits in Shaping Blockchain Banking

Tokenized deposits play a crucial role in the evolution of blockchain banking by bridging the gap between traditional banking practices and innovative digital finance solutions. Through the collaboration of companies like Vantage and Custodia, banks are empowered to issue tokenized deposits that facilitate faster transactions while maintaining compliance with regulations. This approach not only streamlines operations but also enhances customer trust as it retains the core essence of traditional banking – security and stability.

As tokenized deposits become more prevalent, financial institutions can expect to see a shift in consumer behavior. Customers are increasingly demanding faster and more secure banking options. The integration of tokenized deposits allows banks to provide real-time transaction capabilities, minimizing delays associated with traditional banking methods. Consequently, this creates opportunities for regional banks to attract a broader clientele by offering services that resonate with the needs of a digital-savvy population.

How Stablecoins Enhance Security in Financial Transactions

Stablecoins serve as a critical component in the realm of bank tokenization, offering a stable and reliable digital currency that can mitigate volatility often seen with other cryptocurrencies. By leveraging stablecoins, financial institutions can provide customers with a reliable medium of exchange that supports various banking operations while ensuring value stability. This feature makes stablecoins particularly attractive for organizations looking to engage in high-frequency trading or international transactions, where exchange rates can fluctuate dramatically.

In addition to security, the use of stablecoins within the banking system opens doors for innovative financial products and services. For instance, banks can reward customers with interest or tokenized dividends based on their stablecoin holdings, further incentivizing digital adoption. The assurance that these digital assets can maintain parity with traditional currencies enhances their appeal, thereby encouraging more users to embrace digital finance solutions offered by their banks.

The Importance of Regulatory Compliance in Tokenization

Navigating the regulatory landscape is paramount for financial institutions embracing bank tokenization. As these institutions integrate blockchain technology and tokenized deposits into their operations, they must also ensure compliance with existing laws, such as those outlined in the GENIUS Act. This focus on regulatory compliance not only protects the banks but also builds trust among their customers by ensuring that all transactions are conducted within safe and legal parameters.

By adhering to regulatory standards, banks can establish a solid foundation for widespread adoption of tokenization in the financial sector. This compliance not only reassures customers but also paves the way for a more collaborative environment among various financial institutions. When banks prioritize adhering to regulations, they foster a level playing field that encourages innovation while safeguarding the integrity of the financial ecosystem.

Real-World Applications of Bank Tokenization

The practical applications of bank tokenization are already emerging with significant real-world implications. Early adopters like Vantage Bank and Custodia have set an example by demonstrating how tokenized deposits can facilitate cross-border payments, enabling instant transactions that were once bogged down by lengthy processing times. This effectively enhances the overall customer experience while reducing operational costs for banks.

Furthermore, businesses involved in construction and supply chain management can benefit from milestone-based disbursement processes enabled through tokenized transactions. By automating these financial processes, companies can improve efficiency and transparency in their operations, leading to better relationships with stakeholders such as contractors and suppliers. These use cases illustrate how the amalgamation of traditional banking with advanced blockchain technologies can unlock new avenues for growth and innovation.

The Future of Digital Finance through Tokenized Banking

The future of digital finance is poised for dramatic transformation as more banks begin to adopt tokenized banking practices. With regional banks leading the charge, this paradigm shift not only democratizes access to advanced financial services but also encourages greater innovation across the industry. As these institutions adopt blockchain-based solutions, they will likely set new standards for security, speed, and operational efficiency in the financial sector.

Moreover, the continuous evolution of stablecoins and their integration into everyday banking is expected to redefine consumer expectations and behaviors. As customers increasingly embrace digital finance, banks will need to adapt and innovate continuously to meet their demands for seamless and fast banking services. Consequently, traditional banks that integrate tokenization stand to gain a significant competitive edge, positioning themselves as leaders in a rapidly changing financial landscape.

Interoperability in Blockchain Banking Systems

Interoperability is a key factor driving the success of bank tokenization initiatives. The cooperation between different financial institutions to implement a unified platform enables seamless transactions between varying systems. For instance, Custodia and Vantage Bank’s collaborative framework allows regional banks to connect effortlessly and manage tokenized deposits while maintaining their regulatory compliance. This collaboration not only enhances operational efficiency but also expands the range of services that banks can provide to their customers.

Additionally, interoperability fosters an ecosystem where financial institutions can share resources and best practices, reducing barriers to entry for smaller banks. By enabling institutions of all sizes to leverage advanced technologies, interoperability can lead to a more inclusive banking landscape. As more banks join this interconnected network, they can innovate collectively, address common challenges, and ultimately enhance the overall customer experience within digital finance.

The Significance of Customer Trust in Tokenized Banking Solutions

Customer trust is crucial for the successful adoption of tokenized banking solutions. As banks integrate technologies like blockchain and stablecoins, they must prioritize security and transparency to alleviate any concerns customers may have regarding the safety of their assets. By clearly communicating the benefits and underlying protocols of tokenization, banks can build confidence among their clients, ensuring they embrace this innovation rather than resist it.

Moreover, demonstrating a commitment to upholding regulatory standards and safeguarding deposits can further bolster customer trust. Banks that showcase their adherence to the regulatory framework, while offering clear information about how tokenized systems function, will likely attract more clients interested in making the transition to digital finance. Creating educational programs and transparent communication channels can significantly aid in building this essential trust, ultimately facilitating widespread acceptance of tokenized banking solutions.

Innovations in Financial Services through Tokenization

The tokenization of banking services opens a floodgate of innovative financial products that were previously unimaginable. Community and regional banks leveraging this technology can now offer unique services such as microloans, automated compliance checks, and real-time asset tracking to their customers. Such innovations are not only attractive to consumers seeking flexible solutions but can also enhance the financial health of these institutions as they tap into new revenue streams.

Additionally, innovations stemming from tokenization can significantly improve customer engagement. By providing a more interactive and responsive banking experience, institutions can foster stronger relationships with their clientele. For example, integrating tokenized features into mobile banking apps could allow customers to instantly transfer tokenized deposits or utilize stablecoins for purchases, further weaving digital finance into the fabric of daily life.

Community Banking’s Evolution with Blockchain Technology

The evolution of community banking through blockchain technology marks a significant turning point that enhances accessibility and service delivery. With the rise of bank tokenization, smaller financial institutions can compete with mega-banks and fintech corporations by offering unique digital solutions that cater to local communities. This localized approach can help revitalize regional economies while ensuring that financial services are tailored to the specific needs of residents.

Moreover, the incorporation of blockchain technology in community banking can foster collaboration among various institutions, allowing them to share resources and best practices efficiently. By joining forces, these banks can enhance their service offerings, attract new clients, and stimulate growth within their respective regions. As community banks evolve alongside technological advancements, they are better positioned to adapt to changing consumer demands and remain relevant in the fast-paced world of digital finance.

Frequently Asked Questions

What is bank tokenization and how does it benefit financial institutions?

Bank tokenization refers to the process of integrating blockchain technology to create tokenized deposits and stablecoins, allowing financial institutions to enhance security, efficiency, and regulatory compliance while managing money. This approach enables banks to create a seamless connection between traditional banking and digital finance.

How do tokenized deposits improve the banking experience for customers?

Tokenized deposits leverage blockchain technology to provide customers with faster and more secure transactions, ensuring that their deposits are easily accessible yet protected from risks associated with disintermediation. This innovation streamlines banking operations and enhances user satisfaction.

What role do stablecoins play in bank tokenization efforts?

Stablecoins are digital currencies that maintain stable value and offer a secure method for transactions. In bank tokenization, they enable financial institutions to provide liquidity and facilitate faster payments while ensuring regulatory compliance, making them a vital component of the overall digital banking strategy.

Can regional banks effectively utilize blockchain banking through tokenization?

Yes, regional banks can effectively utilize blockchain banking through tokenization, as demonstrated by partnerships like the one between Vantage Bank and Custodia, giving smaller institutions access to advanced financial technologies and the ability to manage tokenized deposits efficiently.

What regulatory measures support the implementation of bank tokenization?

Bank tokenization operates within regulated environments, including frameworks such as the GENIUS Act, which ensures oversight of tokenized deposits and stablecoins while allowing institutions to maintain compliance with existing financial regulations.

What types of transactions can benefit from tokenized banking solutions?

Tokenized banking solutions can significantly enhance various types of transactions, including cross-border payments, milestone-based financing in construction, and efficient supply chain settlements, all of which benefit from improved speed and security afforded by blockchain.

How does bank tokenization affect customer control over their deposits?

Bank tokenization allows customers to maintain better control over their deposits by enabling them to interact directly with their wallets, providing transparency and security while allowing institutions to manage their assets in a regulated environment.

What is the future of digital finance with respect to bank tokenization?

The future of digital finance holds great potential with bank tokenization, as it is expected to bridge the gap between traditional banking systems and emerging financial technologies, enhancing transaction efficiency, security, and regulatory clarity for both institutions and their customers.

| Key Points | Details |

|---|---|

| Custodia and Vantage Partnership | This partnership allows regional banks to utilize tokenization directly in their banking systems. |

| Tokenized Deposits and Stablecoins | The initiative enables banks to issue and manage both tokenized deposits and stablecoins. |

| Infinant’s Interlace Infrastructure | The system provides a secure and interoperable framework for transaction management. |

| Control Over Wallets | Banks maintain control over their wallets for tokenized deposits and stablecoins. |

| Regulatory Compliance | The framework operates under the GENIUS Act, ensuring compliance and security. |

| Early Use Cases | Includes cross-border payments and supply chain settlements, enhancing transaction efficiency. |

Summary

Bank tokenization represents a transformative shift in how financial institutions operate, especially for U.S. regional banks adopting these advanced technologies. The collaboration between Custodia and Vantage Bank is pivotal, as it allows banks to integrate blockchain efficiencies into everyday banking systems effectively. By managing tokenized deposits and stablecoins within a secure and regulated framework, community banks can maximize operational efficiency and regulatory compliance, ultimately revolutionizing the banking experience for their clients.