The Bitcoin difficulty epoch is a critical aspect of the cryptocurrency mining landscape, influencing how miners engage with the blockchain. Following a recent drop in mining difficulty, the hash rate is ramping up, indicating an exciting shift ahead as we approach the next adjustment on October 29, 2025. With approximately 81% of the necessary blocks already mined, the upcoming difficulty epoch is poised to potentially elevate the mining challenge by 6.77%. This phenomenon embodies the dynamic nature of Bitcoin and underscores the ongoing fluctuations in Bitcoin mining, which affect profitability for miners. As we anticipate how the Bitcoin hashrate will evolve in the coming days, enthusiasts are eager to see how these changes will affect Bitcoin’s trajectory in 2025 and beyond.

In the realm of cryptocurrency mining, the term ‘difficulty epoch’ refers to the period during which the Bitcoin network adjusts the complexity of mining operations. This adjustment is crucial for maintaining a consistent block generation rate, helping stabilize Bitcoin’s overall ecosystem. With the incredible hash power exerted by miners today, the anticipation builds for the next round of changes that could significantly impact Bitcoin’s mining efficiency. As we move closer to the expected adjustment date, discussions around Bitcoin’s hash rate and the implications of prior mining difficulty changes increasingly dominate conversations. By understanding how these cycles interact, stakeholders can better navigate the intricate world of Bitcoin mining and anticipate future trends.

Understanding Bitcoin Difficulty Epochs

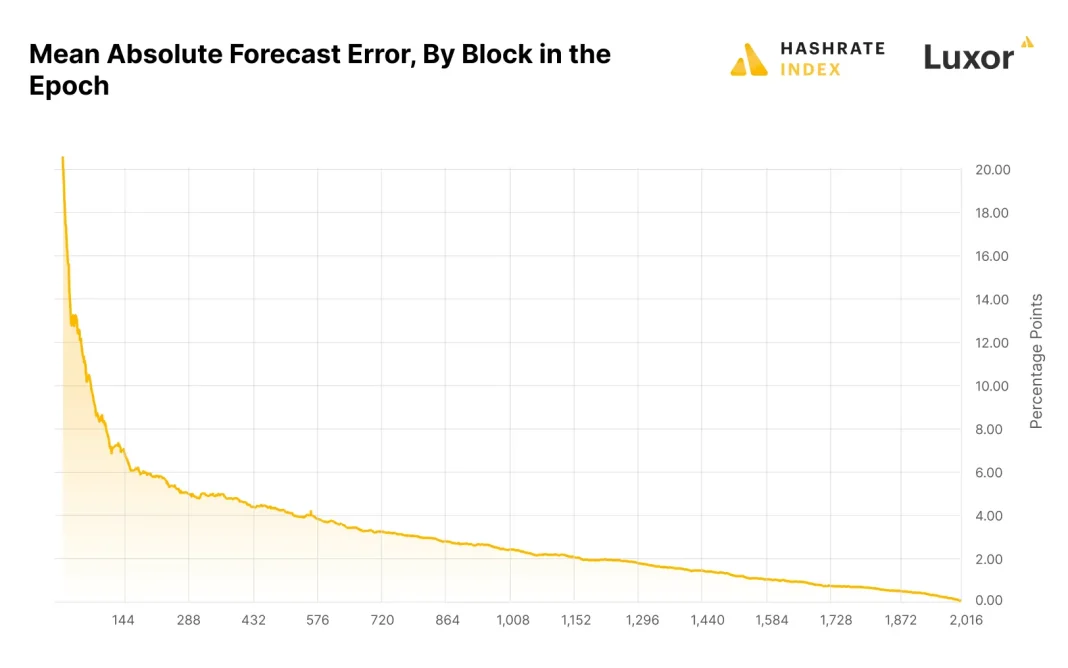

Bitcoin difficulty epochs are vital milestones in the realm of cryptocurrency mining, affecting miners’ profitability and operational efficiency. These epochs dictate the complexity of the puzzles miners must solve to unlock new blocks, thereby influencing the network’s overall stability and security. Each difficulty adjustment occurs approximately every two weeks, or every 2,016 blocks, and is aimed at ensuring that the average time between blocks remains close to ten minutes. This mechanism helps to balance the Bitcoin network, responding dynamically to the total hashrate—a measurement of the computational power used in the mining process.

As the hashrate fluctuates, so does the Bitcoin difficulty, which serves to regulate how many new bitcoins are released into circulation. For instance, if miners collectively increase their computing power significantly, the network will adjust upwards to maintain an equilibrium. Conversely, when miners exit the network, the difficulty reduces. This self-regulating feature not only sustains the mining ecosystem but also keeps the block generation consistent, enabling more predictable outcomes for miners and investors alike.

Frequently Asked Questions

What is the significance of the Bitcoin difficulty epoch in cryptocurrency mining?

The Bitcoin difficulty epoch is critical in cryptocurrency mining as it determines how challenging it is to mine new blocks on the Bitcoin blockchain. This adjustment reflects the overall hashrate of the network and ensures blocks are produced at a consistent 10-minute interval, promoting network stability and security.

How often does the Bitcoin difficulty adjustment occur and why is it important?

The Bitcoin difficulty adjustment occurs approximately every 2,016 blocks, roughly every two weeks. It is essential because it adjusts the mining difficulty based on the current hashrate, ensuring that the average time to mine a block remains close to the target of ten minutes, which is vital for the network’s performance.

What factors influence the Bitcoin mining difficulty during an epoch?

The primary factors influencing Bitcoin mining difficulty during an epoch include the total hashrate of the network, the speed at which miners are solving cryptographic puzzles, and the average block interval times. An increase in mining power generally leads to a higher difficulty adjustment to maintain the ten-minute block target.

How does the Bitcoin hashrate impact the difficulty adjustment process?

The Bitcoin hashrate directly impacts the difficulty adjustment process. A higher hashrate, indicating more computational power being dedicated to mining, typically results in a higher difficulty setting during the adjustment. Conversely, a drop in hashrate can lead to a decrease in difficulty, allowing miners to produce blocks more easily.

What can we expect from Bitcoin’s difficulty adjustment in October 2025?

In October 2025, the Bitcoin difficulty adjustment is projected to increase by approximately 6.77% if current block times remain consistent. This would continue the trend of significant difficulty climbs experienced throughout the year, reflecting a robust hashrate and miner activity.

How do Bitcoin mining trends affect future difficulty epochs?

Bitcoin mining trends can significantly affect future difficulty epochs. If miners consistently produce blocks faster than the target interval, the difficulty will rise, making it harder for them to mine. Conversely, if the mining pace slows, it can lead to a reduction in difficulty, reflecting a more balanced mining environment.

What was the biggest difficulty adjustment Bitcoin experienced in 2025?

The biggest difficulty adjustment in 2025 occurred on July 12, with a notable climb of 7.96%. This adjustment highlights the volatility and dynamic nature of the Bitcoin network as miners respond to changing conditions in the cryptocurrency market.

How does the Bitcoin difficulty epoch impact miner profitability?

The Bitcoin difficulty epoch impacts miner profitability by influencing the rate at which new blocks are mined. Higher difficulty means that miners must invest more computational resources, which can reduce profitability if Bitcoin prices do not rise accordingly. Conversely, lower difficulty can enhance profitability for miners.

| Key Point | Details |

|---|---|

| Current Hasrate | Bitcoin’s hashrate is currently around 1,122 EH/s. |

| Next Difficulty Adjustment | Scheduled for October 29, 2025. |

| Estimated Difficulty Increase | Currently projected to be a 6.77% increase if current block times hold steady. |

| Previous Adjustments | 2025 has seen 21 adjustments: 15 increases and 6 decreases. |

| Recent Performance | Before the last adjustment, miners were lagging, with block intervals longer than 10 minutes. |

| Current Block Interval | As of October 26, average block time is approximately 9 minutes and 21 seconds. |

Summary

The Bitcoin difficulty epoch is poised to create significant changes leading up to its next adjustment on October 29, 2025. With projections suggesting a potential 6.77% increase in difficulty based on current mining performance, this could place it among the highest adjustments of the year. The overall health of the Bitcoin network, indicated by its impressive hashrate and swift block intervals, plays a crucial role in forecasting these adjustments. As miners continue to influence the network’s computing power and efficiency, the upcoming difficulty epoch may not only reshape the immediate landscape but also set benchmarks for future growth in the Bitcoin ecosystem.