Robert Kiyosaki’s financial advice continues to resonate with individuals seeking to escape the pitfalls of economic misinformation and fear-driven narratives. Known for his best-selling book “Rich Dad Poor Dad,” Kiyosaki emphasizes the importance of investing in hard assets like bitcoin, gold, and silver as reliable hedges against the crumbling fiat system and soaring debt levels. He vehemently criticizes financial influencers who thrive on clickbait by spreading alarmist predictions rather than fostering genuine financial education. According to Kiyosaki, the only way to safeguard one’s wealth is through acquiring real assets rather than succumbing to the fear-induced strategies prevalent in today’s financial media. As he urges investors to think critically and invest wisely, Kiyosaki’s insights serve as a beacon for those looking to secure their financial futures amidst uncertainty.

Exploring Robert Kiyosaki’s investment philosophy reveals a focus on pragmatic financial strategies emphasizing asset acquisition. His recommendations advocate for diversifying into hard assets such as cryptocurrencies, particularly bitcoin and ethereum, alongside traditional commodities like gold and silver. By encouraging financial literacy and education, Kiyosaki aims to equip individuals with the knowledge to navigate a tumultuous economic landscape fraught with misleading narratives. He challenges the prevailing doom and gloom that permeates financial discussions, urging a shift towards tangible investments that can endure market fluctuations. Ultimately, Kiyosaki’s approach seeks to empower individuals to reclaim control over their financial destinies, emphasizing the importance of investing wisely and understanding the true nature of wealth.

Robert Kiyosaki’s Financial Education Philosophy

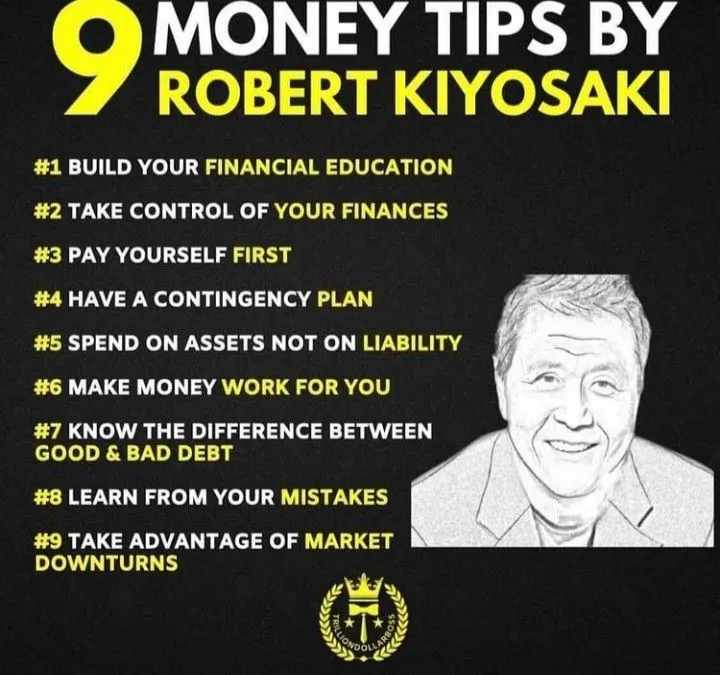

Robert Kiyosaki emphasizes the importance of financial education as a crucial tool for building wealth. In his groundbreaking book, “Rich Dad Poor Dad,” he differentiates between assets and liabilities, urging readers to focus on acquiring income-generating assets. This foundational philosophy serves as an essential guide for individuals seeking financial independence through informed investment strategies. His teachings advocate for a proactive approach to managing money, fostering an understanding of various investment vehicles, including stocks, real estate, and cryptocurrencies.

Kiyosaki argues that traditional education systems often neglect financial literacy, leaving individuals vulnerable to financial pitfalls. By promoting financial education, he aims to empower people to make informed decisions regarding their investments, encouraging a mindset shift from consumer to investor. He believes that understanding economic trends and investment opportunities is key to navigating challenges in the marketplace, especially in light of growing economic uncertainty.

Frequently Asked Questions

What does Robert Kiyosaki think about bitcoin investment?

Robert Kiyosaki believes that investing in bitcoin is essential for protecting wealth against the crumbling fiat system. He views bitcoin and other cryptocurrencies as hard assets that can hedge against economic instability and inflation.

How does Robert Kiyosaki approach financial education?

Kiyosaki advocates for financial education as key to understanding money management. He encourages individuals to learn about hard assets, including gold and silver investment, to make informed decisions and avoid fear-driven narratives.

Why does Kiyosaki emphasize gold and silver investment?

Kiyosaki emphasizes gold and silver investment as a means of safeguarding wealth. He considers these precious metals as real assets that can withstand economic downturns and serve as a hedge against the devaluation of fiat currencies.

What are Kiyosaki’s thoughts on fear-driven financial narratives?

Kiyosaki criticizes fear-driven financial narratives propagated online, accusing influencers of using clickbait strategies. He believes these narratives distract from effective investment strategies like acquiring hard assets.

How does Robert Kiyosaki suggest people counter fear in investing?

Kiyosaki suggests that individuals counter fear by focusing on acquiring tangible assets such as bitcoin, gold, and silver, thereby empowering themselves through financial education and informed investment choices.

What does Robert Kiyosaki say about the U.S. national debt?

Kiyosaki warns that the massive U.S. national debt and poor fiscal leadership are major threats to the economy, likening the situation to a ticking time bomb that makes hard assets all the more necessary.

Is Robert Kiyosaki’s investment advice consistent?

Yes, Kiyosaki’s investment advice consistently stresses the importance of hard assets like gold, silver, and cryptocurrency as reliable stores of value against the risks of inflation and economic mismanagement.

How can I start following Kiyosaki’s financial advice?

To start following Kiyosaki’s financial advice, begin with education on financial literacy, understand the importance of hard asset investment, and consider diversifying into gold, silver, and bitcoin to build a robust financial portfolio.

| Key Points | Details |

|---|---|

| Robert Kiyosaki’s stance on financial narratives | Kiyosaki criticizes fear-driven financial narratives and clickbait tactics in media. |

| Hard assets advocated by Kiyosaki | He emphasizes the importance of investing in bitcoin, ethereum, gold, and silver. |

| Concerns about fiat currency | Kiyosaki warns against the devaluation of the U.S. dollar and the dangers of national debt. |

| Criticism of Kiyosaki | Some believe Kiyosaki uses alarmist rhetoric similar to those he criticizes. |

| Vision for financial education | His goal is to empower individuals through financial education and investment in tangible assets. |

Summary

Robert Kiyosaki’s financial advice urges individuals to be wary of fear-driven narratives dominating the financial media landscape. He strongly advocates for investing in hard assets such as bitcoin, ethereum, gold, and silver as a safeguard against the instability of fiat currencies and the mounting national debt. Kiyosaki’s emphasis on education and tangible investments highlights the need to take control of one’s financial future, positioning these assets as vital tools for wealth preservation in uncertain economic times.