BitcoinOS $BOS Token is poised to revolutionize the digital finance landscape through its innovative approach to tokenomics. As one of the most ambitious deflationary tokens in the cryptocurrency market, $BOS leverages Bitcoin’s robust economy with a distinctive buy-and-burn model. This mechanism promotes permanent scarcity by automatically purchasing and destroying tokens with fees generated from Bitcoin transactions. With Bitcoin’s growth trajectory and programmability, $BOS embodies the future of cryptocurrency tokenomics, ensuring that every transaction contributes to the token’s long-term value. As investors seek opportunities in this rapidly evolving space, BitcoinOS $BOS Token may emerge as a critical player in the new era of digital finance.

Introducing the BitcoinOS $BOS Token, a groundbreaking innovation in the realm of decentralized finance, this cryptocurrency aims to redefine how we understand asset scarcity and value creation. With its unique buy-and-burn methodology, the $BOS token is engineered to harness the growing momentum of Bitcoin’s ecosystem while promoting a deflationary paradigm. In an age where financial transactions can be streamlined through programmable blockchain technology, this token stands out by ensuring that each use within the network contributes to its ultimate scarcity. Not merely another cryptocurrency, $BOS represents a convergence of digital finance and robust economic principles, inviting investors and users alike to engage with its potential for growth and value appreciation. As Bitcoin continues its ascent, the implications for the $BOS token could be profound, particularly in the context of enhancing the overall cryptocurrency landscape.

The Innovative Buy and Burn Mechanism of BitcoinOS

BitcoinOS is at the forefront of cryptocurrency innovation with its unique buy and burn mechanism that potentially outstrips traditional deflationary models. The system is designed to leverage Bitcoin’s extensive network such that every transaction increases buying pressure on the $BOS token while simultaneously reducing its circulating supply. This innovative strategy aligns directly with the growing trend of programmable assets within digital finance, ensuring that $BOS tokens are not just another token with ambiguous utility, but a crucial part of a deflationary equation that directly benefits from Bitcoin’s bull market cycles.

The simplicity of BitcoinOS’s model lies in its ability to connect Bitcoin’s expansive ecosystem with tangible benefits for $BOS holders. Whenever Bitcoin transactions occur, they generate transaction fees, which are then utilized to purchase $BOS tokens and subsequently burn them. This process establishes a clear and predictable relationship between Bitcoin’s network activity and the scarcity of $BOS. In doing so, BitcoinOS transforms the landscape for deflationary cryptocurrencies, ensuring that every usage of Bitcoin within the network equally stimulates the demand and value for $BOS.

Frequently Asked Questions

What is the BitcoinOS $BOS token and how does it relate to deflationary token models?

The BitcoinOS $BOS token is designed as a deflationary cryptocurrency token utilizing a unique buy-and-burn mechanism. As BitcoinOS facilitates various transactions on the Bitcoin network, a portion of the fees collected in Bitcoin is used to periodically buy back $BOS tokens from the market and permanently burn them. This systematic destruction of tokens creates scarcity, positioning $BOS as a potential leader among deflationary tokens in the crypto space.

How does the buy-and-burn mechanism of BitcoinOS $BOS increase token scarcity?

The buy-and-burn mechanism of BitcoinOS $BOS increases token scarcity by automatically using transaction fees paid in Bitcoin to purchase $BOS tokens. These purchased tokens are then burned, reducing the overall supply. As Bitcoin transaction volume grows, so does the buying pressure on $BOS, leading to continuous scarcity and a deflationary token environment.

Can BitcoinOS $BOS token benefits be compared to traditional cryptocurrency tokenomics?

Yes, while many cryptocurrencies employ tokenomics strategies to create value, the BitcoinOS $BOS token distinguishes itself through its integration of Bitcoin’s transaction activity directly into its deflationary system. Unlike traditional tokenomics that may rely on speculative buying or marketing, $BOS’s mechanical approach ensures that increased network usage leads to more Bitcoin fees, more $BOS tokens purchased, and more tokens burned, fostering a sustainable value growth model.

What are the implications of Bitcoin’s institutional adoption on the $BOS token?

Bitcoin’s growing institutional adoption, with significant amounts of Bitcoin moving into institutional hands, creates a positive outlook for the $BOS token. Institutions are seeking yield without custody risk, making BitcoinOS a favorable option. As institutional transactions generate Bitcoin fees, more $BOS tokens will be bought and burned, potentially enhancing the token’s value in the process.

What challenges do traditional DeFi solutions face that BitcoinOS $BOS token addresses?

Traditional DeFi solutions often require users to relinquish custody of their Bitcoin, which creates compliance and custody risks for institutional investors. BitcoinOS, on the other hand, allows users to lock their Bitcoin while maintaining ownership and security. This unique approach enables Bitcoin holders to benefit from DeFi opportunities without exposing themselves to counterparty risks, thereby enhancing the appeal of the $BOS token in the digital finance evolution.

What makes the $BOS token’s supply dynamics unique compared to other tokens?

The $BOS token’s supply dynamics are unique due to its fixed total supply of 21 billion tokens, tied to Bitcoin’s own scarcity model. The systematic burning of tokens every time a transaction occurs means that as the network grows and transaction fees increase, the demand for $BOS tokens rises while the supply diminishes. This setup fosters a deflationary spiral where demand outpaces supply, potentially leading to significant value appreciation over time.

How does the $BOS token fit into the larger ecosystem of Bitcoin’s programmable capabilities?

The $BOS token is integral to Bitcoin’s evolution into a programmable platform. As Bitcoin transactions become increasingly programmable, the associated fees will feed into the $BOS token’s buy-and-burn mechanism. This allows $BOS to capture value from the expanding utility of Bitcoin, making it an essential asset for those looking to invest in Bitcoin’s technological advancements and the future of digital finance.

What can investors expect from the future of BitcoinOS $BOS token in light of market trends?

Investors can expect the BitcoinOS $BOS token to potentially become a key player in the digital finance landscape as Bitcoin’s adoption and programmability grow. With a robust buy-and-burn mechanism tied to Bitcoin’s vast transaction volume and increasing institutional interest, the $BOS token might see enhanced demand and a declining supply, positioning it for possible appreciation in value as more participants engage with the Bitcoin network.

| Key Point | Details |

|---|---|

| Deflationary Model | BitcoinOS introduces a systematic buy-and-burn mechanism to create scarcity for the $BOS token. |

| Bitcoin’s Programmability | As Bitcoin transactions increase, they generate more fees which convert into $BOS purchases, driving scarcity. |

| Institutional Demand | Approximately $690 billion of Bitcoin is held by institutions, creating potential for sustained demand for $BOS through DeFi and yield generation. |

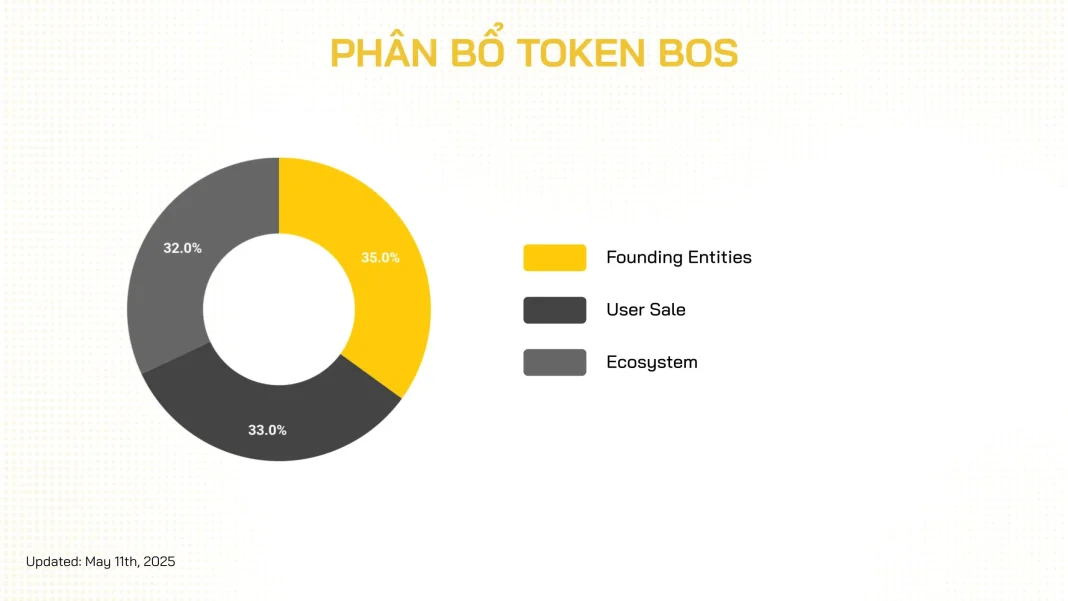

| Tokenomics | With a total supply of 21 billion $BOS and systematic burning, it aims for deflationary conditions as demand grows. |

Summary

BitcoinOS $BOS Token is set to revolutionize the cryptocurrency market with its innovative buy-and-burn mechanism, promising to create a deflationary model that leverages Bitcoin’s unique programming capabilities. As Bitcoin transactions increase, the $BOS token will see enhanced demand through Mechancial value accrual, driven by institutional interest and network utilization. Investors are presented with a timely opportunity to engage with a token that not only consolidates the value of its parent asset, Bitcoin but also creates a clear pathway for future growth as the world increasingly seeks programmable financial solutions.