In the ongoing debate of bitcoin vs gold, the differences in their market performance continue to spark discussions among investors. Recently, Peter Schiff, a prominent gold advocate, argued that bitcoin cannot truly function as a reliable digital equivalent of gold. As the Federal Reserve announced a rate cut, the subsequent reactions between the two assets were telling; while gold saw a significant price increase, bitcoin experienced a notable crash. This contrast raises critical questions for those considering investing in bitcoin as a safe haven asset, especially when gold consistently proves its stability as a traditional investment. By examining these developments, investors must weigh the implications of fluctuating gold prices against the volatility associated with cryptocurrencies.

The debate surrounding cryptocurrency versus precious metals, particularly the comparison of bitcoin and traditional gold investments, has heated up in financial circles. With the recent fluctuations in the market, particularly following the Federal Reserve’s monetary policy shifts, many are reconsidering the perceived safety of digital assets. While gold has long been revered as the ultimate safe haven during economic turmoil, the rising popularity of bitcoin has led to its labeling as ‘digital gold.’ Nevertheless, critics argue that the inconsistencies in bitcoin’s market behavior challenge its status as a reliable, stable investment option. As investors navigate these complex dynamics, understanding the broader implications on their investment strategies becomes paramount.

Understanding the Divergence: Bitcoin vs Gold

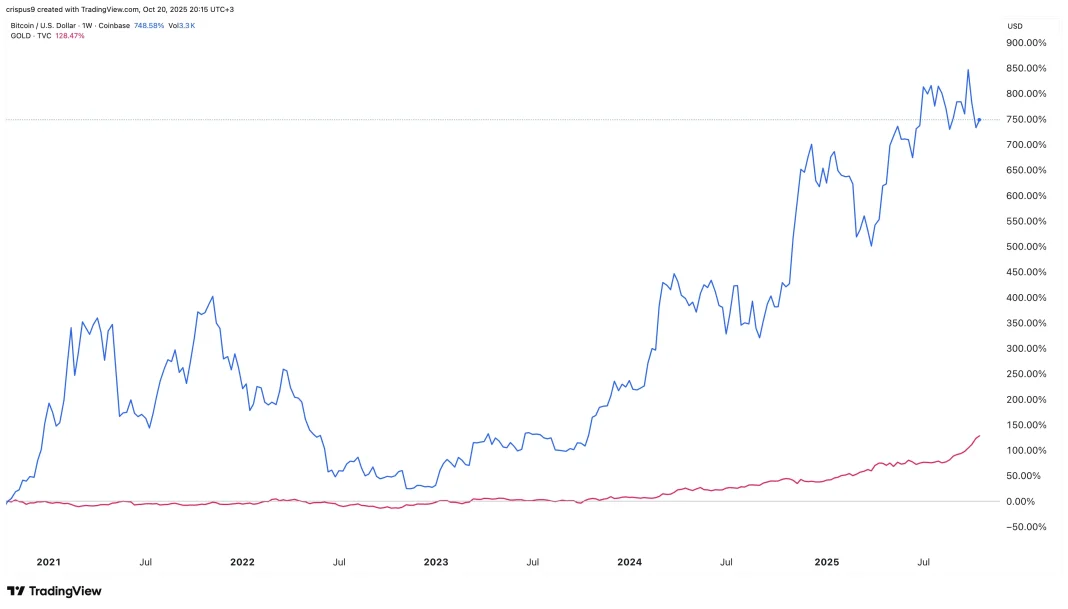

The recent fluctuations in both bitcoin and gold prices following the Federal Reserve’s rate cut provide a clear illustration of how these two assets respond differently to economic stimuli. Gold, historically seen as a safe haven, surged over $90 and reclaimed the critical $4,000 level. This increase highlights gold’s enduring reputation as a stable store of value during economic uncertainty. In contrast, bitcoin experienced a notable decline, dropping over 3% and signaling fears about its reliability in times of market turbulence. This stark difference raises questions about the validity of bitcoin’s branding as ‘digital gold.’

While proponents of bitcoin argue that it could serve as a long-term hedge against inflation similar to gold, the recent performance metrics tell a different story. Investors often flock to gold during times of economic instability, trusting in its historical value retention. On the other hand, bitcoin’s volatility during such crucial periods underscores its lack of maturity as an asset class. As Peter Schiff aptly notes, significant downturns depict bitcoin as more akin to ‘fool’s gold’ rather than a genuine safe-haven asset, prompting investors to reconsider their strategies in this digital investment landscape.

Frequently Asked Questions

Why do some analysts argue that bitcoin cannot be considered digital gold?

Analysts like Peter Schiff argue that bitcoin cannot be considered digital gold because it reacted negatively to the recent Federal Reserve rate cuts, in contrast to gold’s price surge. Schiff suggests that bitcoin does not have the same safe haven characteristics as gold, particularly during economic uncertainties. This disparity raises questions about bitcoin’s reliability as a long-term investment compared to gold.

How did gold prices and bitcoin perform during the latest Federal Reserve rate cut?

During the latest Federal Reserve rate cut, gold prices surged by over 2%, closing above $4,000, indicating a strong reaction to the rate cuts. In contrast, bitcoin’s price plummeted over 3%, falling below $107,000. This contrasting performance highlights the differences in how investors perceive gold as a safe haven versus bitcoin amid changing monetary policy.

What does investing in bitcoin versus gold mean for investors?

Investing in bitcoin versus gold signifies different approaches to asset preservation. While gold is recognized as a traditional safe haven asset with a long history of value retention, bitcoin is seen by some as a speculative investment. The recent market behavior suggests that gold may provide more stability during financial uncertainty compared to bitcoin, which has shown volatility, particularly in response to macroeconomic events.

Is bitcoin a safe haven asset like gold?

Currently, many experts argue that bitcoin does not qualify as a safe haven asset like gold. Despite being labeled as digital gold, bitcoin’s recent performance during economic stress—specifically its drop when gold surged—suggests that it may not withstand value preservation expectations during critical market conditions. The ongoing debate centers around bitcoin’s long-term viability as a reliable safe haven.

How do market perceptions affect bitcoin and gold investments?

Market perceptions significantly impact bitcoin and gold investments. While gold is traditionally viewed as a reliable store of value, recent fluctuations indicate that investors may start to question bitcoin’s status as a safe haven. The contrasting reactions of bitcoin and gold to economic changes, such as interest rate cuts, can influence investor decisions and shifting strategies toward asset allocation.

What does the recent bitcoin crash imply for its future as an investment?

The recent bitcoin crash, especially its decline in response to favorable market conditions for gold, suggests potential uncertainty about its future as an investment. Analysts like Schiff believe that such volatility indicates that bitcoin may fail to achieve its expected status as a secure asset, leading to skepticism among investors and potentially affecting its long-term appeal compared to gold.

Can bitcoin and gold coexist as investment options?

Yes, bitcoin and gold can coexist as investment options, but they cater to different investor profiles and expectations. While gold serves as a traditional safe haven with low volatility, bitcoin appeals to those seeking high-risk, high-reward opportunities. Investors may choose to diversify their portfolios by including both assets to balance risk and potential returns amid economic fluctuations.

| Aspect | Bitcoin | Gold | ||||||

|---|---|---|---|---|---|---|---|---|

| Reaction to Fed Rate Cut | Plummeted over 3%, below $107,000 | Rose over $90, closed above $4,000 | Market Perception | Promoted as a safe haven but failing to perform | Established as a traditional safe haven asset, responds positively to economic changes | Future Outlook | Concerns about potential downturns | Expected to rise amidst weakening dollar and uncertainty |

| Performance Comparison | Cannot replicate gold’s performance | Surged past $4,000 after recent recovery | Market Analysts’ Views | Analysts suggest potential failure | Anticipated rise with economic pressures |

Summary

In the debate of bitcoin vs gold, recent market behaviors indicate a significant divergence between the two assets. While bitcoin struggled following the Federal Reserve’s rate cuts, with a notable drop in its value, gold thrived, reflecting its position as a safe haven in financial markets. Analysts like Peter Schiff argue that this disparity underscores the risks associated with bitcoin, suggesting it cannot yet be considered a true alternative to gold. The ongoing uncertainty in the market hints that while both assets may face challenges, gold remains a more reliable choice for investors seeking stability.