Bitcoin recovery US-China trade deal is sparking optimism across the cryptocurrency landscape. With U.S. Treasury Secretary Scott Bessent confirming that an official agreement will be signed soon, Bitcoin’s price has surged 2.62%, signaling a potential rebound from recent lows. This shift in sentiment comes as the cryptocurrency market grapples with recent volatility, including substantial liquidations totaling around $400 million. Investors are closely monitoring the upcoming U.S.-China trade agreement, as it could play a critical role in stabilizing Bitcoin and influencing broader cryptocurrency market trends in the weeks to come. As Bitcoin’s investment outlook brightens, many are left wondering how these developments will affect Bitcoin price rise and overall market dynamics.

The recent discussions around the cryptocurrency market, particularly in relation to the upcoming U.S.-China trade agreement, offer a glimpse into the potential future of digital assets. With trade tensions easing, Bitcoin’s resurgence hints at a renewed confidence among investors, leading to a ripple effect across the broader financial spectrum. The anticipated treaty promises to alleviate some economic pressures, which could foster a more favorable environment for cryptocurrency investments. Emerging trends in the crypto landscape suggest that the recent gains are not just a fleeting moment but could signify a shift towards optimism in the Bitcoin investment space. As market players analyze the impacts of trade relations on crypto liquidation and price movements, the dynamics of the crypto market are undoubtedly in flux.

Bitcoin Recovery Amidst US-China Trade Deal Confirmation

Bitcoin’s journey towards recovery has gained significant momentum with the confirmation of an imminent US-China trade deal. As U.S. Treasury Secretary Scott Bessent announced the official signing of the trade agreement anticipated next week, Bitcoin responded positively, managing to climb back to a trading price of $109,777.25. This uptrend occurred after the cryptocurrency faced a sharp decline below $107,000, a point that triggered mass liquidations in the crypto market amounting to approximately $400 million. The news of improved relations between the two economic giants has injected fresh optimism into the cryptocurrency markets.

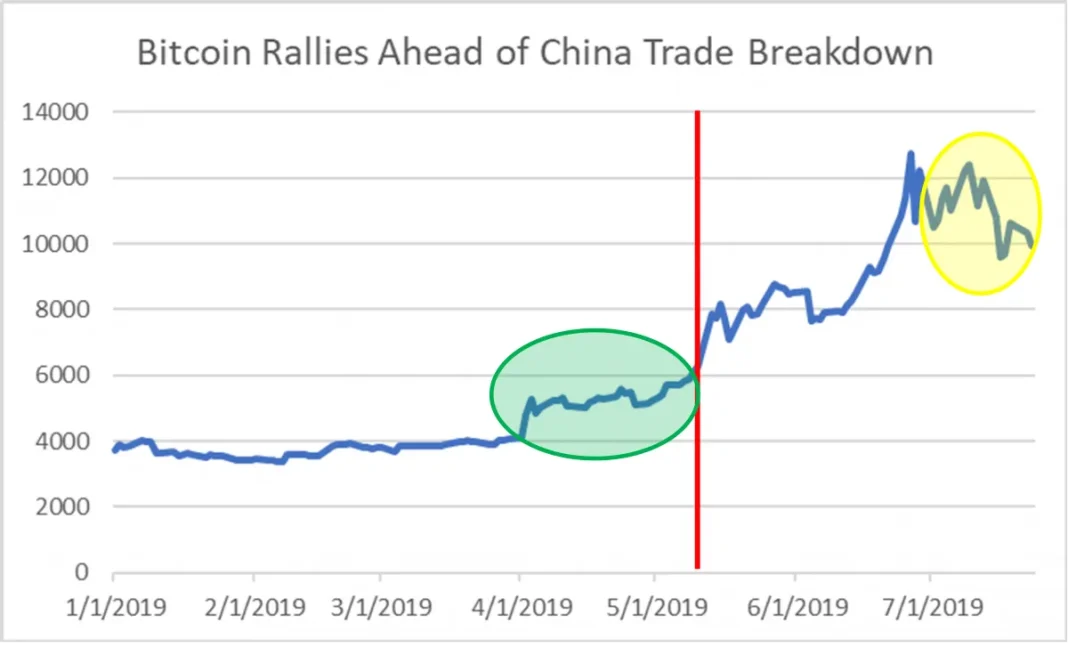

Moreover, the anticipated easing of trade tensions provides a much-needed lift not only for Bitcoin but for the entire cryptocurrency market. Historically, crypto prices have shown sensitivity to macroeconomic developments, and the potential for a stable economic environment is essential for investor confidence. As both parties work towards resolving trading disputes — including the significant rare earth export controls from China — market participants are hopeful that a resolution will ensure smoother operations across various sectors, including cryptocurrencies. This optimism echoes previous trends where Bitcoin’s price movement is closely tied to broader economic indicators.

Impact of US-China Trade Agreement on Bitcoin Investment Outlook

The imminent US-China trade agreement is likely to have far-reaching implications for Bitcoin investors. With a commitment from both nations to resolve contentious issues, such as tariffs and trade restrictions, investors may find a more attractive environment for engaging with Bitcoin as a viable asset class. The agreement indicates a willingness to stabilize international trade, which can enhance market confidence and encourage more substantial investments in the cryptocurrency market. Analysts believe that if the US-China dynamics remain stable, Bitcoin could experience a notable price rise, as many perceive it as a hedge against potential economic volatility.

Furthermore, the provenance of the trade deal includes essential components that safeguard American investments in Chinese markets while also allowing Chinese companies to engage more effectively with U.S. investors. This new wave of potential investment openings and collaborations may lead to increased liquidity in the cryptocurrency markets, as traditional investors may look towards Bitcoin for diversification. The balance achieved by this agreement could also alleviate some of the cryptocurrency liquidation impacts that have been plaguing investors recently, providing a more stable ground for crypto trading and investment.

Market Metrics Response to Crypto Liquidation Events

Recent liquidation events in the cryptocurrency market, especially concerning Bitcoin, have significantly impacted trading metrics. Following a substantial drop that caused around $400 million in liquidations, market players have been quick to recalibrate their strategies in anticipation of recovery driven by external economic variables like the US-China trade negotiations. The cryptocurrency’s market capitalization rose to $2.19 trillion, indicating a renewed interest and influx of capital. However, traders should stay cautious as Bitcoin’s trading volume witnessed fluctuations, illustrating market sensitivity to both internal factors and global economic concerns.

In light of these sudden market shifts, it’s crucial for investors to remain agile and informed about market conditions. The total value of Bitcoin futures open interest has fallen, indicating a potential reduction in speculation as traders reevaluate their positions amid the ongoing economic discussions. As market metrics fluctuate, understanding the cause-and-effect relationship between market news, such as the US-China trade deal and Bitcoin performance, will be vital for investors aiming to capitalize on the cryptocurrency’s price movements and underlying trends.

Cryptocurrency Market Trends Following Major Economic Updates

The cryptocurrency market consistently exhibits a high degree of responsiveness to significant economic updates. Following the recent announcements related to the US-China trade deal, we have observed an uptick in Bitcoin prices, which is often a precursor to larger trends within the broader crypto market. The basic tenet for such movements is that when major global economies make positive strides, risk assets like cryptocurrencies tend to rally as investors feel more confident about entering the marketplace.

One of the prevailing trends is that periods of heightened trade stability often lead to lower volatility in the cryptocurrency markets. Following the anticipated US-China agreement, analysts are beginning to see a shift in market sentiment, which could lead to potential bullish trends in Bitcoin and other cryptocurrencies. Keeping an eye on market capitalization and trading volume metrics during these times will help investors gauge the sustainability of these trends, as they often serve as indicators of broader investor sentiment towards assets in the crypto space.

Understanding the Crypto Liquidation Impacts on Bitcoin Value

Crypto liquidations can significantly affect the price and overall stability of Bitcoin, especially in times of economic tension. The recent significant liquidation event, which exceeded $400 million, demonstrated how market responses to geopolitical developments can create ripples in Bitcoin’s value. When large portions of investors sell or have their positions liquidated, it creates downward pressure on Bitcoin’s price, leading to panic and further sell-offs.

However, the recent positive news regarding the US-China trade deal has started to counteract some of these liquidation effects. With renewed interest and capital flowing back into the market, Bitcoin’s resilience is being tested, and many traders are eager to see how sustained macroeconomic stability could potentially lift Bitcoin back to previous highs. Understanding these liquidation impacts is crucial for any investor looking to grasp Bitcoin’s dynamic movement within the constantly shifting crypto landscape.

Future Projections for Bitcoin Post Trade Deal Announcement

As discussions around the US-China trade agreement unfold, future projections for Bitcoin’s performance become increasingly optimistic. The markets have already begun to reflect this sentiment, with Bitcoin showing positive gains following the announcement by Treasury Secretary Bessent. Analysts predict that continued diplomatic efforts and the implementation of the agreement could lead to a sustained rally in Bitcoin prices over the coming weeks. By strategically positioning themselves, investors can leverage these projected trends to optimize Bitcoin investments.

Additionally, if this trade deal results in favorable conditions for trade and investment between the US and China, Bitcoin could benefit from increased global adoption among investors seeking to diversify their portfolios. This integration into traditional financial systems may attract institutional investors back to cryptocurrencies, further enhancing Bitcoin’s value. The prospect of Bitcoin establishing itself as a legitimate asset class hinges not only on trade developments but also on regulatory progress and market acceptance.

Analyst Perspectives on Bitcoin Fluctuations and Trade Relations

Market analysts are paying close attention to Bitcoin fluctuations, especially in light of changing trade relations between the US and China. They suggest that while macroeconomic indicators like trade agreements can significantly influence Bitcoin’s price, inherent market volatility remains a characteristic that investors must navigate carefully. The optimistic tone following the announcement of the US-China trade deal indicates that analysts foresee a potential stabilization of the cryptocurrency markets, with Bitcoin potentially benefitting from renewed investor confidence.

Furthermore, analysts suggest that the perspectives around Bitcoin should also consider potential headwinds from ongoing regulatory uncertainties. As trade relations normalize, it may pave the way for clearer regulatory frameworks that will impact Bitcoin’s adoption. The anticipation surrounding the crypto market’s reaction to such developments is creating a mixed sentiment where caution is advised amid a cautiously optimistic outlook for Bitcoin’s future.

The Role of Bitcoin in the Global Economic Landscape

Bitcoin’s role in the global economic landscape is evolving, particularly as it gains traction as an alternative asset class. The announcement of the US-China trade deal has underscored Bitcoin’s potential function as a hedge against economic uncertainties. With both nations working towards better economic relations, Bitcoin may find itself being adopted more widely as a store of value and a medium of exchange in times of geopolitical shifts. This factor may solidify Bitcoin’s standing as a critical player in the global economy.

Additionally, as more investors identify Bitcoin’s potential in responding to traditional market fluctuations, it is crucial to evaluate its implications on global investment strategies. The integration of Bitcoin within traditional portfolios represents a shift towards recognizing cryptocurrencies as viable assets amidst ongoing economic fluctuations. As global economies navigate through uncertain terrains, Bitcoin may find a more permanent spot within traditional financial systems looking to diversify amid constant change.

Investor Strategies during Bitcoin’s Price Recovery Phase

As Bitcoin enters a recovery phase with the backdrop of the US-China trade agreement, investors are revisiting their strategies to maximize their gains from this resurgence. Many are advocating for a diversified investment approach, suggesting that allocating resources across different cryptocurrencies while maintaining a core Bitcoin investment could help mitigate risks associated with volatility. This strategy is informed by both historical price patterns and the current trends reflecting increased market engagement following positive trade developments.

Additionally, traders are advised to keep their eyes on key market indicators such as trading volume and price actions in response to news related to the trade deal. Implementing stop-loss orders and taking advantage of market trends by employing short-term trading strategies may also amplify returns amidst the recovery. Ultimately, engaging with Bitcoin during this turbulent yet opportunistic phase requires a balance of strategic foresight and adaptability to capitalize on the changing market dynamics effectively.

Frequently Asked Questions

How does the US-China trade deal impact Bitcoin recovery?

The US-China trade deal’s confirmation has introduced optimism into the cryptocurrency market, leading to a modest Bitcoin recovery as seen with a 2.62% rise in its price following the announcement.

What role does the US-China trade agreement play in Bitcoin price rise?

The impending US-China trade agreement is seen as a catalyst for the Bitcoin price rise, as it helps ease market tensions and encourages investor confidence in cryptocurrencies.

Can Bitcoin investment outlook improve due to the US-China trade deal?

Yes, with the US-China trade deal potentially reducing trade tensions, the Bitcoin investment outlook has improved, making it more appealing for investors looking to capitalize on recovering market trends.

What are the implications of the trade deal on cryptocurrency market trends?

The trade deal is expected to stabilize cryptocurrency market trends by alleviating uncertainties, leading to increased investments and a potential bullish momentum in Bitcoin and other cryptocurrencies.

How are Bitcoin liquidation impacts related to the US-China trade deal?

The recent volatility related to the US-China trade tensions resulted in significant Bitcoin liquidation. However, the news of a trade deal has helped recover some losses, reducing the likelihood of further mass liquidations in the near term.

| Key Point | Details |

|---|---|

| Bitcoin Recovery | Bitcoin gains 2.62%, trading at $109,777.25 after a low of $107,000. |

| Trade Deal Confirmation | US Treasury Secretary Scott Bessent confirmed the US-China trade deal will be signed next week. |

| Impact of Trade Deal | China will pause rare earth export controls; US will reduce tariffs. |

| Market Reaction | Both stocks and Bitcoin reacted positively to the news, with increased trading volumes. |

| Future Outlook | Analysts suggest this could provide short-term relief but warn of potential volatility. |

Summary

Bitcoin recovery is closely linked to the anticipated signing of the US-China trade deal next week. Following confirmations from US Treasury Secretary Scott Bessent, the market responded positively, with Bitcoin experiencing notable gains. The trade agreement signals a de-escalation of tensions that had recently caused significant volatility within cryptocurrency markets. With the easing of restrictions and trading optimism, investors are cautiously optimistic about Bitcoin’s potential stability, even as analysts caution against returning volatility in the long term.