Bitcoin mining difficulty is a critical aspect of the cryptocurrency ecosystem, impacting how Bitcoin miners operate and ultimately their revenue. Recently, a notable 6.31% increase in difficulty has raised the total to an impressive 155.97 trillion, demonstrating just how competitive the mining landscape has become. Despite this uptick, Bitcoin miners have managed to sustain a robust hashrate, consistently exceeding 1,100 exahash per second (EH/s) and keeping block times on target at the traditional 10-minute mark. October was relatively kind to these miners, generating around $1.595 billion in revenue, boosting their earnings compared to September. However, with Bitcoin price fluctuations and this recent rise in mining difficulty, the focus now shifts to the profitability of mining operations, as miners navigate the challenging terrain of energy costs and market values.

Within the realm of cryptocurrency, the concept of mining complexity plays a vital role in shaping the actions of Bitcoin producers and their financial outcomes. Recently reported metrics have highlighted a remarkable 6.31% surge in mining complexity, bringing it to a staggering 155.97 trillion, underscoring the growing competition among miners. Even with this increase, Bitcoin miners have demonstrated resilience by maintaining a solid hashrate that remains above 1,100 exahash per second (EH/s), with most blocks being mined in adherence to the expected timeframe. The month of October proved to be beneficial for these miners, raking in approximately $1.595 billion in earnings, indicating a steady upward trend in their financial health. However, with volatile cryptocurrency prices and rising complexity, the spotlight now casts doubt on the overall mining profitability and the sustainability of these operations.

Impact of Bitcoin Mining Difficulty on Profitability

This week, Bitcoin miners faced a notable 6.31% increase in mining difficulty, bringing the total to a staggering 155.97 trillion. This rise in difficulty means that miners must now invest more computational power to solve cryptographic puzzles and validate transactions on the network. As a direct consequence, many miners are feeling the squeeze on their profitability, particularly given that Bitcoin’s price has encountered a downward trend. For them, this difficulty adjustment is a critical factor as it can significantly impact their earnings and overall sustainability in the market.

Despite the challenges posed by increased mining difficulty, miners have managed to keep a robust hashrate, hovering above the 1,100 exahash per second (EH/s) level. This resilience demonstrates that many miners have adapted quickly to fluctuations in network conditions. However, with profitability influenced by mining difficulty, energy costs, and Bitcoin’s price, miners find themselves caught in a delicate balancing act. As the earnings from block rewards and transaction fees fluctuate, miners must strategically plan their operations to maximize revenue while minimizing costs, which may include scaling back on power usage or even leaving the network if conditions worsen.

Bitcoin Miners’ Revenue Trends

October proved to be a beneficial month for Bitcoin miners, yielding approximately $1.595 billion in revenue. Of this, $1.584 billion stemmed directly from the block subsidy, highlighting the continued importance of mining rewards as a primary income source. This revenue represented a modest increase from September’s earnings of $1.564 billion, ultimately providing miners with a much-needed boost in their finances. As the crypto markets continue to mature, tracking revenue trends is essential for miners seeking to optimize their profitability amidst a backdrop of fluctuating difficulty and Bitcoin prices.

The increased revenue in October translates to an additional $31 million over the previous month, showcasing the potential for profitability even during turbulent market conditions. Such revenue spikes are vital, as miners rely heavily on consistent cash flow to cover operational expenses like electricity, equipment, and maintenance. However, the industry must remain vigilant since external factors, including Bitcoin’s price instability and changes in mining difficulty, can quickly shift the landscape. Therefore, understanding these dynamics is crucial for miners aiming to sustain their operations and adapt to market conditions.

Correlation Between Bitcoin Price and Mining Hashrate

As of November 1, the Bitcoin hashrate stood at a comfortable 1,110.86 EH/s, yet it revealed a noticeable dip from a peak of 1,164 EH/s on October 19. This decline in hashrate amid rising mining difficulty indicates that some miners may be retreating in response to unfavorable financial conditions as Bitcoin’s price falls. A diminishing hashrate can also impact network security, since fewer machines are attempting to solve blocks. It’s essential to monitor this correlation, as it reflects not just miners’ operational choices but also their confidence in the cryptocurrency’s future profitability.

When Bitcoin’s price fluctuates, the implications for mining are significant. A falling price usually compels miners to reassess their operations. If Bitcoin prices drop too low, it could lead to an uptick in miners shutting off their machines, further reducing hashrate. The balance of these factors is critical; should Bitcoin’s price recover, there is potential for the hashrate to stabilize or even increase. However, without a favorable trend in Bitcoin price, many miners may face the hard decision of either shutting down operations or seeking efficiencies in energy consumption and operational costs.

Miners and the Hashprice Dilemma

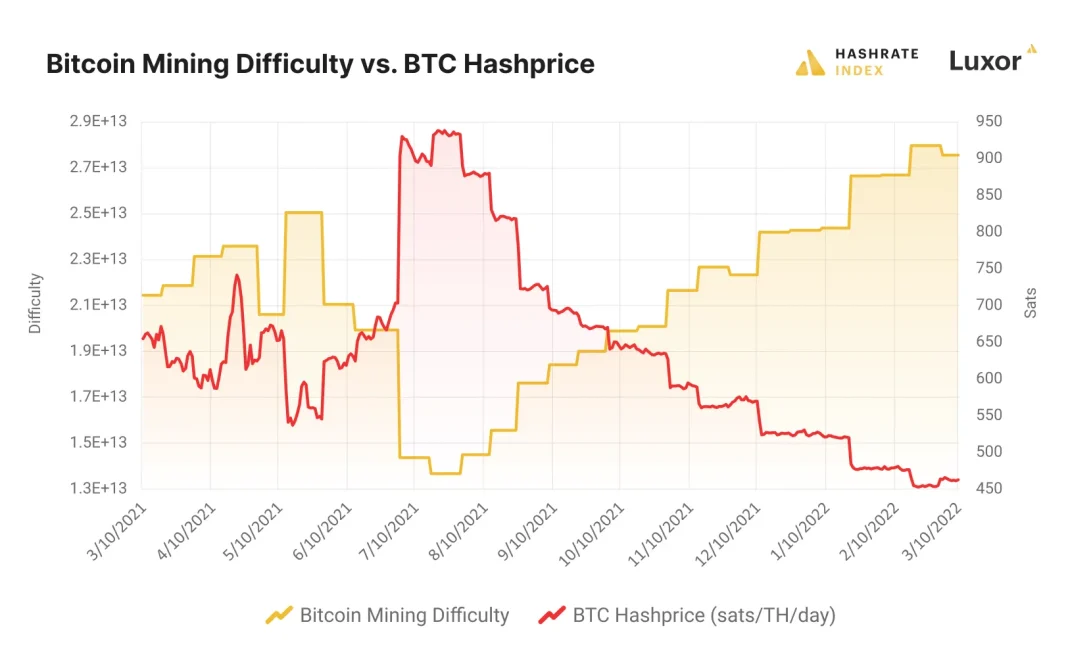

A worrying trend for Bitcoin miners is the decline in hashprice — the estimated value of one petahash per second (PH/s) of mining power. Just thirty days ago, a PH/s was valued at around $50.66, but it has plummeted to approximately $44.67. This reduction directly impacts miners’ revenue since hashprice serves as a tangible measure of how much income they can expect from their mining activities. A lower hashprice, coupled with rising difficulty, puts significant financial pressure on miners, forcing them to rethink their strategies to maintain profitability.

Low hashprice levels highlight the necessity for miners to remain agile and adapt to market conditions. In a scenario where transaction fees comprise only a small fraction of block rewards, miners can no longer depend heavily on these fees as a reliable income stream. The diminishing hashprice means that miners must optimize their operations, including energy consumption and operational strategies, to ensure survival in an increasingly competitive environment. As they navigate this dilemma, finding ways to enhance efficiency without sacrificing output will be paramount.

Future Prospects for Bitcoin Miners

The outlook for Bitcoin miners remains uncertain, particularly given the current pressures of rising mining difficulty and fluctuating Bitcoin prices. Many miners are hopeful for a normalization in the market where Bitcoin’s price rises to more favorable levels, which would, in turn, positively impact hashprice and, ideally, overall profitability. Miners are watching the market closely, as signs of recovery could invigorate their operations and help them recover some of the income lost in recent months.

In the world of Bitcoin mining, patience is a virtue, yet it comes at a cost. As miners await a rebound, they must continue to balance their operational expenses, including electricity costs, against their revenue. This careful calculation is crucial, as profitability hinges on three competing variables: mining difficulty, the Bitcoin market value, and energy costs. Any consequential changes in price or difficulty can significantly shift the equilibrium, forcing miners to adapt quickly to maintain their edge. With this constant state of flux, the resilience and strategies of Bitcoin miners will undoubtedly be tested in the near future.

Frequently Asked Questions

How does Bitcoin mining difficulty affect Bitcoin miners’ profitability?

Bitcoin mining difficulty directly impacts miners’ profitability by determining how challenging it is to solve cryptographic puzzles to add new blocks to the Bitcoin blockchain. When difficulty increases, miners must exert more computational power, which can elevate operational costs. This means that unless Bitcoin’s price rises accordingly, miners may face squeezed margins.

What caused the recent increase in Bitcoin mining difficulty by 6.31%?

The recent increase in Bitcoin mining difficulty by 6.31% was mainly due to a significant rise in the total Bitcoin hashrate, which indicates more miners are participating in the network. As more miners contribute to the network, the difficulty adjusts upwards to ensure that blocks are processed at a nearly consistent interval of approximately 10 minutes.

What is the relationship between Bitcoin mining difficulty and Bitcoin hashrate?

There is a direct relationship between Bitcoin mining difficulty and Bitcoin hashrate. As the Bitcoin hashrate increases—indicating more computational power from miners—the network adjusts the mining difficulty upwards. This adjustment helps maintain the average block time, ensuring the network remains stable and secure.

How can Bitcoin miners improve their revenue in light of changing mining difficulty?

To improve their revenue despite increasing Bitcoin mining difficulty, miners should optimize their operations by investing in more efficient hardware, reducing energy costs, or even joining mining pools to share resources. Keeping an eye on market conditions, such as Bitcoin price movements, is also crucial to ensure profitability.

How does Bitcoin’s price fluctuation impact mining profitability amidst changing difficulty?

Bitcoin’s price fluctuations significantly impact mining profitability, especially as mining difficulty changes. If Bitcoin’s price rises while difficulty increases, miners may still maintain profitability. However, if the price drops, miners could face challenges as operational costs may outweigh earnings from mining, particularly during periods of high difficulty.

What is hashprice, and why is it important for Bitcoin miners amid high difficulty?

Hashprice refers to the estimated value of one petahash per second (PH/s) of mining power. It is essential for Bitcoin miners, especially amid high difficulty levels, as it helps them gauge the potential income from their mining operations. A declining hashprice, like the recent drop from around $50.66 to $44.67, can signal reduced earnings, putting pressure on miners’ profitability.

Why are transaction fees a less dependable income source for Bitcoin miners?

Transaction fees are considered a less dependable income source for Bitcoin miners because they only contribute a small fraction—averaging about 0.75%—of the total block reward’s value. Since these fees can be highly variable and often insufficient, miners rely heavily on the block subsidy provided by newly minted Bitcoins to sustain their operations, especially during high difficulty adjustments.

| Key Points |

|---|

| Bitcoin mining difficulty increased by 6.31% this week, reaching 155.97 trillion. |

| The hashrate remains robust at over 1,100 EH/s, with peak performance at 1,164 EH/s on Oct. 19. |

| Bitcoin miners generated approximately $1.595 billion in revenue in October, up 13.77% from January 2025. |

| Average transaction fees account for only 0.75% of block rewards, highlighting their minor significance to miners. |

| Current difficulty adjustment is the third largest of the year, affecting miners’ profitability amidst falling Bitcoin prices. |

Summary

Bitcoin mining difficulty has become a pressing concern for miners this week, marked by a steep increase of 6.31%. As the network navigates through fluctuating prices and hashrate challenges, miners face mounting pressure on profitability. The resilience of miners in maintaining their hashrate, despite these difficulties, underscores their commitment to the ecosystem. In light of recent shifts in revenue and transaction fees, the need for a favorable market environment becomes ever more critical for sustained operations.