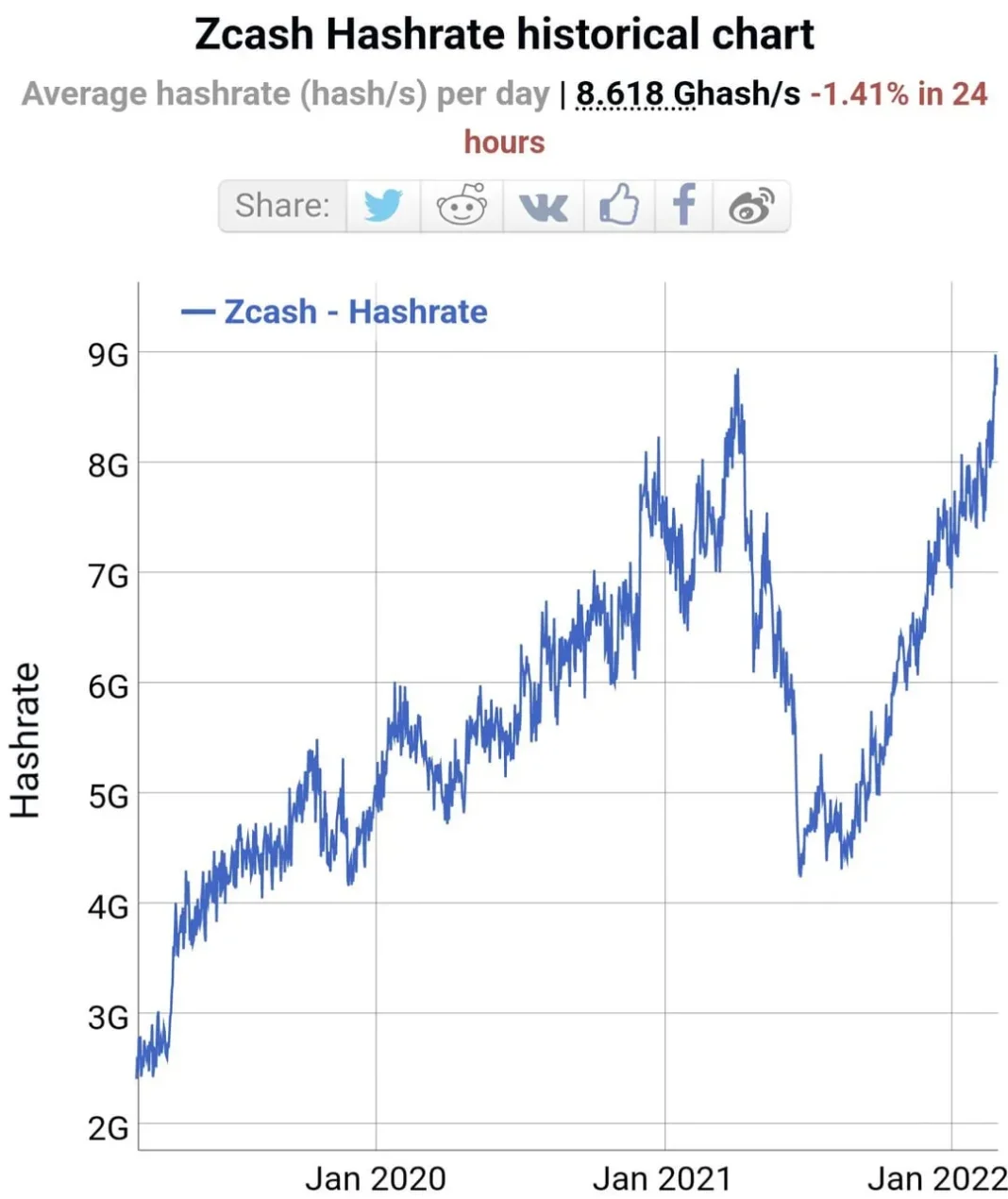

Zcash hashrate has recently surged to record-breaking levels, driven by a remarkable price increase of over 200% this month. As miners flock to capitalize on this price surge, they are finding Zcash mining to be a highly lucrative opportunity. This increase in hashrate not only reflects the interest in ZEC but also signifies a shift in cryptocurrency trends, with many investors recognizing the potential of privacy-focused coins. With mining pools like ViaBTC taking the lead, the competition among miners has intensified, highlighting the growing profitability of the Equihash algorithm. As the ZEC price continues to rise, the focus on optimizing hashrate becomes essential for maximizing returns in the evolving cryptocurrency landscape.

The recent developments in the Zcash network have seen its processing power—or hashrate—reach exceptional new heights. This surge is intricately linked to the escalating value of ZEC, which has captured the attention of both seasoned and novice miners alike. As the profitability of Equihash outpaces other mining algorithms like SHA256, operators are flocking to various mining pools to enhance their earnings. The ongoing trends in the cryptocurrency market indicate a robust interest in privacy-centric mining opportunities, and Zcash stands at the forefront of this movement. With miners competing fiercely, the dynamics of the blockchain ecosystem are rapidly evolving, signifying a promising future for Zcash mining.

Understanding Zcash Hashrate Dynamics

The hashrate of Zcash (ZEC) has recently surged to record heights, reflecting the enthusiasm of miners capitalizing on the upward momentum of its price. This increase in hashrate not only indicates a growing interest in ZEC mining but also highlights the competitive landscape of cryptocurrency mining as it relates to profitability. With Zcash utilizing the Equihash algorithm, miners are finding unique opportunities to maximize their returns. As the hashrate climbs, so does the potential for individual miners to earn from their investments in dedicated mining rigs.

This impressive uptick in Zcash’s hashrate is particularly notable when compared to other cryptocurrencies such as Bitcoin, which relies on the SHA256 algorithm. The quicker block generation times in Zcash, approximately every 75 seconds, allow miners to generate rewards more frequently than those using SHA256. This fundamental difference in how mining operates has led to an increased focus on ZEC and its associated profitability, as miners seek the most advantageous conditions to enhance their earnings.

Frequently Asked Questions

What factors have contributed to the recent surge in Zcash hashrate?

The recent surge in Zcash hashrate can be attributed to a significant price increase in ZEC, which has risen over 200% this month. This price rally has attracted more miners to Zcash mining, resulting in a record high hashrate as they capitalize on the profitability offered by the Equihash algorithm.

How does the Equihash algorithm affect Zcash mining profitability?

Equihash, the mining algorithm for Zcash, has proven to be more profitable than Bitcoin’s SHA256. As the Zcash hashrate increases, miners using machines like the Antminer Z15 Pro are generating daily profits of about $39.56 after costs, making Zcash mining a lucrative endeavor, especially following the recent price surge.

Which mining pools dominate the Zcash hashrate currently?

Currently, ViaBTC dominates the Zcash mining scene with approximately 31.84% of the network’s hashrate, followed by F2pool with 12.45%. These mining pools have significantly contributed to the increase in Zcash hashrate, allowing for sustained block production in the wake of ZEC’s price surge.

What is the significance of Zcash’s hashrate reaching an all-time high?

Zcash’s hashrate reaching an all-time high signifies increased miner activity and a more competitive environment for Zcash mining. This rise reflects miners’ confidence in ZEC’s profitability due to the recent price surge and highlights the shift towards Equihash as the leading mining algorithm.

How often does the Zcash network adjust its mining difficulty?

The Zcash network adjusts its mining difficulty with every block mined, approximately every 75 seconds. This ensures that the hashrate is balanced and that miners are constantly challenged, preventing any drastic fluctuations in block creation times.

What is the impact of cryptocurrency trends on Zcash hashrate?

Current cryptocurrency trends, particularly heightened interest in privacy coins like Zcash and rising prices, have a direct impact on Zcash hashrate. As miners respond to these positive trends, the hashrate typically increases, leading to a more robust mining network and enhanced security for the Zcash ecosystem.

Can Zcash mining profitability match that of Bitcoin mining?

While Bitcoin mining has historically been more established, recent trends suggest that Zcash mining profitability can rival or even exceed that of Bitcoin, especially with the current Equihash efficiency and the recent ZEC price surge stimulating miner interest and investment.

Why is understanding Zcash hashrate important for investors?

Understanding Zcash hashrate is crucial for investors as it indicates the health and security of the Zcash network, reflects overall mining profitability, and helps gauge potential market trends in the cryptocurrency space. An increasing hashrate often correlates with positive investor sentiment and increased market activity.

| Key Point | Details |

|---|---|

| Zcash Price Surge | Zcash (ZEC) price increased over 200% this month, resulting in increased mining activity. |

| Record High Hashrate | Zcash network’s hashrate reached an all-time high of 12.53 GS/s, showcasing increased mining engagement. |

| Mining Algorithm | Zcash operates on Equihash, requiring miners to solve mathematical challenges rather than random guessing. |

| Profitability Comparison | Equihash is now more profitable than Bitcoin’s SHA256, with the Antminer Z15 Pro yielding $39.56 daily. |

| Dominant Mining Pools | ViaBTC leads Zcash mining with 3.99 GS/s (31.84% of network), followed by F2pool (1.56 GS/s, 12.45%). |

| Mining Growth | Mining pools have experienced growth since September 2025, benefiting from the rise in ZEC’s price and profitability. |

Summary

The Zcash hashrate has reached record highs following a significant price surge, indicating a flourishing mining environment for ZEC post 200% price increase this month. Miners are capitalizing on the current profitability trends with the Equihash algorithm, which has proven more lucrative compared to Bitcoin’s mining algorithm. As the number of miners grows, with significant contributions from major mining pools like ViaBTC and F2pool, we can expect continuing developments that may further impact the dynamics of proof-of-work cryptocurrencies.