Bitcoin and Ethereum demand has become a topic of significant interest as recent trends point to a cooling phase in the U.S. cryptocurrency market. According to the latest Cryptoquant report, both spot and derivatives markets are showing signs of reduced activity following the significant price rallies observed in September. The data reveals a concerning shift in investor behavior, with declining U.S. buying pressure and stagnant ETF performance for Ethereum. As Bitcoin spot demand falters, many traders are now reassessing their strategies amid evolving crypto trading trends. This pause indicates that institutional and retail investors might be waiting for new market catalysts before making their next moves in the crypto arena.

The current landscape surrounding the demand for Bitcoin and Ethereum highlights a notable shift in market dynamics. As cryptocurrency enthusiasts observe the latest insights from analytics, many are noting a drop in engagement within the U.S. digital asset ecosystem. Such downturns in market activity, particularly in spot purchases and the performance of Ethereum exchange-traded funds, suggest a broader trend of apprehension among traders. This cooling sentiment is echoed in the contrasting price movements and decreased interest in leveraging positions. As the community reflects on these developments, the anticipation for renewed investment opportunities continues to build.

Current Trends in Bitcoin and Ethereum Demand

The latest Cryptoquant report highlights a noticeable dip in U.S. demand for Bitcoin and Ethereum, revealing a more cautious sentiment among investors. After September’s impressive rally, both cryptocurrencies have seen a reduction in spot market activity and derivatives trading. This slowdown signifies that market participants may be prioritizing profit-taking strategies over new investments, affecting both retail and institutional investors in an increasingly volatile crypto landscape.

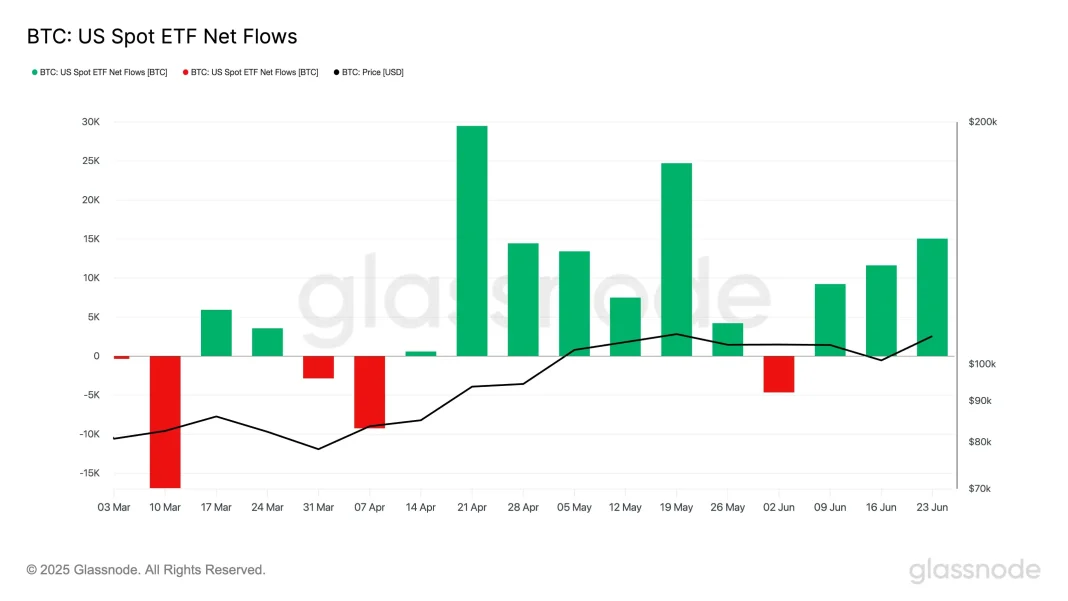

Particularly, the report underscores concerning trends such as a nearly flat performance of Ethereum ETFs since mid-August and Bitcoin ETFs experiencing consistent outflows. As both assets transition from a phase of rapid growth to one of consolidation, traders are focusing on assessing market conditions before making further commitments, indicating a temporary respite in demand.

Impact of U.S. Cryptocurrency Market Cooling

The cooling demand in the U.S. cryptocurrency market has significant implications for future pricing and investor strategies. According to the Cryptoquant analysis, diminished buying pressure, as evidenced by near-zero premiums on platforms like Coinbase, could foreshadow greater market volatility. This stagnant state of demand suggests that investors may be awaiting new catalysts or favorable news before reinvesting in Bitcoin and Ethereum.

Additionally, the decreased premiums and low futures basis points indicate that both institutional and retail participants appear reticent to pursue leveraged positions right now. With Bitcoin’s recent historical highs showing a stark contrast to current demand levels, a shift in trading trends is likely with traders becoming more selective about re-entering the market, possibly altering the dynamics of the cryptocurrency’s overall demand.

Bitcoin Spot Demand and Market Sentiment Analysis

The Cryptoquant report indicates a significant decline in Bitcoin spot demand, as reflected by the weakening premiums on U.S. exchanges. A seven-day average outflow of 281 BTC points to a lack of enthusiasm among investors who may be exercising caution in the face of fluctuating market conditions. Such patterns are typically indicative of an overall neutral or bearish sentiment, which could deter new market entrants.

Moreover, historical patterns show that price rallies often happen alongside positive premiums; therefore, Bitcoin’s current stagnation suggests that the optimism surrounding previous highs may be fading. As the market stabilizes and reevaluates its trajectory, the focus on spot demand will be crucial for predicting potential recovery or further declines in Bitcoin’s value.

Ethereum ETF Performance and Investor Confidence

Ethereum’s ETF performance has become a central point of discussion, particularly as inflows have stalled since mid-August. This trend reflects a broader unease about the asset’s potential, with many investors exercising caution after the late-September peak. The stagnation in capital flows towards Ethereum ETFs highlights the importance of building renewed confidence among traders and institutional investors for future market movements.

Current data from Cryptoquant emphasizes that, without fresh catalysts, it may be challenging for Ethereum to gain traction. As both retail and institutional entities appear to be adopting a ‘wait-and-see’ approach, gauging upcoming regulatory advancements or market shifts will be vital for determining the health and appeal of Ethereum as an investment in the U.S. cryptocurrency market.

Crypto Trading Trends Post-Sep Rally

Following the notable rally in September, crypto trading trends have shifted considerably, with many market players reassessing their strategies. The decline in Bitcoin and Ethereum demand, outlined in the Cryptoquant report, reflects a broader market sentiment that is becoming increasingly cautious. This transformation presents a period of consolidation for many traders who are now more focused on identifying potential risks rather than chasing performances.

Furthermore, the lack of significant buying pressure on U.S. exchanges suggests that traders are not only tightening their belts but are also keenly observing how external factors, such as global market conditions and regulatory news, will influence future trading trends. Assigning priority to analysis over impulsive trading can prove crucial in navigating this transitional phase in the crypto market.

Analyzing Futures Markets for Bitcoin and Ethereum

The futures markets have also mirrored the cooling demand observed in the spot trading sector. As reflected in the Cryptoquant analysis, the annualized basis for Bitcoin on the Chicago Mercantile Exchange is experiencing its lowest metrics in over two years. This downturn in futures indicates a lack of leverage and risk appetite among investors, further compounding the signaling of diminished market enthusiasm.

In the case of Ethereum, the weakening of its six-month futures basis resonates with the overall cooling sentiment coming from the wider cryptocurrency ecosystem. Traders’ hesitance to leverage their positions may stem from the recent high volatility, compelling them to reevaluate their strategies in favor of more measured, strategic investments, underscoring the need for new catalysts to spark renewed activity.

The Influence of Market Sentiment on Crypto Prices

Market sentiment plays a pivotal role in influencing Bitcoin and Ethereum prices, and the current data from Cryptoquant sheds significant light on this dynamic. As U.S. demand for both currencies has cooled, the correlation between positive market sentiment and price appreciation appears to weaken. This downturn has created an environment where price stability is favored, holding potential implications for traders looking to capitalize on future movements.

Investor psychology often swings with market conditions, leading to either euphoric buying or pessimistic selling. With the current indicators showing a cooling phase, it suggests that traders are more likely to adopt a defensive posture, waiting for stronger signals of recovery or institutional support before engaging in significant trades, thereby affecting overall market price dynamics.

Future Outlook for Bitcoin and Ethereum

The future outlook for Bitcoin and Ethereum remains uncertain as the market experiences a cooling off with waning demand. According to the Cryptoquant report, both types of investors are increasingly hesitant to make aggressive moves until fresh catalysts emerge. Insights gained from recent data indicate that market participants are likely to remain on the sidelines, seeking clarity before risking their capital in the current environment.

As the cryptocurrency landscape evolves, monitoring trends in demand, ETF performance, and overall market sentiment will be essential. Until significant price movements are observed or a new narrative emerges, it’s anticipated that Bitcoin and Ethereum may continue to tread water, with a focus on longer-term potentials rather than immediate gains, reflecting a more cautious and strategic trading approach.

Understanding the Role of ETFs in Cryptocurrency Investments

Exchange-Traded Funds (ETFs) have quickly become a pivotal aspect of cryptocurrency investments, offering a regulated avenue for institutional and retail investors. The cooling demand for Bitcoin and Ethereum, as cited in the Cryptoquant report, emphasizes the importance of monitoring ETF performance as a barometer for market health. Stagnant inflows into Ethereum ETFs suggest a need for enhanced investor confidence in the asset class.

ETFs not only provide exposure to cryptocurrencies but also reflect overarching market attitudes. A robust ETF framework can lead to increased legitimacy and broader adoption of cryptocurrencies; however, the observed outflows and flat performance necessitate a thorough investigation into regulatory frameworks and their implications for future ETF products.

Frequently Asked Questions

What trends has the Cryptoquant report identified regarding Bitcoin and Ethereum demand in the U.S.?

The Cryptoquant report indicates that demand for Bitcoin and Ethereum in the U.S. has cooled significantly in both spot and derivatives markets following a rally in September, suggesting a phase of profit-taking and decreased accumulation among investors.

How does the Coinbase premium affect our understanding of Bitcoin and Ethereum demand?

According to Cryptoquant, the Coinbase premium for Bitcoin and Ethereum is hovering around zero, which suggests a decline in U.S. buying pressure and indicates that domestic investors may be hesitating to enter the market.

What is the current performance of Bitcoin and Ethereum ETFs as found in the Cryptoquant report?

The Cryptoquant report shows that U.S. Bitcoin ETFs have become net sellers with consistent outflows, while Ethereum ETF inflows have plateaued since mid-August, reflecting a lack of increased demand from investors.

According to Cryptoquant, what future signals are expected for Bitcoin and Ethereum demand?

The report suggests that both institutional and retail investors are currently in a ‘cooling sentiment’ phase, awaiting new catalysts to stimulate renewed interest and demand for Bitcoin and Ethereum.

What do the futures market analyses indicate about Bitcoin and Ethereum demand?

Cryptoquant’s futures market analysis reveals that the annualized basis for Bitcoin on CME has fallen to 1.98% and Ethereum’s six-month futures basis is at its lowest since July, indicating reduced demand for leveraged exposure in both digital assets.

| Key Point | Details |

|---|---|

| Demand Decline | Demand for Bitcoin and Ethereum has significantly cooled in the U.S. after September. |

| Coinbase Premium Drop | Coinbase premiums for both Bitcoin and Ethereum are around zero, indicating waning demand. |

| ETF Trends | BTC spot ETFs have seen a net outflow of 281 BTC, while ETH inflows have stalled since mid-August. |

| Futures Market | Bitcoin’s futures basis is at its lowest in over two years, and Ethereum’s basis is at its weakest since July. |

| Market Sentiment | There is a cooling sentiment in the market, with both institutional and retail investors waiting for new catalysts. |

| Summary Statement | Cryptoquant indicates U.S. enthusiasm for Bitcoin and Ethereum has paused as the market consolidates gains. |

Summary

Bitcoin and Ethereum demand has experienced a significant slowdown as outlined in the latest Cryptoquant report. Following a notable rally in September, investors in the U.S. are now showing signs of caution, as reflected by the drop in Coinbase premiums and the performance of spot ETFs. With both Bitcoin and Ethereum’s futures market indicators hovering at low levels, it appears that market participants are settling into a phase of reevaluation and profit-taking until new catalysts emerge that could reignite interest. This period of reduced demand highlights the volatility and shifting sentiments pervasive in the cryptocurrency landscape.