Animoca Brands reverse merger with Currenc Group is set to reshape the digital asset landscape by creating the first publicly listed conglomerate in this space. Scheduled to close in 2026, this strategic deal will allow Animoca Brands shareholders to possess a staggering 95% of the new entity, while Currenc Group shareholders retain a minority stake. By merging their operations, the combined company will effectively harness the power of AI fintech and blockchain technology, providing investors with unique exposure to cutting-edge sectors such as decentralized finance and gaming. The implications of such a merger may well redefine marketplace dynamics, highlighting the increasing integration of various digital assets. As discussions continue, all eyes will be on how this ambitious venture navigates regulatory pathways and paves the way for future innovations in the financial landscape.

The upcoming merger between Currenc Group and Animoca Brands signifies a transformative shift towards the convergence of digital assets and traditional finance. By leveraging a reverse merger strategy, this deal aims to establish a robust publicly traded entity within the thriving blockchain ecosystem, which encompasses diverse sectors such as cryptocurrency, decentralized finance, and non-fungible tokens. With Currenc Group poised to integrate its AI-driven fintech offerings with Animoca’s expansive portfolio, the merged organization will likely attract a wide array of investors eager for entry into this burgeoning market. Furthermore, the anticipated consolidation of assets and expertise could significantly enhance the appeal of both firms, incentivizing innovation and growth in the dynamic Web3 space. Ultimately, this partnership stands to unlock new potentials, defining the future of financial transactions in a digitally driven world.

Understanding the Animoca Brands Reverse Merger

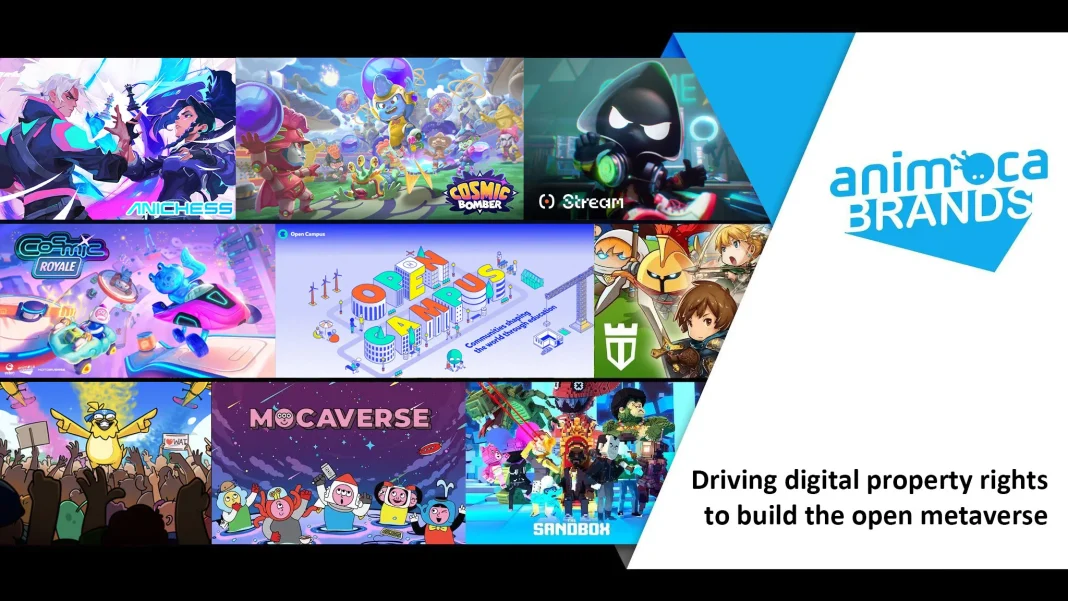

The proposed reverse merger between Animoca Brands and Currenc Group is touted as a transformative deal in the digital asset landscape. A reverse merger, in essence, allows a private company to become publicly traded by merging with a public company, thereby bypassing the traditional Initial Public Offering (IPO) process. For the stakeholders of Animoca Brands, this transaction represents not just a pathway to public listing but also positions them for substantial growth within a newly formed conglomerate focused on leading sectors such as gaming, decentralized finance, and artificial intelligence.

By acquiring Animoca Brands, Currenc Group aims to leverage its advanced fintech capabilities to enhance Animoca’s reach in both traditional and digital asset markets. The significance of this merger lies in the blend of Currenc’s AI fintech services and Animoca’s vast experience with blockchain technology and digital gaming. This confluence is crucial in capitalizing on the burgeoning altcoin economy, which is expected to revolutionize how digital assets are perceived and traded in public markets.

Frequently Asked Questions

What is the Animoca Brands reverse merger with Currenc Group?

The Animoca Brands reverse merger with Currenc Group refers to a proposed transaction where Currenc Group Inc. plans to acquire all shares of Animoca Brands. This would create a publicly traded digital asset conglomerate listed on the Nasdaq, focusing on sectors such as gaming, decentralized finance (DeFi), and AI fintech.

How will the Animoca Brands IPO be structured following the reverse merger?

Post-reverse merger, the Animoca Brands IPO will see Animoca shareholders owning approximately 95% of the new entity, while Currenc shareholders will retain roughly 5%. This structure allows Animoca to maintain significant control over the combined company.

What are the benefits of the publicly listed digital assets resulting from the reverse merger?

The publicly listed digital assets from the Animoca Brands reverse merger will provide investors with diversified exposure to the booming altcoin economy, integrating sectors like AI, NFTs, gaming, and tokenized finance under one publicly traded brand.

What is the timeline for the completion of the Animoca Brands reverse merger?

The Animoca Brands reverse merger with Currenc Group is expected to be completed in 2026, subject to necessary regulatory and shareholder approvals.

What industries will benefit from the Animoca Brands and Currenc merger?

The merger between Animoca Brands and Currenc Group will significantly impact the gaming, decentralized finance (DeFi), artificial intelligence (AI) fintech, and digital asset industries, providing a new asset class for investors.

What impact will the reverse merger have on shareholders of Animoca Brands?

Shareholders of Animoca Brands will benefit from increased control of the merged entity, owning about 95% of the newly formed Nasdaq-listed company, thereby potentially benefiting from the value of a diversified digital asset ecosystem.

Why is the reverse merger of Currenc Group and Animoca Brands considered a milestone?

This reverse merger is viewed as a milestone as it could set a precedent for the integration of AI, crypto, and tokenized finance within public markets, representing a significant evolution in how digital assets are perceived and traded on Wall Street.

What is the significance of the Currenc acquisition of Animoca Brands in the context of Web3?

The Currenc acquisition of Animoca Brands is significant as it represents a strategic move towards creating a leading Web3 conglomerate, combining extensive portfolios in digital assets, AI fintech, and decentralized finance, and offering investors direct participation in this emerging market.

| Key Point | Details |

|---|---|

| Reverse Merger Proposal | Currenc Group Inc. is set to acquire Animoca Brands in a deal expected to close in 2026. |

| Ownership Structure | Animoca shareholders will retain 95% of the new company, Currenc shareholders will hold 5%. |

| Merged Company Name | The new entity will operate under the Animoca Brands name and trade on the Nasdaq. |

| Combined Operations | The merger will combine Currenc’s AI fintech services with Animoca’s digital asset empire. |

| Investment Focus | The entity aims to leverage sectors such as gaming, DeFi, blockchain, and tokenization of real-world assets. |

| Future Implications | If approved, this merger could redefine public investment in the intersection of crypto and AI. |

| Regulatory Considerations | The merger requires regulatory and shareholder approval before it can proceed. |

Summary

The Animoca Brands reverse merger with Currenc Group is a significant development poised to create the world’s first publicly listed digital asset conglomerate. Scheduled for completion in 2026, this merger represents a pivotal move into the altcoin economy, merging traditional finance with the innovative realms of AI and blockchain technology. Stakeholders are eager to see how this venture will unfold, particularly in terms of regulatory scrutiny and its potential to transform public perception and investment strategies in digital assets.