BTC plummets to $104K, sending shockwaves throughout the crypto community as a market crash leaves investors in distress. Amid rising fears concerning overall market stability, this significant Bitcoin price drop has led to over $1.32 billion in liquidations across various platforms, highlighting the ongoing turmoil in the crypto market. Many traders are grappling with altcoin losses as the bearish sentiment permeates the market, influencing not just Bitcoin but a range of altcoins struggling to maintain their value. This widespread crypto market liquidation has stirred anxiety, with industry insiders warning against the panic induced by rampant crypto FUD (fear, uncertainty, and doubt). As the tumultuous waves of bearish pressure continue, investors are left contemplating the future of their assets and the resilience of the broader crypto landscape.

In a stunning development, Bitcoin has experienced a notable decline, with its value dropping to $104,000, sparking significant concern among digital asset holders. This recent downturn has escalated fears among traders, prompting a flurry of liquidations as the valuation of numerous cryptocurrencies falters. The ongoing sell-off across the cryptocurrency markets has not only affected Bitcoin but has also rendered many altcoins vulnerable, witnessing substantial losses themselves. As the market grapples with the implications of these drastic price shifts, the discourse surrounding the underlying factors, such as market manipulation and speculative trading, becomes ever more pertinent. Consequently, industry experts urge caution, advising investors to tread carefully in these uncertain times.

Understanding the Bitcoin Price Drop

The recent Bitcoin price drop has rattled many investors, as BTC plummets to $104K amidst growing market concern. Following a staggering decline of over 3% in market capitalization, a wave of panic surged through the crypto economy. This negative sentiment, driven by skepticism and fear, has not just left Bitcoin vulnerable but has also adversely affected altcoins. The combination of increased crypto FUD and fears of a market correction has resulted in widespread selling, and analysts are urging caution as the market navigates these turbulent waters.

Market analysts attribute this volatility to a range of factors, including macroeconomic bear trends and speculative trading activity that often magnifies losses in the cryptocurrency space. The drop to $104K is significant because it marks a psychological level for many investors, triggering a cascade of liquidations in long positions as fear takes hold. The projected downturn raises serious concerns regarding potential future prices, as many are left questioning if Bitcoin’s surge can withstand sustained periods of market instability.

Impact of Market Liquidations

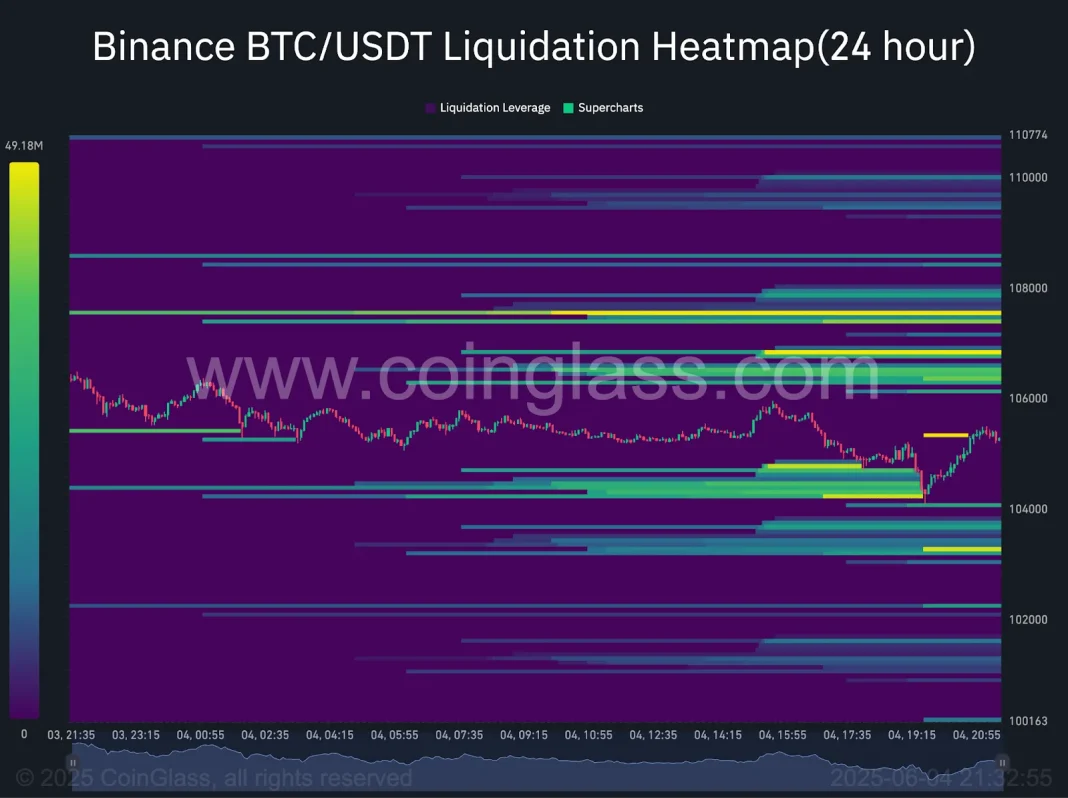

The cascading effect of Bitcoin’s price drop has led to massive market liquidations, with over $1.32 billion wiped out in a short time frame. Such high levels of liquidation during market corrections create a feedback loop that exacerbates price declines. The liquidation of leveraged positions not only contributes to the immediate price drop but often triggers further panic selling among retail investors, further destabilizing the market.

During this turbulent period, altcoins have not been immune, suffering heavy losses parallel to Bitcoin’s struggles. The ramifications of this liquidation extend far beyond just immediate price effects; they can influence trading strategies and investor sentiment for an extended period. As the dust settles from this latest crash, many will be left contemplating the overall resilience of the crypto market against the backdrop of increasing crypto FUD.

While the market has shown remarkable recoveries in the past, the inherent volatility attributed to leveraged trading can contribute to more pronounced price action during downturns. As we observe these market dynamics unfold, the implications for long-term investment strategies come into clearer focus.

The Role of Fear, Uncertainty, and Doubt (FUD) in Crypto

In the world of cryptocurrency, fear, uncertainty, and doubt (FUD) wield significant influence over market behavior. The recent BTC plummet to $104K illustrates how external narratives can create panic leading to mass liquidations. Amidst accusations of coordinated FUD, it’s crucial for investors to understand how misinformation and negative sentiment contribute to market volatility.

The spread of FUD can rapidly shift market sentiment from optimistic to fearful, inducing knee-jerk reactions among investors. Expert voices within the industry, including leaders from major exchanges, highlight the importance of critical analysis and verification of news before taking action. Navigating the emotional landscape of trading requires not only an understanding of market dynamics but also a healthy skepticism towards sensationalized headlines.

Analysts Predict Altcoin Losses Amid Bitcoin Decline

With Bitcoin’s downturn, analysts have begun to predict further altcoin losses as market conditions worsen. Historical trends show that when Bitcoin faces substantial declines, altcoins typically experience even sharper drops as investors flock to cash, further exacerbating losses across the board. The recent analysis suggests that altcoins could drop another 30% as BTC stabilizes, placing immense pressure on various tokens in the market.

The surge in liquidations tied to altcoins indicates a fragile market structure, prone to rapid downturns. Investors in cryptocurrencies like Ethereum have logged significant losses, with ETH’s price retracing to levels not seen since much earlier in the year. In this context, minimizing exposure to underperforming altcoins during this market turbulence becomes a focus for many investors hoping to preserve their portfolios.

Strategies to Navigate Market Turbulence

Amidst the backdrop of a significant market downturn, it is essential for crypto investors to develop strategies to navigate the turbulent waters. One key approach is to establish clear risk management rules, assessing one’s risk tolerance before entering trades. The recent market movements serve as a reminder of the unpredictability inherent in crypto markets, highlighting the importance of strategic planning and preparedness.

Moreover, diversifying investments could cushion the blow of market volatility. Instead of concentrated positions in a few assets, which could amplify losses during a downturn, spreading investments across multiple cryptocurrencies may mitigate risks. Investors should also remain informed on market conditions and news influences, allowing them to adapt swiftly to shifts in investor sentiment.

The Future of Bitcoin After the Crash

As Bitcoin trades at $104K, the question on many investors’ minds is about its future trajectory. Historically, Bitcoin has demonstrated resilience, recovering from sharp declines to establish new all-time highs. However, this current downturn raises concerns about potential sustained bearish sentiment, particularly given the accumulation of liquidity events and ongoing market FUD.

Looking ahead, market analysts suggest that the conditions surrounding Bitcoin’s price will depend significantly on broader economic factors, including regulatory developments and macroeconomic trends. While there is cautious hope for recovery, investors must remain vigilant, leveraging insights and data to guide their decision-making process as the evolving landscape unfolds.

Industry Experts Share Insights Amidst Market Fear

In light of the recent market tumult, industry leaders have begun speaking out to reassure investors and provide clarity on the ongoing situation. Changpeng Zhao, CEO of Binance, emphasized the need to avoid reacting impulsively to FUD, advocating for a hands-on approach to information verification. This advice resonates deeply at a time when misinformation can significantly sway market behavior.

Moreover, experts recommend a balanced approach to investing during periods of economic uncertainty. Encouraging rational thought and long-term strategy over impulsive moves can help investors stave off panic during market corrections. As more voices from the crypto community emerge, the importance of collaboration and education as tools for navigating market crises becomes increasingly clear.

Understanding the Market Dynamics Post-Crash

Post-crash, market dynamics shift considerably as stakeholders reassess their positions. The immediate aftermath of Bitcoin’s price drop presents a re-evaluation phase, where investors grapple with both fear and opportunity. Those locked into long positions prior to the liquidation phase may be forced to rethink their approach, while opportunists may see declining prices as a chance to buy at a perceived discount.

However, caution is essential, as entering the market during these volatile periods can lead to further losses if the downward trend persists. Analyzing market indicators and sentiment can provide critical insights to inform strategic entry points. Understanding the cyclical nature of cryptocurrencies can empower investors to make well-informed decisions rather than emotional choices in the heat of the moment.

Psychological Factors Influencing Investment Decisions

The psychological elements affecting investor decisions in the crypto market are profoundly influential, particularly during downturns. Panic and fear can cloud judgment, leading to precipitated selling that fails to consider long-term prospects. Strategies aimed at understanding emotional responses are essential in mitigating impulsive actions and formulating a well-thought-out investment approach amid market chaos.

Furthermore, acknowledging cognitive biases—such as loss aversion and overconfidence—can enhance decision-making processes. By recognizing these tendencies, investors can cultivate a more rational mindset, allowing them to navigate market fluctuations with increased resilience. Educational resources and community dialogue can aid in building investor confidence, ultimately contributing to a healthier market environment.

Frequently Asked Questions

What caused BTC to plummet to $104K?

BTC plummeted to $104K due to a wave of bearish sentiment in the market, exacerbated by allegations of coordinated fear, uncertainty, and doubt (FUD) which prompted significant market volatility.

What impact did the BTC price drop have on the crypto market?

The BTC price drop to $104K contributed to a total market capitalization decline of 3.2%, resulting in over $1.32 billion liquidated from long and short positions across the crypto market.

How much Bitcoin was liquidated during the crash to $104K?

During the crash where BTC dropped to $104K, approximately $375 million in long positions were liquidated within a four-hour window, showcasing the significant impact of market movements.

Which altcoins suffered losses when Bitcoin dropped to $104K?

When BTC fell to $104K, altcoins like Ethereum, XRP, and BNB experienced heavy losses, with Ethereum seeing a decline that led to $317 million in liquidations.

What is the current sentiment in the market following BTC plummeting to $104K?

Following BTC’s plummet to $104K, the market sentiment is bearish, with industry experts warning against panic and encouraging investors to validate news amidst rising FUD.

What are analysts predicting about altcoin performance following the BTC crash?

Analysts predict that altcoins may continue to drop, potentially losing another 30% in value against BTC in the upcoming weeks, fueled by negative market sentiment.

How can investors protect themselves during Bitcoin price drops like this?

Investors can protect themselves during price drops by avoiding impulsive decisions, conducting thorough research, and staying informed on market trends to dismiss unfounded FUD.

| Key Point | Details |

|---|---|

| Market Decline | The crypto market capitalization dropped by 3.2%, falling to $3.55 trillion. |

| Bitcoin’s Plummet | Bitcoin (BTC) fell sharply to $104,200, leading to liquidations worth $1.32 billion. |

| Altcoin Impact | Ethereum (ETH) dropped below $3,500; XRP fell to $2.28; BNB decreased to $952, resulting in significant liquidations. |

| Industry Reactions | Industry leaders warned against panic, urging validation of news leading to the crash. |

Summary

BTC plummets to $104K amid market fears, signaling a significant downturn in the cryptocurrency space. A wave of bearish sentiment has led to these sharp declines, with over $1.32 billion in liquidations reported. This volatility illustrates the heightened risks of trading crypto assets during uncertain times. As the market reacts to this downturn, it’s crucial for investors to remain vigilant and informed.