Impact investing is revolutionizing the way we think about philanthropy by directly connecting financial returns with measurable social benefits. With a staggering $1.57 trillion market, this innovative approach has found a powerful ally in blockchain technology, enabling decentralized funding and greater transparency. Platforms like GrantiX leverage AI social platforms to streamline the donation process, ensuring resources are allocated efficiently to impactful projects. Additionally, the integration of charity on blockchain creates new opportunities for donors to track their contributions in real time, fostering a culture of accountability and trust. As we transition into the Web3 impact era, the synergy of these technologies promises to transform charitable giving into a sustainable, revenue-positive model for global change.

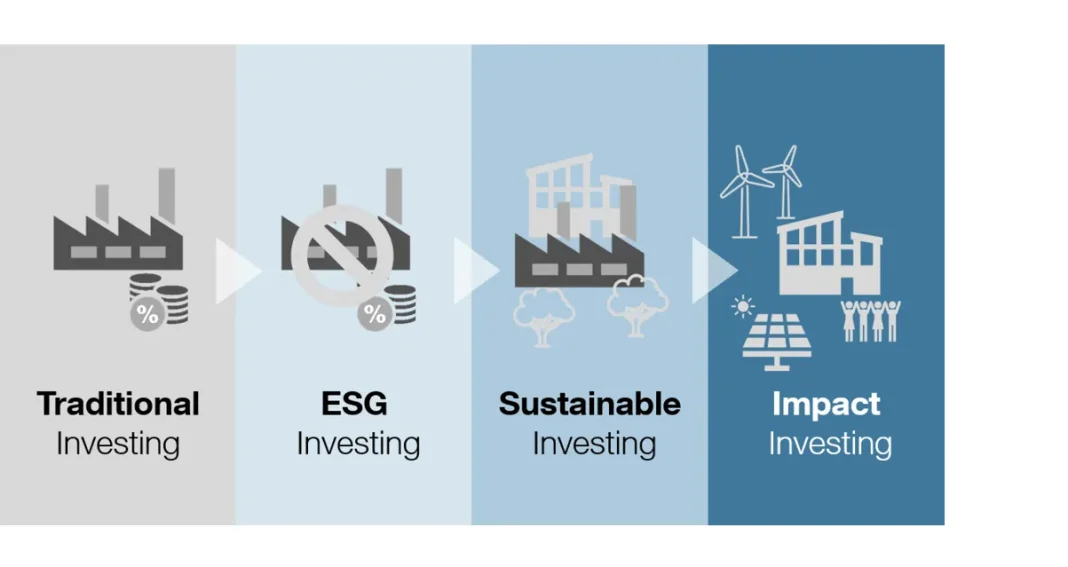

Socially responsible investing, often termed as impact investing, has emerged as a new paradigm aimed at generating positive social outcomes alongside financial returns. This movement is gaining momentum in various sectors, particularly as innovative solutions like decentralized philanthropy and AI-driven platforms come into play. By utilizing blockchain’s unique capabilities, these initiatives facilitate transparent and efficient funding for social causes. The evolution of Web3 is also paving the way for creative funding solutions that blend traditional philanthropy with modern technological advancements. Consequently, the landscape of charity and investment is poised for a significant transformation, enabling diverse stakeholders to contribute to a more equitable and sustainable future.

Revolutionizing Philanthropy with Impact Investing

Impact investing is transforming the way we think about charitable contributions and social good. With the emergence of blockchain technologies, platforms like GrantiX are pioneering a model where donations are not merely a philanthropic gesture but a strategic investment in social outcomes. By leveraging the $1.57 trillion impact-investing market, GrantiX ensures that each dollar contributed is tracked and aligned with measurable results, fostering a culture of accountability and transparency in charitable endeavors.

In this new era of philanthropy, impact investing encourages donors to engage actively in the growth of projects, promoting not just financial returns but social ones as well. GrantiX’s integration of AI technologies allows for detailed analytics, optimizing funding allocation and project effectiveness, benefiting both investors and communities. This paradigm shift is essential in a world where traditional funding sources are declining, uniting diverse stakeholders around a common goal of improving lives through innovative funding solutions.

Harnessing Blockchain Philanthropy for Sustainable Impact

Blockchain philanthropy represents a significant advancement in how charitable donations are managed and distributed. Platforms like GrantiX utilize blockchain technology to enhance the transparency and traceability of donations, making every transaction visible and accountable. This approach not only builds trust among donors but also encourages wider participation in social causes, knowing that their contributions are making a direct impact.

Moreover, integrating blockchain into philanthropy allows for decentralized funding mechanisms that eliminate intermediaries, reducing costs and ensuring that a larger portion of donations reaches the intended beneficiaries. GrantiX exemplifies this with its innovative multi-chain platform that connects donors to verified social entrepreneurs. This decentralized model empowers local initiatives with the financial support they need to thrive, redefining the scope of charity on blockchain and promoting a more sustainable funding ecosystem.

AI-Powered Solutions in Social Finance

Artificial Intelligence (AI) is transforming social finance by introducing sophisticated algorithms that optimize funding strategies and improve the evaluation of social projects. GrantiX’s AI Evaluation and Risk Management Layer plays a crucial role in assessing project efficiency and potential risks, ensuring that each investment leads to tangible social value. Through data-driven insights, the platform is able to match donors with projects that resonate with their values, thereby enhancing donor engagement and satisfaction.

As the platform evolves, AI will continue to refine the way social entrepreneurs and investors interact. By analyzing user behavior and funding trends, GrantiX can predict which projects are likely to succeed and allocate resources accordingly. This predictive capability not only enhances the impact of each dollar donated but also allows social enterprises to grow sustainably and responsibly, making the entire social finance ecosystem more resilient.

The Role of Decentralized Funding in Charitable Ventures

Decentralized funding is revolutionizing how charitable initiatives are financed, providing an alternative to traditional grant-based models. By creating a more equitable system for funding, platforms like GrantiX enable social enterprises to directly engage with potential donors, bypassing cumbersome bureaucratic processes. This accelerates the flow of resources to those who need them most, fostering innovation and creativity in addressing social issues.

GrantiX’s framework empowers social entrepreneurs to manage their funds transparently while presenting measurable outcomes to investors. This system not only increases efficiency but builds a community of engaged donors eager to support frontline initiatives directly. Decentralized funding paves the way for a more democratic approach to philanthropy, where individuals and communities can shape their destinies through empowered financial choices and accountability.

Engaging Donors Through Web3 Impact Models

Web3 technologies are redefining how donors interact with charitable projects, introducing novel ways to contribute and engage. GrantiX’s platform merges social finance with Web3 elements, providing gamified experiences that reinforce the connection between donors and the causes they support. By embedding Learn-to-Earn models, GrantiX transforms the act of giving into an enriching learning experience, enabling users to understand the impacts of their contributions.

Furthermore, incorporating Web3 tools into philanthropy enhances community building, as donors become part of a larger ecosystem focused on collective impact. GrantiX not only empowers users to track their contributions but also to engage in conversations around social value creation, fostering a sense of belonging and shared purpose. This innovative approach changes the landscape of giving, inviting a new generation of tech-savvy donors into the charitable space.

Unlocking New Possibilities with AI and Blockchain Integration

The integration of AI and blockchain technologies offers unprecedented potential for the future of impact investing. By combining these powerful tools, GrantiX creates a framework that enhances the efficiency and effectiveness of charitable giving. The analytical capabilities of AI ensure that funds are allocated to projects with the highest potential for success, while blockchain technology guarantees transparency in how these funds are utilized.

This symbiotic relationship between AI and blockchain enables a scalable and secure impact investing environment. GrantiX’s commitment to innovation not only sets a new standard for philanthropy but also unlocks new avenues for collaboration between social enterprises and investors. As this model continues to evolve, it promises to lead to more significant social changes and demonstrate the impact of technology on charitable initiatives.

Building Trust Through Transparency in Impact Investing

Trust is a critical component in the success of any philanthropic endeavor. GrantiX prioritizes transparency by utilizing blockchain technology to allow donors to trace their contributions from initial donation to the final impact. This visibility into the funding process reassures donors that their money is making a difference, thereby encouraging a culture of giving.

Moreover, GrantiX’s AI-driven evaluations help to build credibility by providing data on the effectiveness of funded projects. By showcasing measurable outcomes, donors can see firsthand how their contributions support real-world change, creating a virtuous cycle that fosters ongoing engagement and support for future initiatives. This commitment to transparency not only strengthens trust but also cultivates a dedicated community focused on achieving social impact.

Promoting Gamification in Charitable Giving

Gamification is transforming traditional charitable giving into an engaging experience that motivates individuals to contribute. GrantiX introduces game-like elements into its platform, rewarding users for their participation and encouraging them to actively contribute to social causes. This intrinsic motivation not only boosts donation rates but also enhances user retention, creating a thriving community of engaged philanthropists.

Through innovative gamified experiences, GrantiX enables users to earn rewards while learning about social issues and contributing to impactful projects. The interplay of fun and philanthropy cultivates a deeper understanding of the challenges faced by communities, promoting empathy and a sense of agency among donors. By making the act of giving enjoyable, GrantiX positions itself as a leader in redefining how philanthropy functions in the modern world.

Future Directions for Impact Investing with GrantiX

As GrantiX prepares for its mainnet launch, the future of impact investing appears promising. The platform’s commitment to merging AI, blockchain, and decentralized funding signifies a step toward a more resilient and accountable philanthropic landscape. Analysts predict that as GrantiX scales, it will pave the way for a new era of accountability in impact investing, where every dollar is optimized for its social return.

Moreover, the growing interest in crypto philanthropy signifies a shift in the demographics of donors, with younger generations looking for meaning and measurable impact from their contributions. GrantiX, through its innovative model, is poised to attract this new wave of socially conscious investors eager to support projects that align with their values. As it bridges the gap between traditional philanthropy and the emerging world of Web3, GrantiX is on the cusp of redefining how we think about charitable giving.

Frequently Asked Questions

What is impact investing and how does it relate to blockchain philanthropy?

Impact investing refers to investments made with the intention to generate positive social or environmental impact alongside a financial return. Blockchain philanthropy leverages blockchain technology to enhance transparency, efficiency, and accountability in charitable giving, allowing impact investors to track their donations and verify the outcomes of funded projects.

How is GrantiX innovating impact investing through its AI social platform?

GrantiX is transforming impact investing by utilizing an AI-driven social platform that connects verified social entrepreneurs with crypto investors. This integration of AI analytics ensures that funding is matched with projects likely to make a significant social impact, optimizing the allocation of investments in real-world social causes.

What role does decentralized funding play in impact investing on GrantiX?

Decentralized funding on GrantiX allows donations to be pooled and managed on blockchain, ensuring that funds are allocated transparently and efficiently. This model empowers donors by providing them with direct insights into how their contributions are being used to support impactful projects, which enhances trust and promotes further financial engagement.

How does GrantiX ensure transparency in charity on the blockchain?

GrantiX ensures transparency in charity on the blockchain through its traceable and verifiable donation tracking system. Every transaction is recorded on-chain, allowing donors to monitor the distribution of their contributions, thereby increasing accountability among social enterprises and fostering a culture of trust within the impact investing community.

What is Web3 impact and how does GrantiX contribute to it?

Web3 impact refers to the integration of decentralized technologies and principles into the impact investing space, focusing on creating socially beneficial outcomes. GrantiX contributes to Web3 impact by providing a sustainable, multi-chain platform that combines DeFi, SocialFi, and AI technologies to facilitate direct funding and measurable impact in charitable initiatives.

How does GrantiX’s gamified Learn-to-Earn model enhance impact investing?

GrantiX’s gamified Learn-to-Earn model enhances impact investing by incentivizing users to engage with educational content about social entrepreneurship and impact projects. Users can earn rewards for learning, which encourages a deeper understanding of the social issues at hand and fosters a more active and informed impact investment community.

What are the advantages of tokenization advisory services for social enterprises on GrantiX?

Tokenization advisory services on GrantiX provide social enterprises with insights on how to leverage blockchain to create digital assets that can attract funding. This can diversify funding sources and enhance the sustainability of their projects, while aligning with the principles of impact investing to achieve social and financial returns.

How does AI Evaluation and Risk Management Layer benefit impact investing in GrantiX?

The AI Evaluation and Risk Management Layer on GrantiX benefits impact investing by analyzing project efficiency and user behavior to ensure that funding is directed towards impactful initiatives. It helps identify potential risks early in the funding process, ensuring better allocation of resources and higher accountability, essential for successful impact investing.

In what ways is GrantiX positioned to redefine the philanthropy landscape?

GrantiX is positioned to redefine the philanthropy landscape by bridging traditional charitable giving with blockchain technology, promoting greater transparency, and facilitating decentralized funding. Its focus on AI-driven analytics and multi-chain accessibility creates a robust ecosystem for impact investors to engage with verified social projects, transforming the way philanthropy is perceived and executed.

| Key Point | Details |

|---|---|

| Introduction of GrantiX | GrantiX is launching a multi-chain impact platform that connects traditional charities with blockchain donors. |

| Market Size | Targets the $1.57 trillion impact investing market. |

| Web3 Technology | Utilizes Arbitrum blockchain to enhance transparency and scalability. |

| Funding Model | Integrates DeFi, CeFi, impact staking, and transaction donations for sustainable funding. |

| User Engagement | Has processed over 15,000 donations totaling $200,000 and attracted over 10,000 users organically. |

| AI Involvement | Includes an AI Evaluation and Risk Management Layer for project efficiency and risk assessment. |

| Future Plans | Plans to launch IDO and IEO presales, CEX listings, and a global marketing campaign. |

| Industry Impact | Positioned to bridge off-chain philanthropy with crypto philanthropy, enhancing efficiency and transparency in impact investing. |

Summary

Impact investing is revolutionized with GrantiX, which offers a blockchain-based platform enhancing transparency and efficiency. By bridging the traditional charity sector with innovative Web3 technology, GrantiX not only facilitates significant funding for social causes but also creates measurable impacts through its AI-driven framework. As it prepares for its upcoming mainnet launch, GrantiX is set to redefine how donations are made and tracked, potentially transforming the entire landscape of philanthropy in the digital age.