Bitcoin mining difficulty plays a crucial role in determining how challenging it is for miners to earn their block rewards on the Bitcoin network. Recently, this difficulty level saw a notable decrease of 2.37%, easing operational pressures for Bitcoin miners who have been struggling with lower mining revenue. This adjustment not only affects the metrics of hashrate adjustment but also impacts the overall efficiency of block discoveries. As mining environments shift, understanding the nuances of Bitcoin network difficulty becomes vital to interpreting current market conditions. With the global hashrate in flux, the latest changes may offer Bitcoin miners a momentary reprieve in an otherwise tumultuous environment.

The challenges of cryptocurrency extraction are captured in the term “Bitcoin mining difficulty,” although this concept can also be described as the complexity of hash computations required to produce new blocks on the blockchain. With the recent downward adjustment in this parameter, many miners are optimistic about the favorable conditions for securing block rewards. The dynamic interplay of mining revenues and hashing power influences how quickly transactions are processed within the network. During periods of lowered mining difficulty, miners may experience a temporary boost to profitability as the overall strain in operations diminishes. Recognizing these shifts is essential for both novice and seasoned participants in the cryptocurrency mining landscape.

Understanding Bitcoin Mining Difficulty Adjustments

Bitcoin mining difficulty adjustments are crucial to maintaining the integrity and stability of the Bitcoin network. These adjustments occur approximately every 2016 blocks, correlating with the fluctuations in the collective hashpower of miners. When the total hashrate of Bitcoin miners increases, the difficulty level rises to ensure new blocks are generated at a steady rate, approximately every 10 minutes. Conversely, if the hashrate decreases, as we have seen recently, the difficulty can lower to provide relief to miners during tough market conditions.

The latest adjustment, which registered a 2.37% decrease in difficulty, is particularly significant in 2025 as it marks the seventh downward shift of the year. This change eases the operational strain on miners, allowing them to discover blocks more efficiently and potentially increasing their profitability, even when bitcoin prices are sliding. Understanding these dynamics is essential for anyone involved in Bitcoin mining or investing, as they directly affect the corresponding mining revenues and the overall health of the Bitcoin ecosystem.

The Impact of Mining Revenue on Bitcoin Miners

Mining revenue is a critical factor for Bitcoin miners, as it directly impacts their profitability and operational sustainability. The two main sources of income for miners are block rewards, which consist of newly minted bitcoins, and transaction fees from the transactions included in a block. As network difficulty adjusts, the potential income from these sources can fluctuate significantly. For instance, with the recent drop in mining difficulty, miners may find it slightly easier to receive block rewards, albeit under the pressure of declining bitcoin prices.

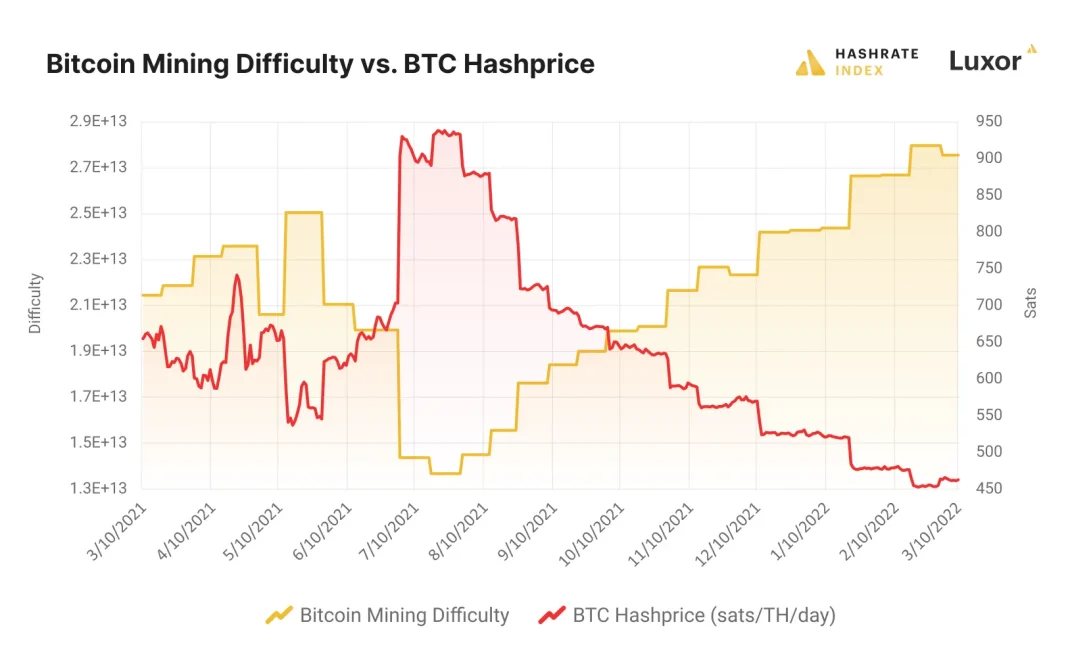

Currently, the hashprice — a measure of the revenue generated per unit of hashrate — has experienced a notable decline. As of the latest data, the hashprice has seen an 11.17% drop from previous levels. This downturn, combined with subdued fee revenue, which now only accounts for an average of 0.57% of the total block subsidy value, poses challenges for miners. Many are now focusing on optimizing their operations and costs to navigate this tightening revenue landscape.

Hashrate Adjustment and Its Implications for the Bitcoin Network

The hashrate of the Bitcoin network reflects the total computational power used by miners to validate transactions and secure the blockchain. A recent decrease in global hashrate to 1,085 EH/s indicates a contraction of 72 EH/s from its recent highs. Such adjustments can affect the network’s efficiency and security. When the hashrate declines, the likelihood of successfully mining new blocks decreases, which can lead to longer block times and hinder the overall transaction throughput of the network.

When there is a downward adjustment in mining difficulty, as we have seen with the recent 2.37% decrease, it provides some respite to miners as they can achieve block rewards more readily despite lower hashrate conditions. This momentary relief plays a vital role in stabilizing the network, allowing miners to recalibrate their strategies for maintaining profitability. Therefore, understanding hashrate trends and their subsequent impact on mining difficulty is vital for both miners and investors.

Exploring Bitcoin Block Rewards in Depth

Block rewards serve as the primary incentive for miners to contribute their computational resources to the Bitcoin network. Each time a miner successfully adds a new block to the blockchain, they are rewarded with a certain number of bitcoins, which decreases approximately every four years in an event known as the halving. This structure ensures a finite supply of bitcoins and plays a significant role in the balance between reward availability and market demand.

Despite the current mining difficulty easing, the economic conditions surrounding block rewards remain influenced by rapidly changing bitcoin prices. If the price of bitcoin remains sluggish, the incentive provided by block rewards may not be sufficient to attract new miners or keep existing ones engaged. Hence, it becomes crucial for miners to stay informed about market dynamics to ensure their operations remain profitable, especially when external pressures are in play.

Factors Influencing Bitcoin Mining Profitability

Several factors come into play when assessing Bitcoin mining profitability. The price of bitcoin is perhaps the most significant influence, as higher prices can enhance mining revenue through increased block rewards and transaction fees. Additionally, mining difficulty is another critical factor; lower difficulty levels allow miners to find blocks more easily, improving their chances of securing rewards. Recent adjustments in mining difficulty, such as the 2.37% dip, underline this relationship, offering miners a temporary relief.

Furthermore, operational costs including electricity prices, hardware efficiency, and overall market conditions significantly affect mining profitability. Miners constantly evaluate these parameters to maximize their returns, especially in a market characterized by fluctuating prices and varying levels of difficulty. As the industry evolves, understanding these interconnected elements is fundamental for anyone involved in Bitcoin mining.

Current Trends in Bitcoin Mining Revenue

The current trends in Bitcoin mining revenue are indicative of the larger economic conditions affecting the cryptocurrency market. As hashprice fell by 11.17% since mid-October, miners are struggling to maintain their income levels. The reduction in mining difficulty, while momentarily beneficial, may not fully offset the declining bitcoin prices, which are leaving many miners in a challenging position.

Moreover, as mining revenue diminishes, it can lead to broader implications for the Bitcoin ecosystem. If operational costs continue to outweigh rewards, some miners may be forced to shut down their operations. This potential reduction in hashrate could lead to further adjustments in mining difficulty, creating a cyclical effect. Understanding these trends can provide insights into the future of Bitcoin mining and its sustainability.

The Relationship Between Bitcoin Mining and Network Security

The security of the Bitcoin network is intrinsically linked to the activity of its miners. As miners contribute significant computational power to the network, they not only secure transactions but also maintain the integrity of the blockchain. However, fluctuations in mining difficulty can influence this security dynamic. A lower difficulty level reduces the barriers for miners, encouraging participation and helping maintain security even in challenging market scenarios.

Conversely, if mining profitability declines significantly, some miners may exit the market, reducing the overall hashrate. This scenario could hamper network security as lower hashrate can potentially increase the risk of attacks. It is therefore essential for Bitcoin miners to adapt their strategies, keeping operational efficiency in mind to ensure they contribute positively to the health and security of the network while navigating the associated risks.

Future Outlook for Bitcoin Miners Amidst Difficulty Adjustments

Looking ahead, the future for Bitcoin miners in the context of difficulty adjustments is uncertain but promising. Recent reductions in mining difficulty, like the recent 2.37% drop, indicate that the network might be entering a transitional phase where miners can recalibrate and respond to current market conditions. This could open up opportunities for enhancements in technology and strategies that leverage these adjustments for long-term sustainability.

On the flip side, miners must remain vigilant about the fluctuating nature of bitcoin prices and market demand. The effects of these ongoing adjustments could lead to ongoing volatility in mining profitability. Therefore, continuous innovation and adaptation are critical to ensuring that miners can thrive in this ever-evolving landscape, particularly as the Bitcoin network grows and matures.

Navigating Temporary Relief in the Mining Sector

As Bitcoin celebrates its recent difficulty adjustment, miners are experiencing a rare moment of relief amid the challenges posed by lower bitcoin prices and declining mining revenues. For many, this 2.37% drop in difficulty offers breathing space that could allow them to restructure their operations and optimize their efficiencies going forward. Although transient, such opportunities can significantly impact profitability and operational viability.

Miners should take this time to assess their strategies in response to the ongoing fluctuations in the Bitcoin market. Investigating new technologies to enhance hashrate output, minimizing energy consumption, and finding innovative ways to increase overall efficiency can serve as crucial steps for survival in an industry marked by volatility. This brief respite hints at a potential recalibration period, critical for preparing miners for whatever challenges lie ahead.

Frequently Asked Questions

What is Bitcoin mining difficulty and how does it affect miners?

Bitcoin mining difficulty refers to how challenging it is to find new blocks on the Bitcoin blockchain, adjusted periodically to ensure blocks are discovered roughly every ten minutes. A lower mining difficulty means that Bitcoin miners can find blocks more easily, potentially increasing their mining revenue due to improved odds of earning block rewards.

How frequently does Bitcoin mining difficulty adjust?

Bitcoin mining difficulty adjusts approximately every 2016 blocks, or roughly every two weeks. These adjustments ensure the Bitcoin network operates smoothly, maintaining relatively consistent block discovery times despite fluctuations in the global hashrate.

What factors influence changes in Bitcoin mining difficulty?

Bitcoin mining difficulty is influenced by the total hashrate of the Bitcoin network and the number of miners participating in the mining process. If more miners join the network and the collective hashrate increases, difficulty rises to maintain the ten-minute block interval. Conversely, if miners leave and the hashrate decreases, difficulty may fall to ease block discovery.

How does a decrease in Bitcoin mining difficulty impact miner income?

A decrease in Bitcoin mining difficulty allows miners to earn block rewards more easily, which may provide temporary relief to their mining revenue amid declining hashprice and fee income. This can help offset operational costs and improve profitability, especially when the Bitcoin price is low.

What is the relationship between Bitcoin mining difficulty and the block reward?

The Bitcoin block reward is the incentive for miners for validating transactions and adding them to the blockchain. When Bitcoin mining difficulty changes, it directly impacts how easily miners can receive these block rewards. A lower mining difficulty increases the probability of earning the block reward, thus positively affecting miner income.

Why is the global hashrate significant to Bitcoin mining difficulty?

The global hashrate reflects the total computational power of all miners on the Bitcoin network. If the global hashrate decreases, it typically leads to a reduction in Bitcoin mining difficulty, making it easier for miners to discover new blocks, which can temporarily boost mining revenue.

What has recently happened to Bitcoin mining difficulty as of October 2023?

In October 2023, Bitcoin mining difficulty experienced a 2.37% decrease, adjusting from 155.97 trillion to 152.27 trillion. This adjustment was welcomed by miners facing low bitcoin prices and mining revenue, as it provided a brief respite from operational pressures.

How does the current Bitcoin mining difficulty impact new block discovery times?

With the recent decrease in Bitcoin mining difficulty, the average block discovery time has improved, currently sitting at approximately 9 minutes and 23 seconds, which is quicker than the standard ten-minute interval. This can help miners complete more transactions in less time.

| Key Point | Details |

|---|---|

| Latest Difficulty Adjustment | The Bitcoin network’s difficulty decreased by 2.37%, changing from 155.97 trillion to 152.27 trillion at block height 923328. |

| Impact on Miners | The adjustment eases the mining process, providing temporary relief to miners amid a dip in bitcoin prices and mining revenues. |

| Current Hashrate | The global hashrate is now at 1,085 EH/s, a drop from the peak of 1,157 EH/s, indicating reduced competition among miners. |

| Average Block Time | The average time for block discovery has improved, now at approximately 9 minutes and 23 seconds, quicker than the ten-minute norm. |

| Miner Revenue Trends | Hashprice has decreased by 11.17%, with the current value of 1 PH/s dropping from $47.89 to $42.54, impacting earnings. |

Summary

Bitcoin mining difficulty has recently seen a significant adjustment, delivering a much-needed reprieve for miners facing challenging economic conditions. This reduction, measured at 2.37%, allows miners to more easily secure block rewards as they navigate decreasing hashprice and subdued revenue streams. Ultimately, such adjustments play a crucial role in maintaining the health and sustainability of the Bitcoin mining ecosystem.