In a surprising turn of events, Bitcoin ETFs have suffered a significant $870 million mass exit, marking one of the largest outflows in the history of digital asset investment. This substantial decline mirrors the broader sentiment within the crypto market news, leading to heightened concern among investors. Alongside Bitcoin, Ether ETFs also experienced a notable dip, shedding an additional $260 million, further underlining the current shift in investor focus. While major players such as Grayscale and Blackrock faced heavy ETF redemptions, Solana has managed to stand out with consistent inflows, highlighting its unique position in this turbulent climate. As the crypto market grapples with these dramatic changes, it becomes clear that adjusting strategies and exploring alternative assets may become the new norm for cautious investors.

The recent developments regarding Bitcoin ETFs have triggered a significant exodus, as investors increasingly seek alternative investment avenues. With a staggering outflow of $870 million, the trend signals a major pivot in the digital asset landscape, where Ether ETFs mirrored this shift with an outflow of $260 million. Amidst these ETF redemptions, the resilient performance of Solana ETFs demonstrates a growing appetite for newer opportunities in the market. This wave of capital withdrawal from established cryptocurrencies like Bitcoin and Ether indicates a broader strategic realignment, prompting investors to reconsider their portfolios in light of the latest crypto market news. As fluid dynamics reshape the landscape, the focus on emerging assets may lead to a re-examination of long-standing investment strategies.

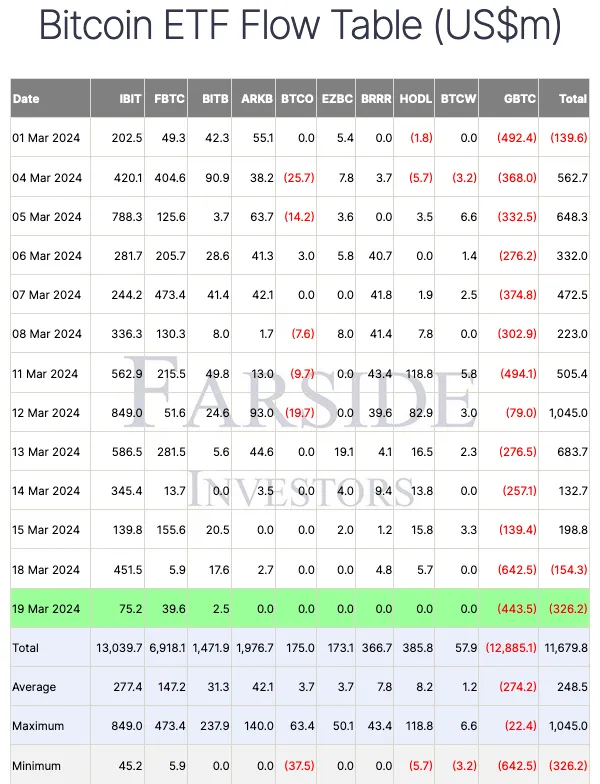

Bitcoin ETFs Outflow Analysis

The record-setting outflow from Bitcoin ETFs, totaling approximately $870 million, marks a significant shift in investor sentiment within the cryptocurrency market. With such a substantial mass exit, it underscores the increasingly cautious approach that many investors are adopting amidst ongoing economic uncertainty. The rapid abandonment of Bitcoin ETFs, particularly from well-known funds like Grayscale and Blackrock, highlights a critical moment in the evolving landscape of digital asset investing. Such drastic outflows are not just concerning for Bitcoin but indicate a broader trend of risk aversion, where investors may be seeking safer or more promising investment avenues.

Furthermore, this episode serves as a stark reminder of the volatility and unpredictability that can characterize the crypto market. Trends indicate that as Bitcoin continues to face considerable pressure, many investors are turning towards alternative investments. The $870 million Bitcoin ETFs outflow may not solely reflect dissatisfaction with Bitcoin but also a shift toward emerging cryptocurrencies, potentially indicating a growing interest in assets such as Ethereum and Solana. As the crypto market recuperates from these redemptions, understanding investor behavior will be pivotal for future ETF strategies and performance.

Impact of Bitcoin and Ether ETF Redemptions

The recent outflows from Bitcoin and Ether ETFs are not merely numbers on paper; they encapsulate a transformative phase in the cryptocurrency ecosystem. The combined outflows exceeding $1 billion on that turbulent day suggest a significant reallocation of capital as investors reevaluate their portfolios in response to market conditions. The record outflow from Ether ETFs also mirrors the overarching bearish sentiment impacting major digital assets, leading to substantial losses across the board. Such retreats are often prompted by fear of further declines, causing investors to seek refuge in more stable investment alternatives or emerging cryptocurrencies.

Amidst these daunting figures, one must consider what the volume of redemptions suggests for the broader crypto landscape. The erosion of trust in established ETFs could pave the way for a renaissance of alternative investments, where newer tokens or other Layer-1 solutions like Solana can attract capital. Indeed, the resilience of Solana amid the Bitcoin and Ether sell-off reveals investors’ appetite for exploring options beyond the traditional giants. This shift could signify an opportunity for decentralized finance (DeFi) protocols and smaller cryptocurrencies to thrive in a volatile market climate.

The Significance of Solana Inflows

While Bitcoin and Ether faced intense sell-offs, Solana ETFs managed to remain buoyant, thus demonstrating a unique narrative within this turbulent market. The positive inflow of $1.49 million to Solana amidst the overall bearish tone indicates a noteworthy divergence in investor preferences. The consistence with which Solana has managed to attract fresh capital, even during adverse market conditions, hints at the growing recognition of its potential. This trend highlights that there are segments within the crypto market that continue to gain investor confidence, suggesting a diversification of interest.

Moreover, the resilience of Solana during periods of significant ETF redemptions indicates that specific projects may emerge as strong contenders in the evolving digital asset ecosystem. As Solana continues to expand its technological capabilities and user base, it sets itself apart from competitors like Bitcoin and Ether, which are currently struggling. This preference for Solana could imply an emerging trend where investors may prioritize projects that offer innovative solutions and potential for growth in the DeFi space, reflecting the ongoing maturation of the cryptocurrency market.

Current Trends in the Cryptocurrency Market

The recent mass exit from Bitcoin and Ether ETFs reinforces a narrative of shifting trends within the cryptocurrency market. Investors appear to be adjusting their strategies, moving away from traditional assets, which may have been deemed safer in the past, in favor of exploring alternative digital currencies. This flux can be attributed to numerous factors, including market volatility, regulatory concerns, and an evolving understanding of which assets may be primed for growth versus stagnation. As evidenced by the varied performance of cryptocurrencies, it’s clear that market dynamics are continuously in play.

Additionally, the emergence of new layers within the crypto ecosystem, driven by projects like Solana, indicates that the market is adapting to changing investor sentiments. A broader acceptance of various Layer-1 solutions may point to a decentralized future that can withstand external pressures. Investors may start viewing established cryptocurrencies as merely a part of a much larger and diverse portfolio that includes rising stars in the space. In this interconnected and dynamic market, the role of Bitcoin and Ether will be pivotal in guiding future investment patterns.

Factors Driving Ethereum ETFs Outflows

The recent Ethereum ETFs outflows, which totaled approximately $260 million, reflect not only individual investor behavior but also overarching market sentiments. Investors pulling capital from these funds suggest a growing uncertainty regarding Ethereum’s price stability and future direction amidst broader economic tumult. With Ethereum frequently compared to Bitcoin, the simultaneous outflows from both leading cryptos could signal a deeper-rooted concern regarding the foundation of the entire crypto market. The hesitance to invest in Ethereum ETFs at this juncture raises questions about the long-term viability of the asset.

Moreover, Ethereum’s current challenges in scaling and transitioning to proof-of-stake have contributed to the bearish outlook many investors are adopting. The market’s view of Ethereum’s potential growth next to newer contenders like Solana indicates a competitive landscape that could sway capital flow dramatically. As Ethereum navigates through its transitional phase, the persistent outflows may serve as a wake-up call for developers and investors alike to address scalability and transaction fees to retain investor interest and confidence.

Understanding ETF Redemption Dynamics

Understanding the dynamics behind ETF redemptions can provide critical insights for investors and institutions alike. When substantial outflows occur, like those witnessed in Bitcoin and Ether ETFs, it prompts a reassessment of why investors are choosing to withdraw their capital. These redemptions can reveal fears about market stability or a belief that assets may underperform in the near future. It’s also a reminder of the liquidity challenges that can arise when markets are under distress, emphasizing the importance of maintaining a diversified portfolio to hedge against potential volatility.

Additionally, ETF redemptions often signal a transitional phase for the overall market, as capital is reallocated to safer or more promising alternative investments. The broader implications could extend beyond just the immediate market effects; they offer a glimpse into the psychological aspects driving investors’ behaviors in the crypto space. Understanding these behavioral trends is essential for crafting strategies that align with the evolving preferences of digital asset investors, particularly during challenging market conditions.

Investor Sentiment and Market Dynamics

The dramatic outflows from Bitcoin and Ether ETFs can be attributed to shifting investor sentiment, which is heavily influenced by market dynamics. Many investors are opting for a more cautious approach, reevaluating their positions and reallocating resources away from traditional major cryptocurrencies. This sentiment is not only a reaction to the current economic environment but also reflects concerns about the sustainability and long-term value of these assets. As historical trends in the crypto space show high volatility, investors are rightfully wary of making long-term commitments when uncertainty looms.

Consequently, this evolving investor sentiment allows for alternative cryptocurrencies, such as Solana, to shine in stark contrast to Bitcoin and Ether. As Solana garners increasing investor confidence amidst broader economic shifts, it suggests a potential shift toward exploring assets with innovative capabilities and promising futures. This duality within investor behavior signals that the crypto market is increasingly nuanced, with discernment playing a key role in investment strategies as individuals strive to balance risk and potential returns.

Future Predictions for Cryptocurrency ETFs

Looking ahead, the future of cryptocurrency ETFs will largely be shaped by the behaviors and preferences exhibited by investors in the wake of recent outflows. As the market stabilizes, it’s likely that some investors may begin re-entering Bitcoin and Ether ETFs if confidence returns, particularly if signs of recovery are noted. However, the strain from the recent mass exits may prompt ETF issuers to reassess their strategies to retain investor interest, potentially innovating products or introducing more diversified investment options to attract a wider range of participants.

Moreover, the rise of alternative cryptocurrencies, especially those like Solana that are demonstrating sustained inflows in an otherwise challenging environment, could lead to the creation of more specialized ETF offerings. As investors seek assets that represent potential growth and adoption, there is an opportunity for innovative ETFs that cater to diverse cryptocurrency niches. The ongoing changes in the market landscape present both challenges and opportunities for these financial products, shaping how the cryptocurrency ETF market evolves in the coming years.

Navigating Market Fluctuations in Cryptocurrencies

Navigating the volatility of cryptocurrency markets requires a keen understanding of market fluctuations, especially in light of recent Bitcoin and Ether ETF outflows. As traders and investors respond to sudden changes in sentiment, it’s crucial to analyze the factors that contribute to such market movements. Investors are advised to remain vigilant, with a firm grasp of the crypto market’s psychological aspects and how they correlate with market dynamics. This understanding can help mitigate risks and strategically position portfolios to adapt to evolving trends.

Furthermore, as fluctuations continue to rattle the market, the rise of new narratives might offer fresh perspectives on investing in digital assets. Maintaining a robust strategy that considers diversification — including positions in emerging projects like Solana — can offer some stability amidst the unpredictable nature of cryptocurrencies. By fostering adaptive strategies and insights based on current trends, investors can navigate the complexities of the crypto landscape while optimizing their potential for long-term success.

Frequently Asked Questions

What factors contributed to the recent Bitcoin ETFs outflow of $870 million?

The recent Bitcoin ETFs outflow of $870 million can be attributed to investor uncertainty and a shift in sentiment towards riskier assets. This mass exit reflects increasing caution among investors in the crypto market, leading them to redeem their Bitcoin ETF holdings.

How did Ether ETFs perform during the Bitcoin ETFs outflow?

During the same period of significant Bitcoin ETFs outflow, Ether ETFs also experienced notable declines, with $260 million flowing out. This indicates a widespread withdrawal trend affecting both major cryptocurrencies amid market volatility.

What does the sharp outflow from Bitcoin ETFs indicate about investor sentiment?

The sharp outflow from Bitcoin ETFs suggests a growing bearish sentiment among investors, indicating a preference for lower-risk assets or a pivot towards alternative investment opportunities in the crypto market.

What trends are emerging with Solana amidst the Bitcoin ETFs outflow?

Amid the Bitcoin ETFs outflow, Solana has been notably seeing inflows, signaling a potential shift in investor focus towards newer and alternative assets in the crypto landscape, contrasting with the retreat from Bitcoin and Ether.

What impact do Bitcoin ETFs redemptions have on the broader crypto market?

Bitcoin ETFs redemptions, particularly the substantial $870 million exit, can have a significant impact on the broader crypto market, potentially leading to increased volatility and influencing other cryptocurrencies like Ether, which similarly suffers from outflows.

| Key Point | Details |

|---|---|

| Mass Outflow from Bitcoin ETFs | Bitcoin ETFs saw an outflow of $869.86 million, marking the second-largest exit in the product class’s history. |

| Major Funds Affected | Grayscale’s Bitcoin Mini Trust lost $318.20 million, followed by Blackrock’s IBIT with $256.64 million. |

| Ether ETFs Outflows | Ether ETFs faced $259.72 million in outflows, led by Blackrock’s ETHA at $137.31 million. |

| Resilience of Solana ETFs | In contrast, Solana ETFs saw a small inflow of $1.49 million, continuing a positive trend. |

| Market Impact | The total volume traded was $6.52 billion, with net assets for Bitcoin ETFs dwindling to $130.54 billion. |

Summary

Bitcoin ETFs outflow reached an unprecedented level with $870 million exiting the market, reflecting significant investor caution in major cryptocurrencies. This event marks the second-largest daily outflow recorded in the history of Bitcoin ETFs, highlighting the ongoing volatility and risk-off sentiment in the digital asset landscape. While Bitcoin and Ether saw massive redemptions, Solana ETFs stood out by garnering inflows, indicating a potential shift towards alternative cryptocurrencies amidst market sell-offs.