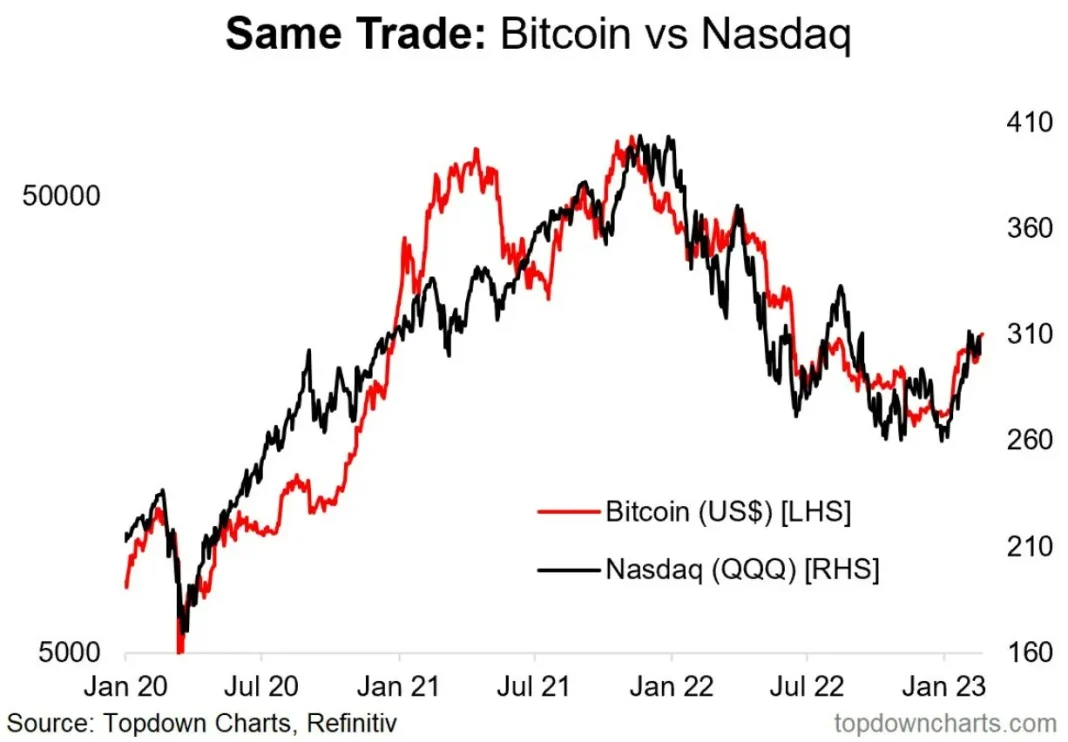

The Bitcoin Nasdaq correlation has become a focal point of crypto market analysis as it spotlights an intriguing aspect of Bitcoin’s behavior amidst fluctuating investor sentiment. While Bitcoin price trends reveal a digital asset navigating near record highs, its reaction to Nasdaq-100 performance tells a different story. Instead of retail investors rallying in response to equity gains, Bitcoin has displayed a tendency to plummet during stock market downturns. This unique dynamic may reflect diminishing enthusiasm among participants in the BTC market and highlights the intricate relationship between cryptocurrencies and traditional assets. As the crypto market continues to evolve, understanding the correlation with Nasdaq becomes crucial in deciphering BTC market dynamics and forecasting future trends.

Exploring the link between Bitcoin and the Nasdaq provides valuable insights into the cryptocurrency’s performance relative to the broader equity market. The connection, often referred to as Bitcoin’s relationship with major stock indexes, emphasizes how shifts in investor psychology can significantly impact digital currencies. When reviewing Bitcoin alongside tech-heavy indices, it becomes evident that fluctuations in investor confidence are mirrored in Bitcoin’s price action. Furthermore, this association serves as a key driver in understanding market structures, especially as Bitcoin behaves more like a leveraged asset affected by traditional market movements. Thus, analyzing these correlations is essential for investors looking to navigate the complexities of the current financial landscape.

Bitcoin’s Sensitivity to Nasdaq Market Movements

Bitcoin’s price trends have increasingly mirrored those of the Nasdaq-100, especially during market downturns. This correlation, currently hovering around 0.8, indicates that bitcoin tends to react significantly on days when the Nasdaq experiences declines. As the equity markets face pressures, investor sentiment shifts negatively, prompting BTC to follow suit more aggressively than it does during rallies. This unusual behavior raises critical questions about the influence of traditional equities on the crypto market and may suggest a deeper underlying relationship between these asset classes.

The heightened sensitivity of Bitcoin to Nasdaq losses is indicative of a broader tendency among investors towards risk aversion. As equities drop, we see a simultaneous increase in selling pressure for bitcoin, as traders look to mitigate losses across their portfolios. Furthermore, the current phase of the crypto market is characterized by stagnant investor participation and uncertain liquidity, which exacerbates bitcoin’s reactions to external shocks in the equity market. In essence, rather than leading the charge in bullish sentiment, BTC now appears to be more of a follower, reflecting the fears prevailing in traditional markets.

Frequently Asked Questions

How does Bitcoin’s correlation with Nasdaq impact Bitcoin price trends?

Bitcoin’s correlation with Nasdaq is primarily negative, meaning BTC tends to drop more significantly during Nasdaq declines. This correlation affects Bitcoin price trends by indicating that investor sentiment is currently cautious, leading to amplified losses in the crypto market during equity downturns.

What is the current Bitcoin-Nasdaq correlation level?

The current Bitcoin-Nasdaq correlation stands at approximately 0.8, highlighting a strong relationship where Bitcoin reacts more dramatically to Nasdaq-100 performance downturns compared to upswings.

Why does Bitcoin react more to Nasdaq declines than rallies?

Bitcoin’s price is showing a negative performance skew, reflecting a tendency to fall harder on days when the Nasdaq declines than to gain when the Nasdaq rises, suggesting weakened investor sentiment in the crypto market.

How do investor sentiments affect Bitcoin’s correlation with Nasdaq?

Investor sentiment plays a crucial role in the Bitcoin-Nasdaq correlation. Currently, the sentiment appears risk-off, leading to Bitcoin exhibiting high sensitivity to Nasdaq declines, which results in greater volatility in the BTC market dynamics.

What role does liquidity play in the Bitcoin-Nasdaq correlation?

Liquidity issues, including stagnant stablecoin supply and slower ETF inflows, contribute to Bitcoin’s heightened sensitivity to Nasdaq declines. This thin liquidity amplifies BTC’s downside reactions, impacting its correlation with equity market movements.

What does Bitcoin’s current performance indicate about market dynamics?

Despite Bitcoin trading near record highs, its current performance—marked by significant drops during Nasdaq sell-offs—suggests investor fatigue in the crypto market, contrasting with a typical bullish cycle.

How does Bitcoin’s behavior during down markets affect investor sentiment?

Bitcoin’s increased volatility and larger drop during down markets indicate a cautious investor sentiment, leading to a general perception of risk aversion in the cryptocurrency space.

What historical patterns are observed in Bitcoin’s correlation with Nasdaq during market cycles?

Historically, a strong Bitcoin-Nasdaq correlation tends to appear at market cycle lows; however, the current high correlation, coupled with negative skews, suggests an unusual scenario where BTC is resilient despite bleeding investor sentiment.

| Key Point | Details |

|---|---|

| Correlation with Nasdaq | Bitcoin has a correlation of about 0.8 with the Nasdaq-100, indicating a strong link, particularly during market declines. |

| Performance Skew | BTC is falling harder on down days for the Nasdaq while showing less enthusiasm during rallies, suggesting negative performance skew. |

| Investor Sentiment | The current market sentiment reflects investor fatigue, as BTC reacts more to equity declines than upswings. |

| Market Dynamics | Heavy focus on equities has diverted speculative capital away from crypto, making BTC more reactive and less driven by its own narrative. |

| Liquidity Profile | Crypto’s liquidity has stagnated, as stablecoin supply is flat and ETF inflows have decreased, exacerbating BTC’s downside sensitivity. |

| Resilience Signal | Despite the negative performance skew, BTC remains near record highs, indicating potential underlying strength in the asset. |

Summary

The Bitcoin Nasdaq correlation is currently characterized by a significant tendency for Bitcoin to track Nasdaq losses more acutely than its gains. This correlation indicates investor fatigue and a shift in market sentiment, with Bitcoin acting as a high-beta asset that is particularly sensitive to equity market declines. The prevailing liquidity issues and a tilt towards equities have left Bitcoin struggling to capitalize on bullish trends. However, BTC’s ability to maintain its value close to all-time highs, despite these challenges, suggests that it retains fundamental strength and may rally in the future.