The Stretch Debt Instrument represents a remarkable evolution in the landscape of financial products, marking a strategic innovation that has drawn attention within cryptocurrency markets. Developed by Strategy, this novel debt instrument is designed to maintain price stability through a dynamic variable dividend mechanism, adapting each month to align with market pricing. Insights from a recent Bitmex Research report shed light on how this unique structure could potentially influence investor behavior and risk exposure. Unlike traditional fixed-income securities, the Stretch Debt Instrument promises a flexible, albeit risky, approach that ties dividend payouts to market performance, captivating both investors and analysts alike. As cryptocurrency adopts more sophisticated financial models, understanding the nuances of the STRC stability claims becomes increasingly essential for stakeholders involved in bitcoin treasury expansion and beyond.

Within the diverse repertoire of financial assets, the innovative Stretch Debt Instrument crafted by Strategy exemplifies a fresh approach to debt securities. Also referred to as the STRC product, this financial instrument employs an adaptive strategy that alters its monthly dividend based on real-time market conditions, setting it apart from conventional fixed-rate debt. Insights from Bitmex Research reveal the complexities and potential risks associated with such a product, especially as it intertwines with the concept of variable dividend debt linked to ongoing bitcoin accumulation. As this new wave of instruments materializes, it becomes crucial for investors to navigate these emerging horizons carefully, balancing the pursuit of returns against the inherent risks posed by adjustments in dividend payments. By exploring alternative financing mechanisms, such as this novel approach, the financial landscape continues to evolve, prompting a reevaluation of long-standing investment strategies.

Understanding the Stretch Debt Instrument: A New Approach to Stability

The Stretch Debt Instrument from Strategy, known as STRC, represents a groundbreaking method in the realm of debt securities. Designed to maintain price stability, STRC does this through its unique variable dividend rate, which fluctuates according to market performance. This paradigm shift differs significantly from traditional fixed-rate debt instruments, as STRC aligns its coupon payments with its trading price. As detailed in Bitmex Research’s report, this innovative structure aims to keep the instrument anchored around a target price, a strategy that sees potential traction in today’s unpredictable financial landscape.

Unlike typical variable-rate debt that reacts to external benchmark interest rates, STRC is specifically crafted to respond to its own market valuation. This functionality allows Strategy to leverage its capital for bitcoin purchases, enhancing its treasury rather than merely supporting corporate operations. With an approach likened to a form of financial system innovation, STRC could potentially offer investors a unique tool in their portfolios, albeit with significant risks attached.

Evaluating the Risks of Strategy’s Variable Dividend Debt

While STRC promises to provide a modern take on debt instruments, the risks associated with its variable dividend structure cannot be overlooked. According to the insights provided by Bitmex Research, one critical concern for investors is Strategy’s ability to cut the dividend rate unilaterally by up to 25 basis points each month. This discretion means that even during favorable market conditions, STRC holders may find their returns diminished if the company opts to reduce payouts. The potential for a swift trajectory to zero dividends highlights a fundamental risk unique to this investment.

Moreover, the accumulation of missed payments presents additional uncertainties for investors. With no guarantees on dividend payouts and no security claims for STRC holders, investors could find themselves in a precarious situation if the company prioritizes its financial health over shareholder returns. The Bitmex report also emphasizes the structural advantages that this option creates for the equity holders of Strategy, suggesting that while the instrument may appear stable, it carries much higher risk than traditional debt products like U.S. Treasuries.

Strategic Implications for Bitcoin Treasury Expansion

The issuance of STRC aligns closely with Strategy’s ongoing efforts to expand its bitcoin treasury, presenting an innovative approach that bypasses conventional funding routes. As highlighted in the Bitmex Research report, capital raised from STRC goes directly into bitcoin acquisitions, showcasing a strategy designed to bolster the company’s cryptocurrency reserves amid fluctuating market conditions. This method complicates the traditional debt narrative, as issues of liquidity and asset-backed securities enter the dialogue.

By integrating a debt instrument with direct bitcoin buyouts, Strategy creates a distinct competitive advantage in the cryptocurrency space. This tactic not only diversifies its financial strategy but also positions the firm to capitalize on market movements in digital assets. However, investors should remain vigilant regarding the implications of this strategy, specifically considering how volatile bitcoin prices could potentially exacerbate the risks inherent in holding STRC.

The Paradox of Stability Claims in Innovative Debt Products

Strategy markets the STRC as a low-risk investment vehicle, akin to short-duration U.S. Treasuries; however, the findings from Bitmex Research challenge these assertions by drawing attention to the unique volatility that can accompany such innovative debt products. By creating a product that adjusts its dividends based on price fluctuations, the firm introduces a paradox: while STRC is designed for stability, the mechanisms that permit this stability could equally contribute to increased investor uncertainty.

Investors tempted by the allure of a novel strategy may not fully account for the risks embedded in the flexible dividend structure and the inherent discretion held by Strategy over dividend payments. This dynamic could lead to situations where investors experience erratic returns, challenging the initial perception of STRC as a secure investment. It further suggests a potential reevaluation of how such innovative financial instruments are perceived in terms of risk and reward.

Comparative Analysis: STRC vs. Traditional Debt Instruments

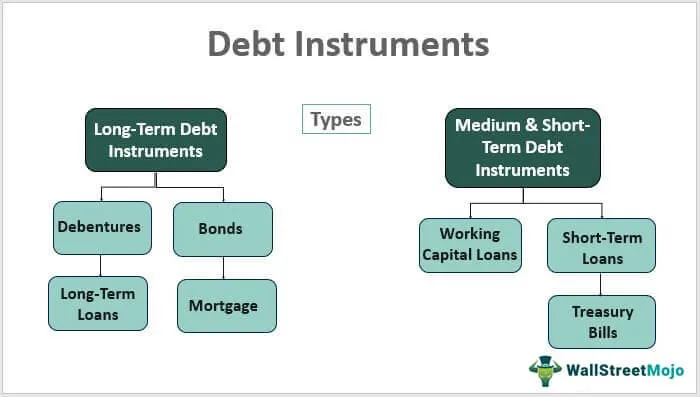

When comparing STRC to traditional debt instruments, the most notable differences lie in their structural frameworks and risk profiles. Traditional bonds typically offer fixed or well-defined variable interest rates linked to broader economic indicators, while STRC’s unique variable dividend dependent on market pricing provides a distinctly different investment experience. Consequently, while STRC might appeal to risk-tolerant investors looking for unconventional avenues, it is essential to recognize it carries more significant risks compared to conventional bonds.

Further analysis provided by Bitmex Research supports this claim, elucidating how STRC’s design could lead to more drastic fluctuations in investor returns in response to market movements. For instance, traditional debt instruments are often considered safer during economic downturns because they maintain consistent coupon payments. In contrast, the flexible nature of STRC can yield unpredictable outcomes, necessitating that investors conduct thorough due diligence when considering allocations in such instruments.

The Future of Debt Instruments in Cryptocurrency Markets

The design and implementation of the STRC signpost a potential future where debt instruments evolve to meet the needs of the rapidly changing cryptocurrency landscape. As digital assets gain more traction, traditional financing structures like fixed-rate bonds may be supplemented—or even replaced—by innovative products that incorporate elements of both crypto and conventional finance. This evolution could redefine how debt is perceived and utilized within the broader market.

Bitmex Research notes that financial innovation typically follows market demand, and as more players enter the crypto space seeking flexible fundraising options, new debt instruments akin to STRC may proliferate. However, the challenges of volatility and investor protection will remain pivotal considerations as these products gain acceptance. The success or failure of STRC will likely set a precedent that could influence the trajectory of future debt instruments in the realm of digital currencies.

Investor Perspectives on the Stretch Debt Instrument

Understanding investor perspectives is crucial when examining the implications of the Stretch Debt Instrument. As reported by Bitmex Research, while some investors may be drawn to STRC’s potential benefits, including its novel approach to dividend payments and alignment with cryptocurrency acquisition, others might express hesitancy due to inherent risks. The discretionary nature of dividend reductions raises questions about long-term viability, prompting a cautious outlook among stakeholders.

Moreover, the marketing of STRC as a stable option may create a false sense of security for less experienced investors who do not fully grasp the implications of its variable structure. For those considering STRC as part of their investment strategy, it is essential to approach it with a critical eye, weighing both its innovative characteristics against the backdrop of traditional debt instruments to make informed choices.

Regulatory Considerations for Stretch Debt Instruments

As the financial landscape continues to adapt alongside advancements in cryptocurrency, regulatory considerations surrounding innovative debt instruments such as STRC are bound to come under scrutiny. Legislators and regulatory bodies may be prompted to evaluate how these unique financial products fit within existing frameworks and what implications might arise as new structures emerge. The Bitmex Research report raises pertinent questions about investor protections and market transparency associated with these novel debt offerings.

With regulatory clarity still developing in many jurisdictions regarding cryptocurrency and related assets, issuers of instruments like STRC must remain vigilant in ensuring compliance while navigating evolving standards. This situation creates a dynamic environment for both issuers and investors, necessitating ongoing dialogue and reassessment as the market matures.

Navigating the Investment Landscape with Stretch Debt

For investors exploring the quality of debt products in an increasingly complex investment landscape, the STRC presents an intriguing yet challenging option. The innovative structure, while offering the possibility of enhanced returns connected to a company’s bitcoin treasury strategy, necessitates a level of understanding regarding market movements and potential risks. As noted in Bitmex Research’s comprehensive analysis, investors must navigate these waters carefully to align their risk tolerance with the unique attributes of STRC.

To enhance investment decisions, individuals should seek to diversify their portfolios while retaining awareness of STRC’s potential for volatility and reduced dividend payments. Understanding the mechanics behind this debt instrument will empower investors to make informed choices, whether they jump into this novel offering or opt for more traditional financial instruments that offer greater predictability and security.

Frequently Asked Questions

What is the Stretch Debt Instrument (STRC) and how does it relate to bitcoin accumulation?

The Stretch Debt Instrument, known as STRC, is a novel venture from Strategy designed to maintain stability through variable dividends that adjust based on market pricing. Unlike traditional debt instruments, STRC’s proceeds are utilized for bitcoin treasury expansion, directly tying its performance to the cryptocurrency’s value.

How does the variable dividend mechanism of the Stretch Debt Instrument work?

The variable dividend mechanism of the Stretch Debt Instrument allows the monthly dividend rate to increase or decrease depending on STRC’s trading price relative to its $100 target. If STRC trades below this target, dividends can rise, while trading above it can lead to lowered dividends, aiming for price stabilization.

What are the risks associated with the Stretch Debt Instrument for investors?

Investors in the Stretch Debt Instrument face several risks, primarily the potential for Strategy to reduce dividends by up to 25 basis points monthly, regardless of market performance. This could lead to significantly diminished returns if the STRC experiences continued pressure.

How does the Stretch Debt Instrument differ from traditional debt instruments?

The Stretch Debt Instrument differs from traditional debt products like U.S. Treasurys by having a unique structure that adjusts its coupon strictly based on its own trading valuation rather than external benchmark rates. This innovation is designed to keep STRC stable while directly supporting bitcoin accumulation.

Does the Stretch Debt Instrument have any security claims for its holders?

No, holders of the Stretch Debt Instrument, STRC, do not have any security claims. The issuer, Strategy, is not obligated to pay dividends, and missed payments can accumulate without guaranteeing repayment to STRC holders, increasing overall investment risk.

Can the Stretch Debt Instrument be considered a Ponzi scheme?

While some features of the Stretch Debt Instrument may resemble a Ponzi scheme due to its reliance on new capital for sustaining dividends, Bitmex Research concludes that it does not fulfill the official criteria. The ability for Strategy to lower dividends provides a longer operational runway, although it greatly increases investor risk.

What impact does the market condition have on the Stretch Debt Instrument?

Market conditions can significantly impact the Stretch Debt Instrument, as adverse conditions could prompt Strategy to lower monthly dividend payments. This, in turn, may lead to a decrease in the market price of STRC, affecting investor returns negatively.

In what way is the Stretch Debt Instrument marketed compared to other investment options?

The Stretch Debt Instrument is marketed as a low-risk option compared to traditional short-duration Treasurys, despite the increased risks identified. This positioning seeks to attract conservative investors while offering a unique investment linked to bitcoin treasury expansion.

| Key Point | Details |

|---|---|

| Overview of Stretch Debt Instrument | Stretch (STRC) is designed to maintain price stability through a variable monthly dividend rate based on market pricing. |

| Market Comparison | Marketed as a low-risk option akin to short-duration U.S. Treasurys, despite its ties to bitcoin accumulation. |

| Dividend Mechanism | STRC’s dividends can increase or decrease based on trading price relative to a $100 target, differing from traditional debt instruments. |

| Risk Factors | Strategy can reduce dividends by up to 25 basis points monthly, risking significant reductions for investors. |

| Payment Obligations | Holders of STRC have no security claims; the company can choose not to pay dividends even if arrears build up. |

| Ponzi Scheme Comparison | Although the product shares some characteristics with a Ponzi scheme, it is not classified as one due to its operational structure. |

Summary

Stretch Debt Instrument is a unique financial product that blends innovative pricing strategies with inherent risks. The Bitmex Research report explores how this debt instrument, STRC, manages its variable dividends to adapt to market dynamics while presenting distinct risks for investors. With its flexible approach to dividend payouts, STRC demonstrates a strategic shift in how debt instruments can function, particularly in the context of cryptocurrency investments. However, potential investors must weigh these novel characteristics against the substantial risks, especially concerning dividend reductions and payment obligations.