Bitcoin ETF outflows have become a significant focal point in the current crypto landscape, marking their fifth straight day of losses amidst waning investor confidence. As traders withdraw considerable sums, totaling millions, from Bitcoin and Ether ETFs, the market grapples with a shifting investor sentiment in crypto. In contrast, Solana ETFs are witnessing a remarkable countertrend, attracting around $30 million in inflows, underscoring a juxtaposition in ETF performance across various digital assets. The unfolding crypto market trends indicate that while Bitcoin and Ether face mounting challenges, altcoins like Solana are capturing investor interest. This dynamic highlights the ongoing volatility within the cryptocurrency sector, making it crucial for market participants to stay informed on these developments.

In the latest developments surrounding cryptocurrency investments, the focus has shifted towards ETF outflows, particularly involving Bitcoin and Ethereum products, as they continue to experience substantial capital withdrawals. These recent trends indicate a cautious investor sentiment within the crypto sphere, fueled by macroeconomic pressures and profit-taking strategies. Conversely, Solana has emerged as a bright spot, enjoying a steady inflow of funds, which reflects a shifting preference among investors for alternative digital assets. Furthermore, analyzing the performance of different ETFs reveals stark contrasts in market reactions, where traditional leaders like Bitcoin and Ether struggle, while trendier options are gaining traction in the ever-evolving crypto market landscape. Overall, these movements underscore a transformative period in the ETF realm, warranting close attention from both investors and analysts alike.

Understanding Bitcoin ETF Outflows Amid Market Pressures

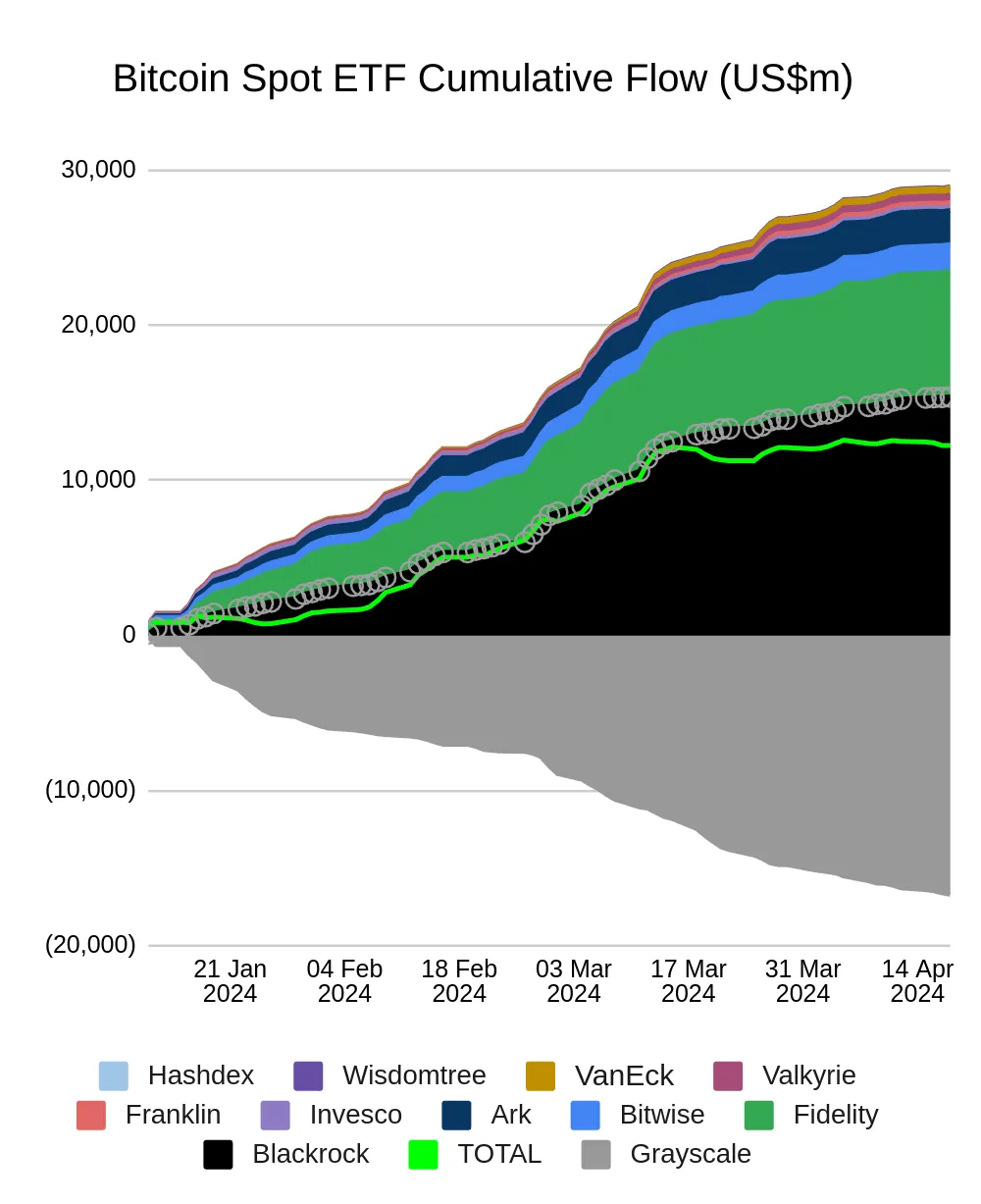

Bitcoin ETFs have faced significant outflows recently, particularly noted with a staggering exit of $523.15 million from Blackrock’s IBIT on November 18. This marks a continuation of a troubling trend for Bitcoin ETFs, which logged their fifth consecutive day of net outflows. The persistent withdrawals can be attributed to a combination of macroeconomic pressures and strategic profit-taking, as investors evaluate the current volatility in the crypto market. Such actions reflect not only concerns about the asset’s performance but also broader investor sentiment in crypto, leading many to reassess their positions towards more stable or potentially lucrative opportunities.

In examining the implications of these outflows, it becomes clear that they may signal a temporary shift in investor strategy rather than a long-term bearish outlook. While short-term trends indicate a withdrawal of funds, it’s essential to consider that inflows into ETFs earlier this year were among the highest recorded in ETF history, affirming ongoing interest in digital assets. Thus, while Bitcoin’s ETFs experience outflows, the overall enthusiasm for crypto remains alive, albeit in a more discerning manner as investors navigate through an ever-moving landscape.

The Performance of Ether ETFs: A Closer Look

Ether ETFs have also struggled recently, with a recorded net outflow of $74.22 million as of November 18. This marked the sixth consecutive day of declines for Ether products, primarily driven by substantial withdrawals from major players like Blackrock’s ETHA. The underlying reasons for these retreats echo those seen with Bitcoin ETFs: macroeconomic conditions, changing investor sentiments, and liquidity tightening within the market. Despite some attempts to rebound with inflows into Grayscale’s Ether Mini Trust and others, the overall outlook remains bleak, highlighting the struggles of Ether in a volatile trading environment.

Moreover, while these outflows paint a concerning picture for Ether ETFs, it is crucial to illustrate the sharp contrast with the performance of Solana ETFs, which have been thriving amid the downturn. The crypto market trends suggest a stratification where investors are seeking strong altcoins to support their portfolios, indicating a potential shift in focus away from traditional cryptocurrencies like Ethereum. Understanding these dynamics can aid in assessing how Ether fits into the larger conversation surrounding ETFs and the evolving investor landscape.

Solana ETFs: An Emergent Leader in the Crypto Space

In stark contrast to the outflows surrounding Bitcoin and Ether, Solana ETFs have showcased a remarkable strength, boasting an inflow of $30.09 million on November 18 alone. This positive momentum has extended over multiple weeks, suggesting a shifting interest among investors towards more promising altcoin opportunities. The leading position for Solana is driven by favorable market conditions, evidenced by increased trading activity reaching $73.14 million, and a subsequent rise in net assets to $593.73 million. Such performance underscores the potential evolution of investor strategies as they seek to capitalize on altcoins demonstrating resilience.

Moreover, the inflow dynamics surrounding Solana ETFs highlight a growing investor sentiment that favors innovation and performance over traditional benchmarks. Notably, the substantial contributions from various Solana ETF products, like Bitwise’s BSOL and Grayscale’s GSOL, indicate a robust appetite for exposure to new and performing altcoins. This ongoing trend may point towards a broader market adjustment as investors increasingly prioritize agility and potential returns, especially in a market rife with uncertainties. Solana’s success reinforces the necessity for adaptability in crypto investments, paving the way for its distinction as a leading alternative in the current venture landscape.

Market Trends: The Rise of Altcoins Amid Bitcoin and Ether Declines

The current trends in the crypto market are increasingly characterized by significant investor movements away from Bitcoin and Ether, as evidenced by the recent outflows from their respective ETFs. This shift not only highlights the immediate challenges faced by these leading cryptocurrencies but also emphasizes a dynamic pivot towards altcoins like Solana. The strong inflows into Solana ETFs suggest a growing preference for assets that offer potential growth amidst macroeconomic uncertainties, illustrating a broader re-evaluation of crypto portfolios by investors seeking opportunities in a fragmented market.

Market trends also reflect an evolving investor sentiment where traditional crypto giants are reassessing their place in the investment hierarchy. With Solana’s ascent coinciding with Bitcoin and Ether’s struggles, there’s an emerging narrative: as established dominions experience volatility and outflows, smaller cryptocurrencies are capturing investor attention by presenting viable alternatives. This paradigm shift may lead to a more diversified approach to crypto investment, where altcoins begin to carve out a significant market share, responding to the needs of investors looking for stability amidst tumultuous market conditions.

The Implications of ETF Performance on Investor Behavior

The performance of ETFs in the current climate has wide-ranging implications for investor behavior, particularly in how they adjust to fluctuations in the market. The ongoing outflows from Bitcoin and Ether ETFs signify a response to mounting pressures, driving investors to rethink their strategies amidst increased volatility. This change in behavior indicates not just a reaction to immediate market conditions, but also long-term implications regarding how investors in the crypto ecosystem will navigate risk and reward in future trading scenarios.

In addition, the contrasting performance of Solana ETFs, which are seeing an influx of investment, highlights a selectively opportunistic perspective emerging among crypto investors. This reflects a broader trend of market participants placing a premium on agility and the potential for quick returns, especially in a landscape marked by unpredictability. The success of Solana within this context serves as a case study for how investor sentiment can rapidly pivot, emphasizing the necessity for adapting strategies that align with performance trends and the evolving nature of the crypto space.

Analyzing the Investor Sentiment in Crypto During Market Shifts

Investor sentiment in the crypto market is notoriously volatile, but recent trends reveal significant indicators of a shift in focus among participants. As Bitcoin and Ether ETFs suffer from ongoing outflows, a growing number of investors are gravitating towards altcoins like Solana, which are perceived to offer greater potential in the current market climate. This transition reflects an adaptive strategy where investors actively seek assets that demonstrate resilience and momentum amid overarching macroeconomic pressures.

Understanding investor sentiment is crucial for anticipating future market movements, particularly how emotions and trader psychology influence decisions during periods of uncertainty. The growing preference for Solana amidst Bitcoin and Ether’s declines signals a potential long-term restructuring of the crypto market landscape. Observing how ETFs perform, alongside macroeconomic factors and investor sentiment shifts, provides critical insights into the decision-making processes that could shape the evolution of crypto investments moving forward.

Profit-Taking as a Key Driver of Ongoing ETF Outflows

Profit-taking has emerged as a significant factor driving the ongoing outflows from both Bitcoin and Ether ETFs, especially as investors look to capitalize on previous gains amidst current market volatility. The recent historical peaks of cryptocurrencies have provided ample opportunities for traders to secure profits, prompting a wave of withdrawals that have negatively impacted ETF performance. This trend underscores the delicate balance investors must navigate between securing gains and holding assets for potential long-term appreciation.

Additionally, profit-taking behavior may reflect broader strategies employed by investors as they respond to changing market dynamics. As liquidity tightens and uncertainties amplify, such capital reallocations become critical. Understanding the psychology behind profit-taking helps in discerning how future outflows may evolve, particularly if trends indicate that investors will continue to prioritize short-term gains over long-term holdings amid fluctuating market conditions.

The Resilience of Solana: A Case Study for Emerging Cryptos

Solana’s recent surge in ETF inflows presents an intriguing case study of resilience in the face of Bitcoin and Ether’s struggles. With a solid inflow of $30.09 million, Solana is carving out a niche among emerging cryptocurrencies, showcasing its ability to attract investor interest and capital even when major players falter. This resilience may serve as a beacon for investors searching for opportunities that diverge from conventional options, suggesting that strategic diversification into promising altcoins could yield favorable results.

Analyzing the factors contributing to Solana’s upward trajectory reveals insights into the broader crypto market trends. The engagement of new investors attracted by innovation and strong performance signals a shift in how participants view the crypto landscape. Lessons learned from Solana’s current success can inspire strategies for future investments—particularly fostering a mindset that seeks out growth and potential in lesser-known assets while navigating the inherent volatility of the digital asset market.

Looking Ahead: Future Prospects for Bitcoin, Ether, and Solana ETFs

As we look ahead to future prospects for Bitcoin, Ether, and Solana ETFs, a complex narrative unfolds. Bitcoin and Ether’s recent outflows indicate a persistent caution among investors, reflecting broader macroeconomic uncertainties that can shape decision-making trajectories. However, the resilient performance of Solana suggests that there remains a robust interest in diversifying portfolios towards altcoins that may offer elevated risk-adjusted returns. This evolving landscape invites investors to reconsider their approaches and strategies to maximize potential amidst fluctuating conditions.

Looking forward, the future of ETFs in the crypto space will likely hinge on how these major cryptocurrencies adapt to ongoing economic pressures, as well as the continued performance of emerging players like Solana. Should investor sentiment continue to pivot away from traditional cryptocurrencies, a more dynamic, multi-faceted approach to crypto investments may define success in the years to come. Engaging with these trends can provide critical foresight, enabling investors to navigate their journeys through a continually shifting domain.

Frequently Asked Questions

What are the recent trends in Bitcoin ETF outflows?

Bitcoin ETFs have experienced a significant trend of outflows, logging five consecutive days of redemptions totaling $372.77 million. This trend is driven by macroeconomic pressures and profit-taking by investors.

How are Ether ETF outflows impacting the crypto market?

Ether ETFs have encountered a similar fate, facing their sixth consecutive day of outflows with $74.22 million withdrawn. Major withdrawals from funds like Blackrock’s ETHA have heavily influenced this segment, reflecting a continued bearish sentiment in the crypto market.

What factors are driving Bitcoin and Ether ETF outflows?

The outflows from Bitcoin and Ether ETFs are primarily driven by macroeconomic pressures, a tightening of liquidity, and profit-taking strategies among short-term investors.

Why are Solana ETFs experiencing inflows despite Bitcoin and Ether outflows?

Solana ETFs have managed to attract inflows of $30.09 million as investors shift their focus to altcoins that are performing better than Bitcoin and Ether, indicating a growing optimism in Solana’s market potential.

How do Bitcoin ETF outflows relate to overall investor sentiment in crypto?

The sustained outflows from Bitcoin ETFs signal a shift in investor sentiment driven by recent market volatility and macroeconomic concerns, while inflows into Solana ETFs suggest a search for resilience among altcoin investments.

What implications do Bitcoin and Ether ETF outflows have for ETF performance?

The ongoing outflows from Bitcoin and Ether ETFs highlight a concerning trend for ETF performance, as these funds grapple with net asset declines amid short-term investor repositioning and market mechanics.

Are Bitcoin ETF outflows indicative of long-term trends in cryptocurrency?

While Bitcoin ETF outflows reflect current short-term volatility and market sentiment, the underlying demand for crypto ETFs, particularly in altcoins like Solana, indicates a possible segment of investors positioning for long-term growth.

| Category | Outflow Amount | Key Contributors | Inflow Amount | Net Assets |

|---|---|---|---|---|

| Bitcoin ETFs | $372.77 million | Blackrock’s IBIT: -$523.15 million | Grayscale’s Bitcoin Mini Trust: $139.63 million, Franklin’s EZBC: $10.76 million | $122.29 billion |

| Ether ETFs | $74.22 million | Blackrock’s ETHA: -$165.07 million | Grayscale’s Ether Mini Trust: $62.39 million, Bitwise’s ETHW: $19.10 million | $19.60 billion |

| Solana ETFs | $30.09 million | Bitwise’s BSOL: $23 million, Grayscale’s GSOL: $3.19 million, Fidelity FSOL: $2.07 million, VanEck VSOL: $1.83 million | $593.73 million |

Summary

Bitcoin ETF outflows have become a significant trend as investors react to macroeconomic pressures and profit-taking strategies. The continued outflow from Bitcoin and Ether ETFs signifies a challenging period for these assets, while Solana ETFs have managed to attract considerable inflows. This shift hints at a potential change in investor sentiment, with a focus on altcoins like Solana gaining traction amidst the overall market turbulence.