Bitcoin mining capacity is a critical element in the evolving landscape of cryptocurrency mining, and recent developments indicate a transformative shift in how companies approach this robust industry. American Bitcoin, a Trump-backed entity listed on Nasdaq as $ABTC, aims to enhance its mining capacity to an impressive 50 EH/s, marking a bold initiative in BTC mining. This endeavor is not merely an expansion of mining capabilities; it reflects a strategic growth plan that intertwines Bitcoin mining with treasury holdings to optimize profitability. As the demand for Bitcoin continues to rise, understanding the dynamics of mining capacity becomes vital for investors and enthusiasts alike. With innovative mining strategies and a distinct approach to resource allocation, American Bitcoin positions itself at the forefront of the cryptocurrency sector, striving to redefine the essence of mining and treasury management within the Bitcoin space.

In the realm of cryptocurrency extraction, the term “mining capacity” encapsulates the potential of organizations like American Bitcoin to harness blockchain technology for profit. This innovative company is redefining BTC extraction by aiming for a significant production rate of 50 EH/s, thus reflecting a comprehensive strategy that merges financial growth with sustainable operations. With a focus on optimizing their computing power, the organization is poised to adapt to the fast-paced world of digital currencies. Additionally, this modernization signifies a shift in how companies manage their assets and their approach towards building substantial Bitcoin reserves, highlighting new Bitcoin mining strategies that emphasize efficiency and financial viability. As American Bitcoin navigates this dynamic landscape, its progress may offer crucial insights for stakeholders involved in the broader conversation surrounding cryptocurrency mining.

Understanding Bitcoin Mining Capacity

Bitcoin mining capacity is a critical metric for assessing the health and productivity of Bitcoin mining operations. In this rapidly evolving landscape, American Bitcoin aims to achieve a remarkable mining capacity of 50 EH/s. This milestone is not just about numbers; it signifies the company’s commitment to scalable operations and its strategic positioning within the cryptocurrency market. As American Bitcoin expands its capabilities, it demonstrates a pioneering approach by integrating its mining activities with treasury strategies, ensuring that each mined Bitcoin contributes to its growing asset base.

The metrics surrounding mining capacity also shed light on operational efficiency. American Bitcoin recorded an impressive installed capacity of around 25 EH/s by the end of its third quarter after just a few months in public operation. The focus on optimizing energy use and increasing hash rates allows for a greater output of mined Bitcoins, which in turn enhances the overall profitability of the operation. Companies that can effectively manage their mining capacities are better positioned to navigate the volatile Bitcoin market and benefit from upward price movements.

Frequently Asked Questions

What is Bitcoin mining capacity and how does it impact mining operations?

Bitcoin mining capacity refers to the total computational power available at a mining facility, typically measured in exahashes per second (EH/s). A higher Bitcoin mining capacity allows for more transactions to be processed and increases the likelihood of earning Bitcoin rewards. For example, American Bitcoin aims to reach a mining capacity of 50 EH/s, significantly boosting its operational potential and profitability.

How does American Bitcoin plan to achieve a 50 EH/s Bitcoin mining capacity?

American Bitcoin plans to achieve its target of 50 EH/s Bitcoin mining capacity through strategic investments in additional miners and partnerships, particularly with Hut 8. By leveraging an asset-light model, they focus on financing their ASIC miners and utilizing existing infrastructure managed by Hut 8, allowing them to scale efficiently without significant capital expenses.

What strategies are being employed for cost-effective Bitcoin mining capacity?

To optimize their Bitcoin mining capacity while minimizing costs, American Bitcoin utilizes strategies such as flexible power sourcing from a wind farm and funding miners through BTC-collateralized financing. This approach helps maintain lower operational costs and enhances their ability to remain profitable even during volatile market conditions.

Why is Bitcoin treasury management important alongside mining capacity?

Bitcoin treasury management is crucial as it enables companies like American Bitcoin to not only mine Bitcoin but also to hold and manage their Bitcoin assets effectively. By increasing their Bitcoin reserves alongside mining capacity, they can improve overall financial health, build shareholder value, and protect against market fluctuations.

What challenges could affect Bitcoin mining capacity in the future?

Challenges that could impact Bitcoin mining capacity include fluctuating Bitcoin prices, increased competition leading to market saturation, regulatory changes affecting mining operations, and potential issues related to power sourcing and infrastructure availability. American Bitcoin’s ability to manage these risks will be critical as it expands its mining capacity.

How does the efficiency of Bitcoin mining capacity impact profitability?

The efficiency of Bitcoin mining capacity directly influences profitability, as mining operations that achieve lower energy consumption (measured in joules per terahash) can produce Bitcoin at reduced costs. American Bitcoin has reported an average efficiency of 16.3 J/TH, which supports their claim of lower operational costs compared to acquiring Bitcoin through market purchases.

What is the significance of increasing Bitcoin per share alongside mining capacity?

Increasing Bitcoin per share alongside Bitcoin mining capacity is significant because it reflects the value generated per share from the company’s Bitcoin holdings. A focus on this metric allows investors to gauge the company’s growth in assets relative to equity, providing insight into the company’s financial stability and investment attractiveness as they aim for an expanded mining capacity.

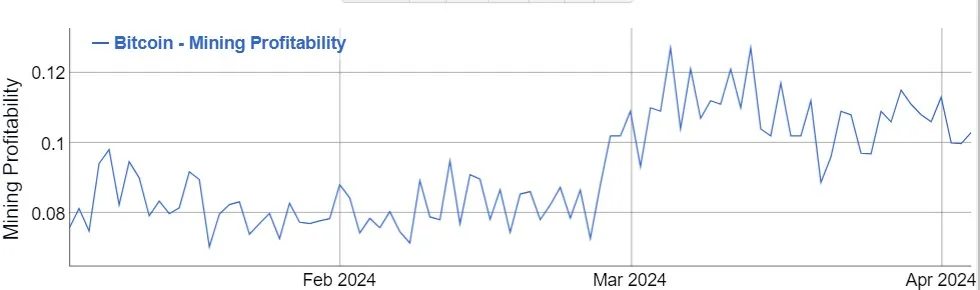

What is the relationship between BTC mining and market trends?

BTC mining and market trends are closely linked, as changes in Bitcoin prices can affect the economics of mining operations. High Bitcoin prices generally lead to increased profitability for miners, while downturns can challenge their sustainability. American Bitcoin’s model aims to position itself advantageously by maintaining a robust mining capacity and a healthy Bitcoin treasury to weather market fluctuations.

| Key Point | Details |

|---|---|

| Company Background | American Bitcoin (Nasdaq: ABTC) aims for a Bitcoin mining capacity of 50 EH/s as part of its growth strategy. |

| Current Capacity | As of Q3 2025, the company has about 25 EH/s of installed capacity. |

| Bitcoin Reserves | From zero BTC in April to over 4,000 BTC by September. |

| Financial Strategy | Utilizes an asset-light model by partnering with Hut 8 to avoid heavy infrastructure costs. |

| Profit Margins | For Q3 2025, reported a gross margin of 56%. They assert they can mine Bitcoin at approximately half the market cost. |

| Future Prospects | Focus on reaching a mining capacity of 50 EH/s and maintaining profitability amidst market fluctuations. |

Summary

Bitcoin mining capacity is crucial for American Bitcoin, as they strategize to reach 50 EH/s while navigating a tumultuous market. This company has quickly scaled its operations since going public, increasing its Bitcoin reserves significantly while implementing a unique asset-light model. American Bitcoin’s approach leverages partnerships to minimize infrastructure costs and focuses on mining efficiency, ensuring it can remain competitive in pricing. As they continue to expand, the viability of maintaining diverse revenue streams and managing risks becomes paramount, especially as they pledge two-thirds of their mined Bitcoin as collateral. Monitoring their progress toward the ambitious 50 EH/s goal will be essential for investors and market observers.