Bitcoin ETF outflows reached a staggering $903.11 million recently, marking one of the most significant withdrawals in the history of cryptocurrency investments. This mass exit disrupted a brief recovery that many had hoped would stabilize the market. The downturn in Bitcoin assets coincided with extended losses for ether funds, which have now seen eight consecutive days of outflows. Interestingly, while Bitcoin and ether struggled, Solana ETFs emerged as an outlier, attracting significant inflows and highlighting a shift in crypto market trends. As the landscape for crypto investment products evolves, the implications of these Bitcoin ETF outflows could shape investor strategies moving forward.

In recent developments, the cryptocurrency landscape has witnessed substantial withdrawals from Bitcoin investment products, reflecting a notable shift in investor sentiment. As Bitcoin ETFs face historic outflows, the focus turns to alternative assets like Ethereum and Solana, which showcase a more promising performance amidst this turbulence. The contrasting trends seen in the crypto market suggest that while traditional Bitcoin and ether options may be losing favor, newer opportunities in the form of Solana ETFs are gaining traction. This divergence could signal a broader transformation in cryptocurrency investments, as investors recalibrate their portfolios in light of evolving market dynamics. With the rise of niche assets and the evolving ecosystem, understanding these movements is crucial for navigating future trends in the crypto space.

Massive Outflows from Bitcoin ETFs

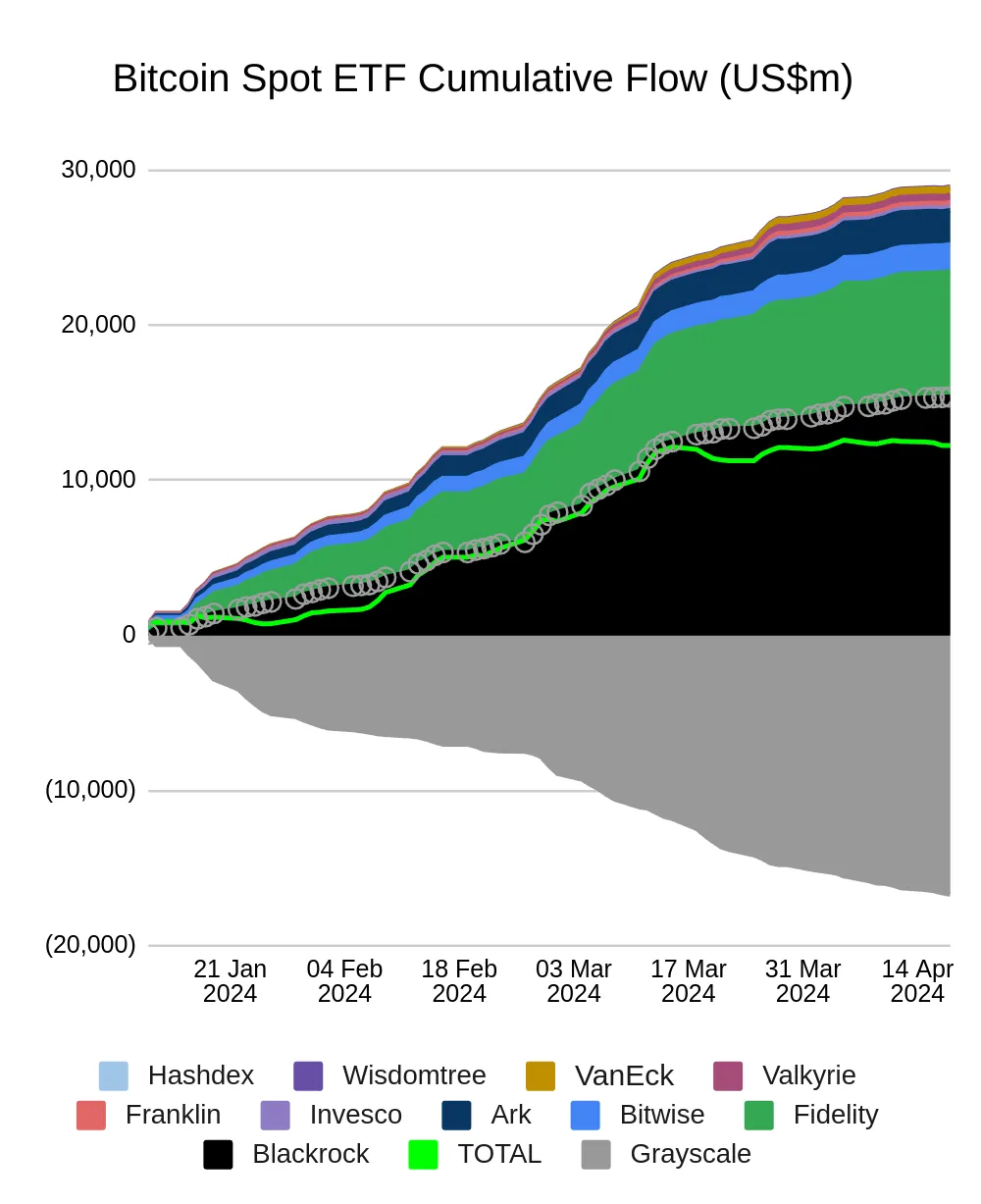

The cryptocurrency landscape witnessed a seismic shift as Bitcoin ETFs faced an alarming outflow, marking the second-largest in history. On that fateful day, an unprecedented $903.11 million was withdrawn from Bitcoin investment products, shattering the recent bullish momentum they had managed to establish. This massive withdrawal can be attributed to a variety of factors, including investor sentiment shifting amid escalating market uncertainties. Major players like Blackrock’s IBIT and Grayscale’s GBTC spearheaded this trend, with significant withdrawals contributing to the broader decline in Bitcoin’s net asset value.

The ramifications of these outflows are significant, as Bitcoin ETFs saw their net assets plummet to around $113.02 billion, reflecting a dramatic decline in investor confidence. This shift is especially noteworthy given that Bitcoin has historically been viewed as a safe haven for cryptocurrency investments. The current bearish trend signals to market analysts and investors alike that the landscape is evolving, with many seeking alternative assets such as Ethereum and Solana, exploring the possibility of greater returns amid turbulence in Bitcoin investments.

Comparative Analysis of Ethereum and Solana ETFs

In stark contrast to the alarming outflows seen in Bitcoin ETFs, Ethereum ETFs have also suffered considerable setbacks, with investors increasingly withdrawing funds. Ether products experienced another decline, totaling $261.59 million over eight consecutive days of outflows. The primary culprits behind these withdrawals include major ETFs like Blackrock’s ETHA and Fidelity’s FETH, revealing that even the second-largest cryptocurrency isn’t immune to market volatility. Such persistent declines highlight a significant investor retreat, prompting speculation about the future viability of Ethereum as a go-to option for safe cryptocurrency investments.

Conversely, Solana ETFs are emerging as a beacon of stability in an otherwise tumultuous market. Over the same period, Solana successfully attracted $23.66 million in inflows, bolstering its position among cryptocurrency investments. The consistent inflow into Solana ETFs can be attributed to growing investor confidence in the Solana ecosystem and its ability to support various decentralized applications. Compared to the struggles faced by both Bitcoin and Ethereum, Solana’s strong performance underscores a strategic shift in investor interest, indicating a potential reallocation of assets towards more promising ventures.

Market Trends: The Cryptocurrency ETF Landscape

The recent outflows from Bitcoin and Ethereum ETFs have illuminated a significant trend within the cryptocurrency market: investors are becoming increasingly discerning with their assets. This evolution reflects the broader crypto market trends that indicate a search for solid and outperforming investments, propelling Solana ETFs into the spotlight as a valid alternative. Even within a challenging economic environment, Solana’s ability to maintain positive inflows suggests that it is capturing market share and investor interest that may have waned for traditional giants like Bitcoin and Ethereum.

This differentiation in investment patterns could suggest a possible shift in the cryptocurrency sphere with Solana’s innovative approach and scalability offering unique value propositions to investors. The diverging fortunes among these major ETFs might prompt a reevaluation of investment strategies, with more people leaning towards assets that exhibit resilience and growth potential. As investors analyze these crypto market trends, it is imperative for them to remain vigilant and adaptive, aware that the rapid evolution of the market necessitates a flexible investment strategy across diverse cryptocurrency options.

The Future of Bitcoin ETFs Amid Withdrawals

The future of Bitcoin ETFs hangs in a precarious balance following the unprecedented withdrawals, prompting questions about the long-term viability of these investment vehicles. As bitcoin NFTs struggle with outflows amounting to nearly $2 billion in just five days, concerns about liquidity and the overall trust in Bitcoin as an investment have surfaced. Analysts are keeping a close eye on market indicators and price movements to assess whether this trend is simply a temporary setback or a sign of deeper issues within the crypto market.

Furthermore, the implications of these withdrawals could lead to increased scrutiny from regulators, signaling a critical juncture for cryptocurrency investments. As Bitcoin ETFs attempt to navigate these choppy waters, they may have to innovate or risk losing their competitive edge. To regain investor confidence, ETF issuers might need to promote transparency, cost-effectiveness, and innovation in features that could attract investors back from alternative assets like Solana.

Investor Sentiment: A Shift in Focus

The current market landscape reveals a significant shift in investor sentiment, as witnessed by the stark contrast in performance among Bitcoin, Ethereum, and Solana ETFs. The large withdrawals from Bitcoin and Ethereum highlight a potential reevaluation of crypto market strategies, as investors seem to be turning towards alternatives that promise stability and potential growth. This evolving sentiment indicates that investors are no longer viewing Bitcoin and Ethereum as infallible, but are instead analyzing risks and diversifying their portfolios with assets like Solana to hedge against downturns.

Moreover, the concerns raised by the massive outflow from Bitcoin ETFs could suggest that investors are seeking reassurance and security, making them cautious about re-entering these markets until they perceive stability. This shift in focus can create opportunities for emerging cryptocurrencies, as demonstrated by Solana’s strong inflow amidst the chaos. The long-term effects of this changing sentiment will significantly shape future investment strategies within the crypto space.

Solana’s Resilience: Inflows During a Downturn

Despite the significant downturn in Bitcoin and Ethereum ETF markets, Solana has demonstrated remarkable resilience, highlighting the strength of its proposition in the crowded crypto space. The recent $23.66 million in inflows reflects the growing confidence among investors in Solana’s capabilities and performance relative to its peers. This influx not only reinforces Solana’s status but also positions it as a likely contender in the ongoing battle for dominance in cryptocurrency investments.

Solana’s unique features, including its fast transaction speeds and low fees, have contributed to its appeal during a time when market turbulence looms over more established cryptocurrencies. As enthusiasm for cryptocurrencies shifts, it is this adaptability and the performance of funds such as Solana ETFs that will likely shape investment trends and market dynamics moving forward.

Navigating the ETF Landscape: Strategies for Investors

Navigating the rising tides and ebbs of the cryptocurrency ETF landscape requires astute strategies, especially in light of the recent outflows seen in Bitcoin and Ethereum products. Investors need to conduct thorough due diligence and consider the underlying fundamentals of each asset rather than succumbing to fear-based selling in the face of market downturns. This requires a keen understanding of the crypto landscape and a readiness to pivot towards opportunities that show potential for growth, such as Solana’s burgeoning market presence.

Moreover, re-evaluating investment strategies in response to market shifts could prove beneficial. Investors should employ diversified portfolios that balance high-risk, high-reward assets with more stable darlings in the crypto space. By doing so, they can mitigate risks associated with substantial withdrawals from traditional Bitcoin and Ethereum ETFs, ensuring they remain at the forefront of evolving crypto market trends.

Why Solana is Attracting Investor Capital

The newfound interest and investment in Solana ETFs can be dissected through the lens of market dynamics and the platform’s distinct advantages in the cryptocurrency ecosystem. As Bitcoin and Ethereum face significant challenges, Solana offers a fresh narrative that attracts investors looking for innovative solutions and robust growth potential. With its capacity to handle exceptionally high transaction volumes and lower fees compared to other blockchain platforms, Solana shines as a viable investment opportunity in contrast to its beleaguered counterparts.

Additionally, the rapid development of decentralized applications (dApps) within the Solana ecosystem reinforces the platform’s desirability among investors. With this expansion, Solana could very well position itself as a leading blockchain infrastructure in the coming years, offering more than just speculative trading but tangible utility for developers and users alike. This blend of robust technological capabilities and positive investor sentiment underlines why Solana ETFs continue to attract capital investment even amidst a tumultuous market.

Future Predictions for Cryptocurrency Investments

Looking ahead, the future of cryptocurrency investments appears promising albeit fraught with complexities. As evidenced by the contrasting performances of Bitcoin, Ethereum, and Solana ETFs, market dynamics are continuously evolving. The massive outflows experienced by Bitcoin ETFs could see a cautiously optimistic approach from investors, who may redefine their strategies as they seek new opportunities within the crypto landscape. With the lessons learned from current market phenomena, diversification into emerging assets like Solana is becoming increasingly critical.

Moreover, cryptocurrency investments are likely to undergo further scrutiny from regulators, likely impacting ETF strategies and consequently the crypto market’s structure. This regulatory oversight could foster a more stable environment for potential investors, paving the way for a more conscientious approach to investing in Bitcoin and Ethereum alongside promising alternatives like Solana. As the cryptocurrency market continues to develop, remaining adaptable and alert to changes will be vital for those looking to capitalize on opportunities within this dynamic sector.

Frequently Asked Questions

What contributed to the significant Bitcoin ETF outflows recently?

The recent significant Bitcoin ETF outflows, totaling $903.11 million, were primarily driven by withdrawals from major investment products such as Blackrock’s IBIT, Grayscale’s GBTC, and Fidelity’s FBTC, reflecting a broader retreat from cryptocurrency investments.

How have Bitcoin ETF outflows impacted the overall crypto market trends?

The massive Bitcoin ETF outflows have contributed to a bearish trend in the cryptocurrency market, impacting investor sentiment and decreasing net assets of Bitcoin ETFs to $113.02 billion, while trading activity surged to $8.92 billion.

Are the recent Bitcoin ETF outflows a sign of a broader decline in cryptocurrency investments?

Yes, the staggering outflows from Bitcoin ETFs, alongside continued outflows from Ethereum ETFs, indicate a potential shift in investor confidence and a declining interest in major cryptocurrencies.

What does the record Bitcoin ETF outflows imply for future investments in cryptocurrencies?

The record Bitcoin ETF outflows suggest cautious sentiment among investors, which could lead to a slowdown in cryptocurrency investments until market conditions stabilize or show clear signs of recovery.

How do Bitcoin ETF outflows compare to the performance of other ETFs like Solana’s?

While Bitcoin ETFs experienced significant outflows, Solana ETFs notably attracted $23.66 million in inflows, highlighting a stark contrast in market sentiment and the strength of demand for different cryptocurrency investments.

What investment strategies might investors consider following the recent Bitcoin ETF outflows?

Following the recent Bitcoin ETF outflows, investors may consider diversifying into alternative cryptocurrencies, such as Solana, which continues to show robust inflows and a more positive trading outlook amid the market downturn.

Could the significant outflows from Bitcoin ETFs affect institutional investments in cryptocurrencies?

Yes, the significant outflows from Bitcoin ETFs may lead institutions to reassess their cryptocurrency strategies, potentially slowing down institutional investments until market conditions improve.

What are the implications of Bitcoin ETF outflows for retail investors?

Retail investors should be wary of the implications of Bitcoin ETF outflows, as a continued downtrend can indicate a lack of confidence in major cryptocurrencies. Strategic caution and diversification into alternative investments may be prudent.

How are Bitcoin ETF outflows influencing the regulatory landscape for cryptocurrencies?

The substantial Bitcoin ETF outflows may prompt regulators to closely monitor market behaviors, potentially leading to new guidelines aimed at enhancing the stability of cryptocurrency investments and protecting investor interests.

Is there a connection between Bitcoin ETF outflows and the performance of Ethereum ETFs?

Yes, the performance of Ethereum ETFs has closely mirrored Bitcoin ETF outflows, with both experiencing significant withdrawals, reflecting a broader trend of investor retreat from major cryptocurrencies during this period.

| Category | Outflows | Highlights |

|---|---|---|

| Bitcoin | $903.11 million | Largest outflow in history; led by Blackrock’s IBIT at $355.50 million. |

| Ether | $261.59 million | Eight consecutive days of outflows. |

| Solana | $23.66 million | Consistent inflows, leading with Bitwise’s BSOL at $20.12 million. |

Summary

Bitcoin ETF outflows reached significant levels with $903.11 million withdrawn, marking the second-largest outflow in history. This event highlights the ongoing volatility in the cryptocurrency space and indicates a potential shift in investor sentiment away from bitcoin and ether, as ether ETFs experienced eight days of consecutive outflows. Conversely, Solana ETFs have been gaining traction, showcasing strength amid the broader downturn in the market. As investors seek stability, Solana stands out as a compelling option, reflecting a divergence in demand across cryptocurrency investment products.