Ripple blockchain integration is revolutionizing the financial landscape, allowing traditional banking institutions to embrace modern financial technology seamlessly. In partnership with DXC Technology, this initiative introduces advanced digital asset custody and payment solutions within core banking platforms, effectively merging robust legacy systems with innovative blockchain payments. The collaboration showcases Ripple’s commitment to enhancing crypto financial services while ensuring regulatory compliance and operational continuity for banks. As institutions worldwide manage trillions of dollars in deposits and millions of accounts, this integration promotes a secure and efficient pathway for adopting digital assets. With Ripple’s cutting-edge technology, the financial sector is poised for a transformative shift towards a more inclusive and digitized economy.

The integration of Ripple’s blockchain technology into established banking frameworks represents a pivotal move towards digitizing financial services. By collaborating with DXC Technology, Ripple is not just offering technological enhancements but also facilitating a significant evolution in how banks handle digital asset custody and manage blockchain-related payments. This partnership enables legacy financial systems to adapt to the increasing demand for cryptocurrency services while still maintaining the integrity and security of existing infrastructure. Through this strategic collaboration, financial institutions can now explore a future where traditional banking seamlessly intersects with digital innovation. As the market for crypto financial services expands, such integrations promise to bridge the gap between conventional banking practices and the burgeoning world of digital currencies.

Ripple Blockchain Integration: A Catalyst for Traditional Finance

The integration of the Ripple blockchain into traditional financial systems represents a significant breakthrough in bridging the gap between legacy banking infrastructure and modern digital asset management. By collaborating with DXC Technology, Ripple is equipping financial institutions with powerful tools to manage digital assets securely while complying with regulatory standards. This advancement is pivotal for legacy banks, as it allows them to embrace the growing trend of crypto financial services without overhauling their existing systems.

The surge in digital asset adoption among consumers and businesses necessitates that banks evolve to provide dynamic digital asset custody solutions. Ripple’s technology enables seamless integration into DXC’s Hogan core banking platform, which already handles billions in deposits. Through this partnership, banks can enhance their service offerings, empowering them to attract clients interested in new payment methods and digital currencies, ultimately redefining the banking experience.

Transforming Core Banking Platforms Through Partnership

The partnership between Ripple and DXC Technology is poised to transform core banking platforms by integrating modern blockchain payment solutions. The Hogan platform manages over $5 trillion in deposits, showcasing its robust capacity to support large-scale banking operations. By incorporating Ripple’s blockchain solutions, businesses can leverage faster and more secure transaction capabilities, enhancing their operational efficiency. This development is crucial for traditional banks aiming to stay competitive in a rapidly evolving financial landscape.

Moreover, integrating digital asset custody alongside conventional banking services enables institutions to meet increasing consumer demand for innovative financial products. As customers become more comfortable with cryptocurrencies, banks that adapt to include these offerings stand to benefit significantly. This partnership not only modernizes the banking experience by streamlining operations but also provides banks with a pathway to diversify their services with digital assets, appealing to a broader customer base.

The Future of Digital Asset Custody in Banking

Digital asset custody has emerged as a top priority for banks navigating the complex landscape of cryptocurrencies and blockchain technology. With regulatory scrutiny on the rise, institutions must find a secure and compliant approach to managing these assets. The Ripple and DXC partnership is particularly noteworthy as it combines secure custody with distinct blockchain payment solutions directly within core banking systems, making it easier for banks to adopt digital currencies.

This initiative not only enhances the security of digital asset management but also allows banks to maintain existing operational frameworks while introducing new services. By facilitating the compliant handling of cryptocurrencies and stablecoins, banks can alleviate concerns about risk management while increasing their competitive edge in the financial sector. As digital assets gain prominence, integrating these features into core banking platforms will become essential for maintaining relevance in the market.

Streamlining Payments with Ripple’s Blockchain Solutions

The integration of Ripple’s blockchain payment solutions streamlines transaction processes for banks, offering a faster and more efficient means of managing cross-border payments. As financial institutions look to enhance their operational capabilities, utilizing blockchain technology enables instantaneous settlements and reduced transaction fees compared to traditional methods. This shift in payment dynamics not only benefits banks but also provides advantages to customers seeking cost-effective and quick transaction options.

Furthermore, as banks increasingly adopt lucrative blockchain payments, they can expect to attract new clientele while retaining existing customers. By diversifying their payment offerings through Ripple’s innovative solutions, banks can present themselves as forward-thinking institutions ready to meet the needs of digital-savvy consumers. This approach is integral to establishing trust and reliability as the market for crypto financial services continues to grow.

Navigating Regulatory Landscapes with Secure Custody Solutions

As financial institutions embark on integrating blockchain technology, navigating the regulatory landscape becomes a formidable challenge. The partnership between Ripple and DXC Technology addresses these concerns head-on by providing robust digital asset custody solutions that align with existing regulatory frameworks. This proactive approach captures the attention of regulators, reassuring them that banks are prioritizing security and compliance as they venture into the world of digital assets.

Through the use of Ripple Custody, banks can securely manage clients’ digital assets while complying with regulatory requirements. As institutions strive for compliance, the partnership effectively alleviates fears surrounding security breaches and mismanagement of digital currencies. This strategic focus on regulatory alignment is vital for banks looking to build credibility and foster confidence among customers in this new financial era.

Enabling Seamless Integration with Legacy Systems

Legacy systems have long posed challenges in the adoption of new technologies within banking. However, the collaboration between Ripple and DXC Technology has set a new standard for how banks can seamlessly integrate modern blockchain functionalities without completely overhauling their existing architectures. The integration of digital asset custody and payment solutions into the Hogan platform exemplifies how innovation can coexist with traditional banking systems, making it a vital consideration for forward-thinking institutions.

This adaptability ensures that banks can deliver enhanced services while maintaining their established frameworks, which is critical for operational stability. By leveraging Ripple’s technology, banks can add functionalities like crypto transactions and stablecoin management, allowing them to compete effectively in an increasingly digital financial landscape. This blend of old and new technology sets the stage for a more connected and diversified banking experience.

Enhancing Customer Experience with Digital Assets

As banks increasingly adopt digital asset capabilities through partnerships like that of Ripple and DXC Technology, the potential to enhance customer experience grows exponentially. Customers are increasingly seeking financial products that meet their digital needs, including access to cryptocurrencies and blockchain-supported services. By integrating these technologies, banks can provide a more comprehensive and satisfying banking experience that reflects modern consumer preferences.

Moreover, incorporating digital asset capabilities into core banking platforms enables institutions to respond swiftly to shifts in the market and customer demand. This responsiveness not only improves customer satisfaction but also fosters greater loyalty among clients who prefer banks that embrace innovative solutions. Ultimately, the ability to offer a diverse range of services, including digital asset custody and blockchain payments, positions traditional banks favorably amidst growing competition from fintech companies.

The Impact of Digital Transformation on Banking Services

Digital transformation has become paramount for banks aiming to thrive amidst rapid technological advancement. The partnership between Ripple and DXC Technology signifies a landmark shift as it empowers banks to modernize their services significantly. By deploying blockchain technology into core banking systems, banks can enhance their operational efficiency and effectiveness, offering clients cutting-edge financial solutions that meet contemporary needs.

Furthermore, this transformation aligns with the broader trend of banks evolving beyond traditional roles to embrace a more versatile range of services. With the potential for blockchain payments and secure digital asset custody, banks can redefine financial service delivery, creating value for both the institutions and their customers. In this new era, the embrace of digital transformation achieved through strategic partnerships will determine the success of banks in navigating future challenges.

Connecting Traditional Finance with On-Chain Solutions

The collaboration between Ripple and DXC Technology symbolizes a significant step in connecting traditional finance with on-chain solutions. By integrating blockchain technology into core banking platforms, banks can create a robust ecosystem that caters to both conventional banking needs and the emerging demands of digital asset users. This innovative combination enables seamless interactions between traditional accounts and decentralized platforms, offering a holistic banking experience.

As banks look to the future, fostering connections between legacy systems and on-chain solutions will be crucial in facilitating greater engagement with digital assets. The ability to offer services like blockchain payments within the existing infrastructure allows banks to innovate while preserving stability. This synergy not only benefits institutions but also empowers customers to navigate their banking needs more effectively within this evolving financial landscape.

Exploring the Benefits of Blockchain Payments for Banks

Blockchain payments present numerous benefits for banks, including enhanced transaction speed, reduced costs, and increased security. By adopting Ripple’s payment solutions, banks can leverage fast, secure transactions that significantly outperform traditional banking systems. This efficiency is particularly important in today’s globalized financial landscape, where customers demand quicker access to their funds and efficient transfer services.

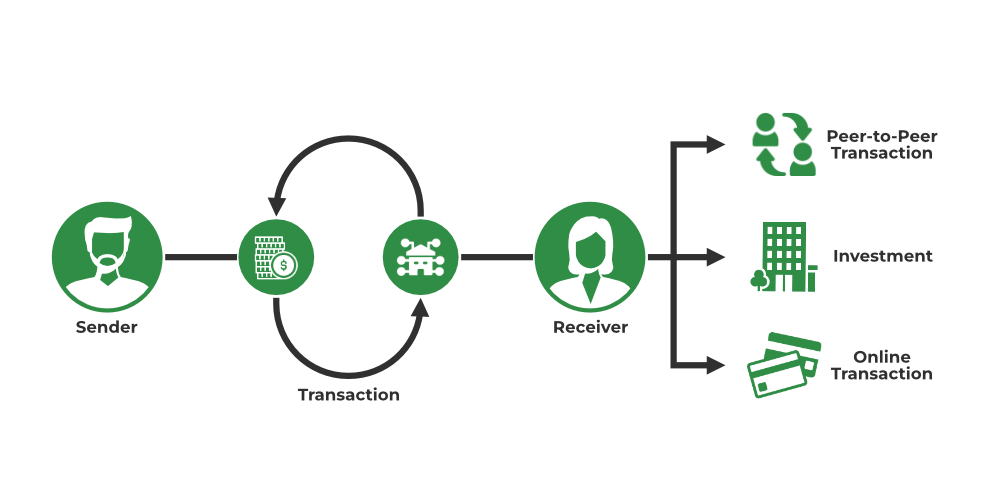

Additionally, integrating blockchain into payment processes not only streamlines operations but also helps banks minimize transaction fees. By reducing reliance on intermediaries typically involved in cross-border payments, blockchain technology allows for direct and peer-to-peer transactions, thereby lowering costs associated with traditional banking fees. This strategic shift toward blockchain payments aligns with the evolving consumer preference for more cost-effective financial solutions.

Frequently Asked Questions

How does Ripple blockchain integration enhance digital asset custody?

Ripple blockchain integration enhances digital asset custody by providing secure, institutional-grade custody solutions that can be directly integrated into existing core banking platforms, allowing banks to manage digital assets efficiently and safely.

What role does the DXC Technology partnership play in blockchain payments?

The DXC Technology partnership enables seamless blockchain payments by embedding Ripple’s payment tools into core banking systems, facilitating smooth transactions of digital assets alongside traditional currencies.

How can financial institutions benefit from Ripple blockchain integration with their core banking platforms?

Financial institutions can benefit from Ripple blockchain integration by accessing advanced digital asset custody services and streamlined payment solutions, which improve operational efficiency and regulatory compliance.

What are the key features of Ripple’s services integrated into DXC’s Hogan platform?

Key features of Ripple’s services integrated into DXC’s Hogan platform include secure digital asset custody, blockchain payment solutions, and integration with RLUSD, enhancing overall banking functionality for digital financial services.

Why is digital asset custody important for banks integrating Ripple technology?

Digital asset custody is important for banks integrating Ripple technology because it ensures that institutions can securely hold and manage digital currencies, thus enabling them to offer comprehensive crypto financial services while maintaining compliance and client trust.

What impact does Ripple’s blockchain integration have on the evolution of traditional finance?

Ripple’s blockchain integration drives the evolution of traditional finance by modernizing banking operations, allowing for faster, efficient transactions and expanding the adoption of digital currencies in regulated financial systems.

In what ways does the partnership between DXC and Ripple support compliance for banks?

The partnership supports compliance by providing tools that facilitate secure digital asset transactions within the legal framework, ensuring that banks can integrate blockchain payments without disrupting existing regulatory processes.

| Key Point | Explanation |

|---|---|

| Partnership with DXC Technology | Ripple aims to enhance blockchain integration in traditional finance through this partnership. |

| Core Banking Platform | DXC’s Hogan platform manages $5 trillion in deposits and millions of accounts, facilitating seamless transitions for banks. |

| Digital Asset Solutions | Integration includes custody and payment solutions, enabling secure management of digital assets and compliance. |

| Regulatory Compliance | Partnership helps banks integrate digital assets while adhering to existing regulatory frameworks. |

| Market Modernization | Addresses the urgency for banks and fintech to modernize and adopt enterprise blockchain solutions. |

| Bridging Traditional and Digital Finance | Combines legacy banking systems with on-chain finance, creating new service opportunities for banks. |

Summary

Ripple blockchain integration is paving the way for traditional financial institutions to adopt digital asset custody and payment solutions through its partnership with DXC Technology. This collaboration allows banks to modernize their operations without disrupting existing systems, ensuring secure and compliant services for digital assets. With the backing of a robust core banking platform, Ripple’s initiatives are set to bridge the gap between old and new financial systems, fostering a more innovative and accessible financial landscape.