Gold and silver prices have become increasingly important in the investment landscape, especially as they approach historic highs that are startling investors and analysts alike. As we move into 2026, the gold price forecast suggests an exciting trajectory, nearing $5,000 per ounce, while silver market analysis indicates potential for rapid climbs as it approaches the $100 mark. The relationship between gold and silver has evolved, shedding light on their roles as precious metals investments amid a backdrop of geopolitical uncertainty. With both metals witnessing significant increases, understanding their dynamics can provide insightful perspectives for investors. As we analyze the 2026 gold silver prediction, it becomes evident that these two metals are not just commodities, but essential components of a robust investment strategy.

In the world of financial assets, gold and silver are commanding attention as they navigate towards unprecedented price levels. As precious commodities, their values have been significantly influenced by market trends and investor behavior. The recent surge in these metals, alongside projections for their future performance, invites a deeper dive into precious metals investment opportunities. Understanding market analyses around these two metals reveals not only their historical significance but also their potential for continued growth. Thus, assessing the evolving gold and silver market landscape provides valuable insights for both long-term strategies and immediate investment decisions.

Current Gold and Silver Prices: Record Highs in 2026

As of early 2026, the precious metals market is witnessing unprecedented highs, with gold reaching near $5,000 per ounce and silver approaching the $100 mark. This surge can be attributed to a combination of factors that have kept investors actively engaged in these markets. Central banks, in particular, have turned towards gold as a hedge against geopolitical uncertainties, marking a significant shift in investment strategies. The current economic landscape, characterized by rising inflation and market volatility, has led many to consider gold and silver as safe-haven assets, further propelling their demand.

Silver’s increase in price has been particularly noteworthy in the past year, fueled by both safe-haven demand and strong industrial usage. Factories across the globe are ramping up their silver consumption, driven by its essential role in technology and renewable energy sectors. The projected growth in these areas underlines why some analysts expect a more tumultuous ride for silver prices compared to gold, potentially leading to sharper fluctuations as the market continues to respond to supply and demand dynamics.

Understanding the Gold-Silver Relationship in Today’s Market

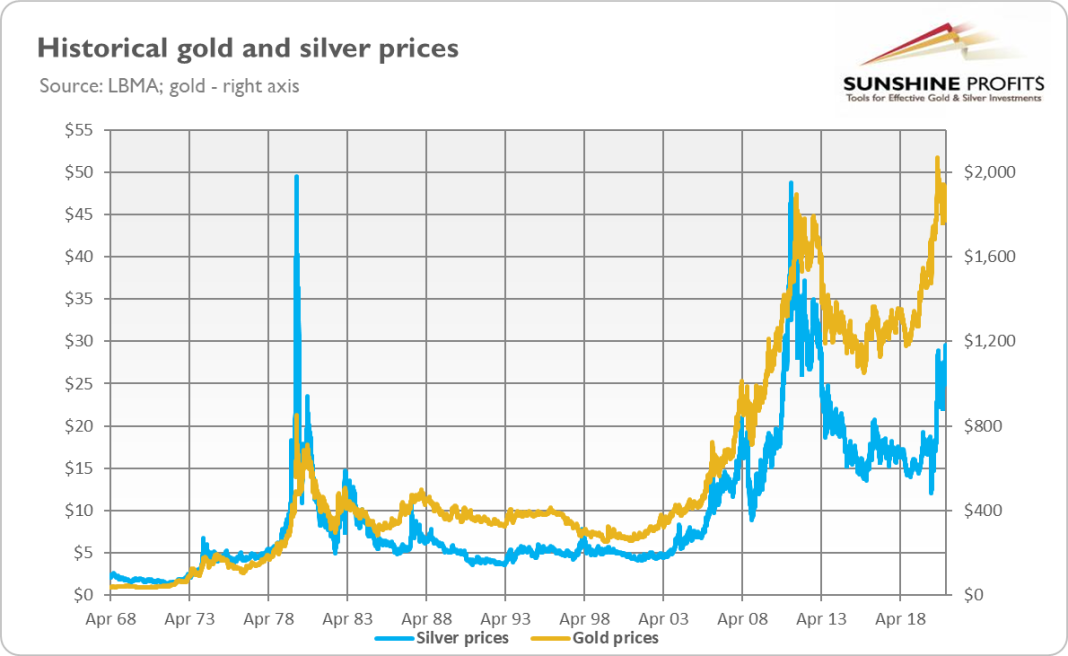

The relationship between gold and silver is often highlighted in financial analyses, especially during periods of market turbulence. Historically, these two precious metals tend to move in tandem; however, their dynamics can vary significantly based on economic conditions. In 2026, as gold prices soar, silver is positioned to follow suit, but with unique drivers that could create a divergence in their market trajectories. Investors are recognizing that while gold may offer stability, silver presents an opportunity for higher returns, particularly due to its increased industrial demand.

This interplay between gold and silver prices is essential for investors to comprehend. Traditionally, the gold-to-silver ratio offers insights into future price movements. Currently, the ratio is seen favorably towards silver, as its industrial applications are expected to escalate, supporting its investment appeal. Moreover, as the demand for gold remains robust due to investor hesitance in volatile markets, silver’s price might react more dramatically to real-time developments, creating trading opportunities for astute investors.

Precious Metals Investment Strategies for 2026

Investing in precious metals such as gold and silver is gaining traction as a viable strategy for wealth preservation amidst inflationary pressures and economic uncertainty. The forecast for gold remains bullish, with projections indicating that it could maintain its momentum through 2026 and beyond. Investors looking to capitalize on this trend need to diversify their portfolios, considering a mix of both gold and silver to hedge against potential market volatility. This approach not only captures the upside potential of both metals but also balances risk.

Additionally, savvy investors might consider the cyclical nature of precious metals, with an eye on silver’s potential due to its industrial demand. Unlike gold, which predominantly serves as a financial hedge, silver’s dual role as both an investment and a critical industrial commodity makes it a compelling option going forward. Forecasting indicates that if the economic climate supports increased manufacturing and technological advancements, silver prices could witness substantial rallies, offering lucrative returns for those who invest strategically.

Forecast for Gold Prices in 2026: What to Expect

The gold price forecast for 2026 suggests a continuing rise as economic conditions remain uncertain worldwide. Factors such as central banks’ aggressive buying policies and increasing geopolitical tensions contribute to a bullish outlook for gold. As it approaches the $5,000 mark, many analysts stress the importance of considering external variables that could impact this trajectory. Should a significant political or economic event occur, it might either accelerate or curtail gold’s ascent, making it imperative for investors to remain vigilant.

Additionally, historical trends indicate that gold prices often experience significant surges following periods of accumulation by central banks. Such behavior serves as a clear signal for investors about confidence in gold as a long-term asset. As 2026 progresses, those keeping a close eye on market indicators will find opportunities in both gold investments and potential exploration of futures and options in the gold market.

Silver Market Analysis: Driving Forces Behind the Surge

Silver has recently emerged as a star player in the precious metals market, marked by a significant upswing in its price due to compelling factors in both supply and demand. Analysis shows that a combination of surging industrial demand, ongoing production deficits, and limited growth in silver mining capabilities are converging to create a favorable environment for price increases. As industries seek to leverage silver’s conductivity and reflective properties, its market momentum is only expected to grow stronger.

Moreover, the anticipated growth in the green technology sector, where silver plays a pivotal role, is a contributing factor to the positive sentiment surrounding silver prices. Analysts predict that as sustainable technologies continue to expand, industrial demand for silver will rise dramatically, reinforcing its price points well beyond current levels. For investors, this makes silver an attractive proposition, especially when paired with gold investments to balance their portfolios.

Investment Risks in Gold and Silver Markets

Despite the bullish outlook for gold and silver prices in 2026, prospective investors must remain aware of the inherent risks associated with investing in these volatile markets. Market corrections, shifts in investor sentiment, and geopolitical events can create unpredictable price swings. For instance, should there be a significant economic recovery, the demand for safe-haven assets like gold and silver may diminish, potentially leading to price declines. It is critical for investors to perform thorough due diligence and maintain diverse investment strategies.

Diversifying within the precious metals sector itself can help mitigate risks; investors might consider not just physical holdings in gold and silver, but also exploring ETFs and other financial instruments that track precious metal performance. By understanding the nuances of market dynamics and being prepared for sudden fluctuations, investors can navigate the complexities of the gold and silver markets effectively.

Global Economic Influence on Gold and Silver Prices

The prices of gold and silver are heavily influenced by global economic trends and policies. Central banks around the world hold significant gold reserves, which they may adjust based on fiscal measures and economic outlooks affecting the market. In 2026, as inflation remains a hot topic in various economies, the role of gold as a hedge will likely become more pronounced. Investors paying attention to monetary policies will find that they play a crucial role in shaping the future of precious metal pricing.

In addition to central bank policies, investor behavior in response to economic indicators such as unemployment rates, inflation data, and geopolitical tensions can lead to fluctuating gold and silver prices. Reacting to these developments allows investors to seize opportunities, but they must also be cautious about potential overreactions in the market. Thus, an understanding of both national and international trends helps investors anticipate market movements more effectively.

Long-term Commodity Demand: A Look Ahead

As we move deeper into 2026, the long-term outlook for gold and silver remains promising due to ongoing demand from various sectors, including jewelry, technology, and investment. Analysts predict that shifts in consumer preferences towards sustainable products could further intensify the demand for silver in manufacturing processes. Additionally, with gold’s traditional role as a store of value, its importance in uncertain times suggests a continuously strong investment case.

In particular, technology’s increasing reliance on precious metals will likely bolster silver’s market position, while gold’s investment demand will see steady growth amid global uncertainties. For those considering investment in gold and silver, aligning with market forecasts and emerging trends can lead to fruitful opportunities, enabling investors to capitalize on the evolving landscape of precious metals.

The Role of Central Banks in Precious Metals Investment

Central banks play a pivotal role in shaping the narrative of gold and silver prices through their purchasing decisions. As of 2026, many central banks are actively increasing their gold reserves, driven by the need for economic security amidst global political instability. This growing trend not only reinforces gold’s status as a safe-haven asset but also fuels speculation about future price movements, prompting investors to evaluate their strategies accordingly.

In contrast, while silver does not serve as a reserve asset for central banks, its industrial applications make it essential in economic activities. The combined influence of central banks purchasing gold and the increasing demand for silver in various sectors illustrates a unique interplay that investors should consider. Understanding the motivations and actions of central banks provides invaluable insights into potential gold and silver price trajectories, aiding in smarter investment decisions.

Frequently Asked Questions

What are the latest gold price forecasts for 2026?

The current forecast for gold prices in 2026 is aiming for levels near $5,000 per ounce. Analysts suggest that unless a black swan event occurs, the bullish trend will continue, driven by high demand from central banks and investors.

How does silver market analysis reflect its growth potential in 2026?

Silver market analysis reveals a significant upside for silver prices, which recently peaked at nearly $100 per ounce. Factors such as rising industrial demand and supply shortages are key elements supporting this growth.

Why are gold and silver considered good precious metals investments now?

Gold and silver are viewed as favorable investments due to their solid performances in 2026, with gold up over 13% and silver skyrocketing nearly 39% year-to-date, largely fueled by geopolitical uncertainties and strong industrial demand.

What is the gold-silver relationship in terms of pricing trends?

The gold-silver relationship shows a strong correlation in price movements, as both metals surged in early 2026. Recent trends indicate that while gold is trading close to $5,000, silver is nearing the $100 mark, highlighting their interdependent market dynamics.

What is the 2026 gold-silver prediction based on current trends?

The 2026 gold-silver prediction indicates a continued bullish trend for both metals, with analysts believing gold could reach $5,000 and silver close to $100, supported by strong market fundamentals and increased demand in both industrial and investment spheres.

| Key Points |

|---|

| Gold approached historic marks of $5,000 per ounce, while silver nears $100. |

| Gold futures reached a session high of $4,970, and silver futures hit $99.395 per ounce during trading. |

| Gold has increased over 13% in 2026, while silver has surged nearly 39% YTD. |

| Demand for gold is driven by investors and central banks seeking safe havens, whereas silver benefits from industrial use and limited production growth. |

| Silver traded at over $111 per ounce in China, indicating stronger demand compared to Western markets. |

| Despite the rise of precious metals, Bitcoin struggles to regain its previous heights, currently trading around $89K. |

Summary

Gold and silver prices are experiencing significant upward momentum, with gold nearing the $5,000 mark and silver almost touching $100 per ounce. The rising demand for these precious metals is attributed to geopolitical uncertainties, strong investment activity, and industrial needs for silver. With both metals showcasing remarkable year-to-date gains, investors are keenly observing these trends as they anticipate further price movements.