The recent Bitcoin price drop has sent shockwaves through the cryptocurrency market, as it fell below $73,000 for the second consecutive day amidst a tumultuous week. This dramatic decline, which has seen Bitcoin lose nearly 18% of its value since mid-January, reflects the broader Bitcoin market downturn and highlights the ongoing concerns surrounding cryptocurrency volatility. Investors have experienced approximately $500 billion in losses, as liquidations have surged, with more than $830 million in leveraged positions erased within just 24 hours. Compounding these challenges, discussions around potential U.S. Senate crypto regulation may further shift market sentiment, as investors grapple with the implications of new laws. This latest development has reignited the digital gold debate, questioning Bitcoin’s role amidst traditional assets during uncertain times.

In recent weeks, the cryptocurrency landscape has faced significant challenges, particularly with the sharp decline in Bitcoin values. Digital assets such as Bitcoin are now under the scrutiny of market analysts, especially in light of the sharp downturn and the associated market turmoil. The recent volatility in the crypto sector has been exacerbated by a wave of liquidations, prompting discussions around the sustainability of these digital currencies. Additionally, ongoing regulatory talks in the U.S. Senate concerning cryptocurrency frameworks are contributing to the unease gripping investors. This intense scrutiny has revived the conversation around Bitcoin’s status as digital gold, as its behavior increasingly mirrors that of high-risk tech stocks rather than safe-haven assets.

Bitcoin Price Drop: Analyzing Recent Trends

Bitcoin has recently faced a significant price drop, falling below the critical $73,000 threshold for two consecutive days. This recent decline is part of a broader trend where Bitcoin has lost nearly 18% of its value in just a week, leading to a staggering reduction of about $500 billion in its overall market capitalization. The volatility of the cryptocurrency market is evident as Bitcoin fluctuates sharply, seemingly mirroring the performance of tech-heavy indices like the Nasdaq, which have also experienced substantial losses.

This ongoing drop highlights the risks associated with investing in cryptocurrencies, particularly in a climate where market sentiment remains bearish. As Bitcoin dipped from a peak of $76,300 to an intraday low of $72,000, investors are left wondering if this is a short-term pullback or indicative of a more prolonged downturn. Understanding these price movements is crucial, especially given the unpredictable nature of cryptocurrency volatility.

Impact of Bitcoin Liquidations on Market Sentiment

The recent Bitcoin price drop has not only affected the overall value of the cryptocurrency but has also led to significant liquidations across the market. Over the past 24 hours, total leveraged liquidations exceeded $830 million, predominantly impacting bullish long positions. This wave of liquidations was triggered by the sharp decline on February 4, which alone eliminated $125 million in long positions within a mere four hours, causing panic among traders and contributing to the prevailing negative sentiment.

Such liquidations are symptomatic of the broader volatility in the cryptocurrency market. The fear of more liquidations often leads to a lack of confidence among investors, creating a vicious cycle that exacerbates downturns. As more traders are forced to sell their positions during these periods of dramatic price decline, the overall market capitalization of Bitcoin continues to suffer, leaving many to question the stability of their investments.

The Role of US Senate Crypto Regulation in Market Dynamics

In the midst of this Bitcoin price drop, the looming discussions in the U.S. Senate regarding crypto regulation have brought a glimmer of hope for some investors. The introduction of the CLARITY Act, aimed at establishing a comprehensive regulatory framework for the cryptocurrency market, could provide much-needed clarity and stability. However, the market’s reaction to this potential legislation has been muted, as recent events suggest that regulatory discussions alone may not be enough to reverse the bearish trend.

Investors are eagerly watching to see how these regulations will impact Bitcoin and the broader cryptocurrency marketplace. While some believe that a structured regulatory environment could foster a more sustainable growth trajectory, others remain skeptical, especially given the recent downturn. The relationship between regulatory measures and market confidence remains complex, and how the Senate handles these discussions could significantly influence Bitcoin’s future price dynamics.

Current Market Conditions: Bitcoin and the Digital Gold Debate

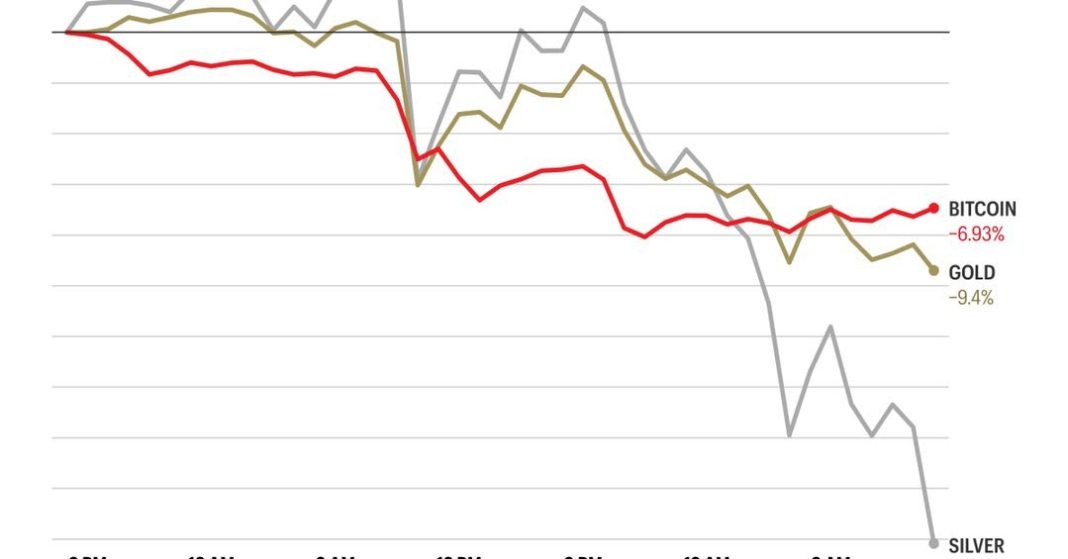

As Bitcoin continues to struggle with its price drop and overall market volatility, the ongoing debate regarding its status as ‘digital gold’ has intensified. Traditionally seen as a hedge against inflation and a store of value, the recent behavior of Bitcoin suggests it is behaving more like a high-beta tech stock than a safe-haven asset. This shift in perception has many investors questioning whether Bitcoin can truly fulfill the role of digital gold amid significant market fluctuations.

The correlation between Bitcoin and tech stocks, such as those in the Nasdaq, indicates that investor sentiment is heavily influenced by broader market trends rather than traditional economic indicators. As Bitcoin diverges from gold’s stable trajectory, the argument that it can serve as a reliable store of value is increasingly challenged. Investors must weigh these dynamics carefully as they consider their positions in Bitcoin, particularly during periods of market downturn.

Analyzing the Effects of Cryptocurrency Volatility

Cryptocurrency volatility is a double-edged sword, offering both opportunities and risks for investors. The recent Bitcoin price drop exemplifies this volatility, creating conditions where significant swings in value can lead to substantial financial losses or potential gains. Understanding the mechanisms behind these price fluctuations is essential for anyone participating in the crypto market.

Factors contributing to this volatility include economic indicators, investor sentiment, and external influences such as regulatory news. As Bitcoin experiences sharp declines, the correlation with traditional markets also becomes apparent. Many investors are now evaluating their strategies in response to this volatility, with some suggesting a more cautious approach amidst the current market turmoil.

Market Reactions to Bitcoin’s Price Movements

Despite the recent downturn in Bitcoin prices, the reactions from the market have been varied. While some investors panic and liquidate their positions, others see this as an opportunity to buy at lower prices. The psychological aspect of investing plays a crucial role in how traders respond to significant market changes, especially when prices drop below critical support levels.

As Bitcoin struggles to maintain its value, the market remains sensitive to both macroeconomic factors and internal dynamics within the crypto space. Analysts are closely monitoring these reactions, as they can provide insights into future price trends and investor behaviors. Understanding the collective sentiment across the market can help investors prepare for potential rebounds or further declines.

The Interplay Between Bitcoin and Market Indices

Bitcoin’s recent price drop reflects a larger trend affecting tech stocks, notably the Nasdaq, prompting many to explore the connections between these markets. The cryptocurrency has exhibited a growing correlation with tech stocks, often mirroring their movements, as evidenced by the simultaneous dips in both Bitcoin and Nasdaq indices. This relationship raises questions about Bitcoin’s identity as a traditionally independent asset class.

As these correlations continue, investors must tread carefully, as downturns in tech stocks could correspond to further declines in Bitcoin prices. The alignment of market trends signals a need for investors in Bitcoin to consider external factors beyond the cryptocurrency itself, reshaping their investment strategies in response to broader market movements.

Bitcoin’s Future: Navigating Through Market Challenges

As Bitcoin grapples with the aftereffects of a significant price drop, many investors are left to ponder its future within the volatile cryptocurrency landscape. With nearly $500 billion wiped from its market cap, the need for a strategic reassessment of investment approaches is more critical than ever. Market commentators emphasize the importance of remaining informed about both external factors and internal dynamics that influence Bitcoin’s performance.

The challenges ahead are steep; with ongoing debates regarding its status as digital gold and increasing regulatory scrutiny, Bitcoin’s path forward will require adaptive strategies. While some analysts remain optimistic about Bitcoin’s recovery potential, others advise caution, advocating for a diversified approach that mitigates risks associated with the inherent volatility of cryptocurrencies.

Embracing Volatility: Investing Strategies Amidst Bitcoin’s Downturn

Given the recent volatility in Bitcoin prices, investors are reevaluating their strategies to navigate the current market conditions more effectively. Knowledge of cryptocurrency volatility and risk management becomes paramount when dealing with such unpredictable assets. Embracing strategies that account for downturns can help protect investment portfolios while positioning oneself for potential rebounds when the market stabilizes.

In this regard, some investors suggest adopting a dollar-cost averaging approach, where assets like Bitcoin are purchased at regular intervals regardless of price fluctuations. This method reduces the impact of volatility and allows for a more balanced accumulation of assets over time, decreasing the risks associated with large, single investments during downturns. By incorporating such strategies, investors can better withstand the pressures of an unpredictable market.

Frequently Asked Questions

What are the reasons for the recent Bitcoin price drop?

The recent Bitcoin price drop can be attributed to various factors, including a volatile week where the cryptocurrency lost nearly 18% of its value, with significant sell-offs in tech stocks affecting market sentiment. Specifically, the decline was influenced by lower performances from AI-related stocks, resulting in a strong correlation with the Nasdaq’s downturn, and contributing to a loss of about $500 billion in market capitalization since mid-January.

How does cryptocurrency volatility affect Bitcoin’s price?

Cryptocurrency volatility significantly impacts Bitcoin’s price by leading to sharp fluctuations in its value. As seen recently, factors such as market sentiment shifts, liquidations of leveraged positions, and sell-offs in correlated sectors like technology can exacerbate Bitcoin’s volatility, creating an environment where price drops can occur rapidly.

What impact do Bitcoin liquidations have on the market?

Bitcoin liquidations, particularly during price drops, can lead to cascading effects in the market. For instance, on February 4, a notable decline triggered $125 million in liquidations within just four hours, and total liquidations exceeded $830 million in 24 hours. This activity highlights how liquidations can amplify market downturns, causing further selling pressure and contributing to overall price instability.

How does US Senate crypto regulation relate to the Bitcoin price drop?

The recent Bitcoin price drop comes amid discussions in the U.S. Senate regarding potential crypto regulations. Although expected to clarify the regulatory landscape, uncertainty surrounding these discussions may have maintained a bearish sentiment in the market, preventing investors from gaining confidence and contributing to the ongoing price decline.

Is Bitcoin still considered digital gold despite recent price drops?

The recent Bitcoin price drops have reignited debates on its designation as digital gold, especially as Bitcoin has shown behavior more akin to tech stocks rather than a stable store of value. The ongoing correlation with technology stocks and divergence from traditional safe-haven assets like gold raises questions about its status as digital gold during periods of market stress.

| Key Point | Details |

|---|---|

| Current Price | Bitcoin fell below $73,000 for two consecutive days. |

| Market Value Drop | Bitcoin lost nearly 18% of its value and about $500 billion in market cap since mid-January. |

| Intraday Decline | Bitcoin dipped from $76,300 to a low of $72,000, marking a 3% decline. |

| Market Cap | Market capitalization now down to $1.45 trillion. |

| Liquidations | Over $830 million in leveraged liquidations, hitting bullish long positions hardest. |

| ETF Outflows | $272 million in outflows from spot bitcoin exchange-traded funds. |

| Market Sentiment | Market remains bearish despite positive regulatory discussions in the U.S. |

| Stock Correlation | Bitcoin’s correlation with Nasdaq persists; unlike precious metals. |

| Investor Calls | Calls for Strategy Chairman Michael Saylor to reassess funding approach. |

| Future Outlook | Optimists highlight significant cash reserves to mitigate volatility impact. |

Summary

The recent Bitcoin price drop has raised significant concerns among investors, as it continues to face challenges in the current market environment. With a decline below $73,000 for the second day in a row, Bitcoin’s value has plummeted nearly 18% since mid-January. This downturn has not only affected individual investments but has also decreased the overall market capitalization significantly. As market sentiment remains bearish, the correlation between Bitcoin and tech stocks further complicates its perception as a stable investment. Stakeholders are closely watching as discussions around regulatory frameworks for cryptocurrency unfold, while also contemplating the long-term implications of Strategy’s funding approach. Despite current volatility, some analysts believe that Bitcoin’s foundational strength may allow it to weather this storm.