In a stunning turn of events, Ethereum’s market cap decline has shaken the crypto landscape, witnessing a staggering drop of $100 billion within just a week. This sharp decline, amounting to nearly 27%, has seen Ethereum’s price plummet to $2,107, its lowest value since May 2025. Such dramatic fluctuations are being closely analyzed, prompting investors to explore the underlying factors behind this Ethereum price drop. Market analysts suggest that this volatility is amplified by macroeconomic pressures and significant movements by institutional investors, particularly Blackrock’s recent asset transfers. Understanding the intricacies of Ethereum market analysis, including the potential support levels and the impact on Ethereum investing, will be imperative for stakeholders navigating this tumultuous period.

The recent turmoil in Ethereum’s valuation has raised eyebrows across the cryptocurrency community, particularly in light of the substantial decrease in its market capitalization. As the second-largest cryptocurrency grapples with pervasive sell-offs, many are left questioning the future of Ethereum amidst a wave of bearish sentiment. This dramatic downturn has transformed discussions around Ethereum investing, pushing experts to evaluate current trends and the role of institutional players in this landscape. Furthermore, the increased scrutiny on Ethereum support levels highlights the critical junction facing the asset as it seeks to stabilize after significant declines. Engaging in a thorough Ethereum market analysis is essential for grasping the broader implications of this upheaval.

Ethereum Market Cap Decline: Causes and Consequences

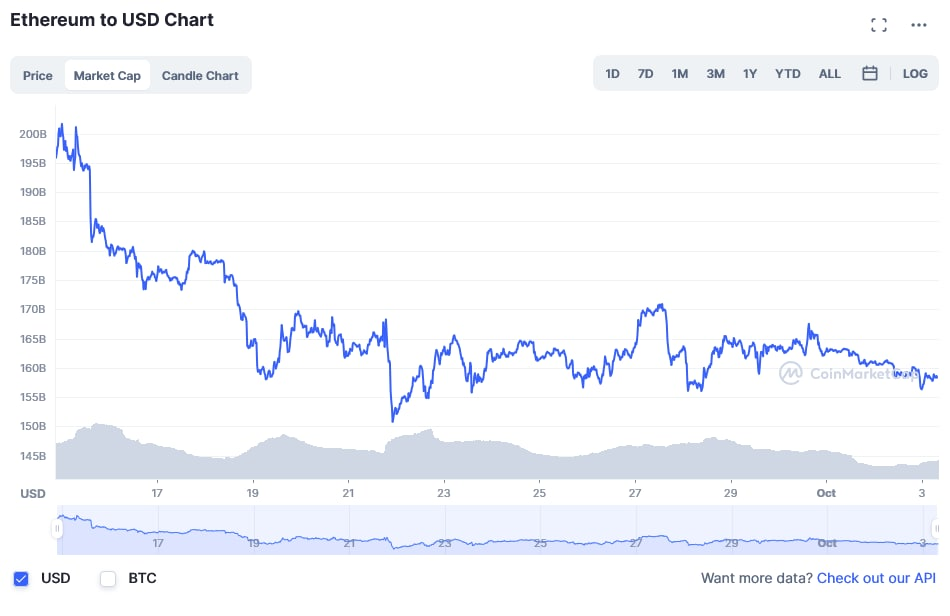

This past week marked a significant downturn for Ethereum, as it witnessed a staggering decline of $100 billion in market capitalization. The fall was primarily triggered by broader macroeconomic concerns, compounded by specific events such as the transfer of $170 million in Ethereum to Coinbase Prime by Blackrock, the world’s largest asset manager. Such movements have historically incited fear and volatility within the market, causing retail investors to liquidate their positions in panic. This stark decline has left many investors evaluating the future trajectory of Ethereum as they grapple with the implications of this sudden market cap shrinkage.

The repercussions of Ethereum’s market cap decline extend beyond immediate trading sentiments. Institutional investors, who had been gradually increasing their Ethereum holdings, are now re-evaluating their strategies in light of sudden volatility. Analysts speculate that the massive exit could signal an opportunity for strategic entry points in the future. This market adjustment is vital for discerning future trends and understanding how Ethereum’s price recovery may unfold, especially as it navigates critical support levels that could challenge its path to recovery.

Understanding Ethereum Price Drops: An Analytical Approach

When analyzing Ethereum’s recent price drop, it becomes essential to consider the interplay of various market dynamics. The steep decline, reported at 27% over the course of just one week, has raised alarms among crypto investors. Factors such as geopolitical tensions and stubborn inflation have contributed to the uncertain market climate, driving prices downward. Furthermore, the dominance of Bitcoin in market headlines unintentionally placed Ethereum in a shadowed position despite its significant role as the second-largest cryptocurrency. Investors must navigate not just the price trends, but also the backdrop of market fundamentals in order to make informed investment decisions.

Moreover, Ethereum’s technical analysis showcases distinct patterns that may inform its next move. With its dip below critical price levels, many analysts are asserting that Ethereum is currently exploring a unique price discovery phase. The observable support zones and fluctuating resistance levels will be crucial indicators to monitor as the market reacts to news and investor sentiment. Understanding these nuances can provide a framework for evaluating Ethereum’s potential trajectories in a rapidly evolving financial landscape.

Institutional Investors and Ethereum: An Evolving Landscape

The role of institutional investors in Ethereum’s market performance is becoming increasingly prominent, especially during downturns like the recent market cap decline. With institutions holding significant stakes, movements such as the $170 million transfer to Coinbase not only influence retail investor sentiment but also set off chain reactions that can destabilize the market. This dynamic indicates that institutions are more than just players; they are pivotal in shaping Ethereum’s price volatility, and their actions can lead to considerable shifts in market confidence and investor behavior.

Despite the recent decline, institutional interest in Ethereum remains strong, as evidenced by the growing validator entry queue that reached 71 days. This reflects a backlog of investors eagerly staking their assets, suggesting a willingness to weather short-term volatility in anticipation of long-term gains. Convictions from institutions like Tom Lee’s firm, which continues to stand by its Ethereum holdings, underline a sentiment that the fundamentals may still uphold value despite market turbulence. This evolving landscape illustrates that institutional involvement could still hold the key to Ethereum’s resilience and future price recovery.

Ethereum Support Levels and Future Projections

Analyzing Ethereum’s price recovery will necessitate stringent evaluations of its support levels, particularly in light of the recent market cap decline. Analysts have pinpointed the $1,959 mark as a critical support zone where the price could stabilize. If Ethereum manages to bounce back from this level, it could signal potential bullish momentum, encouraging investors to re-enter the market. Historical context provides further insight, as past cycles suggest that strong support often precipitates significant price rallies, and those waiting at these strategically marked zones could benefit from renewed buying interest.

In the technical analysis realm, ETH’s relative strength index (RSI) points to liquidity and pressure scenarios that must be closely monitored. With the current indicators reflecting oversold conditions, this could create a significant reversal opportunity if ETH successfully consolidates above these critical levels. Investors need to pay attention to both the price action and volume metrics to gauge whether Ethereum can indeed find its footing and trend upwards. Future projections hinge on establishing a solid support framework post this considerable drop, setting the stage for a potential recovery path.

The Impact of Market Dynamics on Ethereum’s Performance

Ethereum’s steep market cap decline serves as a barometer for broader market dynamics and behaviors. Cryptocurrencies typically react unpredictably to external pressures, and Ethereum’s recent volatility highlights how sensitive the asset can be to shifts in investor sentiment, particularly from institutional players. As retail investors react to institutional actions, such as liquidations or asset reallocations, wave-like phenomena occur, creating tumultuous market conditions that can dramatically affect Ethereum’s price.

In addition to investor sentiment, regulatory developments and macroeconomic indicators play crucial roles in shifting market landscapes. The persistence of inflationary pressures and geopolitical tensions continues to threaten market stability. Thus, monitoring these external factors, alongside Ethereum’s immediate technical charts, will offer valuable insights for players navigating this turbulent market. Establishing solid analytical frameworks will be essential for understanding the dual nature of Ethereum’s market performance amid these prevalent forces.

Ethereum Investing: Strategies in a Volatile Environment

For investors exploring Ethereum during this period of significant market turbulence, developing a robust investment strategy is paramount. Traditional methods may not suffice in a climate characterized by rapid price fluctuations. Investors are encouraged to adopt a long-term perspective while remaining agile enough to respond to immediate market developments. This might include dollar-cost averaging, which allows entry into ETH at various price points, thereby mitigating the risk tied to volatility.

Furthermore, recognizing critical support and resistance levels becomes part of the strategic planning for Ethereum investing. By identifying key price points, investors can set informed stop-loss orders and gain positions that align with both short-term trends and long-term fundamentals. Such strategies also benefit from diversification among crypto assets, thereby balancing exposure across different market trends while capitalizing on Ethereum’s potential upside when it stabilizes post-correction.

Analyzing Bearish Patterns in Ethereum Trading

In times of downturn, notably like that which Ethereum is currently experiencing, it becomes critical to analyze bearish patterns for appropriate trading decisions. The inverse cup-and-handle formation seen in Ethereum’s charts provides insight into potential risks and future price behavior. As analysts highlight resistance levels and target potential bearish trends, investors must remain cognizant of how these technical indicators can serve as predictors for downward price movements.

However, while bearish patterns dominate the charts, it is essential not to overlook underlying signals of recovery potential. The current Relative Strength Index indicates oversold conditions, often heralding a corrective upswing. Traders should keep a vigilant eye for shifts in market sentiment that could flip the pattern narrative. By balancing bearish insights with recovery indicators, savvy investors can better position themselves to capitalize on Ethereum’s eventual price reversals.

Ethereum’s Long-Term Fundamentals Amid Short-Term Volatility

Despite ongoing market volatility, Ethereum’s long-term fundamentals showcase a robust foundation that might lead to a positive outlook in the future. The technology underpinning Ethereum, including ongoing upgrades like the transition to Ethereum 2.0, highlights its potential for scaling and decreased transaction costs. Such developments are crucial as they lay the groundwork for broader adoption and long-term resilience, even when price dynamics appear bleak.

Furthermore, the increasing demand for Ethereum as a staking asset underlines its utility beyond mere speculative trading. As more crypto enthusiasts adopt staking practices, the reduced circulating supply could place upward pressure on prices in the coming months. This creates an environment where, despite short-term fluctuations, Ethereum’s fundamental attributes present compelling opportunities for investors willing to maintain a long-term investment horizon.

Risks and Opportunities in Ethereum Trading

Investors venturing into Ethereum trading during periods of decline must navigate the associated risks while simultaneously seizing emerging opportunities. Risk awareness involves understanding market liquidity, price volatility, and potential regulatory implications that could affect trading strategies. In particular, keeping an eye on institutional actions and macroeconomic indicators will be key to managing downside risks in the Ethereum market.

On the opportunity side, the existing market cap decline could pave the way for well-timed entries, particularly for trend-focused traders. The misalignment of supply and demand can lead to temporary price differentials that disciplined traders might exploit to gain advantageous positions. By staying informed and flexible within their trading frameworks, investors can unlock potential rewards while mitigating the inherent risks in the unpredictable world of cryptocurrency.

Frequently Asked Questions

What caused the recent Ethereum market cap decline?

The recent Ethereum market cap decline was primarily driven by a series of macroeconomic factors and a significant movement of assets by institutional investors like BlackRock, which transferred $170 million in Bitcoin and Ethereum to Coinbase Prime, fueling fears of potential liquidations.

How much did Ethereum’s market cap drop in a week?

Ethereum’s market cap declined by nearly $100 billion in just one week, reflecting a 27% decrease from $365 billion to $265 billion, marking its sharpest decline of the year.

What does the current Ethereum market analysis suggest about future pricing?

Current Ethereum market analysis suggests that despite its sharp decline, there are signs of strong demand, as seen in the 71-day queue for validator entries, which may indicate a potential rebound in pricing as the supply-demand dynamic favors bullish sentiment.

What are the key Ethereum support levels to watch?

Key Ethereum support levels to watch include a possible cycle bottom near $1,959, with immediate support seen between $2,100 and $2,200. Analysts also highlight resistance at $2,960 as a critical level post-breakdown.

Should investors be concerned about Ethereum’s recent price drop?

Investors should take the recent Ethereum price drop seriously but also consider the underlying fundamentals, such as staking demand and technical indicators that may suggest oversold conditions and the potential for a price recovery.

What impact do institutional investors have on Ethereum’s market cap?

Institutional investors significantly impact Ethereum’s market cap, as large transactions, like BlackRock’s recent asset transfers, can lead to heightened market volatility and trigger fears of liquidation among retail investors.

What does Ethereum’s validator queue indicate about market sentiment?

Ethereum’s prolonged validator queue, currently at 71 days, indicates strong market sentiment among institutional and retail investors eager to stake, suggesting that while prices are currently depressed, there is robust underlying demand for the asset.

Could there be a price recovery for Ethereum despite the recent decline?

Yes, there could be a price recovery for Ethereum despite the recent decline. Analysts point to the strong staking demand and critical support levels which may provide a foundation for potential upward movement, even as the market faces bearish trends.

What are the main bearish patterns identified in Ethereum’s recent trading?

Ethereum has displayed bearish patterns such as the breakdown of an inverse cup-and-handle formation and a decline in its relative strength index (RSI), indicating downward momentum and ongoing liquidation pressures in the market.

| Key Topic | Details |

|---|---|

| Market Cap Decline | Ethereum lost $100 billion in market value, dropping from $365 billion to $265 billion, a decline of nearly 27%. |

| Price Drop | ETH price fell to $2,107, the lowest since May 2025. |

| Macroeconomic Pressures | Broader market struggles due to geopolitical friction and inflation. |

| Institutional Movements | BlackRock transferred $170 million in cryptocurrencies, increasing fear of liquidation. |

| Staking Demand | Validator entry queue has increased to 71 days, indicating strong demand to stake assets. |

| Technical Analysis | The MVRV ratio suggests ETH is near a support zone, while bearish patterns are strong despite oversold signals. |

Summary

The Ethereum market cap decline has been significant, with the asset shedding $100 billion and a nearly 27% drop in valuation over one week. This dramatic fall was catalyzed by macroeconomic issues and substantial movements from institutional investors, which added to the market’s volatility. However, signs of strong staking demand along with technical indicators also point towards potential recovery, suggesting that while the short-term scenario appears grim, the long-term fundamentals may lead to a rebound.