The ongoing debate around the Bitcoin $6000 prediction has sparked renewed interest among crypto enthusiasts and investors alike. Esteemed financial educator Robert Kiyosaki has publicly embraced this potentially critical price point, asserting that he is ready to capitalize on any opportunity to purchase Bitcoin again should it return to such levels. As speculation mounts regarding Bitcoin’s price history and future forecasts, Kiyosaki’s confident stance emphasizes his unique Bitcoin investment strategy amidst a sea of cryptocurrency debates. Critics, however, question the credibility of his past buying claims, highlighting discrepancies in his reported acquisition prices. Still, Kiyosaki’s commitment to a long-term investment perspective reminds investors to focus more on asset valuation than on the timing of purchases.

In light of the recent discussions surrounding Bitcoin’s price forecasts, many have turned their attention to the possibility of its value dropping as low as $6,000 again. Renowned author and financial strategist Robert Kiyosaki has been vocal about his readiness to invest at this threshold, indicating a deep belief in Bitcoin’s long-term potential. This situation invites broader discussions on historical price movements of Bitcoin and the diverse investment approaches individuals adopt in the cryptocurrency landscape. The debates fueled by Kiyosaki’s assertions bring forth critical questions about cryptocurrency market behavior and investor psychology. As enthusiasts navigate these fluctuations, understanding the fundamentals behind investment decisions becomes increasingly important.

Understanding Bitcoin’s Value: Kiyosaki’s Perspective on Price Levels

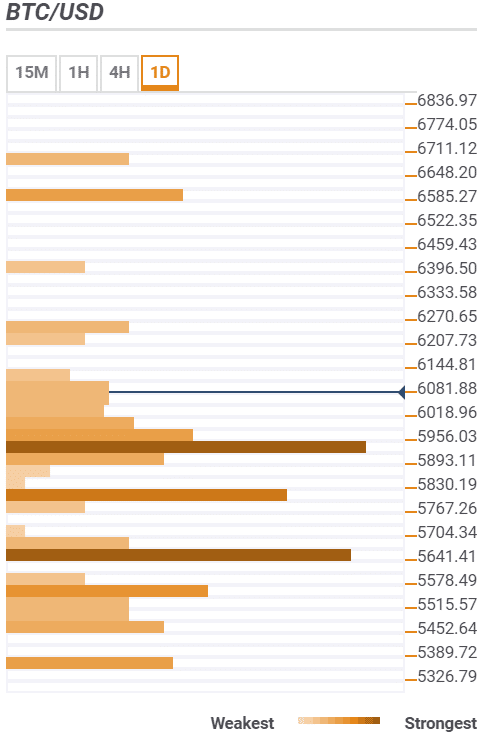

Robert Kiyosaki, a well-known financial educator, emphasizes the importance of price levels in the cryptocurrency market, particularly when discussing Bitcoin. He has long maintained that he prioritizes the value of an asset over the precise timing of purchases. This philosophy is evident in his assertion that if Bitcoin ever nears the $6,000 mark again, he will seize the opportunity to buy without hesitation. Kiyosaki believes that savvy investors should focus on acquiring assets at desirable price thresholds rather than get bogged down by the timing of their purchases.

Kiyosaki’s perspective on Bitcoin reflects broader discussions in the cryptocurrency community about effective investment strategies. Many investors argue against trading based on short-term price fluctuations and instead endorse a long-term hold strategy. This aligns with Kiyosaki’s past buying habits, where he has consistently acquired Bitcoin during market rallies, showing that his investment philosophy is driven more by price levels than timing.

Frequently Asked Questions

What is Robert Kiyosaki’s prediction for Bitcoin reaching $6,000?

Robert Kiyosaki has expressed his intention to buy more Bitcoin if it hits $6,000 again, emphasizing that price levels guide his investment decisions over specific dates.

Why does Kiyosaki claim Bitcoin is a good investment even at varying prices?

Kiyosaki argues that it’s about the value of Bitcoin as an asset, suggesting that investors should focus on price levels rather than dates of purchase.

How does Kiyosaki’s history with Bitcoin purchases relate to the $6,000 prediction?

Critics have questioned Kiyosaki’s consistency, noting that while he claims to buy Bitcoin at $6,000, he has also made significant purchases at much higher prices.

What strategies does Kiyosaki recommend for Bitcoin investors amid the $6,000 speculation?

Kiyosaki advises investors to prioritize asset value over acquisition dates and to consider compounding investments in Bitcoin, gold, and other assets.

What are common concerns about Kiyosaki’s Bitcoin investment strategy?

Many raise concerns about Kiyosaki’s inconsistent statements regarding his Bitcoin purchases, particularly around the $6,000 price level versus higher market prices.

How does Bitcoin’s price history influence Kiyosaki’s perspective on future investments?

Kiyosaki highlights past trends in Bitcoin price history as relevant for future buying decisions, particularly viewing recurring dips, like $6,000, as buying opportunities.

What does Kiyosaki suggest about the timing of Bitcoin investments?

Kiyosaki suggests that timing is less important than identifying robust price levels, stating that if Bitcoin returns to $6,000, he would be ready to invest regardless of the timing.

What are Kiyosaki’s thoughts on the current debates in cryptocurrency surrounding Bitcoin’s value?

Kiyosaki maintains that discussions about Bitcoin’s value should focus on its potential and historical price performance, especially during dips like the projected $6,000.

What lessons does Kiyosaki share regarding Bitcoin investment amidst price fluctuations?

He advises staying focused on asset value rather than speculative timing, advocating for continual investment in Bitcoin and other commodities as the market fluctuates.

| Key Point | Details |

|---|---|

| Kiyosaki’s Bitcoin Purchase Claims | He insists on buying Bitcoin primarily at $6,000, despite criticisms over the timing. |

| Critics’ Concerns | Critics challenge the validity of Kiyosaki’s claims based on evidence of past purchases at higher prices. |

| Price vs. Date | Kiyosaki emphasizes that the price point of Bitcoin is more important than the date of purchase. |

| Accumulation Strategy | He plans to purchase more Bitcoin if it reaches $6,000 again, focusing on asset value rather than acquisition dates. |

| Other Asset Priorities | Kiyosaki also prioritizes gold, silver, and Ethereum alongside Bitcoin in his investment strategy. |

Summary

The Bitcoin $6000 prediction by Robert Kiyosaki has sparked both interest and skepticism in the cryptocurrency community. Kiyosaki maintains that he is prepared to buy more Bitcoin if it dips to $6,000, reinforcing his belief that investment decisions should be guided by price levels rather than the timing of purchases. However, his past communications reveal a tendency to buy Bitcoin at significantly higher prices, leading to questions about the consistency of his claims. In an era where price volatility reigns, Kiyosaki’s viewpoint offers a stark reminder that long-term value perception is crucial in the unpredictable world of cryptocurrency investment.