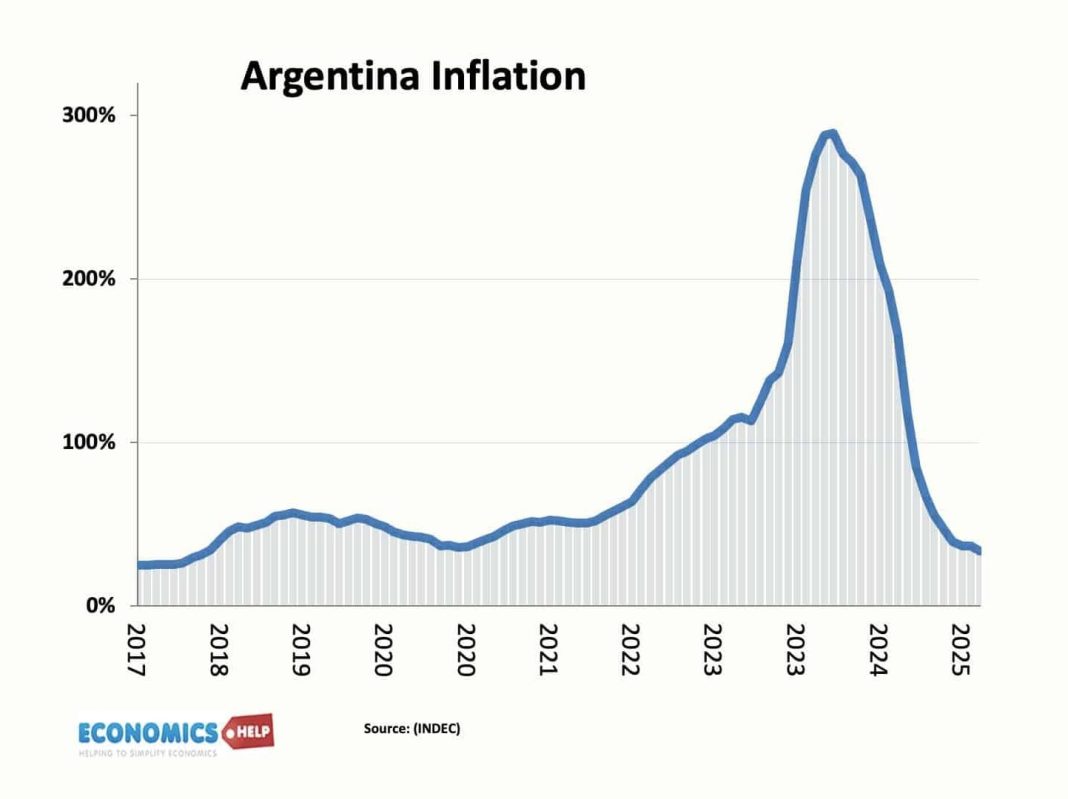

Argentina inflation has become a pivotal issue as the nation’s economic landscape faces widespread scrutiny. The recent resignation of Marco Lavagna, the director of Argentina’s national statistics agency, has amplified discussions surrounding inflation index changes and their implications for the country’s already precarious financial situation. Amidst Milei’s controversial economic policies, Lavagna’s exit raises questions about the reliability of Argentina inflation statistics, especially with the postponed implementation of a new inflation measurement. Many experts suggest that this delay could obfuscate the true state of the Argentina economic crisis, potentially masking the rising costs of living from the public. As inflation continues to soar, the effects on consumer prices are evident, leading to significant fluctuations in the currency and market confidence.

The ongoing economic turmoil in Argentina, particularly the inflation crisis, is generating considerable concern among policymakers and citizens alike. With the recent changes in leadership at the Institute of National Statistics and Censuses (Indec), it appears the methodology used to track inflation is under review, causing unrest in financial markets. The impact of Marco Lavagna’s departure is notably profound; his resignation ignites fears of potential data manipulation in the face of Milei’s ambitious economic reforms. As Argentina navigates this storm, the shifting economic indicators could profoundly challenge the stability of both consumer prices and currency exchange rates. Analysts are closely monitoring how these developments might shape Argentina’s economic outlook in the months to come.

Understanding Argentina’s Inflation Crisis

Argentina’s inflation crisis has become a focal point as political changes unfold, particularly with the resignation of Marco Lavagna as head of the national statistics agency. This recent development has drawn attention to the country’s inflation rates, which are a vital indicator of economic health. The public and analysts are closely monitoring the situation, as the new inflation calculation methods proposed by Milei’s administration could present a different narrative on the nation’s economic struggles. Understanding these dynamics is crucial for both local and international stakeholders.

The inflation in Argentina has been a turbulent issue for years, especially as the country faces economic challenges and political upheaval. With skyrocketing prices affecting everyday consumers, the revised inflation index is expected to either highlight or downplay the current financial strains. Economists stress that a thorough understanding of these inflation figures and their implications can help clarify Argentina’s standing in global markets, particularly given the significant reliance on its agricultural exports.

The Impact of Marco Lavagna’s Resignation on Economic Policies

Marco Lavagna’s resignation has sent ripples through Argentina’s economic landscape, leading many to question the integrity of the national statistics. His departure raises questions about the reliability of the inflation index at a time when Milei’s government is facing scrutiny for potential data manipulation. It’s believed that Lavagna’s support of the administration may have hindered his agency’s credibility, particularly as the country grapples with an economic crisis and mounting public dissatisfaction with rising living costs.

Analysts predict that the implications of Lavagna’s resignation could extend beyond just statistical reports—affecting investor confidence and market stability. Investors are particularly concerned about how the introduction of a new inflation calculation will influence Milei’s economic policies. The uncertainty may lead to volatility in the Argentine stock market, as evidenced by the recent 8% selloff of the S&P Merval index. Such market reactions hint at deep-seated fears surrounding the economic policies and future financial stability of Argentina.

Challenges posed by inflation are exacerbated by incomplete data, as any hesitations in reporting may create a cycle of instability. While some economists argue for transparency in economic reporting, others caution that excessive scrutiny could hinder necessary reforms. Ultimately, the resignation of Lavagna represents more than just a personnel change; it embodies the ongoing challenge of achieving economic stability in the shadow of rapidly changing inflationary pressures.

The Role of Inflation Indices in Argentina’s Economy

Inflation indices serve as crucial barometers for economic health, influencing monetary policy decisions and public sentiment in Argentina. The ongoing controversy surrounding the inflation index is not simply a technical issue; it reflects broader economic realities impacting everyday Argentines. With Milei’s newly proposed index under review, concerns are mounting regarding its accuracy and potential to sway perceptions of the current economic crisis.

Current inflation statistics suggest that food prices are on an upward trajectory, with reports indicating a significant 2.5% increase within just one week. This surge highlights the implications of delayed adjustments to the inflation index, as families face mounting costs and reduced purchasing power. By understanding the discrepancies in inflation reporting and the potential impacts of newly implemented policies, economists and policymakers can better navigate the pressures of inflationary forces within Argentina.

Milei’s Economic Policies and Their Effects on Inflation

Javier Milei’s approach to economic reforms has sparked intense debate among economists and the public alike. His policies, often described as aggressive or even radical, are designed to curtail inflation and stabilize the economy. However, the recent fallout from Lavagna’s resignation raises questions about whether these measures will adequately address the complexities of the inflation crisis. The tension between implementing swift reforms and ensuring public trust in economic statistics is a delicate balance that Milei must navigate.

While Milei’s administration aims to promote economic growth and investment, the actual outcomes of his policies remain to be seen. The delayed introduction of a new inflation calculation method may hinder the effectiveness of these policies, as investors and citizens become increasingly cautious. If inflation continues to rise unchecked, it could undermine the groundwork for Milei’s ambitious economic agenda, demonstrating the intricate relationship between sound policy-making and accurate financial reporting.

Analyzing the Future of Argentina’s Economic Stability

The resignation of Marco Lavagna marks a crucial point in assessing Argentina’s economic trajectory. As the country seeks to recover from a prolonged economic downturn, the validity of its inflation statistics will play a pivotal role in shaping public perception and economic confidence. Without reliable data, it becomes challenging for policymakers to implement effective measures, potentially leading to further economic decay.

In light of these challenges, it’s crucial for Argentina to recalibrate its approach to inflation statistics and to ensure that economic indicators reflect genuine conditions. This adjustment could foster improved investor confidence and set the foundation for long-term economic recovery. However, without transparent data that accurately reflects the inflation situation, the path forward may remain murky at best.

The Link Between Argentina Inflation and the Dollar-Peso Exchange Rate

The inflation rate in Argentina directly influences the country’s currency stability, particularly the dollar-peso exchange rate. As inflation continues to rise, the value of the peso fluctuates, creating an uncertain environment for both local and foreign investors. Recently, analysts predicted that the continued adjustment of inflation indices could result in greater volatility in the exchange rate, complicating financial transactions and long-term investments.

The dollar-peso dynamic illustrates the interconnectedness of economic factors within Argentina’s volatile market. A significant depreciation of the peso could lead to further inflation, trapping the economy in a cycle of instability. This emphasizes the importance of establishing a reliable inflation index that stakeholders can trust to make informed decisions regarding currency exchange and investment strategies.

The Effect of Inflation on Consumer Prices

As inflation continues to rise in Argentina, consumers are feeling the pinch at the supermarket checkout. Notably, the reported 2.5% increase in food and beverage prices within a single week has sent shockwaves through the economy, raising concerns about affordability and access to essential goods. This spike not only impacts individual households but also highlights the broader inflationary pressures facing the nation as a whole.

The ramifications of these rising consumer prices are particularly acute for lower-income families, who may struggle to meet basic needs amid escalating costs. As Milei’s administration grapples with these challenges, the need for effective policy responses becomes ever more pressing. Ensuring that adequate measures are taken to stabilize prices and provide relief to consumers will be key to navigating the ongoing inflationary crisis in Argentina.

The Controversial Changes in the Inflation Index Calculation

The proposed changes to Argentina’s inflation calculation method have sparked significant debates amid concerns of potential data manipulation. As the government seeks to reform how inflation is reported, many question the motivations behind this move, particularly in light of Lavagna’s resignation. The new computation method, which relies on spending data from years past, may fail to accurately represent the current economic landscape, leading to a less favorable portrayal of Milei’s economic policy.

This re-evaluation of the inflation index not only plays a crucial role in government analytics but also affects public perception. If the public feels that inflation is being underreported, mistrust in government statistics could erode further, complicating efforts for effective economic reform. The accuracy and transparency in reporting economic data are vital for restoring confidence among Argentinians who have already endured years of economic hardship.

Implications for Future Economic Reforms in Argentina

As Argentina faces an inflation crisis, the implications of Lavagna’s resignation and the proposed changes to the inflation index are far-reaching. The need for comprehensive economic reform has never been more pressing, yet the government’s approach in addressing these matters remains under scrutiny. Without a stable and trusted framework for measuring inflation, future reforms may struggle to gain traction, leading to a continuation of the status quo.

Moving forward, it will be imperative for Milei’s administration to instill a sense of confidence among citizens and investors alike. Transparency in reporting inflation figures and a commitment to addressing underlying economic challenges will be essential to rebuilding trust in the government’s economic agenda. Navigating these turbulent waters will require decisive action and the willingness to adapt to the ever-changing economic landscape.

Frequently Asked Questions

What are the implications of Argentina inflation statistics following Marco Lavagna’s resignation?

Marco Lavagna’s resignation has intensified scrutiny of Argentina’s inflation statistics, with concerns surrounding potential data manipulation and accuracy. Analysts worry that the delay in adopting a new inflation index could significantly impact future economic reports, highlighting the need for transparency in inflation calculations.

How could Milei’s economic policies be affected by changes in the inflation index?

The proposed changes to Argentina’s inflation index may reflect less favorable outcomes for Javier Milei’s economic policies. Adjustments based on more recent spending patterns could reveal higher inflation rates, challenging the effectiveness of his so-called ‘chainsaw’ economic measures aimed at addressing the ongoing crisis.

What immediate market reactions have been observed after the announcement of Argentina inflation changes?

Following the announcement of Marco Lavagna’s resignation, the Argentine stock market experienced an 8% drop. This selloff indicates heightened investor concerns regarding market stability and the potential implications of revised inflation calculations on the economy.

How does the recent rise in food prices relate to Argentina inflation trends?

In February, food and beverage prices in Argentina surged by 2.5%, reflecting the ongoing inflation trends. This significant increase marks the largest weekly rise since March 2024, demonstrating the impact of current inflation levels on consumer costs amid the economic challenges facing the country.

What challenges does Argentina face with the upcoming changes to the inflation index?

The upcoming changes to the inflation index present challenges for Argentina, particularly regarding public perception and economic policy. Critics argue that the outdated methods for calculating inflation may not accurately represent current spending behaviors, potentially masking the true state of the economic crisis.

How does Marco Lavagna’s resignation relate to the credibility of Argentina’s economic data?

Marco Lavagna’s resignation raises serious questions about the credibility of Argentina’s economic data, particularly concerning inflation statistics. His departure from Indec may lead to increased skepticism regarding the accuracy and reliability of future inflation reports under Milei’s administration.

What impact will the new inflation index have on the dollar-peso exchange rate?

The adoption of a new inflation index is expected to influence the dollar-peso exchange rate. As inflation rates are critical to currency valuation, any changes in the inflation index can affect market perceptions and lead to fluctuations in the exchange rate as Argentina transitions to a more flexible economic model.

| Key Points | Details |

|---|---|

| Marco Lavagna’s resignation | The head of Argentina’s statistics institute, Lavagna, resigned, which has drawn attention to the inflation index. |

| Impact of delayed inflation index | Milei’s government postponed a new method for calculating inflation, potentially manipulating figures. |

| Concerns of data manipulation | Consulting firms have accused the government of manipulating inflation data following Lavagna’s resignation. |

| New calculation method | The new method reflects spending patterns from 2017-2018 and may show lower inflation increases. |

| Impact on Argentine stocks | Stocks fell 8% after Lavagna’s resignation, indicating market instability. |

| Price increases | Food and beverage prices surged by 2.5% in early February, the highest increase since March 2024. |

Summary

Argentina inflation has taken center stage following the resignation of statistics chief Marco Lavagna, which raises questions about the integrity of the nation’s inflation data. The postponement of a new inflation index by Milei’s government has led to concerns of potential manipulation of economic figures. As the situation unfolds, market reactions, including an 8% drop in stocks and rising consumer prices, highlight the urgency for accurate inflation reporting in Argentina.