Swift blockchain payments are redefining how money moves across borders, aiming to speed up settlement and reduce friction. Backed by more than 30 banks across 16 countries, the initiative supports Swift cross-border payments through 24/7 real-time settlement on a shared, tokenized ledger. This approach extends Swift’s trusted financial messaging network into real-time cross-border settlements, blending speed with security within a global payments blockchain vision. This approach builds on a distributed ledger-based settlement concept to improve resilience, traceability, and interoperability across the ecosystem. Notably, the initiative includes a ConsenSys prototype, illustrating progress from concept to concrete pilots.

Viewed through the lens of next-generation payments, the initiative resembles a distributed ledger-based settlement layer that sits under established messaging channels. Banks describe it as a secure, interoperable network designed to clear and settle value around the clock, rather than in standard banking hours. The emphasis is on tokenized value and smart-designed protocols that help reduce settlement risk and improve auditability for participants. Industry observers frame it as part of a broader shift toward a global, real-time payments ecosystem that can scale with trade and capital flows. By leaning on established financial messaging rails while exploring clever sequencing and validation rules, the project aims to minimize latency and cut operational costs. Early pilots and proofs of concept, including a prototype developed with a major software provider, show how institutions can experiment without disturbing existing infrastructures. For the market, the question is how quickly and smoothly such a ledger can integrate with existing rails while meeting regulatory expectations. If successful, blockchain-based settlements could serve as the backbone for faster cross-border moves by aligning protocols with existing governance. In this transition, collaboration among banks, fintechs, and regulators will shape how soon the system becomes commonplace.

Swift blockchain payments: 30+ Banks Back a 24/7 Ledger for Global Payments

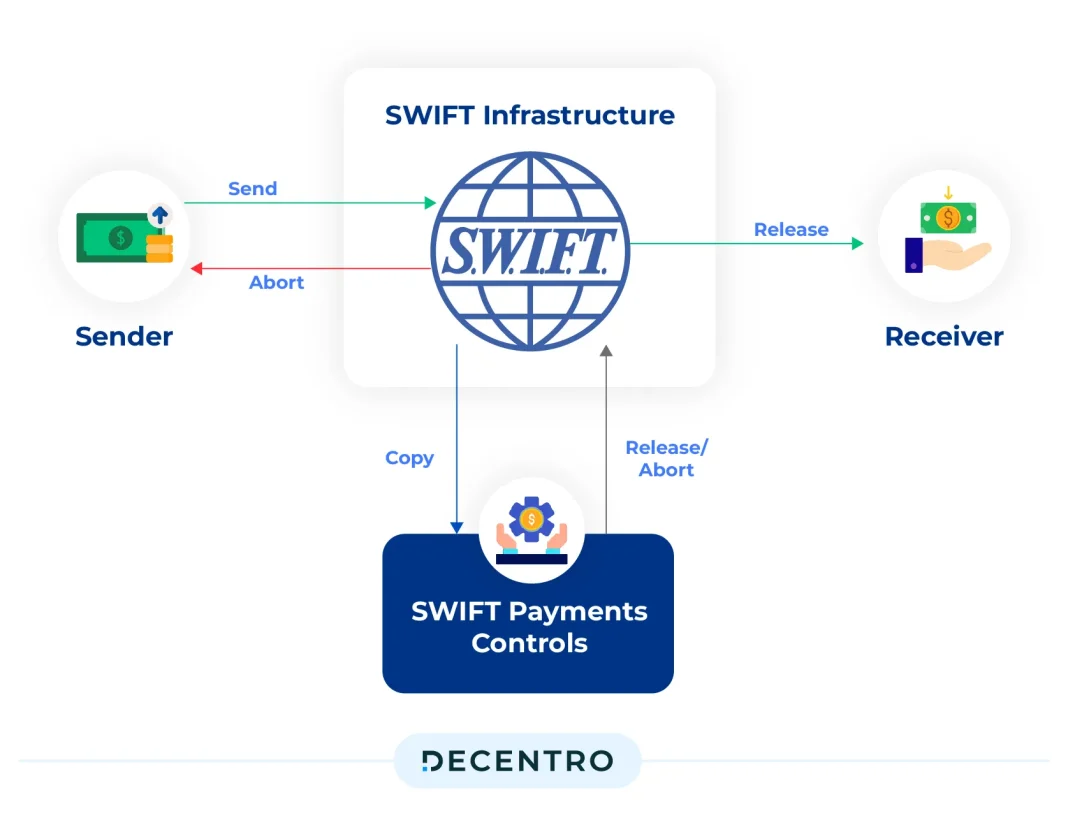

Swift is advancing global payments with a blockchain-based ledger backed by more than 30 major banks from 16 countries, targeting real-time, secure, 24/7 cross-border transactions. The initiative moves beyond traditional messaging toward a shared, tokenized ledger that can move value as quickly as messages travel today, enabling near-instant cross-border payments.

Backed by a wide consortium, the project aims to deliver resilience, interoperability, and tighter controls for cross-border traffic on a round-the-clock basis. By combining established messaging with a live settlement layer, Swift seeks to reduce delays and improve the efficiency of global value transfers.

ConsenSys Prototype Drives Real-Time Cross-Border Payments in Swift’s Ledger

A ConsenSys prototype sits at the core of the effort, defining the first use case: real-time, 24/7 cross-border payments on a blockchain-based ledger. This prototype will test tokenized value transfer and the feasibility of a unified settlement layer across borders.

Swift plans phased development around the ConsenSys prototype, gathering feedback from more than 30 participating institutions to refine the ledger and lay the groundwork for broader deployment across the global network.

Global Banks Across 16 Countries Back Swift’s Blockchain Push for Real-Time Settlement

Institutions including Absa, Akbank, ANZ, Banco Santander, Bank of America, Banorte, BBVA, BNP Paribas, BNY, Bradesco, Citi, Crédit Agricole, DBS Bank, Deutsche Bank, HSBC, and others across 16 countries are backing the initiative. This broad participation demonstrates strong industry interest in a blockchain-enabled settlement path.

The initiative is framed as a way to advance Swift cross-border payments through blockchain-based settlements, enabling faster, tokenized value movement while maintaining robust regulatory compliance and risk controls.

From Messaging to Tokenized Value: The Global Payments Blockchain Vision

The shift from secure messaging to a global payments blockchain signals a move toward real-time, tokenized settlement across borders. By moving value onto a shared ledger, banks can reduce latency and create a more transparent transfer flow.

If the ledger proves scalable, it could rearchitect how clearing and settlement operate, lowering friction and improving interoperability among banks, market infrastructures, and corporate clients across jurisdictions.

24/7 Real-Time Payments: Building Resilience and Compliance into the Ledger

Achieving 24/7 real-time payments requires a robust, always-on platform with high uptime, continuous monitoring, and clear governance. The project emphasizes uptime assurances and resilient operational practices to support nonstop cross-border activity.

Security, privacy, and regulatory compliance are integrated into the design to protect participants while enabling near-instant settlement across a diverse set of banks and markets.

Interoperability Across Banks and Market Infrastructures

Swift already links more than 11,500 banking and securities organizations, market infrastructures, and corporate clients, illustrating the breadth of potential integration for a blockchain-based ledger. This network foundation is a critical asset for scaling the new settlement layer.

As the ledger grows, interoperability will be essential for connecting central banks, clearinghouses, and corporates across varied regulatory landscapes, geographic regions, and technical environments.

Neutral, Secure, Member-Owned: How Swift’s Cooperative Model Supports Blockchain Adoption

Swift operates as a global member-owned cooperative, a structure that provides neutrality and governance essential for broad blockchain adoption. This model helps ensure fair access, standardized practices, and a trusted governance framework as new rails are introduced.

The cooperative approach also supports rigorous audits, security standards, and transparent decision-making, which can reassure institutions considering participation in a blockchain-based settlement network.

Roadmap to Adoption: Phase One Prototype and Future Phases

The initiative begins with a phase-one ConsenSys-driven prototype to validate real-time, cross-border payment use cases on the ledger. This early testing grounds the concept in practical experience and risk management.

Future phases will broaden participation, refine interoperability, and accelerate deployment as banks test, learn, and extend the ledger’s capabilities across regions and product lines.

Scaling the Ledger: The 16-Country Network Behind the Ledger

A 16-country network featuring 30+ banks marks a significant scale-up in Swift’s blockchain push for global settlements. The breadth of participation helps address diverse regulatory and market needs as the project matures.

This geographic spread also supports piloting in varied environments, enabling lessons on interoperability, governance, and operational resilience that can inform broader rollout.

Impact on Global Payments: Why Blockchain-Based Settlements Matter

If the blockchain-based settlements approach delivers on its promise, settlement risk could decrease and funds could move faster, reshaping the landscape of global payments. The ledger aims to provide a more transparent, auditable trail for cross-border transfers.

The initiative aligns with a broader trend toward modernized rails that are resilient, compliant, and capable of 24/7 operation, offering a more efficient backbone for international commerce.

Future of Cross-Border Payments: How Swift Sets Industry Standards

By establishing a standards-setting platform for cross-border payments, Swift could influence industry norms and encourage broader blockchain adoption in finance. The collaboration underscores the potential for public-private cooperation to define new, secure benchmarks.

The joint effort among banks, market infrastructures, and tech partners demonstrates how 24/7 real-time payments and blockchain-based settlements may become the new baseline for international commerce, guiding future implementations worldwide.

Frequently Asked Questions

What is Swift blockchain payments and how do blockchain-based settlements enable faster cross-border transactions?

Swift blockchain payments refers to Swift’s initiative to run a blockchain-powered shared ledger for global payments. By using blockchain-based settlements, it aims to move tokenized value in real time across borders, supporting 24/7 real-time payments with enhanced resilience and interoperability.

What role does the ConsenSys prototype play in Swift blockchain payments?

The ConsenSys prototype is the initial concept for Swift’s blockchain payments ledger. In phase one, it will help explore real-time cross-border payments and inform future development stages.

Which institutions are backing Swift blockchain payments and how broad is the collaboration?

More than 30 banks across 16 countries are backing the Swift blockchain payments initiative, collaborating to design and test a shared ledger for the first use case of 24/7 cross-border payments.

How could blockchain-based settlements change Swift cross-border payments for businesses and banks?

Blockchain-based settlements could enable 24/7 real-time payments on a global payments blockchain, tokenized value transfers, and improved resilience, security, and interoperability between banks and payment systems.

What is the long-term vision of Swift’s blockchain ledger in the global payments ecosystem?

The long-term goal is to extend Swift’s secure financial messaging to a global payments blockchain that supports continuous, real-time settlements, aligning with existing rails while enabling broader interoperability.

When might live 24/7 cross-border payments become available through Swift blockchain payments?

The project is in early stages, including a ConsenSys prototype and phased development. A live rollout depends on proof-of-concept results and subsequent implementation phases.

| Key Point | Details | Impact | ||

|---|---|---|---|---|

| Project aim | Build a blockchain-powered shared ledger for round-the-clock cross-border payments (real-time, 24/7). | Modernizes Swift’s rails and enables faster settlement. | ||

| Backing institutions | More than 30 global financial institutions from 16 countries support the initiative. | Lends scale and credibility; helps ensure resilience and interoperability. | ||

| Prototype/first use case | Concept prototype in phase one, starting with real-time 24/7 cross-border payments; prototype by ConsenSys. | Shows practical path toward deployment and testing with industry partners. | ||

| Development status | Swift kicked off work with a group to design and build the ledger; feedback loop from institutions around the world. | Ongoing iterative development with governance from the global community. | ||

| Participants (sample) | Absa, Akbank, ANZ, Banco Santander, Bank of America, Banorte, BBVA, BNP Paribas, BNY, Bradesco, Citi, Crédit Agricole, DBS Bank, Deutsche Bank, Emirates NBD, First Abu Dhabi Bank, Firstrand Bank, HSBC, Itaú Unibanco, JPMorgan Chase, Mizuho, MUFG, NatWest, OCBC, Royal Bank of Canada, Saudi Awwal Bank, Shinhan Bank, Societe Generale-Forge, Standard Chartered, TD Bank Group, UOB, Wells Fargo, Westpac. | Strategic context | Part of Swift’s effort to modernize traditional rails while preparing for a digital future; secure messaging remains core. | Positions Swift to set industry standards for blockchain adoption. |

| Swift facts | Swift is a global member-owned cooperative and leading provider of secure financial messaging; network includes 11,500+ institutions in 200+ countries. | Existing scale supports broad adoption and interoperability for the new ledger. |

Summary

HTML table explaining key points about Swift’s blockchain ledger initiative.