U.S. crypto legislation is making significant strides as momentum builds inside the White House with ongoing discussions among industry leaders, banks, and lawmakers. Recent meetings emphasize bipartisan cooperation aimed at unraveling the regulatory challenges that have long hindered clarity in the crypto market structure. With key participants actively engaging in stablecoin discussions and exploring frameworks for digital asset regulation, stakeholders express optimism about reaching a consensus. By uniting diverse interests, the U.S. government aims to position the nation as a global leader in technological innovation while ensuring consumer protections within the burgeoning crypto ecosystem. As these vital conversations unfold, the focus remains on advancing comprehensive legislation that can effectively support the future of digital currencies.

Recent developments in the realm of cryptocurrency law in the United States have generated significant interest among policy-makers and financial institutions alike. Discussions among government officials, industry representatives, and banking leaders reflect an unprecedented effort to establish a clear framework for the regulation of digital currencies and assets. This collaborative dialogue is crucial not only for understanding the current landscape but also for paving the way forward for sustainable growth in the crypto market. Among the key topics under consideration are measures surrounding stablecoins and overarching regulations that govern how digital transactions are handled. As these legislative talks progress, the path to defining a cohesive structure for the cryptocurrency sector becomes increasingly vital to the success of a stable digital economy.

The Importance of U.S. Crypto Legislation

U.S. crypto legislation has emerged as a pivotal topic as the government seeks to regulate the rapidly evolving digital asset landscape. With significant meetings convened by the White House bringing together key stakeholders—from industry leaders to banking representatives—there is a clear push towards establishing a coherent regulatory framework. These legislative efforts aim to ensure that the United States remains competitive in the global crypto market, by fostering innovation while safeguarding investors. Notably, bipartisan talks indicate that legislators are prioritizing the welfare of consumers and the integrity of financial systems as they navigate this complex space.

As discussions progress, the need for legislative clarity grows increasingly urgent. Current market dynamics are heavily influenced by the lack of a standardized approach to digital assets, which creates uncertainty for both investors and businesses. With the stakes higher than ever, various proposed bills, such as the Digital Asset Market CLARITY Act, seek to delineate the roles of regulatory bodies like the SEC and CFTC. The continuation of these dialogues reflects a consensus among policymakers that the U.S. must establish itself firmly as a leader regarding digital asset regulation.

Bipartisan Crypto Talks: What’s at Stake?

Bipartisan crypto talks are crucial in shaping a regulatory landscape that accommodates growth while ensuring consumer protection. The recent meetings at the White House signal a new era where both parties recognize the importance of creating frameworks that benefit the industry and its stakeholders. Key officials have emphasized the need to address various aspects of crypto regulation, including market structure and the management of stablecoins, ensuring that they can coexist harmoniously within traditional financial systems. This cooperation can help mitigate risks and foster an environment where innovation can thrive without regulatory fear.

The involvement of major banking institutions in these discussions showcases the confluence of traditional finance and the crypto sector. Banks have articulated their perspectives on stablecoin rewards and operational guidelines, indicating the necessity of defining clear roles for both crypto firms and banks. Such comprehensive discussions are not only pivotal for regulatory clarity but also for aligning interests across different sectors, thereby ensuring a well-rounded approach that addresses economic growth, security, and stability.

Market Structure Challenges in Digital Assets

Recognizing the challenges in crypto market structure is vital for developing meaningful regulatory frameworks. Stakeholders, including crypto companies and banks, have expressed the need for a consistent approach towards defining what constitutes a digital asset, and how different tokens and coins should be treated under law. The disparity in regulation can lead to confusion, and as the industry matures, there is a pressing need for rules that provide certainty while fostering an environment for technological advancements.

Currently, ongoing discussions surrounding the Digital Asset Market CLARITY Act reflect a tension between innovation and regulation. With some lawmakers advocating for stricter guidelines and others pushing for flexibility, achieving a consensus remains challenging. Understanding these dynamics is crucial for investors and companies alike, as they navigate the complexities of a market still finding its regulatory footing. Clearer regulations could pave the way for greater institutional investment and diversification of services within the crypto space.

The Role of Stablecoins in Regulatory Conversations

Stablecoins have become a focal point in regulatory conversations as they embody the intersection of digital currencies and traditional finance. The significance of stablecoins in facilitating digital transactions and investments has not gone unnoticed in the recent discussions at the White House. As various stakeholders negotiate acceptable practices for stablecoin usage and yield generation, defining a regulatory framework will be essential to ensure trust and credibility in these assets. Consensus among banks and crypto firms on how to treat stablecoins will lay a foundation for future growth and accessibility in the market.

The involvement of prominent banks in discussions regarding stablecoins indicates a recognition of their potential impact on financial systems. As banks outline their positions, the balance between regulation and innovation must be carefully maintained to prevent stifling growth. Creating parameters that allow stablecoins to flourish while also protecting consumers and maintaining financial stability represents a significant opportunity for regulators and market participants alike.

The Impact of White House Meetings on Crypto Regulation

The importance of the White House meetings for the future of crypto regulation cannot be understated. These gatherings serve as a platform for influential voices within the crypto ecosystem and traditional banking sectors to collaborate on solutions to long-standing regulatory issues. With senior policymakers engaging directly with industry representatives, the dialogue aims to bridge the gap between innovation and legal standards. By prioritizing open communication, the White House is positioning itself as a facilitator of progress, demonstrating its commitment to establishing a clear regulatory framework.

Moreover, the positive outcomes of these meetings can set a precedent for future engagements between sectors that have historically operated independently. When crypto leaders express optimism regarding constructive dialogue, it reflects an industry eager for clarity and direction. By fostering bipartisan cooperation and focusing on the regulatory nuances of digital assets, these talks can potentially accelerate the legislative process, setting the stage for transformative changes in the crypto market.

The Future of Digital Asset Regulation in the U.S.

Looking ahead, the future of digital asset regulation in the U.S. hinges on the ability of lawmakers to synthesize insights from their discussions with stakeholders. As the regulatory landscape continues to evolve, it is crucial for Congress and regulatory bodies to strike the right balance between comprehensive oversight and the necessity for innovation. This requires a deep understanding of the unique qualities of blockchain technology and the implications of various digital assets on the economy.

Moving forward, the anticipated regulatory frameworks must be flexible enough to adapt to the fast-paced developments within the crypto space while also providing investors with the protections they need. Enhanced coordination between the SEC, CFTC, and other entities involved in oversight will be vital in crafting rules that not only protect consumers but also pave the way for the U.S. to remain a competitive player in the global digital economy.

Investor Optimism Post-White House Meetings

Investor sentiment has been rejuvenated in light of the recent White House meetings focusing on crypto legislation. The visible commitment from both sides of the aisle in Congress reflects a growing understanding of the importance of regulatory certainty for fostering market development. As industry leaders express cautious optimism, the prospect of a balanced regulatory framework encourages both individual and institutional investors to consider more substantial engagement in the crypto market.

This newfound optimism can also have ripple effects on market stability. When investors see that lawmakers are taking actionable steps towards clear regulations, confidence can be restored, potentially leading to increased investments in digital assets. As discussions on market structure and stablecoin oversight continue, investors will be closely monitoring outcomes, knowing that definitive legislation could minimize risks and solidify the legitimacy of the crypto economy.

Challenges Facing the Digital Asset Market

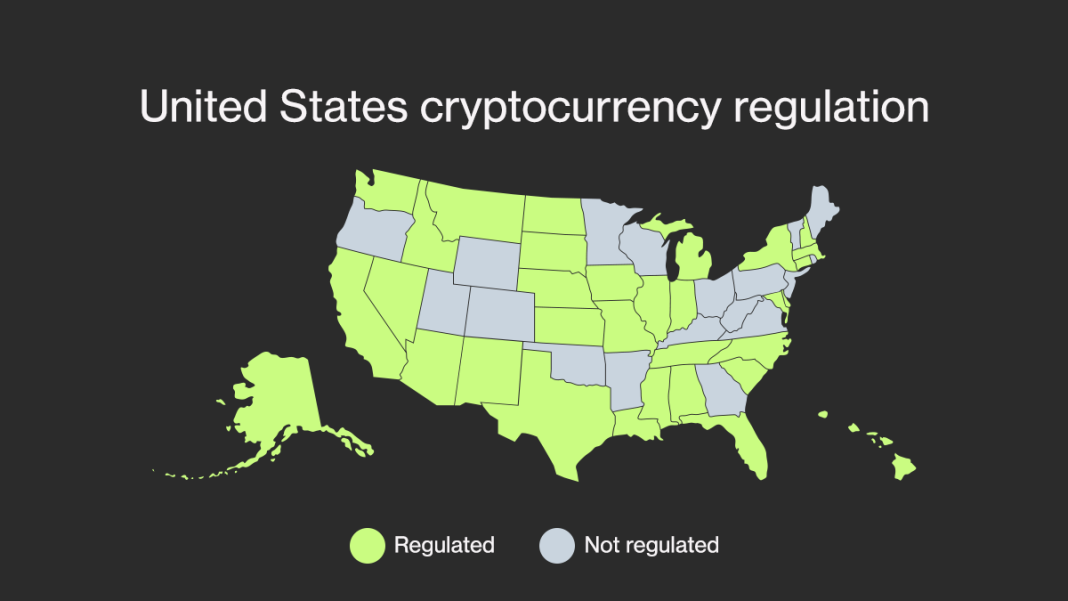

Despite the positive momentum generated by recent regulatory discussions, the digital asset market faces numerous challenges that need to be addressed. The fragmentation of existing regulations across states and federal jurisdictions has resulted in operational hurdles for crypto companies striving to maintain compliance. This inconsistency not only limits the operational scope of these companies but also adds an element of uncertainty for investors.

Additionally, technological advancements within the sector, including developments in decentralized finance (DeFi) and Non-Fungible Tokens (NFTs), introduce further complications for regulators attempting to establish clear guidelines. Adapting to these innovations while ensuring investor protection remains a delicate balancing act for lawmakers, one that necessitates ongoing collaboration between regulatory bodies and industry experts.

Regulatory Risks and Opportunities in Crypto

Navigating the complex landscape of regulatory risks and opportunities in the crypto sector requires vigilance from both investors and companies. The potential for swift regulatory changes can pose threats to established business models, yet it also offers opportunities for innovators to shape the future dynamics of finance. Industry leaders are increasingly advocating for clear guidelines that delineate the roles of various stakeholders, which could help mitigate regulatory uncertainties.

At the same time, proactive engagement with regulators can empower crypto firms to advocate for frameworks that encourage innovation. By participating in the legislative conversation, these companies can ensure that their voices are heard, fostering a more welcoming environment for technological advancements. Successful navigation of these regulatory waters could position firms to take full advantage of emerging opportunities while maintaining compliance with evolving legal standards.

Frequently Asked Questions

What was discussed during the White House crypto meeting regarding U.S. crypto legislation?

During the recent White House crypto meeting, key discussions focused on breaking the regulatory stalemate surrounding U.S. digital asset legislation. Representatives from the crypto industry, major banks, and policymakers collaborated to advance the Digital Asset Market CLARITY Act and improve market structure, particularly regarding stablecoin regulations. This bipartisan effort aims to provide more clarity to investors and firms within the U.S. crypto market.

How does bipartisan momentum for U.S. crypto legislation impact the market?

The bipartisan momentum for U.S. crypto legislation significantly impacts the market by signaling potential regulatory clarity and stability. As lawmakers from both parties engage in discussions over digital asset regulation, stakeholders in the crypto space gain confidence that a cohesive framework will be established. This could lead to increased institutional investment and broader acceptance of cryptocurrencies within the financial system.

What role did major banks play in the White House’s stablecoin discussions?

Major banks, including Goldman Sachs, JPMorgan, Bank of America, and others, played a critical role in the White House’s stablecoin discussions. They presented written principles regarding the regulation of stablecoins and engaged in negotiations about permissible activities. The involvement of these banks underscores the importance of traditional financial institutions in shaping the regulatory approach to digital assets.

Why is the Digital Asset Market CLARITY Act significant for U.S. crypto legislation?

The Digital Asset Market CLARITY Act is significant for U.S. crypto legislation as it aims to establish a comprehensive federal regulatory framework for digital assets. By clearly defining the roles of the SEC and CFTC in regulating cryptocurrencies and digital commodities, this legislation seeks to bring stability and clarity to the rapidly evolving crypto landscape, fostering innovation and investor protection.

What outcomes are expected from the recent bipartisan crypto talks initiated by the White House?

The outcomes expected from the recent bipartisan crypto talks include the advancement of regulatory clarity for digital assets and a potential agreement on stablecoin oversight. If successful, these discussions could lead to formal legislative action that establishes a coherent market structure, ultimately benefiting investors and fostering growth in the U.S. crypto market.

How could the latest White House meetings influence future U.S. digital asset policy?

The latest White House meetings could significantly influence future U.S. digital asset policy by facilitating collaboration between industry leaders and lawmakers. The constructive discussions emphasize the need for regulatory clarity, which could result in meaningful reforms to existing laws, enhance investor confidence, and position the U.S. as a leader in digital asset innovation globally.

| Key Points | Details |

|---|---|

| Bipartisan Momentum | Intensified discussions among White House, industry leaders, and banks regarding U.S. crypto legislation. |

| Blockchain Association’s Statement | CEO Summer Mersinger emphasized the importance of bipartisan efforts in advancing a digital asset market structure. |

| Ripple’s Legal Analysis | Stuart Alderoty mentioned productive dialogue and highlighted the urgent need for regulatory clarity. |

| White House Meetings | Two key meetings focused on resolving stablecoin oversight and digital asset market structure. |

| Digital Asset Market CLARITY Act | Aiming to provide a federal regulatory framework, yet its progress is stalled in the Senate. |

Summary

U.S. crypto legislation is gaining significant traction as the White House engages with industry leaders and policymakers to navigate regulatory challenges. The collaborative efforts indicate a shared commitment to establishing a clear framework for digital assets, which is essential for positioning the United States as a leader in cryptocurrency innovation. Ongoing discussions among key stakeholders, including banks and tech firms, seek to overcome existing legislative hurdles and ensure a roadmap that fosters both consumer protection and market growth.