Swift access to blockchains is enabling banks to connect public and permissioned ledgers without replacing core infrastructure. By leveraging Swift ISO 20022 blockchain integration, financial institutions can trigger on-chain actions through Chainlink CRE, linking traditional messaging to smart contracts. In pilot programs with UBS Tokenize, the tokenized funds UBS Tokenize initiative demonstrated on-chain fund workflows triggered by ISO 20022 messages routed across Swift. This approach is designed to advance banking sector blockchain interoperability, reducing friction between off-chain rails and on-chain processes. As a plug-and-play model, it promises easier compliance automation and broader access to tokenized assets without disrupting existing systems.

Viewed through an LSI lens, this development reads as a bridge between traditional banking rails and modern distributed ledgers, enabling on-chain actions from familiar messaging channels. Alternative terms such as ISO 20022-driven blockchain interfaces, off-chain to on-chain fund workflows, and tokenized asset platforms emerge as natural extensions of interoperability in the financial sector. By pairing established standards with programmable contracts, firms can explore new asset classes and fund administration without overhauling core systems. The trend supports broader banking sector blockchain interoperability by aligning legacy processes with decentralized technologies, paving a scalable path for tokenized funds and digital asset services. In short, traditional lenders may validate and settle blockchain-based activities within familiar workflows, signaling a more connected financial ecosystem.

Swift ISO 20022 blockchain integration: opening doors to cross-system access

Swift ISO 20022 blockchain integration is enabling banks to initiate on-chain actions without replacing core infrastructure, using CRE as the bridge between legacy messaging and blockchain logic. This approach leverages Swift’s established standards to connect traditional financial networks with modern tokenized fund ecosystems, creating a smoother pathway for innovation.

By tapping into the installed base of Swift, the initiative promotes banking sector blockchain interoperability. This setup supports on-chain fund workflows while preserving existing payment rails, reducing the risk and complexity typically associated with new blockchain integrations.

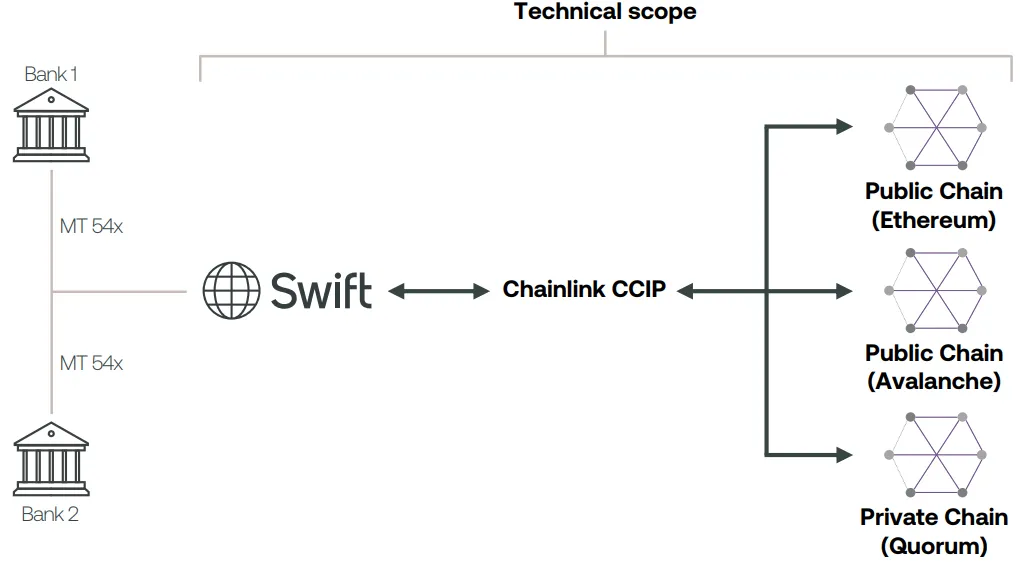

Chainlink CRE enables banks to reach public and permissioned blockchains

Chainlink CRE acts as a connective layer that translates ISO 20022 cues into smart-contract triggers. This enables banks and service providers to interact with both public blockchains and permissioned ledgers without overhauling their infrastructure.

The CRE-enabled bridge facilitates access to diverse blockchain networks, reinforcing banking sector blockchain interoperability and expanding the potential for tokenized services within traditional fund operations.

UBS Tokenize pilot: tokenized funds in action through CRE and ISO messaging

UBS Tokenize, UBS’s in-house tokenization unit, participated in a pilot where subscriptions and redemptions for a tokenized fund smart contract were initiated by ISO 20022 messages across Swift. The test demonstrates how tokenized assets can move between on-chain and off-chain systems using standard financial messaging.

CRE received the messages and triggered fund workflow logic in the Chainlink Digital Transfer Agent (DTA), enabling on-chain fund workflows and tokenized fund settlement within a controlled pilot environment.

A plug-and-play model for transfer agents and intermediaries

Chainlink described the messaging-to-smart-contract link as a plug-and-play model for transfer agents and other intermediaries. This design aims to streamline integration, letting existing participants adopt blockchain-enabled processes without bespoke overnight changes.

The plug-and-play approach supports easier compliance automation and reconciliation by shifting more of the fund workflow onto the blockchain, reducing manual handoffs and potential reconciliation gaps.

From off-chain rails to on-chain fund processes

The demonstration showcased connecting offchain banking rails with onchain fund processes, bridging traditional settlement mechanisms with blockchain-backed workflows. This alignment helps reconcile timing and settlement between disparate systems.

By linking ISO 20022 messaging to on-chain logic via CRE, the project highlights how off-chain cash settlement can align with on-chain fund subscriptions and redemptions, expanding the reach of tokenized fund services.

Global funds industry outlook: Swift-CRE collaboration and interoperability

Chainlink framed the effort as relevant to the global funds industry, signaling a broader adoption path for tokenized fund services across asset managers and custodians. The collaboration aims to scale the model beyond UBS Tokenize to additional participants.

Leveraging Swift’s installed base reinforces banking sector blockchain interoperability, opening possibilities for standardized interfaces and faster experimentation with tokenized funds across markets and jurisdictions.

Compliance automation and reconciliation on the blockchain layer

Chainlink indicated that placing more of the fund workflow on-chain could simplify compliance automation and improve reconciliation accuracy. Moving governance and settlement steps to the blockchain reduces manual checks and speeds up cycle times.

As more processes migrate onto the chain, firms can leverage DTA standards and ISO messaging to maintain traceability, auditability, and control over tokenized fund operations while preserving regulatory alignment.

Timelines, pilots, and potential asset managers: what to expect

Chainlink did not disclose timelines for production rollouts or name additional asset managers beyond UBS Tokenize in the current briefing. The pilot serves as an empirical baseline for assessing feasibility, scalability, and governance requirements.

Future expansions will likely involve more asset managers and diverse fund structures, testing the resilience of CRE-driven on-chain fund workflows across different asset classes and market environments.

Project Guardian lineage: Singapore MAS experiments informing CRE-Swift work

The initiative builds on prior work with Swift and UBS under the Monetary Authority of Singapore’s Project Guardian in 2024, which explored tokenized fund orders and offchain cash settlement using existing payment rails. This context helps explain the practicality and governance considerations of the CRE approach.

That earlier project laid groundwork for on-chain settlement mechanisms that CRE can leverage, reinforcing interoperability goals and reducing the friction of bringing tokenized assets into mainstream banking operations.

Future of finance: Swift meets smart contracts and tokenized funds

The initiative signals a future where traditional banking messaging interfaces can drive smart-contract logic without disrupting established processes. This convergence points to new capabilities for fund managers, custodians, and service providers working with tokenized funds.

For the banking sector, this means deeper banking sector blockchain interoperability, more seamless on-chain fund workflows, and broader access to tokenized fund services, all enabled by the interplay of Swift, CRE, and Chainlink.

Frequently Asked Questions

How does Swift access to blockchains via ISO 20022 blockchain integration with Chainlink CRE work?

Swift access to blockchains via ISO 20022 blockchain integration lets banks trigger on-chain actions using standard ISO 20022 messages without replacing core infrastructure. Chainlink CRE receives these Swift messages and invokes on-chain processes through the Chainlink Digital Transfer Agent (DTA), enabling on-chain fund workflows. This approach was demonstrated in a pilot with UBS Tokenize.

What are on-chain fund workflows in the context of Swift ISO 20022 blockchain integration?

On-chain fund workflows describe subscriptions and redemptions that are initiated and managed by smart contracts on the blockchain when ISO 20022 messages are sent via CRE. The setup connects off-chain banking rails with on-chain fund processes, improving transparency and reconciliation.

What role did UBS Tokenize play in the Swift-to-blockchains pilot?

UBS Tokenize served as the tokenization unit in the pilot. Subscriptions and redemptions for a tokenized fund smart contract were initiated by ISO 20022 messages across Swift and handled by Chainlink CRE.

Who is Chainlink CRE and how does it enable banking sector blockchain interoperability?

Chainlink CRE is the component that bridges Swift ISO 20022 messages to on-chain actions, enabling banking sector blockchain interoperability by allowing banks and service providers to access public or permissioned blockchains without replacing core infrastructure.

Why is this Swift to blockchain approach significant for tokenized funds and banking interoperability (e.g., UBS Tokenize)?

It lowers barriers to experimenting with tokenized funds like UBS Tokenize by leveraging existing Swift workflows, supports interoperability across banking systems, and can improve automation, compliance, and reconciliation by moving more fund workflows on-chain.

Are there timelines for production rollouts of this Swift-to-blockchain integration?

Chainlink did not disclose production rollout timelines or additional asset managers beyond UBS Tokenize, as of the announcement.

What is the key takeaway of ‘Swift meets smart contracts’ for the future of finance?

The initiative presents a plug-and-play model that connects legacy banking rails with on-chain fund processes, enabling easier testing and deployment of blockchain-enabled services in the global funds industry.

| Aspect | Key Points | Notes |

|---|---|---|

| Initiative Purpose | Banks can use Swift to access blockchains via CRE without replacing core infrastructure; ISO 20022 messages can initiate onchain actions. | Announced in Frankfurt; extends prior work with Swift and UBS under Project Guardian (2024); aims to connect offchain rails with onchain fund processes. |

| Pilot Details | UBS Tokenize pilot; subscriptions and redemptions for a UBS tokenized fund smart contract initiated by ISO 20022 messages across Swift; CRE handles messages and triggers fund workflow logic (DTA) on-chain. | Demonstration bridges offchain banking rails with onchain fund processes; plug-and-play model for transfer agents and intermediaries; aims to simplify compliance automation and reconciliation onchain. |

| Architecture & Tech | CRE processes messages; DTA standard executes fund workflow; messages from Swift lead to onchain actions; interacts with blockchain apps via existing tools and identity frameworks. | Extension of 2024 Project Guardian; tokenized fund settlement concept involves offchain cash settlement. |

| Scope & Timeline | No production rollout timelines disclosed; no additional asset managers named beyond UBS Tokenize. | Global funds industry relevance; described as a test drive. |

| Impact & Vision | Aims to lower barriers to experimenting with tokenized funds; places more workflow onchain; plug-and-play model for transfer agents and intermediaries; leverages Swift’s installed base and identity frameworks. | Describes an ecosystem approach to modernizing fund processes by integrating traditional messaging with blockchain workflows. |

| Notable Detail / Quote | “Swift meets smart contracts, and UBS gets a test drive.” | Highlights the shift toward onchain fund processing using established messaging systems. |