Bitcoin mining revenue September has cooled modestly from August, with preliminary data showing a 4.23% drop that translates to roughly $69 million less in a single month, a signal that even established operations faced tighter financial headwinds as market momentum waned. Nonetheless, miners remain focused on sustaining cash flow through efficient deployments and careful cost control, a reality that underscores Bitcoin mining profitability as operators chase meaningfully better unit economics in an environment where every kilowatt-hour counts. The note of caution is tempered by evidence of resilience in SHA-256 hashrate, with network power hovering near historically elevated levels and suggesting that the backbone of block production remains robust even as revenue per block compresses. Industry watchers are paying attention to the Bitcoin mining difficulty forecast, which hints at a potential adjustment path higher as continuous hashing activity drives epoch cadence and the mining landscape adapts to the evolving economics. With blocks continuing to unlock the subsidy, the coming weeks could see a shift toward more efficient rigs and smarter energy strategies.

In broader terms, the September episode underscores how block subsidies, fee income, and power efficiency converge to shape the income narrative for cryptocurrency miners. Analysts describe the same story using phrases like network hashing capacity, reward economics, and the cost-to-revenue ratio, all pointing to a resilient but competitive mining ecosystem. The emphasis shifts from raw revenue to how hardware selection, energy costs, and market dynamics interact with the difficulty trajectory to set near-term profitability expectations. Overall, the data invites operators to optimize rigs, cooling, and site-level economics to remain viable as the difficulty and rewards adjust over time.

Bitcoin mining revenue September: Analyzing the September Slump in Miner Returns

September’s revenue slump shaved roughly 4.23% off miners’ cash flow, a drop of about $69 million versus August. The SHA-256 hashrate market shows a spot value of around $52.10 per PH/s, down from $53.15 recorded earlier in September, signaling a tighter environment for mining economics.

Most of September’s revenue remained anchored in Bitcoin block rewards, with approximately $1.550 billion coming from the subsidy and only a modest $14 million sourced from onchain fees. Even as revenue declined, the 24-hour average onchain fees represented a small portion of total rewards, highlighting how profitability in the near term continues to hinge on the block subsidy rather than transaction fees.

SHA-256 Hashrate Trends and Their Impact on Bitcoin Block Rewards

The SHA-256 hashrate rose to about 1,065.53 EH/s, underscoring the network’s strength even as revenue softened. The peak for September reached roughly 1,109 EH/s, illustrating the competitive landscape miners face as they compete for block rewards.

As hashrate climbs, mining profitability becomes increasingly sensitive to energy costs and equipment efficiency. In a high-hashrate environment, only highly efficient rigs with favorable power economics can sustain healthy margins.

Bitcoin Mining Difficulty Forecast: Short-Term Projections for September Epochs

A 4.63% to 5.9% difficulty hike has been forecast for today as the 2,016-block epoch progresses, with blocks arriving faster than the standard ten-minute cadence.

The Bitcoin mining difficulty forecast remains tentative and could shift as soon as the next blocks fall into place. Miners are watching these adjustments closely, since even small changes in difficulty can impact profitability and equipment utilization.

Onchain Fees’ Role in Miner Revenue and Market Dynamics

Onchain fees contributed about $14 million of September’s revenue, a fraction of the total, and well under 1% of the block rewards. This underscores how mining profitability is still primarily driven by the block subsidy rather than transaction fees.

While onchain fee income can grow with network activity, the near-term impact on overall profitability remains modest relative to the dominant role of Bitcoin block rewards in monthly earnings.

Bitcoin Block Rewards: Core Driver of September Revenue

Block rewards dominated September’s earnings, with the subsidy alone totaling about $1.595 billion of the roughly $1.61 billion mined that month.

That reliability underpins Bitcoin mining profitability by providing a steady baseline even as other income streams fluctuate. Nevertheless, the looming rise in difficulty continues to pressure margins for less efficient operators.

Comparing August and September: Revenue Trajectories for Bitcoin Miners

September’s revenue of $1.564 billion represents a $69 million decline from August’s $1.633 billion, highlighting a softer month for miners.

This drop underscores how miners are exposed to the interplay of block rewards, onchain fees, and hash power dynamics. September then trails July’s metrics, emphasizing the fragile balance in monthly revenue.

Hashrate Mobility: How Rapid Epochs Shape Efficiency and Margins

The network’s hashrate movement—up to 1,065.53 EH/s—combined with a 9 minutes 26 seconds average block cadence, illustrates the ongoing efficiency race as epoch times compress.

Miners must continually optimize energy usage and compute efficiency, as margins tighten with faster epochs and persistent hash power growth. Lean operations and smarter cooling and power strategies become vital to sustaining profitability.

Market Valuation of Hashrate: Spot Price of SHA256 Hashrate and What It Means

The spot value of SHA256 hashrate stood at $52.10 per PH/s, a modest drop from $53.15 earlier in September, signaling a cautious investment climate for new mining capacity.

This valuation influences decisions around equipment upgrades and expansion, intersecting with Bitcoin mining profitability and the trajectory of the Bitcoin mining difficulty forecast.

Mining Profitability Amid Slower Growth: Earnings From Fees vs Rewards

Onchain fees remain a minor share of revenue—roughly 0.65% of the daily block rewards—emphasizing that most income still comes from Bitcoin block rewards.

As network activity evolves, fee income could rise, but profitability in the near term will likely continue to hinge on the block subsidy and efficiency improvements in power usage and hardware.

Operational Implications for Rigs in a Lean Margin Environment

With margins under pressure and rising difficulty, only lean operations will sustain profitability. Miners are pressured to prioritize energy efficiency, reliability, and cost controls.

This environment accelerates the push for newer, more efficient SHA-256 hashrate hardware and smarter deployment strategies to keep expenses aligned with revenue under tighter market conditions.

Epoch Pace and Difficulty: Potential Outcomes for The Next 1-2 Epochs

As the 2,016-block epoch continues, a potential 4.63% to 5.9% difficulty hike could alter the balance of revenue and costs, affecting mining economics.

Miners and analysts will monitor block cadence and hash rate growth to gauge whether difficulty adjustments will overshoot or undershoot forecasts, shaping decisions on equipment utilization and investment.

Year-to-Date Context: September’s Performance Relative to July and August

September’s metrics trailed July’s totals and even August’s performance, with the monthly total around $1.61 billion and block rewards representing the vast majority of that sum.

The year-to-date picture shows a volatile mix of rising hashrate, modest onchain fee income, and a strong block reward backbone that supports overall mining profitability even as currencies and margins oscillate.

Frequently Asked Questions

What was Bitcoin mining revenue September, and how did it compare to August?

Bitcoin mining revenue September declined 4.23% to about $1.564 billion, down from $1.633 billion in August. Most of September’s revenue came from Bitcoin block rewards (roughly $1.550 billion), with onchain fees contributing a modest ~$14 million, reflecting tighter profitability even as activity remained high.

How did SHA-256 hashrate influence Bitcoin mining revenue September?

SHA-256 hashrate stood at about 1,065.53 exahashes per second (EH/s) in September, well above levels from 30 days prior. This elevated hashrate supported revenue generation despite the month’s decline, though profitability still faced pressure from higher difficulty forecasts.

What portion of Bitcoin mining revenue September came from block rewards versus onchain fees?

In September, the overwhelming majority of revenue came from Bitcoin block rewards—approximately $1.55 billion—while onchain fees contributed about $14 million, highlighting that block subsidies dominated Bitcoin mining revenue September.

What is the Bitcoin mining difficulty forecast for September’s epoch?

Bitcoin mining difficulty forecast for September suggested a potential 4.63% to 5.9% increase in difficulty as the epoch progressed, which could further influence mining profitability and the economics of Bitcoin mining revenue September.

How significant were onchain fees in Bitcoin mining revenue September?

Onchain fees were relatively small in September, totaling around $14 million and averaging about 0.65% of the block reward mix on a 24-hour basis, illustrating that most revenue still came from block rewards rather than fees.

How did block intervals and epoch pace affect Bitcoin mining revenue September?

Block intervals averaged roughly 9 minutes and 26 seconds in September, with the epoch pace accelerating miners toward completing more blocks per day. This faster cadence, combined with a high hashrate, helped sustain revenue levels even as overall profitability softened.

What is the overall takeaway for miners regarding September’s Bitcoin mining revenue and profitability?

The September period showed a modest revenue slip and a rising difficulty landscape, squeezing margins for some operators. Yet miners continued to operate at high hashrates, relying mainly on block rewards while onchain fees remained a small, steady contributor to Bitcoin mining revenue September.

| Aspect | September Highlights |

|---|---|

| Revenue (September) | $1.564B; down $69M vs August; -4.23% |

| Revenue Composition | Block rewards: $1.550B; On-chain fees: $14M |

| August comparison | August revenue: $1.633B; major portion from block rewards |

| Hashrate & network activity | Hashrate 1,065.53 EH/s in Sep; peak 1,109 EH/s; 9m26s block times |

| Block times / Epoch | 2,016-block epoch; blocks faster than standard 10 minutes |

| Difficulty projection | Possible 4.63%–5.9% increase; not guaranteed |

| Profitability / Margins | Leanest rigs likely to stay; margins squeezed; on-chain fees |

| Price per PH/s | Hashrate index value: $52.10/PH/s; down from $53.15 on Sept 1 |

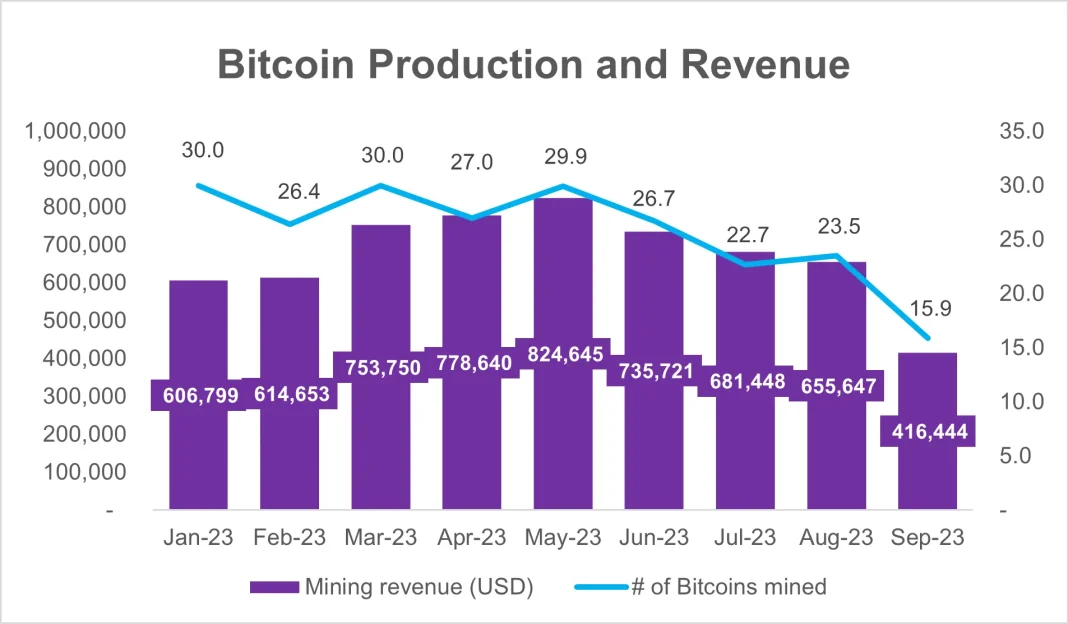

| Sources | Image source: newhedge.io; data from hashrateindex.com |

Summary

Bitcoin mining revenue September shows a modest decline as operators reported revenue slipping 4.23% to $1.564 billion. Block rewards remain the primary income driver, with about $1.550 billion from block rewards and $14 million from on-chain fees. Hashrate stays robust at 1,065.53 EH/s (peaking near 1,109 EH/s), with faster-than-expected block times around 9 minutes 26 seconds. The forecasted difficulty increase of roughly 4.63% to 5.9% adds to the sector’s headwinds, suggesting profitability will rely on leaner, more efficient rigs. Data sources include newhedge.io and hashrateindex.com.