Foresight Ventures unveiled a $50 million fund aimed at accelerating stablecoin infrastructure across issuance, rails, and compliance in a move announced from Singapore. The fund will back projects spanning stablecoin issuance and coordination, stablecoin rails, stablecoin compliance, and exchanges and liquidity, with support for stablecoin on/off-ramps and stablecoin payments. Managing Partner Alice Li said the goal is to support stablecoin integration with existing financial frameworks in a way that is seamless, compliant, and scalable, emphasizing ambitions for both retail and institutional adoption. Foresight also published research, including the report Stablecoin L1/L2: Defining the Next Era of Global Payments, profiling five stablecoin-native blockchains and outlining their strategies. The firm plans to pair capital deployment with its media network to encourage adoption across the broader stablecoin value chain.

Viewed through an LSI lens, the effort centers on fiat-backed digital currencies that act as a settlement layer for cross-network transfers, incorporating minting and issuance platforms, liquidity rails, and regulatory-ready custody. This framing bridges traditional finance and Web3, enabling payments, cross-border settlements, and merchant acceptance through interoperable rails. In practice, the focus is on scalable, interoperable ecosystems that connect conventional banking infrastructure with next-generation digital tokens.

Foresight Ventures Unveils a $50M Fund for stablecoin infrastructure: Backing Issuance, Rails, and Compliance

On Oct. 1, Foresight Ventures announced a $50 million fund dedicated to backing projects that build stablecoin infrastructure across issuance, rails, and compliance, with the announcement centered in Singapore.

The Stablecoin Infrastructure Fund aims to cover the full value chain—from stablecoin issuance and coordination to exchanges, liquidity, and compliant on- and off-ramps—while supporting payment-focused blockchains and applications tying stablecoins to real-world assets, artificial intelligence, onchain FX, and merchant acquiring. The firm also said it will pair capital deployment with its media network to accelerate adoption.

Stablecoin Issuance and Coordination Take Center Stage in Foresight’s Strategy

The fund targets projects spanning issuance and coordination, exchanges and liquidity, compliant on- and off-ramps, and payment-focused blockchains, aligning with a comprehensive approach to stablecoin infrastructure.

Since 2023, Foresight has backed Ethena, Noble, Codex, Agora, and WSPN, underscoring a thesis that stablecoins serve as a conduit between traditional finance (TradFi) and Web3 and are evolving into a settlement layer for global payments.

Building Stablecoin Rails and On/Off-Ramps for Mainstream Adoption

A core focus is constructing robust stablecoin rails—the liquidity networks and routing paths that move tokens between wallets, exchanges, and merchants.

Strengthening stablecoin on/off-ramps helps facilitate smoother fiat-to-digital-asset transitions, enabling broader retail and institutional use and reducing entry barriers for new participants in the ecosystem.

Stablecoin Compliance as a Core Pillar for Retail and Institutional Adoption

Managing Partner Alice Li emphasized that the goal is to integrate stablecoin ecosystems with existing financial frameworks in a way that is seamless, compliant, and scalable.

A strong emphasis on stablecoin compliance aims to reduce regulatory friction as adoption grows across both retail and institutional segments, supporting safer and more transparent market participation.

Payment-Focused Blockchains and the Stablecoin Payments Ecosystem

The fund will back payment-focused blockchains and applications that tie stablecoins to real-world use cases, including merchant acquiring and cross-border payments.

With a focus on stablecoin payments, the initiative seeks to unlock new commerce opportunities for merchants and customers alike, accelerating the integration of digital currencies into everyday transactions.

Stablecoin L1/L2 Research and Its Global Payments Framework

Foresight released ‘Stablecoin L1/L2: Defining the Next Era of Global Payments,’ profiling five stablecoin-native blockchains—Plasma, Stable, Codex, Noble, and 1Money—and detailing their strategies and technical progress.

The study signals a research-driven approach to capital allocation, aiming to support protocols with scalable payment rails and cross-border capabilities that align with the fund’s broader thesis.

TradFi Meets Web3: The Settlement-Layer Vision for Stablecoins

The firm frames stablecoins as a conduit between traditional finance and Web3 and describes them as evolving into a settlement layer for global commerce.

This vision supports seamless integration with existing financial frameworks, risk controls, and faster settlement for both retail and institutional users, advancing stablecoins as a practical settlement medium.

Portfolio Momentum: Ethena, Noble, Codex, Agora, and WSPN Backing

Since 2023, Foresight has backed several projects in the stablecoin segment, including Ethena, Noble, Codex, Agora, and WSPN.

The fund’s strategy pairs capital deployment with its media network to accelerate stablecoin infrastructure adoption across issuance, rails, compliance, and payments ecosystems.

Real-World Asset Tie-Ins, AI, and Onchain FX in Stablecoin Infrastructure

The fund supports applications tying stablecoins to real-world assets and to emerging technologies like artificial intelligence and onchain foreign exchange.

Such tie-ins broaden the use cases for stablecoins and strengthen stablecoin payments and cross-border settlement within a scalable, compliant framework.

Roadmap and Global Adoption: Scaling Stablecoin Infrastructure

The path forward emphasizes a scalable, compliant trajectory toward broad adoption, guided by a rigorous research-driven framework for capital allocation.

While deployment timelines were not disclosed, the fund aims to accelerate stablecoin issuance, rails, and on/off-ramps across retail and institutional segments, positioning stablecoins as a widely used settlement asset.

Frequently Asked Questions

What is stablecoin infrastructure and what components does it include, such as stablecoin issuance, rails, compliance, and payments?

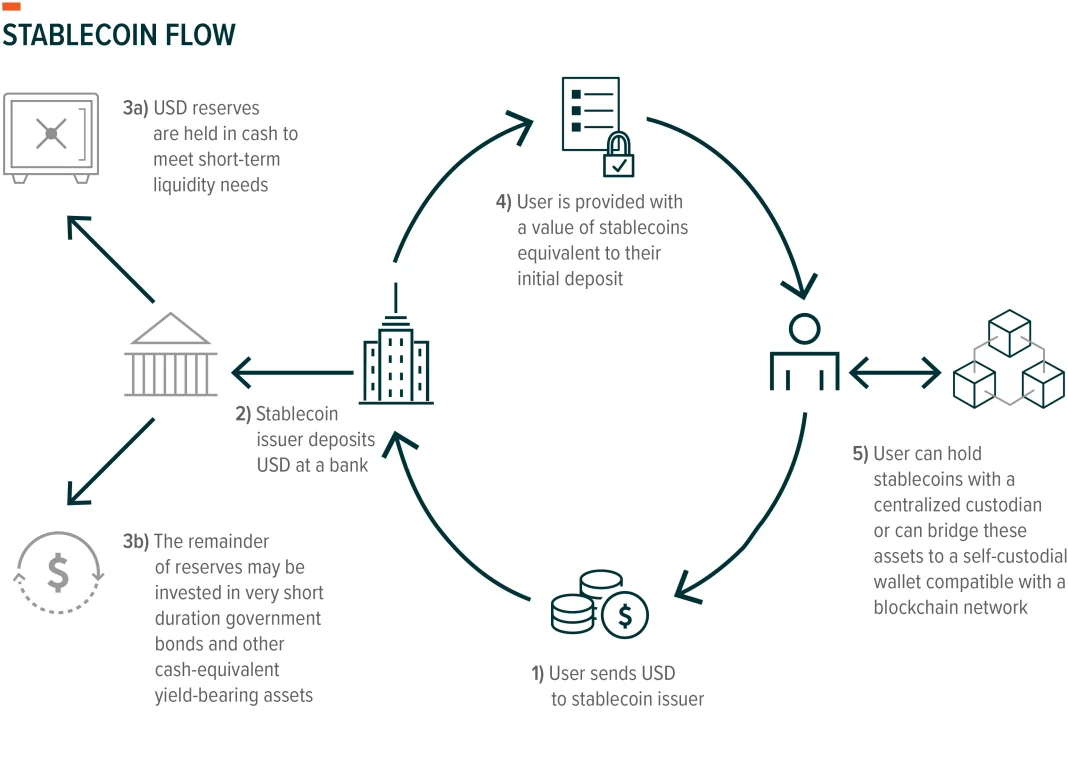

Stablecoin infrastructure is the framework that enables the creation, movement, and use of stablecoins. Key components include stablecoin issuance, rails for interoperable settlement with traditional finance, compliance measures, and stablecoin payments, along with on‑ and off‑ramps that let users enter and exit the system.

How does stablecoin issuance fit into a broader stablecoin infrastructure?

Stablecoin issuance is the process of creating a token pegged to a stable asset. In infrastructure terms, issuance must work with rails, liquidity, and compliance to ensure reliable onboarding and settlement across the ecosystem.

What are stablecoin rails and why are they important in stablecoin infrastructure?

Stablecoin rails are the underlying networks and processes that connect issuance with exchanges, banks, and payment systems. They enable fast, compliant settlement and interoperability across TradFi and Web3 within the infrastructure.

Why is stablecoin compliance essential for building robust stablecoin infrastructure?

Stablecoin compliance ensures that creation and use of stablecoins align with regulatory standards, reducing risk for issuers, users, and counterparties. It covers KYC/AML, licensing, reporting, and auditability within the infrastructure.

How do stablecoin on/off-ramps work within stablecoin infrastructure?

Stablecoin on-ramps and off-ramps are the entry and exit points for converting fiat to stablecoins and back. Building compliant on/off-ramps often involves partnerships with payment processors, banks, and exchanges and is a core part of the infrastructure.

What role do stablecoin payments play in infrastructure and how do they connect to real-world assets?

Stablecoin payments enable merchant transactions, cross‑border settlements, and programmable value transfer within the infrastructure. They support real‑world asset integrations and can tie stablecoins to payment-focused blockchains and commerce use cases.

What did the $50 million Foresight Ventures fund target in the stablecoin infrastructure space?

On Oct. 1, Foresight Ventures unveiled a $50 million fund to back the stablecoin infrastructure value chain, including issuance, rails, and compliant on-/off-ramps, as well as payments. The fund aims to support projects spanning issuance and coordination, exchanges and liquidity, and real‑world asset and payment‑focused applications, signaling a research‑driven approach to scaling adoption.

| Key Point | Summary |

|---|---|

| Fund size and objective | $50 million fund unveiled on Oct. 1 in Singapore to back stablecoin infrastructure across issuance, rails, and compliance. |

| Scope | Targets projects spanning issuance/coordination, exchanges/liquidity, compliant on- and off-ramps, and payment-focused blockchains. |

| Additional focus | Applications tying stablecoins to real-world assets, AI, onchain foreign exchange, and merchant acquiring. |

| Coverage | Covers the entire stablecoin value chain; described as an industry first; limited partners, deployment timelines, and target check sizes not disclosed. |

| Track record | Since 2023, backed projects like Ethena, Noble, Codex, Agora, and WSPN; part of a thesis that stablecoins link TradFi and Web3 and serve as a settlement layer. |

| Mission | Aim to integrate stablecoin infrastructure with existing financial frameworks in a seamless, compliant, and scalable way, pursuing both retail and institutional adoption. |

| Research component | Launched the report “Stablecoin L1/L2: Defining the Next Era of Global Payments,” profiling five stablecoin-native blockchains and outlining their strategies and progress; signals a research-driven approach to capital allocation. |

| Strategic outlook | Plans to pair capital deployment with its media network to accelerate adoption. |

Summary

Stablecoin infrastructure overview table completed. The content highlights a $50M fund by Foresight Ventures targeting the full stablecoin value chain, including issuance, rails, and compliance, with a research-driven, industry-first approach to capital allocation.