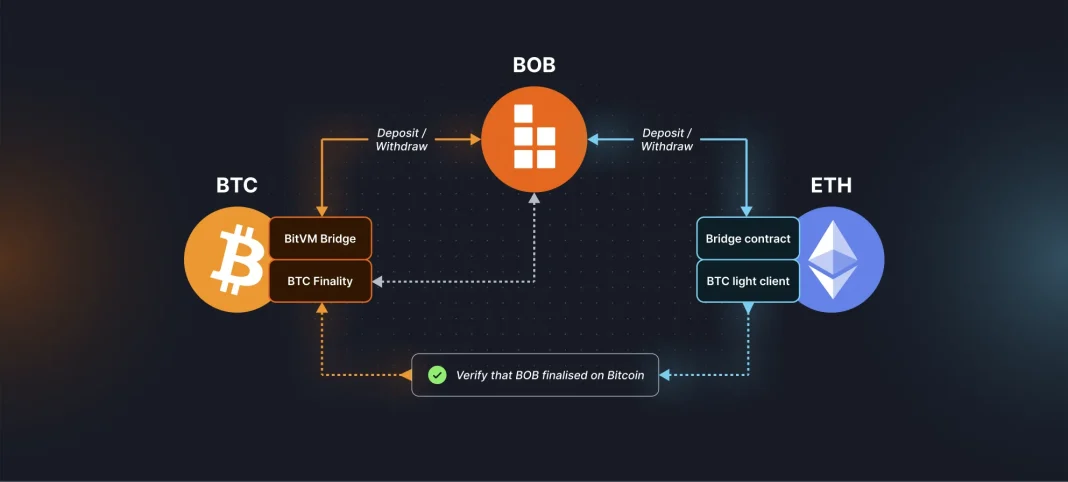

Hybrid L2 BTC transfers are accelerating as BOB enables one-click native BTC moves across multiple networks. Built on Bitcoin (BOB), a hybrid Layer-2 blockchain, the system pairs on-chain security with rapid settlement through the BOB Gateway. The BOB Gateway connects native BTC to wBTC.OFT across 11 LayerZero-supported blockchains, enabling cross-chain BTC transfers through LayerZero OFT standards. This approach replaces complex bridging with a streamlined conversion, injecting fresh Bitcoin DeFi liquidity into participating ecosystems while preserving custody backing. Industry voices emphasize improved access and user experience as key benefits of a more direct cross-chain flow.

From an LSI-informed view, the topic centers on interoperable Bitcoin movement across Layer-2 rails rather than traditional bridges. By enabling native BTC to interact with wrapped tokens, such as wBTC.OFT, the system opens liquidity channels for decentralized finance. This approach reduces custody complexity while expanding access to BTC-enabled liquidity across multiple ecosystems and onramps. As adoption grows, the conversation pivots to scalable, user-friendly gateways and standardized token representations that support broader Bitcoin DeFi activity.

Hybrid L2 BTC transfers: One-Click Native BTC Across 11 Major Chains

Hybrid L2 BTC transfers enable one-click native BTC movements across 11 major chains by uniting Bitcoin on BOB with LayerZero-enabled ecosystems. Built on Bitcoin (BOB), this approach delivers seamless cross-chain BTC transfers that bypass traditional bridge complexities while expanding access to multi-chain liquidity.

The update leverages BOB Gateway to connect native BTC to BitGo’s wBTC.OFT across LayerZero-supported networks, including Ethereum, Avalanche, Base, BNB Chain, Unichain, Optimism, Sei, and BOB. This setup accelerates native BTC-to-wBTC.OFT conversions and unlocks Bitcoin DeFi liquidity across the wider DeFi landscape.

BOB Gateway: Connecting native BTC to wBTC.OFT on LayerZero OFT

BOB Gateway serves as the one-click on- and off-ramp that links native BTC to BitGo’s wBTC.OFT across LayerZero-enabled ecosystems. This bridge-free pathway enables fast, direct BTC transfers and simplifies onboarding for users seeking cross-chain DeFi access.

By adopting LayerZero OFT standards, the gateway preserves custody-backed guarantees for every wBTC token while enabling native BTC to flow smoothly into DeFi protocols. This drives broader Bitcoin DeFi liquidity and makes cross-chain flows more user-friendly for developers and investors alike.

LayerZero OFT and 11 Chains Expand Bitcoin DeFi Liquidity

LayerZero OFT provides the interoperable messaging and token-transfer backbone that unlocks cross-chain BTC movement across 11 chains. This standard supports secure, scalable native BTC to wBTC.OFT transfers and reduces interoperability friction among diverse ecosystems.

With broader chain support—ranging across Ethereum, Avalanche, Base, and more—the platform expands Bitcoin DeFi liquidity by enabling direct BTC deposits and settlements within DeFi apps. The result is a richer, multi-chain liquidity pool for Bitcoin-native users and projects.

Cross-Chain BTC Transfers Become Seamless with 1-Click Bridging

Cross-chain BTC transfers are now more accessible as bridging complexity is replaced by a streamlined 1-click conversion workflow. The BOB Gateway minimizes friction and accelerates liquidity movement across LayerZero-enabled networks.

Developers can leverage the Gateway SDK to enable direct Bitcoin deposits in participating protocols, unlocking liquidity and expanding the scope of Bitcoin-based DeFi across multiple chains. This streamlined flow supports faster settlement and improved user experiences.

Native BTC to wBTC.OFT: Custody-Backed, Regulated, and Ready for DeFi

Native BTC to wBTC.OFT transfers preserve custody backing for every token, aligning with regulated standards in cross-chain finance. This custody model underpins trust as Bitcoin moves across ecosystems via LayerZero OFT corridors.

The regulated custody approach reduces risk while enabling DeFi applications to reliably accept Bitcoin deposits across networks. By combining custody guarantees with cross-chain compatibility, the system supports safer multi-chain DeFi exposure.

Bitcoin DeFi Liquidity Grows Through Instant Transfers Across LayerZero Ecosystems

Bitcoin DeFi liquidity expands as instant BTC ↔ wBTC.OFT moves unlock new capital across 11 LayerZero-enabled ecosystems. The rapid settlement facilitates more efficient use of Bitcoin within DeFi protocols.

This liquidity growth enables thousands of DeFi strategies—collateralization, yield farming, and liquidity provision—by providing BTC-friendly routing and settlement capabilities across diverse networks.

Expanded Onramps to Bitcoin DeFi: Soneium, Bera, Sonic, and Beyond

Expanding onramps to Bitcoin DeFi includes chains such as Soneium, Bera, Sonic, and other LayerZero-supported networks. These additions broaden the reach for native BTC transfers and increase Bitcoin DeFi liquidity across more ecosystems.

As onramps grow, developers gain more gateways for cross-chain BTC transfers, enabling smoother conversions from native BTC to wBTC.OFT and vice versa. The expanded network effect accelerates Bitcoin’s presence in DeFi markets.

The BOB Gateway’s Role in Cross-Chain Flows and User Experience

The BOB Gateway optimizes cross-chain flows by delivering one-click transfers and simplifying custody across networks. This enhances usability for both retail and institutional users participating in cross-chain Bitcoin activity.

Co-founders highlighted improved access and user experience as central benefits, noting that streamlined onboarding and frictionless transfers elevate Bitcoin’s role in multi-chain DeFi ecosystems.

Gateway SDK Integration: Enabling 15k dApps to Accept Direct BTC Deposits

Gateway SDK integration enables nearly 15,000 decentralized applications to accept direct Bitcoin deposits, expanding the practical use cases for native BTC in DeFi. This widespread capability accelerates cross-chain adoption across diverse protocols.

The SDK supports easy integration for developers, allowing apps to accept native BTC or wBTC.OFT deposits while maintaining custody safeguards. This drives Bitcoin DeFi liquidity by widening the pool of onramps and liquidity providers.

Future Outlook: Hybrid L2 BTC Transfers Shaping Cross-Chain Finance

Looking ahead, Hybrid L2 BTC transfers are poised to reshape cross-chain finance by accelerating native BTC movements and broadening multi-chain onramps for Bitcoin. The integration of Bitcoin intents with LayerZero OFT standards supports scalable, tokenized BTC across ecosystems.

As more chains come online and liquidity grows, the Bitcoin DeFi ecosystem stands to benefit from enhanced UX, deeper liquidity, and more robust interconnectivity between native BTC and DeFi protocols across LayerZero-connected networks.

Frequently Asked Questions

What are Hybrid L2 BTC transfers and how does BOB Gateway enable them?

Hybrid L2 BTC transfers combine native Bitcoin with Layer-2 efficiency to move BTC across ecosystems. BOB Gateway provides a one-click on/off ramp that connects native Bitcoin to BitGo’s wBTC.OFT across 11 LayerZero-supported chains, delivering instant native BTC ↔ wBTC.OFT transfers, expanded BTC liquidity for DeFi, and regulated custody backing for every wBTC token.

How do cross-chain BTC transfers work with LayerZero OFT and BOB Gateway in Hybrid L2 BTC transfers?

Cross-chain transfers use LayerZero OFT to carry wBTC.OFT tokens on destination chains. The BOB Gateway handles the cross-chain conversion with a simple one-click flow, replacing traditional bridging and enabling direct Bitcoin deposits via the Gateway SDK across supported chains (about 15k dapps).

What is native BTC to wBTC.OFT and why does it matter for Bitcoin DeFi liquidity in Hybrid L2 BTC transfers?

Native BTC to wBTC.OFT is Bitcoin represented as an OFT token on LayerZero across supported chains. It matters because it unlocks Bitcoin DeFi liquidity by enabling instant BTC transfers across chains while preserving custody backing for every wBTC token.

Which chains are supported by Hybrid L2 BTC transfers via BOB Gateway?

Hybrid L2 BTC transfers support 11 LayerZero-enabled chains, including Ethereum, Avalanche, Base, BNB Chain, Unichain, Optimism, Sei, and BOB. The platform continues expanding to additional chains like Soneium, Bera, and Sonic to broaden Bitcoin DeFi onramps.

How does BOB Gateway simplify cross-chain flows compared to traditional bridges?

BOB Gateway replaces complex bridging with a streamlined conversion, enabling instant native BTC ↔ wBTC.OFT transfers across 11 chains. It also enables roughly 15k dapps to accept direct Bitcoin deposits via the Gateway SDK, expanding Bitcoin DeFi liquidity with custody backing.

What is LayerZero OFT and how does it relate to Hybrid L2 BTC transfers?

LayerZero OFT is the Omnichain Fungible Token standard that enables cross-chain tokens. Hybrid L2 BTC transfers use LayerZero OFT to move BTC as wBTC.OFT across multiple chains, powered by the BOB Gateway.

How does Hybrid L2 BTC transfers preserve custody backing for every wBTC token?

BOB emphasizes regulated custody backing for every wBTC token, ensuring that the wrapped BTC on LayerZero remains securely backed by real BTC while enabling cross-chain liquidity.

How can developers integrate with Gateway SDK to accept direct Bitcoin deposits across supported chains?

Developers can integrate the Gateway SDK to enable direct BTC deposits (via native BTC and wBTC.OFT) across LayerZero-supported chains, allowing thousands of dapps to accept Bitcoin deposits with a simple one-click flow.

What is Bitcoin DeFi liquidity in the context of Hybrid L2 BTC transfers?

Bitcoin DeFi liquidity refers to BTC that can flow into DeFi protocols across LayerZero-supported chains through wBTC.OFT, increasing cross-chain Bitcoin liquidity and enabling broader access to Bitcoin-based DeFi.

What future expansions are planned for Hybrid L2 BTC transfers?

BOB plans to expand onramps to Bitcoin DeFi by adding more chains beyond the current 11, including Soneium, Bera, and Sonic, to broaden access and improve user experience.

| Key Point | Details |

|---|---|

| What is the BOB Gateway? | A one-click on- and off-ramp that connects native Bitcoin to BitGo’s wBTC.OFT across 11 LayerZero-supported blockchains. |

| Foundation | Built on Bitcoin (BOB), a hybrid Layer-2 (L2) blockchain. |

| Cross-chain coverage | Transfers across 11 LayerZero-supported blockchains, including Ethereum, Avalanche, Base, BNB Chain, Unichain, Optimism, Sei, and BOB. |

| Key technologies | Powered by BOB’s Bitcoin intents system and LayerZero’s OFT standard. |

| Impact on DeFi and apps | Gives nearly 15,000 dApps on those chains the ability to accept direct Bitcoin deposits via a Gateway SDK. |

| Liquidity and custody | Replaces complex bridging with streamlined conversion, injects fresh BTC liquidity into DeFi, while preserving regulated custody backing for every wBTC token. |

| Expansion and future chains | Expanded support for chains such as Soneium, Bera, Sonic and others to further onramps to Bitcoin DeFi. |

Summary

Conclusion: Hybrid L2 BTC transfers are reshaping cross-chain Bitcoin liquidity by enabling instant native BTC ↔ wBTC.OFT transfers across multiple ecosystems via the BOB Gateway. This approach simplifies cross-chain flows, boosts accessibility for roughly 15,000 decentralized applications, and strengthens Bitcoin DeFi by injecting liquidity while maintaining regulated custody backing. As LayerZero OFT standards converge with BOB’s Bitcoin intents system, onramps to Bitcoin DeFi are likely to expand further through additional chains like Soneium, Bera, and Sonic, driving broader adoption and smoother user experiences for developers and end users alike.