Tokenization in finance is redefining how assets are owned, traded, and settled across borders, enabling new structures that combine traditional custody with programmable rules and transparent, auditable ledgers, a shift backed by cryptographically secure records and interoperable standards that let multiple rails talk to each other, and governance models are evolving to address custody, taxation, and compliance across multiple jurisdictions. It blends decades of market infrastructure with emerging digital rails, promising greater transparency, fractional ownership, faster settlement cycles, and broader investor access regardless of location, while investors gain optionality through new portfolios and advanced risk analytics, and incumbents contemplate integration with legacy systems. Industry voices suggest real-time trading of tokenized assets could emerge, supported by settlement pipelines that reduce latency and enable 24/7 market participation, with custodians and regulators adapting to this new pace, while exchanges and banks explore settlement-native mechanisms and cross-border compliance, and regulatory sandboxes offer practical pilots. As these liquidity layers mature, price discovery could improve by exposing more participants to quantitative signals and the feedback loops that price formation depends on, potentially leveling the playing field for smaller entrants, improving hedging tools, and increasing funding efficiency for startups and established firms alike, while liquidity resilience and security considerations shape design choices. Analysts argue that cross-border liquidity will expand as digital rails unlock access to diverse asset classes, from securities to real assets, while standardization and interoperability become key drivers of scalable, global capital flows, supported by data-sharing, common taxonomies, and harmonized regulatory approaches, and market data, auditing, and dispute resolution mechanisms will be critical as assets move into tokenized formats.

A related strand of this trend emphasizes digital asset tokenization as the mechanism by which ownership is encoded on secure ledgers and carried through programmable rules. This approach uses token-based securities, blockchain-enabled securitization, and fractional ownership to broaden access and streamline settlement. As markets experiment with programmable contracts and interoperable data standards, liquidity and transparency could improve, enabling new investment models across traditional equities, real estate, and other assets.

Tokenization in finance: Will It Eat the Global Financial System?

Robinhood CEO Vlad Tenev framed tokenization as more than a trend, describing it as a freight train barreling through finance. He argued that tokenization could unlock 24/7 markets and enable fractional ownership across a wide range of assets, from stocks to real estate. The idea is to streamline access for individual investors and institutions alike, while expanding cross-border participation at internet speed. As the rails for real-time activity take shape, tokenized assets begin to redefine how capital moves and how price discovery happens.

While the promise is compelling, the path is not guaranteed. Regulatory frameworks, issuer disclosures, data integrity, and custody considerations must mature in tandem with technology. The convergence of crypto rails with traditional finance could lower costs and speed up settlement, but incumbents and policymakers will test the resilience of new models before broad adoption. Tokenization’s impact on finance will depend on how well markets balance innovation with investor protection and systemic risk controls.

Real-Time Trading: The Promise of Tokenized Assets

At Token2049, Tenev described his goal of real-time, round-the-clock trading of tokenized assets, a capability Robinhood has already piloted in Europe. The concept envisions continuous liquidity and faster price signals as markets stay open beyond traditional hours. Investors would gain more opportunities to execute orders when information is fresh, improving overall participation in tokenized markets.

However, turning that promise into everyday practice requires robust infrastructure, reliable price feeds, and clear custody rules. Regulators and issuers will scrutinize standards for settlement speeds, transparency, and risk management. As tokenized assets proliferate, market participants must align on common nomenclature and interoperability so price discovery remains credible across borders.

Price Discovery in a Tokenized World

Tokenization has the potential to enhance price discovery by pooling data from multiple jurisdictions and asset classes in near real time. Continuous trading and improved accessibility could reduce information gaps and make prices reflect broader demand, not just local liquidity pockets. This new regime can expand the scope of investable assets while sharpening the quality of market signals.

Yet the shift also creates questions about data integrity, oracle reliability, and the speed of regulatory responses. Traditional exchanges may need to adapt to new price feeds, and cross-market arbitrage could intensify competition for credible, auditable price information. Sound governance and robust risk controls will be essential to preserve trust in tokenized price discovery.

Cross-Border Liquidity and Global Access

Tokenization can unlock cross-border liquidity by enabling participation in markets with internet-speed settlement and fractional ownership. Investors from different regions could trade tokenized assets round the clock, expanding the reach of capital and diversifying portfolios beyond local confines. The resulting liquidity is a powerful driver for price efficiency and market breadth.

Nevertheless, cross-border activity raises regulatory and tax considerations, KYC/AML compliance, and jurisdictional data requirements. Operators must navigate disparate rules and ensure consistent investor protections across boundaries. As liquidity grows, risk management practices and custody solutions will be tested to sustain confidence in global markets.

Regulatory Pathways and Industry Readiness

Industry stakeholders argue that clear regulatory pathways are essential to unlock tokenization at scale. Europe has shown leadership with frameworks that push pilot programs forward, while the United States tends to move more cautiously due to legacy financial plumbing. The speed of adoption will hinge on harmonized standards, investor protections, and transparent disclosures for tokenized assets.

Operational readiness—such as standard token formats, interoperable back-office systems, and robust cyber protections—will determine how quickly institutions embrace tokenization. Regulators, issuers, and platforms must collaborate to align incentives, mitigate risks, and ensure that tokenized finance supports reliable price discovery without compromising market integrity.

Europe Takes the Lead in Tokenization Adoption

Europe has been at the forefront of tokenization pilots and regulatory experimentation, accelerating the rollout of tokenized securities and cross-border access. The region’s frameworks support rapid experimentation while maintaining safeguards for investors and issuers alike. As tokenized access broadens, European markets increasingly demonstrate the feasibility of 24/7 liquidity and real-time price signals.

With Europe out front, other regions watch closely as they build compatible infrastructure and governance models. The pace of adoption will depend on continuing collaboration among regulators, exchanges, and fintech firms to deliver scalable, compliant solutions that align with existing finance traditions and new tokenized practices.

The Convergence of Crypto Rails and Traditional Finance

Robinhood’s commentary and pilots point toward a future in which crypto rails and traditional finance converge, blurring the lines between asset classes and trading venues. Tokenized stocks, real estate, and other assets could be traded alongside conventional securities in a seamless, real-time ecosystem that supports global participation and faster settlement.

That convergence also reshapes incumbents’ strategies, with a stronger emphasis on liquidity access, user-friendly platforms, and real-time price data. As tokenization expands, retail investors could gain greater exposure to IPOs and private markets, while issuers explore more efficient ways to raise capital through tokenized offerings and liquidity-enabled fundraising.

Tokenization of IPOs and Private Markets

Robinhood has signaled a path to broader retail access to IPO allocations and private markets through tokenization efforts, moving beyond traditional routes. Tokenized offerings promise faster processing and enhanced liquidity, enabling new forms of investor participation at different stages of a company’s growth.

Price discovery and market breadth could improve as tokenized IPOs and private assets circulate across global platforms. However, investors must contend with additional layers of risk, including valuation challenges, custody considerations, and regulatory scrutiny as the market learns to price tokenized assets accurately.

Timeline: From Promise to Ubiquity in 5–10 Years

Tenev suggested that ubiquity for tokenized finance could arrive within five to ten years as regulatory frameworks, technology, and market infrastructure mature. The trajectory envisions a shift toward pervasive tokenization across asset classes and jurisdictions, supported by improved interchangeability and standards.

Europe’s early adoption may accelerate global progress, while the United States may proceed more cautiously. The timeline will depend on interoperability across platforms, compatible custody solutions, and the reconciliation of legal and tax regimes to enable seamless, real-time trading of tokenized assets.

Risks, Rewards, and the Future of Tokenized Finance

The most compelling rewards include lower costs, faster settlement, expanded market breadth, and easier access to tokenized assets for both retail and professional traders. Real-time trading and broader price discovery stand to enhance liquidity and efficiency across markets, potentially transforming how capital moves worldwide.

Yet the journey comes with notable risks: regulatory fragmentation, custody challenges, cyber threats, and privacy concerns. To realize the benefits of tokenized finance, stakeholders must build robust risk controls, clear governance, and resilient technology that can support cross-border liquidity and scalable growth while safeguarding investors.

Frequently Asked Questions

What is tokenization in finance and how does it work?

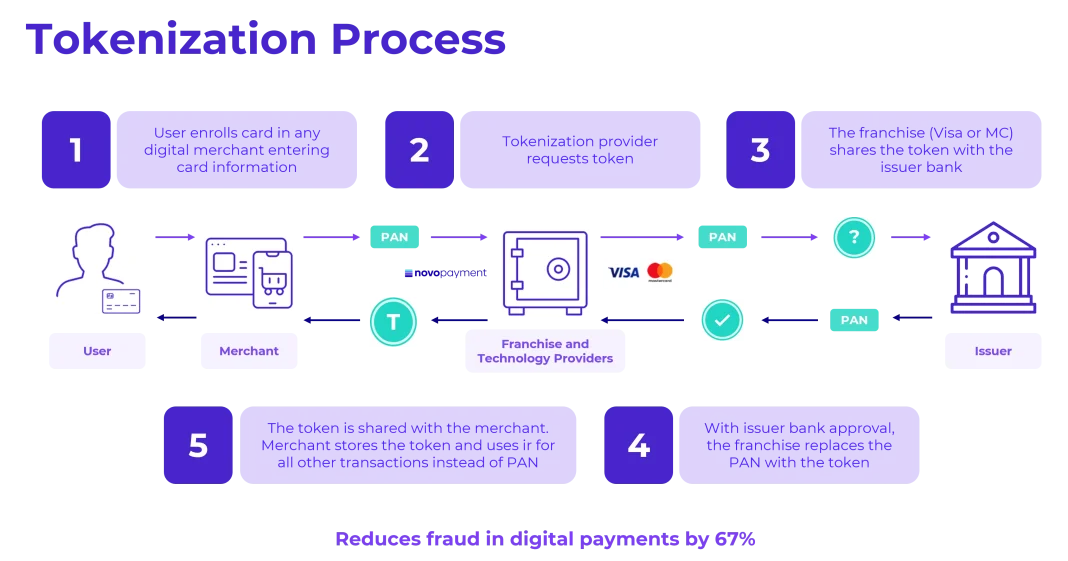

Tokenization in finance converts ownership rights of assets into digital tokens on a blockchain. This enables fractional ownership, programmable features, and easier transfer. It supports real-time trading, faster price discovery, and broader cross-border liquidity by connecting global buyers and sellers on tokenized rails.

How does tokenization enable real-time trading in finance?

Tokenization creates digital rails that support 24/7 trading beyond traditional market hours. It can shorten settlement times and provide continuous liquidity, leading to real-time price discovery across markets.

What is price discovery in tokenized finance markets?

Price discovery is the process by which the market determines the value of tokenized assets through ongoing, transparent trading. Tokenized markets offer continuous price signals and broader participation, improving price discovery compared with traditional systems.

How does tokenization improve cross-border liquidity for investors?

By enabling global access to tokenized assets, tokenization supports near-instant cross-border settlement and increased liquidity as more buyers and sellers can participate online.

Which asset classes can be tokenized in finance?

Tokenization in finance can cover a wide range of assets from stocks and real estate to private market investments, art, and more, enabling fractional ownership and diversified portfolios.

What regulatory considerations apply to tokenization in finance?

Tokenization must comply with KYC/AML standards and applicable securities or commodities laws. Regulators are evolving frameworks to balance innovation with investor protection, with Europe often leading and the United States moving more slowly.

How does tokenization impact costs and settlement in real-time trading?

Tokenization can lower costs by reducing intermediaries and enable faster settlement through automated processes. This supports improved liquidity and more efficient real-time trading.

What did Vlad Tenev say about tokenization’s impact on finance and real-time trading?

Tenev described tokenization as a freight train that will reshape finance, converging crypto rails with traditional markets. He emphasized 24/7 access, real-time price discovery, and broader cross-border liquidity as the outcomes investors can expect.

| Point | Details | Implications |

|---|---|---|

| Tokenization framed as a freight train (inevitable) | Tenev says tokenization isn’t a trend but a force driving finance, with tokenized assets enabling broader liquidity and access. | Signals an unavoidable shift that incumbents must adapt to or risk obsolescence. |

| 24/7 markets and fractional ownership across assets | Tokenization enables around-the-clock trading and ownership fractions in assets from stocks to real estate. | Could lower barriers to entry and broaden investor participation. |

| Real-time, round-the-clock trading of tokenized assets | Robinhood has piloted real-time price discovery for tokenized assets in Europe; regulation and implementation are ongoing. | Regulators and firms need to work through new compliance and operational models. |

| Geographic timeline: Europe ahead; the U.S. slower due to legacy systems | Tenev expects ubiquity within five to ten years as frameworks mature; Europe leading, U.S. lagging. | Cross-border adoption may unfold unevenly, influenced by existing infrastructure. |

| Convergence of crypto rails and traditional finance | Tokenization could blend crypto rails with conventional markets, erasing old boundary lines between asset classes. | New market architectures may emerge, emphasizing real-time price discovery and liquidity. |

| Robinhood’s strategic stance | The firm aims to lead the confluence of tokenization with traditional finance and is building exposure to tokenized private markets and IPO access. | Firms must innovate to deliver issuer-friendly, regulator-aligned solutions. |

| Expected benefits and directional shift | Tokenization could lower costs, speed settlements, and expand market breadth if rails are laid as promised. | Adaptation and proactive execution are crucial for capturing advantages. |

Summary

Tokenization in finance is advancing as a transformative force, with leaders like Vlad Tenev framing it as an inevitable shift toward faster, more inclusive markets. The base content outlines how tokenization enables 24/7 trading, fractional ownership, and real-time price discovery across asset classes, and notes Europe’s earlier adoption versus the United States. It also highlights regulatory and infrastructure considerations as crypto rails converge with traditional finance, and emphasizes the need for incumbents to adapt to this evolving landscape.