Bitcoin network difficulty rose 5.97% to 150.84 trillion, a move that quietly redefines how miners compare hardware, energy costs, and the payback horizon for new rigs while nudging the competitive landscape toward fiercer block races and greater emphasis on efficiency, reliability, and uptime across global data centers. Bitcoin mining difficulty 2025 has become shorthand for the year’s evolving mining economics, with operators weighing capital expenditures, cooling or warming energy strategies, the mix of consumer-grade and industrial hardware, and the risk-reward tradeoffs that determine when upgrading or scaling capacity makes financial sense in a volatile market. Bitcoin network difficulty changes continue to reflect the protocol’s 2,016-block retarget cadence, producing cycles of tougher days and occasional relief that ripple through supplier demand, regional electricity pricing, hardware supply chains, and the deployment cadence of cutting-edge ASICs, while also influencing where new facilities are located and how quickly they can amortize investments. Bitcoin hashrate trends 2025 reveal a sustained surge in computational power, pushing the network well beyond the 1 zettahash milestone and influencing profitability dynamics even as the 24-hour block pace drifts toward or away from the coveted 10-minute target, with miners responding to price swings and the evolving efficiency of specialized hardware. Bitcoin block time 10 minutes remains a foundational measure that anchors revenue projections, with miners weighing equipment depreciation, electricity costs, and market volatility as they anticipate the next difficulty retarget and its implications for long-term cash flow, capital allocation, and the resilience of the network under varying demand patterns.

Beyond the exact phrase mining difficulty, this topic is often discussed through related ideas such as hash rate dynamics, mining competition, and the cadence of block creation that guides investment and risk management. Analysts also talk about energy efficiency, hardware lifecycles, and the economics of energy per hash, all tied to the same underlying difficulty mechanism. Taken together, these terms illuminate how security, network reliability, and market signals interact to shape participation by solo miners and large operators alike.

Bitcoin network difficulty: current state and implications for miners

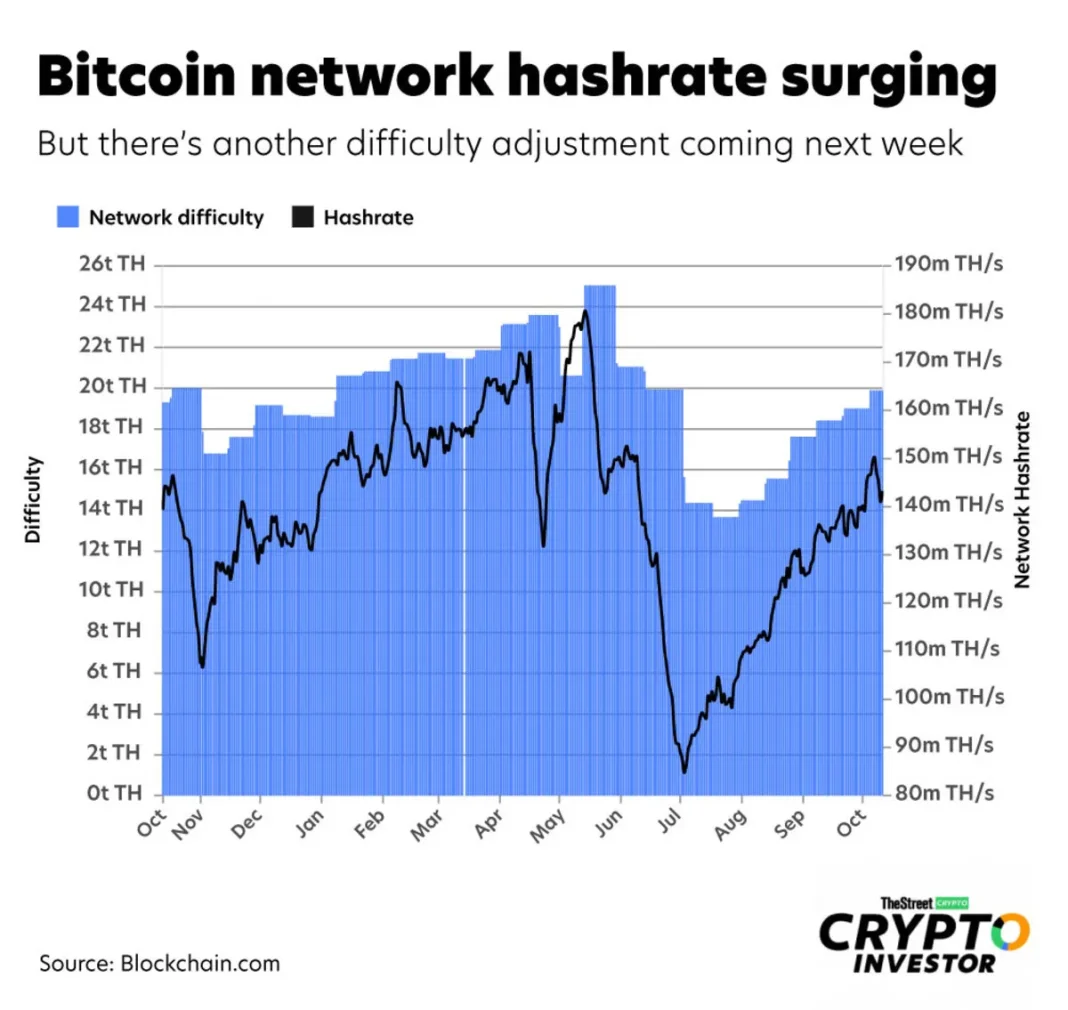

Bitcoin network difficulty rose 5.97% to 150.84 trillion, signaling a tighter race among miners. The difficulty metric represents the odds of solving a block and adjusts every 2,016 blocks to keep the average block time near 10 minutes. Since the launch in January 2009, when difficulty stood at 1, the mining race has grown dramatically, demanding substantially more computational power today. The current level shows how much the ecosystem has scaled, with sustained pressure on hardware efficiency and energy use.

Hashrate has surpassed the 1 zettahash milestone, hitting 1,071.28 EH/s, underscoring the intense investment in ASICs and facilities. Despite record power, blocks are now being mined at a slightly slower pace on average, with the 24-hour block time clocking in at 10 minutes 40 seconds. The next retarget on Oct. 16, 2025 will reveal whether miners catch a probabilistic break or face steeper odds ahead.

Bitcoin mining difficulty 2025: drivers and expectations

Bitcoin mining difficulty 2025 has featured notable volatility, with the year’s top five increases signaling ongoing pressure from rapid hashrate growth and price dynamics. So far, the net change for 2025 adds up to about +50.40% from the troughs, even as five declines total −16.54%. Each upward move tightens mining margins, while downward steps can offer temporary relief for producers with efficient equipment. The dynamic underscores that difficulty is a primary driver of profitability alongside BTC price.

Factors behind the shifts include rapid hashrate growth, technological improvements, and mood swings in BTC price. The interplay between Bitcoin mining difficulty 2025 and Bitcoin network difficulty changes creates a moving target for profitability and investment decisions. As miners chase efficiency, they watch BTC mining profitability 2025 alongside hashrate trends 2025 to estimate returns.

Bitcoin network difficulty changes in 2025: monthly patterns and forecasts

Bitcoin network difficulty changes in 2025 have occurred through numerous adjustments, with 15 upward moves and 5 downward ones, reflecting a highly active ecosystem. The frequent shifts push the longer-term trajectory higher, even as some events temporarily ease the odds for miners. The pattern of adjustments demonstrates that miners respond quickly to price swings and energy dynamics.

With the Oct. 16, 2025 retarget looming, market participants anticipate whether the next adjustment will provide relief or tighten the path to a block. Historical patterns show that retargets can reshape economics for weeks after they occur, influencing mining rents and facility planning. For investors, tracking these changes is essential to gauge risk and opportunity.

Bitcoin hashrate trends 2025 and their effects on block production

Bitcoin hashrate trends 2025 show sustained strength, with the network sustaining above 1 zettahash and peaking near 1,071.28 EH/s. This growth reflects continued investment in high-efficiency ASICs and new data-center capacity in regions with favorable energy prices. As hashrate climbs, miners must balance upfront hardware costs against long-term energy efficiencies to maintain margins.

Even as hashrate climbs, block production dynamics can diverge from the raw power figure. The 10-minute target remains critical, as higher hashrate does not automatically guarantee faster blocks if difficulty adjusts upward. Understanding this relationship helps miners optimize deployment timing, energy contracts, and cooling strategies.

BTC mining profitability 2025: price, revenue, and margins

BTC mining profitability 2025 has seen revenue per PH/s rise from a Sept. 28 trough of $48.53 to about $50.66 today, supported by a BTC price near $120,337. These figures show a narrow margin improvement even as the overall difficulty context remains elevated. Profitability is highly sensitive to both BTC price moves and electricity costs, making efficiency upgrades essential.

However, the period a month earlier recorded higher per-PH values around $54.13, illustrating how volatile profitability can be. Miners may welcome any dip in difficulty if it coincides with rising BTC price, but the long-run trend depends on energy costs and the ability to deploy efficient hardware. This combination explains why many operators focus on next-generation ASICs and smarter heat management.

Bitcoin block time 10 minutes: reality vs the target

Bitcoin block time 10 minutes is the design target for the network, aiming to produce a block roughly every 10 minutes on average. In practice, the 24-hour average block time has recently clocked in at 10 minutes 40 seconds, suggesting occasional deviations under heavy hashrate and tougher difficulty. The tug-of-war between demand, energy, and efficiency shapes how closely the network tracks the ideal cadence.

Even with a high-power environment, blocks can accelerate or slow down based on the latest retarget and energy economics. The current regime sits above the target block cadence at times, while the last epoch indicated blocks were mined faster than the 10-minute benchmark, underscoring the complexity of real-world dynamics. For miners, every 2,016-block cycle matters as it resets the difficulty and re-writes expected returns.

Next retarget on Oct. 16, 2025: what it means for miners

Next retarget on Oct. 16, 2025 is a focal point for market participants, as it will adjust the odds for the coming period. Retargets compress or stretch the required hash power, influencing whether miners see a relief or face steeper odds. Traders track this date to gauge potential shifts in BTC mining profitability 2025 and the broader risk/reward profile.

Historically, retargets can cause short-term volatility in revenue streams and equipment utilization. Operators may reallocate hashrate, shift to different energy contracts, or plan capital expenditure around that date. In essence, the Oct. 16 event functions as a real-time test of whether the network is easing or tightening the mining landscape.

Historical perspective: from difficulty 1 to 150.84 trillion

Historical perspective: from difficulty 1 in 2009 to 150.84 trillion today, the scale of Bitcoin mining has expanded dramatically. The early days offered an almost open door to digital gold, while today the competition requires sophisticated infrastructure. This growth tracks the exponential rise in hashrate and the evolution of mining ecosystems.

Understanding this trajectory helps investors and operators contextualize current profitability and future expectations. The transition from tiny to massive scale also highlights the importance of efficiency, electricity markets, and climate considerations in mining performance.

Mining hardware decisions in a rising difficulty landscape

Mining hardware decisions in a rising difficulty landscape focus on energy efficiency and total cost of ownership. With the network sustaining above 1 zettahash, operators prioritize next-generation ASICs that deliver higher hashes per watt and lower heat output. The hashrate trends 2025 inform procurement timelines and capacity planning.

Additionally, operators evaluate where to deploy equipment—regions with cheap, reliable electricity, favorable cooling, and robust grid stability. As difficulty climbs, the economics of new deployments vs. leveraging existing assets swing in favor of more efficient rigs and smarter maintenance. The ongoing cycle of improvement pushes the industry toward modular, scalable data centers.

Price versus difficulty: navigating risk and opportunity

Price versus difficulty shapes risk and opportunity for miners and investors alike. BTC price resilience can offset higher difficulty by widening revenue per hash, while sudden price drops can compress margins even when efficiency improves. This dynamic makes timing and hedging strategies important for long-run returns.

Stakeholders monitor the interplay of BTC mining profitability 2025 indicators, block time reliability, and energy costs to project cash flows. The overall message is that success in 2025 requires a balanced portfolio of price awareness, tech upgrades, and flexible operations.

Energy costs, power markets, and profitability in 2025

Energy costs and power markets dominate profitability in a high-difficulty regime. Regions with cheap, renewables-friendly electricity offer the best economics for miners, helping offset the pressure of rising hashrate. The 1 zettahash-scale network requires careful electricity planning and cooling capacity to maintain steady production.

Supply chain, equipment availability, and regulatory environments also influence profitability in 2025. Operators increasingly rely on dynamic energy contracts and resilient infrastructure to withstand volatility in hashrate and price. This landscape underscores the need for strategic planning and financial resilience.

Key takeaways for miners and investors in 2025

Key takeaways for miners and investors in 2025: the network remains highly competitive, with a 5.97% QoQ rise in difficulty and a sustained hashrate above 1 zettahash. Efficient hardware, favorable energy contracts, and disciplined capital planning are essential to navigate the cycle of adjustments.

Remaining agile around retarget dates like Oct. 16, 2025 and monitoring LSI-enabled terms such as Bitcoin mining difficulty 2025, Bitcoin network difficulty changes, and Bitcoin block time 10 minutes will help stakeholders manage risk and identify opportunities in this evolving sector.

Frequently Asked Questions

What is Bitcoin network difficulty in 2025 and how has it changed?

Bitcoin’s network difficulty rose 5.97% to 150.84 trillion. It adjusts every 2,016 blocks. In 2025, the network saw 15 up-adjustments and 5 down-adjustments, for a net gain of about +50.40% despite some declines totaling −16.54%. Hashrate reached about 1,071.28 EH/s, and the 24-hour block time sits at roughly 10 minutes 40 seconds, a bit slower than the 10-minute target.

How do Bitcoin network difficulty changes affect BTC mining profitability 2025?

Bitcoin network difficulty changes influence the amount of work required to mine a block. In 2025, revenue per PH/s rose from $48.53 to $50.66, with BTC trading around $120,337. Profitability also depends on energy costs and price movements, and recent profitability data shows a dip from peak levels seen in the prior month. The next retarget on Oct 16, 2025 could further affect mining economics.

What do Bitcoin hashrate trends 2025 indicate about mining and difficulty?

Hashrate trends 2025 show power in the hands of miners, with the network hashrate exceeding 1 zettahash (1,071.28 EH/s). Despite this high hashrate, blocks have recently been mined faster than the 10-minute target in the last epoch, though the 24-hour average block time remains about 10 minutes 40 seconds, illustrating the ongoing balance between hashrate, difficulty, and block production.

What is BTC mining profitability 2025 given the current network difficulty and price?

BTC mining profitability 2025 has been variable. Revenue per PH/s has hovered around $50, with BTC prices near $120,337. Profitability is still influenced by energy costs and market swings, and it was below the prior month’s peak (around $54.13 per PH/s). The Oct 16, 2025 retarget could shift margins depending on whether difficulty rises or falls.

Why is Bitcoin block time 10 minutes sometimes longer even with high hashrate and changing Bitcoin network difficulty?

The Bitcoin block time target is 10 minutes, but the 24-hour average has been about 10 minutes 40 seconds in 2025. Higher hashrate and shifting Bitcoin network difficulty don’t guarantee exact 10-minute blocks because difficulty adjusts every 2,016 blocks and real-time hash power can fluctuate, affecting when blocks are found.

When is the next retarget date for Bitcoin network difficulty and what does it mean for miners?

The next retarget date is October 16, 2025. A retarget can push difficulty up or down, influencing mining odds. In 2025 there have been more up-adjustments (15) than down-adjustments (5), yielding a net increase of about +50.40%. Depending on the result, miners could see tighter or looser competition after the retarget.

How does the 1 zettahash-level hashrate relate to the 150.84 trillion network difficulty and block production?

A hashrate above 1 zettahash (1,071.28 EH/s) means miners are applying substantial computational power. Coupled with a 150.84 trillion difficulty, this results in high competition and longer albeit occasional delays between blocks, with current average block time around 10 minutes 40 seconds and the difficulty readjusting every 2,016 blocks.

| Key Point | Details |

|---|---|

| Current change | Bitcoin’s network difficulty rose 5.97% to 150.84 trillion. |

| Analogy | Difficulty is like the odds of winning a colossal dice-toss lottery that resets every 10 minutes. |

| Historical baseline | In January 2009, difficulty stood at 1; the target was practically wide open. |

| Relative today vs early days | With 150.84 trillion difficulty, miners must churn through about 150.84 trillion times more dice rolls than in those early days to land a winning block. |

| Difficulty adjustments cadence | Every 2,016 blocks the difficulty adjusts. |

| 2025 pattern | So far in 2025, it’s gone down five times and up fifteen times. |

| Net changes | Upward shifts total +50.40%; drops total −16.54%. |

| Hashrate and time | Hashrate remains above 1 zettahash at 1,071.28 EH/s; blocks mined average 10 minutes 40 seconds. |

| Revenue and price | Revenue per PH/s rose from $48.53 (Sept 28) to $50.66 today; BTC price near $120,337; 30 days earlier, $54.13 per PH/s. |

| Outlook and next retarget | Next retarget on Oct. 16, 2025; outcome could mean a relief or a steeper odds ahead. |

Summary

Bitcoin network difficulty continues to be a key indicator of mining competitiveness. As of today, Bitcoin network difficulty rose 5.97% to 150.84 trillion, with the network’s hashrate around 1,071.28 EH/s and a 24-hour block time averaging 10 minutes 40 seconds. The price per PH/s has moved from $48.53 on Sept 28 to about $50.66 today, while BTC trades near $120,337, highlighting a mixed profitability landscape relative to 30 days prior. The next retarget on Oct 16, 2025 will help determine whether difficulty will ease or tighten further, underscoring the ongoing dynamic between network difficulty, price, and miner behavior.