Bitcoin all-time high momentum has traders buzzing as the market digests the latest headlines around a US government shutdown, with many investors weighing the prospects of policy clarity against the backdrop of ongoing fiscal turmoil. The cryptocurrency market near all-time high conditions continue to lift sentiment, even as lawmakers bargain over funding and economic data streams, creating a backdrop where risk assets compete with traditional benchmarks. Analysts highlight a persistent bitcoin price rally and a rising bitcoin market cap as signs of durable demand, supported by institutional interest, favorable liquidity conditions, and expanding on-chain activity. The timing has fueled questions about the government shutdown crypto impact on liquidity and investor risk appetite, prompting comparisons with prior cycles. Traders also monitor btc futures open interest as liquidity shifts and volatility remains elevated ahead of potential policy signals, with derivatives markets reflecting a tug-of-war between bulls and bears.

From a broader lens, traders are watching a price peak unfold in the digital-asset space as the leading cryptocurrency nears new highs. Market participants describe a sustained ascent in digital asset values, supported by growing network activity and expanding institutional involvement. Policy stalemate and macro uncertainty continue to shape risk appetite, even as wallets swell and confidence returns to risk-on sectors. Overall, the narrative centers on the momentum of a flagship token rising toward fresh milestones, reflected in stronger derivatives activity and cross-asset flow.

Bitcoin all-time high on the horizon: navigating the third day of the government shutdown

On the third day of the U.S. government shutdown, bitcoin is behaving as if nothing unusual is happening in the macro arena. The crypto market has surged, with the broader cryptocurrency market near all-time high levels as investors weigh potential rate cuts and macro resilience. This backdrop keeps bitcoin within striking distance of its record, suggesting that capital is still flowing into digital assets despite congressional gridlock. The current dynamic underscores how policy uncertainty can sometimes coincide with bullish sentiment in the crypto space.

Market data show bitcoin hovering around notable price milestones, reflecting a bitcoin price rally that has persisted alongside a swelling market cap. As bitcoin trades near $122k, traders are watching for a fresh all-time high while liquidity remains robust. Futures and liquidations activity are reinforcing the narrative that traders are positioning for continued upside, with open interest in BTC futures contributing to the sense that demand remains constructive even during fiscal stalemate.

Bitcoin price rally accelerates as the crypto market nears a fresh crest

The ongoing price action for bitcoin mirrors the broader momentum across cryptocurrencies, presenting a sustained bitcoin price rally even as political headlines dominate headlines. Investors see policy uncertainty as a backdrop rather than a derailment, and the crypto market near all-time high levels adds credibility to the thesis that digital assets are carving out new highs in a widening risk-on environment. This momentum has helped bitcoin regain attention from mainstream traders and institutions alike.

As the market cap climbs, traders focus on micro signals like order flow and open interest to gauge whether the rally can sustain. The current price environment shows robust demand chasing limited supply, with bitcoin capitalization contributing to the narrative of a dynamic market undergoing structural shifts. The resilience of the rally is further underscored by steady inflows and a willingness among participants to hold through volatility.

Bitcoin market cap climbs as investors price in continued demand

Bitcoin’s ascent is accompanied by a rising market cap, a stat that confirms broad investor interest and the scaling size of the asset in the crypto ecosystem. As institutions show renewed appetite, the bitcoin market cap acts as a proxy for confidence in digital assets during a period of political turbulence. This expansion supports price action and encourages liquidity providers to participate more aggressively in both spot and derivative markets.

Industry analysts note that the rising market cap also reflects capital inflows from a diverse set of buyers, from hedge funds to retail traders, who are recalibrating risk in a market that benefits from ongoing interest in blockchain technology. With capital continuing to aggregate, traders are eyeing next benchmarks and potential catalysts that could push bitcoin toward and beyond prior all-time highs.

Government shutdown crypto impact: deciphering policy risk and market response

The phrase government shutdown crypto impact captures the tension between fiscal policy challenges and crypto markets. While U.S. policymakers stall on funding, investors have treated the shutdown as a non-traditional macro event that can amplify volatility yet also spark a bid for hedges in digital assets. This dynamic has left bitcoin traders weighing the durability of a rally against potential regulatory or liquidity shifts caused by a prolonged shutdown.

Crypto-specific indicators show healthy trading activity despite the political noise, suggesting that the market perceives the shutdown as a catalyst for rapid information flow rather than a structural threat to fundamentals. As long as the liquidity environment remains supportive, the market can absorb headlines and maintain a trajectory toward fresh highs.

BTC futures open interest signals strength behind the move and liquidity depth

BTC futures open interest has risen, indicating that market participants are building larger positions in anticipation of continued upside. This trend aligns with a broader crypto market near all-time high backdrop, where futures activity provides a proxy for investor conviction and risk appetite. Higher open interest often accompanies price advances as traders seek leverage and hedging strategies in a rising market.

The latest data highlight that liquidations skew toward shorts, with a notable portion of liquidations concentrated in the short side, suggesting hedging behavior and a willingness to tolerate short-term drawdowns. This dynamic reflects a robust liquidity pool that supports orderly price discovery, reducing the likelihood of abrupt reversals and reinforcing the case for further upside in the near term.

Bitcoin dominance and altcoins: monitoring shifts in momentum as markets rally

Bitcoin dominance remains a key gauge of market structure as the crypto market marches toward new highs. A rising bitcoin dominance percentage can indicate Bitcoin is leading the rally, while a waning dominance might signal growing altcoin strength. Investors should monitor this metric alongside market cap dynamics to gauge whether the bullish trend is broad-based or increasingly concentrated in BTC.

Altcoins often follow Bitcoin’s lead, but when bitcoin price action accelerates, liquidity tends to pool across a mix of DeFi tokens, layer-2 ecosystems, and large-cap alts. The current environment supports a strategic tilt toward balanced exposure across the crypto spectrum, with risk management remaining essential given potential volatility in a market near all-time high levels.

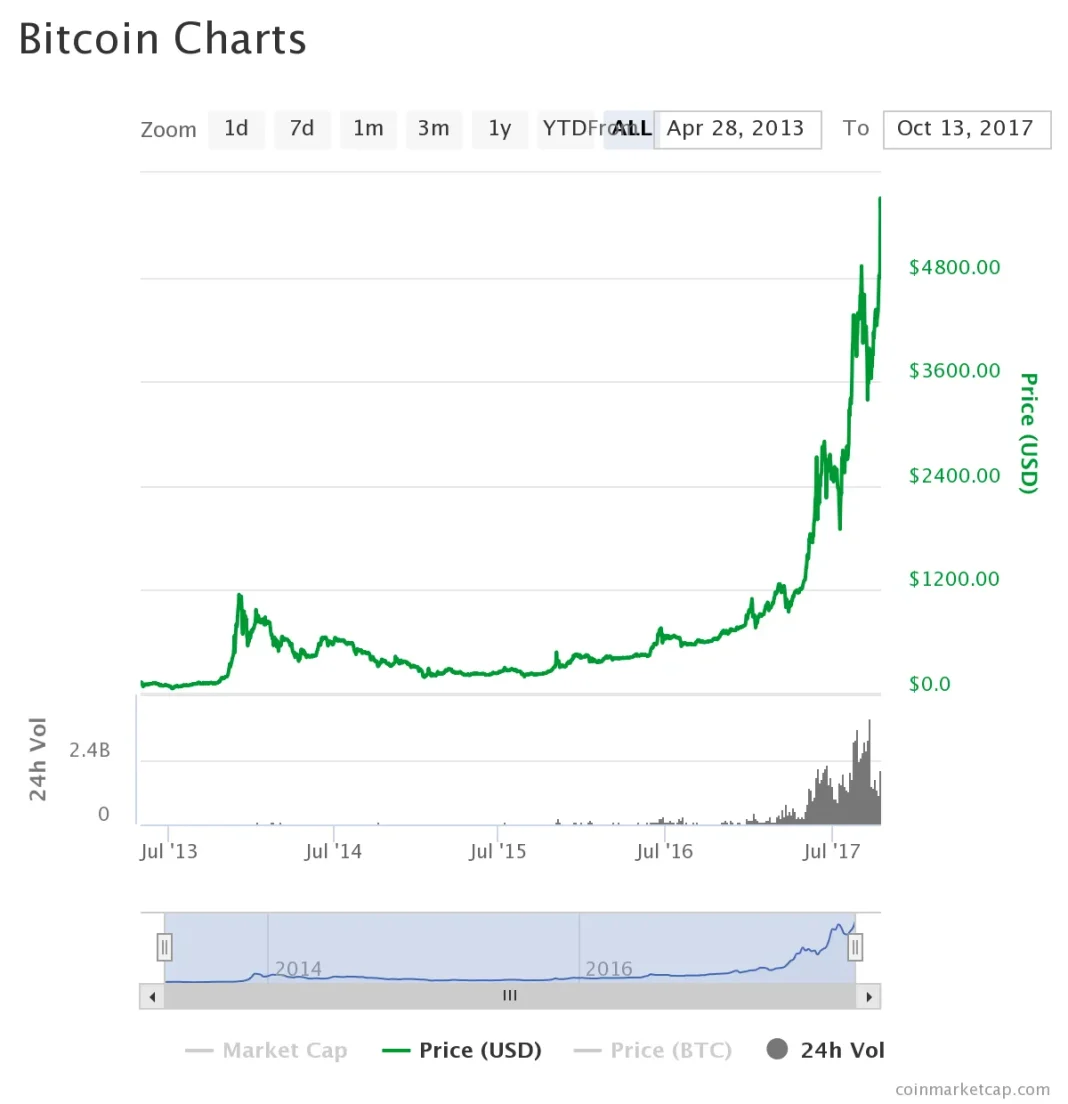

Liquidity trends and 24-hour volume: gauging ongoing market activity

Liquidity metrics show elevated 24-hour volume, underscoring sustained trading interest across the crypto market. A robust volume backdrop helps facilitate orderly moves toward the all-time high region and supports efficient price discovery for bitcoin and related tokens. Traders watch volume patterns to validate the strength of the rally and to assess whether upside momentum can persist.

As the market cap climbs, total capital inflows reinforce a healthy liquidity environment that allows participants to enter and exit positions with lower slippage. The combination of rising price action and higher daily turnover often correlates with tightening bid-ask spreads, which in turn bolsters confidence in the sustainability of the current rally.

Historical context: how past shutdowns influenced Bitcoin’s trajectories and current highs

Comparing the current episode to prior government shutdowns helps contextualize Bitcoin’s performance path. In past cycles, cryptocurrency markets showed resilience, with Bitcoin often trading through periods of policy uncertainty and eventually reaching new all-time highs. The current narrative—driven by macro strength, rising liquidity, and institutional participation—suggests a similar trajectory even as headlines remain unsettled.

Historical patterns also remind investors of the importance of risk controls, as secular bull markets can be interrupted by external shocks. While bitcoin may approach a fresh all-time high in the near term, prudent risk management and diversification remain prudent strategies for navigating the broader crypto landscape.

Macro cues and rate-cut expectations shaping BTC’s path to new highs

Macro indicators and rate-cut expectations are supportive of a bullish crypto stance, with investors pricing in monetary policy moves that could loosen financial conditions. This environment tends to boost risk assets, including bitcoin, and fuels the bitcoin price rally as traders anticipate continued liquidity injections and favorable funding costs.

Analysts gauge how these macro dynamics interact with on-chain activity and exchange flows. If rate cuts materialize as anticipated, bitcoin could see further upside as investors rotate from traditional equities toward crypto assets, reinforcing the broader market’s march toward all-time high territory.

Long-term projections and risk management in a bull market for digital assets

Looking ahead, analysts weigh scenarios where bitcoin could test new apex levels while assessing the sustainability of the current rally. Long-term projections often factor in bitcoin’s market cap trajectory, mining economics, and demand from institutional buyers who view BTC as a hedge against inflation and geopolitics.

In a bullish setup, risk management remains essential: diversification, hedging via futures, and vigilant monitoring of open interest help traders limit downside while participating in potential upside. As markets push toward all-time highs, the emphasis is on disciplined positioning and a careful assessment of liquidity risk in a rapidly evolving crypto ecosystem.

Regulatory signals, policy risk, and the evolving crypto narrative amid a shutdown

Regulatory signals and policy risk continue to shape the shape of the crypto market as it navigates a period of government disruption. Buyers and sellers alike watch for updates from policymakers, anticipating how potential regulatory shifts could affect liquidity, access to exchanges, and the overall risk premium embedded in bitcoin.

Despite regulatory uncertainty, institutional interest and retail participation have shown resilience, suggesting that the macro narrative remains intact. The ongoing dialogue between policy makers and the crypto industry remains a key variable in determining whether bitcoin can press toward new all-time highs or encounter episodic pullbacks.

Analyst consensus and trader sentiment around next-price milestones

Analysts are weighing whether bitcoin can extend its current trajectory beyond the near-term all-time high target, with some forecasting a decisive price action into the mid-to-upper five figures in USD terms in the coming weeks. Trader sentiment, driven by news flow and macro cues, continues to support a constructive view on bitcoin’s base case.

The prevailing sentiment, paired with solid on-chain metrics and a robust crypto market near all-time high, suggests a broad willingness to participate in both spot and derivatives markets. As always, active risk management and clear exit plans help traders navigate the volatile terrain as the market tests new highs.

Conclusion: navigating the next phase of the bull market with caution and focus

The current phase presents a compelling setup for bitcoin as it nears a potential all-time high while navigating a government shutdown and macro uncertainty. The combination of strong liquidity, rising market cap, and resilient consumer and institutional demand supports a constructive view on the near-term path.

Investors should stay attuned to evolving dynamics in bitcoin price rally, the cryptocurrency market near all-time high, and shifts in btc futures open interest as a signal of continued risk appetite. With disciplined risk management and attention to regulatory and macro developments, the road to new highs can be navigated with a balanced and informed approach.

Frequently Asked Questions

What does Bitcoin all-time high mean in the current bitcoin price rally during the government shutdown?

Bitcoin all-time high refers to approaching the historic peak in price. During the government shutdown’s third day, Bitcoin was part of a broader bitcoin price rally, trading around $122,958.26 and contributing to a cryptocurrency market near all-time highs. The market cap was about $2.44 trillion, and bitcoin futures open interest stood around $89.63 billion, signaling strong investor interest.

How is the bitcoin price rally affecting the cryptocurrency market near all-time high amid the government shutdown crypto impact?

The bitcoin price rally helped push the cryptocurrency market toward an all-time high despite the shutdown. Bitcoin’s price gained, the market cap hovered near $2.44 trillion, and futures activity remained elevated with open interest around $89.63 billion, indicating continued demand and confidence among traders.

What is the role of bitcoin market cap in signaling a potential all-time high during this period?

Bitcoin market cap, near $2.44 trillion, reflects broad investor demand and liquidity. When combined with a rising price and strong trading activity, it supports momentum toward an all-time high and signals sustained interest in Bitcoin.

How does BTC futures open interest relate to Bitcoin approaching an all-time high?

BTC futures open interest was about $89.63 billion, up 1.03% in 24 hours. Higher open interest indicates ongoing participation and leverage by traders, which can accompany a move toward or beyond an all-time high.

What could the government shutdown crypto impact mean for Bitcoin’s price movement toward an all-time high?

While a government shutdown introduces macro uncertainty, crypto markets showed resilience. The data suggests investors remained bullish, helping Bitcoin approach its all-time high and maintaining upward momentum despite external factors.

What key indicators should investors monitor around Bitcoin near all-time high and the bitcoin price rally?

Investors should watch price action around the all-time high, the bitcoin market cap, 24h trading volume, bitcoin dominance, and futures open interest. Current signals include price around $122k, market cap near $2.44T, daily volume around $87B, and open interest near $89.6B.

| Key Point | Details |

|---|---|

| Context | Bitcoin is near its all-time high on the third day of a U.S. federal government shutdown. The crypto market cap has surged to about $4.2 trillion, with Bitcoin within roughly $2,000 of its record high. |

| Market Reaction | Markets were resilient: stocks broadly up, while some tech shares like Palantir declined about 7%. Overall crypto market rose 1.48% since yesterday. |

| Shutdown Details | The U.S. government ran out of money and shut down at midnight Wednesday. It’s the fifteenth shutdown since 1980; attempts to pass temporary funding bills failed, leaving federal employees in limbo. |

| Historical Context | The previous shutdown (Dec 22, 2018–Jan 25, 2019) lasted 35 days and cost about $3 billion, with Bitcoin behaving differently than in the current episode. |

| ADP Jobs Report | ADP reported private-sector jobs fell by 32,000, despite economists expecting a rise of 45,000, yet investors remained bullish on rate-cut prospects. |

| Forecast / Target | Geoffrey Kendrick of Standard Chartered Bank suggested Bitcoin would print a fresh all-time high next week and could reach around $135,000 in Q3. |

| Price Metrics | Bitcoin price around $122,958.26; up 1.62% in 24h and 12.55% in 7d; traded within $119,344.31–$123,944.70 yesterday; 24h volume $87.09B; market cap $2.44T; Bitcoin dominance 58.91%. |

| Futures & Liquidations | Total Bitcoin futures open interest at $89.63B; liquidations $211.58M since yesterday (mostly shorts $153.36M; longs $58.22M). |

Summary

Conclusion: Bitcoin all-time high remains a focal point amid ongoing macro uncertainty and sector rotation. The near-term outlook hinges on regulatory signals, rate-cut expectations, and global liquidity, with investors watching Bitcoin as a key gauge of risk sentiment in the crypto space.