DeFi TVL is reshaping how investors view crypto finance as the sector climbs toward new milestones, with the broader crypto economy already near $4 trillion. Tracking the Total Value Locked DeFi metric helps gauge liquidity across lending platforms, exchanges, and staking protocols. DefiLlama TVL data shows daily shifts among top platforms, highlighting the big movers like Aave, Lido, and others. In this dynamic environment, DeFi staking and restaking are key drivers, extending capital across layers and networks. As momentum continues, analysts see DeFi TVL as a bellwether for growth, innovation, and evolving user trust.

Viewed from a broader angle, the on-chain value locked in DeFi ecosystems captures how liquidity moves across lending venues, automated market makers, and staking rails. A look back at the DeFi TVL 2021 peak provides a useful benchmark for assessing whether current capital deployment is on a similar trajectory. By cross-referencing DefiLlama TVL data with sector-specific signals, analysts map shifts in demand, risk appetite, and protocol diversification. This framing emphasizes that liquidity in decentralized finance depends not just on token prices, but on active participation, DeFi staking and restaking, and cross-chain interoperability.

DeFi TVL 2021 peak — Can DeFi Reaching Its All-Time High Again?

The crypto economy has vaulted past the $4 trillion milestone, and DeFi’s total value locked (TVL) remains a key metric of momentum. As liquidity floods into lending, staking, and decentralized exchanges, DeFi TVL edges closer to the all-time high set back in November 2021. This landmark, often cited as the DeFi TVL 2021 peak, sits alongside a broader narrative where DeFi protocols are proving their staying power even as market volatility persists. DefiLlama TVL data helps quantify this trajectory, giving traders and policymakers a real-time read on capital allocation across networks.

In the last 24 hours, DeFi added about $3.677 billion to its TVL, signaling sustained demand and granular growth across chains. While the crypto market hovers around $4.21 trillion, the stablecoin market alone tops $300 billion, underscoring the liquidity that underpins DeFi activity. The chasing pack—DEXs, lending pools, and staking facilities—are collectively contributing to a dynamic where every protocol’s performance feeds into the broader question of whether DeFi can surpass the November 2021 peak.

Total Value Locked DeFi — A Breakdown of Lending, Staking, and Restaking

DeFi’s TVL is not a monolith; it’s a mosaic of activities that keeps the total value locked robust in a multi-chain landscape. Lending platforms still lead in absolute TVL, with Aave sitting at the helm with roughly $44.971 billion, illustrating how traditional credit-like mechanisms anchor the DeFi stack. Close behind, staking and restaking protocols are stacking billions, signaling that users prize both capital efficiency and security enhancements afforded by newer paradigms.

The staking ecosystem shows powerful, sustained growth across major players. Lido commands about $38.22 billion in TVL, while Eigenlayer’s restaking entry has grown to roughly $18.85 billion, despite a noticeable one-month slip. Binance’s Staked ETH remains a formidable force with around $15.8 billion, highlighting how centralized entities continue to influence staking dynamics. Ethena and Ether.fi also contribute meaningful sums, illustrating a diversified distribution of locked value across lending, staking, and multi-chain deployments.

DefiLlama TVL Data — Reading Real-Time Signals Behind DeFi’s Momentum

DefiLlama TVL data provides a granular snapshot of where liquidity sits at any given moment, helping analysts understand the sector’s rhythm beyond headline numbers. The latest figures corroborate a broad-based lift across top protocols, with multi-chain activity illustrating how liquidity migrates in search of yield, security, and efficiency. As the DefiLlama dataset tracks dozens of chains, it becomes a critical reference point for gauging whether DeFi’s TVL growth can sustain pace through shifting market conditions.

From the perspective of traders and developers, DefiLlama TVL data translates into actionable signals: which lending markets are expanding, which staking venues attract new deposits, and how restaking mechanisms influence risk and reward. The data also reinforces the narrative that DeFi’s TVL is not just about one protocol; it’s a tapestry of winners and laggards that collectively maintain the liquidity backbone of the crypto economy.

Aave and the Lending Crown — Leading the DeFi TVL Rally

Lending giants remain central to DeFi’s TVL story, with Aave occupying a crown position at roughly $44.971 billion. This dominance reflects continued demand for decentralized credit, risk-sharing, and liquidity provisioning, even as competition intensifies from other lending markets and cross-chain bridges. The Aave-led surge underscores how lending protocols anchor the overall DeFi TVL landscape and influence the broader health of decentralized finance.

Beyond Aave, the lending segment coexists with thriving staking and restaking ecosystems. The combination of high collateral efficiency, robust security models, and evolving governance has kept lending TVL buoyant in a market where users chase durable yields and transparent risk frameworks. The result is a multi-venue environment where the TVL contributed by lending remains a cornerstone of DeFi liquidity.

Lido and the Staking Ecosystem — Where TVL Accelerates Through Staking

Lido’s staking dominance, with about $38.22 billion locked, illustrates how staking pools have become a primary channel for capital deployment in DeFi. Staking not only provides yield but also reinforces network security and validator incentives across multiple chains. As DeFi grows, Lido’s scale signals that staking is a core pillar of TVL growth and long-term value capture for investors who prioritize composability and reliability.

The staking and restaking narrative is further amplified by restaking innovators like Eigenlayer, which holds roughly $18.85 billion in TVL. This segment suggests a future where restaking becomes a more routine mechanism for extracting additional yield while leveraging security properties. As staking ecosystems mature, we can expect continued concentration around leading staking protocols while new entrants push the envelope on cross-chain compatibility.

Eigenlayer and Restaking — The New Frontier in DeFi TVL

Eigenlayer’s restaking push shows how restaking strategies can unlock extra value within the DeFi stack. With about $18.85 billion in TVL, restaking is carving out a niche that blends security enhancements with higher yield opportunities. The one-month slip in its pace reminds investors that innovation in DeFi comes with evolving risk profiles, making monitoring protocols and upgrade paths crucial for sustained growth.

As restaking gains traction, other platforms are exploring similar models to diversify their value propositions. The restaking trend intersects with multi-chain expansion, improved oracle designs, and layer-2 integrations, creating a feedback loop that can lift overall TVL as users seek more efficient and secure ways to deploy capital. The DeFi TVL landscape thus evolves from pure liquidity depth to security-augmented yield strategies.

Staking Giants: Binance Staked ETH, Ethena, and the Dominance of Large-Scale Staking

Staking goliaths like Binance’s Staked ETH protocol have locked in about $15.8 billion, highlighting how centralized platforms still command significant staking traction. This concentration underscores the ongoing collaboration between centralized and decentralized actors to deliver scalable staking solutions that attract mainstream capital while maintaining protocol security and governance. In the broader TVL chart, these players anchor the staking sector’s resilience.

Ethena’s steady climb, with roughly $14.98 billion in TVL and a notable 17.96% monthly gain, demonstrates that mid-tier players can deliver meaningful momentum and diversify liquidity across multiple networks. The staking mix, including Ether.fi at $11.24 billion and other validators, reflects a healthy ecosystem where staking rewards, liquid staking options, and cross-chain compatibility drive continued growth in Total Value Locked DeFi.

Ethereum’s Role in the TVL Rally — Staking, DeFi, and Cross-Chain Growth

Ethereum remains a central pillar in DeFi’s TVL dynamics, with major staking and lending venues anchored on its network. The ongoing combination of ETH staking yields and DeFi protocols’ diversification across chains illustrates how Ethereum’s security layer underpins broader TVL expansion. As Eth2-era improvements unfold, the alignment between staking rewards and DeFi yields continues to attract capital and reinforce Ethereum’s leadership in the space.

Cross-chain activity further expands Ethereum’s influence, as protocols deploy on multiple chains to capture new users and liquidity. The result is a more intricate TVL map where Ethereum’s baseline supports multi-chain liquidity and staking incentives, while new entrants push into 29 chains and beyond. This interconnectedness underscores the importance of DefiLlama TVL data for tracking how Ethereum-centric activity translates into multi-chain liquidity and resilience.

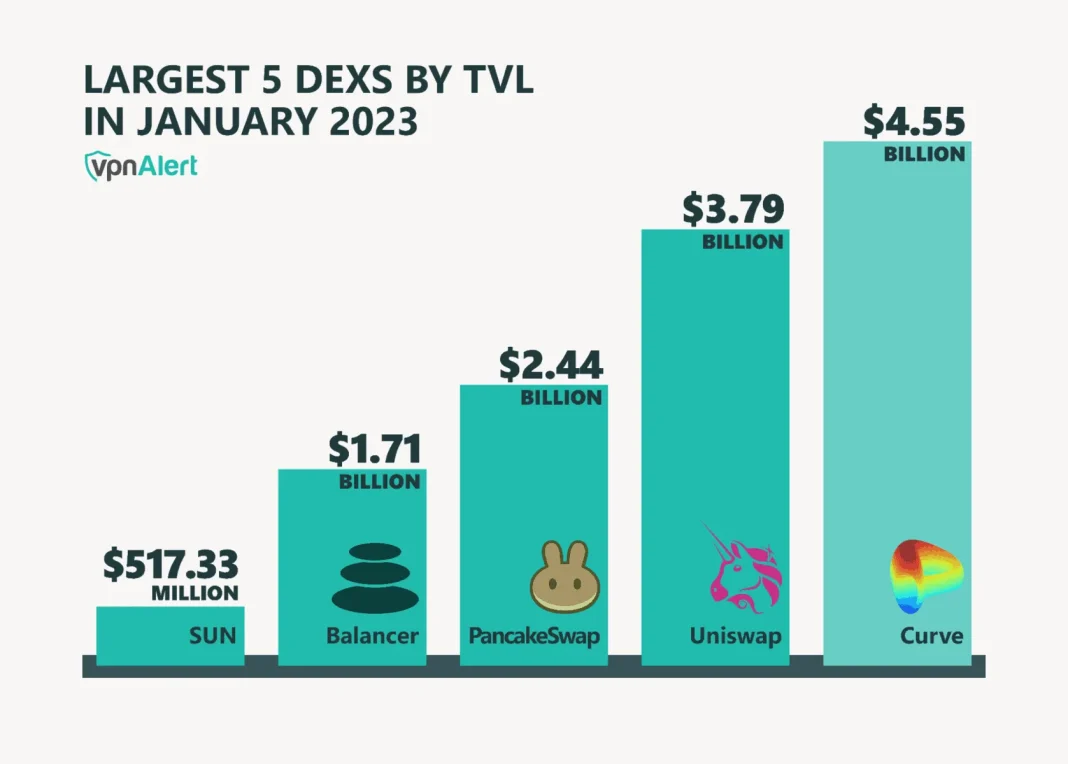

DEX Volumes and Protocol Revenue — How Trading Activity Fuels TVL Growth

Decentralized exchanges (DEXes) have shown robust trading volumes, with daily trades totaling billions and sizable fees flowing back into liquidity pools. This on-chain activity not only fuels protocol revenue but also contributes to the perceived value of locked capital, as traders seed liquidity to capture yield and fees. The resulting TVL growth is visible across top platforms in the DeFi ecosystem and aligns with the broader narrative of DeFi’s continued profitability.

A closer look at the numbers reveals a diversified funding landscape where lending, staking, and DEX activity collectively push the TVL higher. The fee flows from DEX trades act as a barometer for user engagement and protocol health, reinforcing the idea that DeFi’s TVL is a function of active participation across multiple verticals rather than a single driver.

Top Ten DeFi Players and the 29-Chain Panorama — A Multi-Protocol TVL Tapestry

Taken together, DeFi’s top ten heavyweights demonstrate a multi-chain, multi-venue liquidity tapestry that mirrors 2021’s peak energy. Liquidity is distributed across lending, staking, restaking, and cross-chain protocols that span dozens of networks, giving the space a resilience that can buoy TVL through market cycles. The current mix—lending giants, staking leaders, and restaking upstarts—suggests a healthy balance between capital efficiency and risk management.

The broader ecosystem now spans 29 chains, with players like Morpho expanding across networks and delivering incremental gains. Bitcoin’s Babylon Protocol also contributes with billions in TVL, while Pendle and other yield-oriented projects add nuance to the yield-seeking behavior of users. DefiLlama TVL data helps capture this complexity, offering a lens into how capital migrates and which segments are driving the most sustained TVL growth.

What It Will Take to Break the 2021 November Record — Market Conditions and Strategic Moves

Breaking the November 2021 record requires a confluence of favorable market conditions, continued protocol innovation, and disciplined risk management. The base data shows a healthy DeFi TVL environment, but surpassing that peak will demand steady inflows from both retail and institutional participants, along with robust security and governance frameworks that reduce capital flight during downturns. The path forward will hinge on sustaining yield, liquidity, and trust in key protocols.

Strategic moves across the ecosystem—improved staking mechanics, enhanced restaking security, and cross-chain liquidity optimization—will likely be necessary to push TVL beyond the 2021 peak. As DefiLlama TVL data continues to track liquidity, investors will watch for signals such as new capital inflows into top-tier staking venues, sharper growth in lending pools, and healthier DEX fee ecosystems to confirm that DeFi’s momentum remains intact.

The Future of DeFi TVL: Liquidity, Security, and Regulation Shaping Growth

Looking ahead, DeFi TVL growth will depend on a blend of scalable liquidity, fortified security, and thoughtful regulation that fosters mainstream adoption without stifling innovation. The current landscape—where top protocols combine lending, staking, and restaking—offers a template for sustainable growth anchored by real-world utility and transparent governance. As long as users see durable yields and robust risk controls, TVL is likely to remain a primary barometer of DeFi’s health.

Regulatory clarity and improved risk management will influence investor confidence and the velocity of capital inflows. The balancing act between innovation and compliance will shape which protocols can attract long-term liquidity, and DefiLlama TVL data will continue to play a crucial role in monitoring these shifts. In this evolving environment, the DeFi ecosystem must maintain open, auditable data practices to support trust and continued growth across multiple chains.

Frequently Asked Questions

What is DeFi TVL and why is it important for the Total Value Locked DeFi metric?

DeFi TVL is the total value locked in decentralized finance protocols across lending, staking, and other activities. It serves as a primary gauge of market liquidity and user adoption, a core input for the Total Value Locked DeFi metric and is tracked by DefiLlama TVL data.

Has the DeFi TVL reached the 2021 peak according to DefiLlama TVL data?

DefiLlama TVL data show DeFi TVL moving toward the DeFi TVL 2021 peak, with gains across lending, staking, and restaking that keep the benchmark in sight.

Which protocols currently top the Total Value Locked DeFi rankings according to DefiLlama TVL data?

DefiLlama TVL data indicate leaders like Aave for lending and Lido for staking, with other participants contributing to the top DeFi TVL and shaping the broader TVL landscape.

What is DeFi staking and restaking, and how does it impact DeFi TVL?

DeFi staking locks tokens to earn rewards; restaking adds a second layer of staking, expanding the Total Value Locked DeFi and boosting the visibility of DeFi TVL in data like DefiLlama TVL data.

How fast is the DeFi TVL changing day to day, and what does DefiLlama TVL data show?

Daily TVL movements can be brisk as markets shift; DefiLlama TVL data tracks these changes across chains, providing a read on momentum toward the DeFi TVL 2021 peak.

How does the current DeFi TVL relate to the broader crypto market cap?

The broader crypto economy sits around several trillion dollars, with DeFi TVL representing a key subset that is continuously tracked via DefiLlama TVL data.

What factors could push TVL above the 2021 peak?

Sustained DeFi staking and restaking activity, expanded cross-chain TVL, and stronger lending and DEX volumes could push DeFi TVL beyond the DeFi TVL 2021 peak, as reflected in DefiLlama TVL data.

What role do DEXes and lending protocols play in DeFi TVL growth?

DEXes and lending protocols are major drivers of Total Value Locked DeFi, attracting capital that DefiLlama TVL data highlights when ranking top TVL across protocols.

What should investors know about DeFi staking and restaking’s impact on TVL?

Staking and restaking attract long-term capital, boosting DeFi TVL and signaling healthy liquidity, a pattern observed in DefiLlama TVL data.

How can readers interpret daily TVL movements in the context of the DeFi TVL 2021 peak?

Look for sustained trends rather than single-day moves; if daily TVL changes continue pushing totals toward the DeFi TVL 2021 peak, it may indicate rising adoption as tracked by DefiLlama TVL data.

| Key Point | Details |

|---|---|

| Total DeFi TVL | Currently above $4 trillion; crypto economy ~ $4.21 trillion; stablecoins >$300 billion. |

| All-time peak gap | Nov 9, 2021 peak: $178.841B; current TVL is ~7.04% below that; needs about $11.754B to topple the record. |

| Recent 24h change | DeFi added $3.677B to TVL in the last 24 hours (DefiLlama). |

| Trading activity on DEXes | DEX trades totaled $18.67B in 24 hours; traders paid $120.98M in fees. |

| Top protocols by TVL (selected) | Aave: $44.971B; Lido: $38.22B; Eigenlayer: $18.85B; Binance Staked ETH: $15.8B; Ethena: $14.98B. |

| Other notable TVLs | Ether.fi: $11.24B; Spark: $9.22B; Morpho: $7.78B; Babylon Protocol: $6.95B; Pendle: $6.77B. |

| Overall takeaway | Top DeFi players remain well capitalized; the sector hints at the potential to challenge or approach the 2021 peak as it grows across lending, staking, and restaking. |

Summary

DeFi TVL signals the ongoing health and momentum of the crypto ecosystem, as lending, staking, restaking, and DEX activity attract sustained capital. While the sector eyes the 2021 peak, the breadth of large-cap protocols and the steady growth across marquee apps underscore DeFi’s resilience and ongoing innovation. As a key gauge of market health, DeFi TVL suggests continued opportunities for investors and users seeking exposure to the evolving decentralized finance landscape.