Perp DEX volumes hit a record level in September, marking a milestone for decentralized derivatives. According to Defillama, total volume climbed to about $1.43 trillion, up roughly 50% from the prior month. Aster led the field with about $672.43 billion, nearly half of all Perp DEX activity, while Hyperliquid captured $281.44 billion and Lighter Layer 2 added $170.12 billion after moving its network to mainnet. The surge highlights growing participation from retail traders and institutional momentum in on-chain derivatives and perpetual futures. With centralized exchanges under scrutiny, decentralized perpetual venues are becoming the preferred playground for leveraged crypto trading.

Beyond the headline figures, the momentum points to a broader expansion of on-chain derivatives and perpetual contracts within decentralized ecosystems. Investors are increasingly drawn to transparent, verifiable venues that blend leverage with blockchain-based settlement. These dynamics underscore a shift toward specialized, high-performance platforms that scale perpetual futures trading without traditional intermediaries. As Layer 2 networks such as Lighter Layer 2 mature, faster settlement and lower fees could unlock deeper liquidity across these markets.

Perp DEX Volumes Break $1.4 Trillion Milestone in September

In September, Perp DEX volumes surged to $1.43 trillion, according to Defillama, marking a historic milestone for on-chain derivatives trading and perpetual futures on decentralized venues. The scale of activity signals a shift in how crypto traders access leveraged exposure, with a growing preference for transparent, verifiable liquidity that operates outside traditional centralized exchanges.

This record month was driven by multi-hundred-billion-dollar performances from leading protocols, underscoring a broader market demand for decentralized, auditable trading infrastructure. The leap in Perp DEX volumes highlights both retail trader participation and institutional momentum flowing into on-chain derivatives, as market participants seek faster settlement and improved price discovery through Layer 1 and Layer 2 ecosystems.

Aster’s Dominance: Nearly Half of All Perp DEX Activity

Aster led the market with $672.43 billion in trading activity, accounting for nearly half of all Perp DEX volume. This outsized share reflects Aster’s ability to attract high-frequency traders and provide deep liquidity for perpetual futures contracts on-chain.

Analysts note that Aster’s dominance signals a strategic tilt toward specialized, high-performance venues where speed, verifiable settlement, and robust order matching attract large-scale liquidity pools. As on-chain derivatives mature, Aster’s market leadership could influence how new entrants prioritize technology, risk controls, and liquidity partnerships.

Hyperliquid Climbs to Prominent Position with $281.44B in September

Hyperliquid posted $281.44 billion in volume, cementing its status among the top perpetual protocols and underscoring healthy competition within on-chain derivatives markets.

The platform’s continued growth demonstrates the appeal of streamlined perpetual futures trading on-chain, with traders seeking reliable liquidity and reduced slippage across diverse market conditions. Hyperliquid’s trajectory also reflects the broader shift toward decentralized venues that can compete with centralized venues on throughput and transparency.

Lighter Layer 2 Enters the Mainnet: Expanding Options for Perpetual Trading

Lighter achieved $170.12 billion in volume after moving its Layer 2 network to public mainnet, illustrating how Layer 2 scaling is unlocking deeper liquidity for on-chain derivatives.

This move aligns with wider Layer 2 adoption in DeFi, enabling faster order execution, lower gas costs, and more sustainable perpetual futures trading. By combining Layer 2 efficiency with on-chain settlement, Lighter Layer 2 expands the reach and accessibility of perpetuals for a broader audience.

EdgeX and the Mid-Tier Growth Narrative in Perp DEXs

EdgeX nearly reached the $100 billion club with $97.83 billion in trading, highlighting continued expansion beyond the top leaderboards in on-chain derivatives.

The breadth of activity across mid-tier protocols illustrates a maturing ecosystem where diverse platforms compete on liquidity provision, risk controls, and user experience. This growth strengthens overall market depth for perpetual futures and supports healthier price discovery across the space.

Jupiter’s Role and Market Structure Shifts in September

Jupiter traded $22.15 billion, reflecting its niche position within the broader perpetual futures arena and signaling continued diversification of Perp DEX volumes.

As more players enter and expand, the market structure is evolving toward specialized venues that emphasize speed, secure settlement, and transparent, auditable on-chain activity, benefiting traders who value reliability and access.

Regulatory Landscape: Why Decentralized Perpetuals Attract Traders Now

With centralized exchanges facing regulatory scrutiny, DeFi perpetual futures platforms offer a path toward regulated-like transparency through on-chain governance and verifiable settlements.

The September surge demonstrates growing confidence in decentralized risk controls and open liquidity, encouraging both retail and institutional traders to explore on-chain derivatives markets as a compliant, auditable alternative.

The Rise of On-Chain Derivatives: From Niche to Core Crypto Infrastructure

Data show that on-chain derivatives are transitioning from a niche product to core crypto infrastructure, with perpetual futures driving significant daily activity on credible decentralized platforms.

This trend is supported by the liquidity depth of Aster, Hyperliquid, and Lighter Layer 2-enabled venues, which enhances market-making, price discovery, and resilience across varying market regimes.

Aster’s Strategy: High-Frequency Trading and Market Share Expansion

Aster’s leadership highlights a strategy centered on high-frequency trading models, low-latency order routing, and rapid on-chain settlement that strongly appeals to active traders.

The outcome reinforces the market shift toward specialized, high-performance platforms in the Perp DEX landscape, shaping competitive dynamics and sustainable growth trajectories for on-chain derivatives.

Retail and Institutional Momentum: Why Perp DEXs Are Gaining Ground

September’s performance reflects a blend of rising retail participation and growing institutional momentum as traders seek transparent, borderless access to perpetual futures.

In a regulatory environment that scrutinizes centralized venues, decentralized perpetual exchanges deliver auditable activity and permissionless access, attracting a broad audience during periods of volatility.

Future Outlook: Decentralized Perpetuals Set to Challenge Centralized Derivatives

With volumes on an upward trajectory, decentralized perpetuals are entering a new phase of scale and competition against centralized derivatives markets.

Analysts expect continued growth for on-chain derivatives, supported by Layer 2 innovations and the ongoing adoption of L2 networks to lower fees, improve throughput, and enhance trader confidence.

Layer 2 Adoption, Interoperability, and the Expansion of Perp Trading

The expansion of Lighter Layer 2 and related scaling solutions is a key driver behind the sustained growth of Perp DEX volumes and cross-chain liquidity.

As more Layer 2 ecosystems integrate with on-chain derivatives protocols, perpetual futures trading becomes more accessible, efficient, and auditable for participants, strengthening the overall DeFi infrastructure.

Frequently Asked Questions

What was the total Perp DEX volumes in September and which platforms led the market?

September’s Perp DEX volumes reached about $1.43 trillion (per Defillama). The leaders were Aster with roughly $672.43B, Hyperliquid with $281.44B, and Lighter Layer 2 with $170.12B after moving to public mainnet.

How did on-chain derivatives volumes trend month over month for Perp DEXs?

The month showed a near 50% increase from August, totaling about $1.43 trillion in on-chain derivatives volumes, highlighting rising retail and institutional momentum in perpetual futures on Perp DEXs.

Which Perp DEX dominated September’s Perp DEX volumes?

Aster led the pack, capturing nearly half of all Perp DEX activity, with Hyperliquid and Lighter Layer 2 contributing sizable volumes and expanding the ecosystem’s liquidity.

What does the surge in Perp DEX volumes indicate about perpetual futures adoption?

The surge signals growing demand for on-chain perpetual futures and a shift toward decentralized, verifiable venues as centralized exchanges face regulatory scrutiny.

How did Lighter Layer 2 impact Perp DEX volumes after its mainnet move?

Lighter Layer 2 posted about $170.12B in September after bringing its Layer 2 network to public mainnet, underscoring how Layer 2 scaling boosts throughput and drives Perp DEX volumes.

Why are decentralized perpetual exchanges gaining traction among traders?

Decentralized perpetual exchanges offer transparent on-chain settlement, lower counterparty risk, and robust liquidity for perpetual futures, attracting both retail traders and institutions seeking efficient, crypto-native trading venues.

What is the significance of Aster’s market share in Perp DEX volumes?

Aster’s leadership highlights a shift toward specialized, high-frequency Perp DEXs, with a market share that dwarfs rivals and signals growing demand for decentralized perpetual venues.

How can traders use Perp DEX volume insights to inform strategies?

Track Perp DEX volumes (e.g., Defillama) and monitor leaders like Aster, Hyperliquid, and Lighter Layer 2 to gauge liquidity, price impact, and opportunities in on-chain perpetual futures trading.

| Key Point | Details |

|---|---|

| Total market volume (September) | DefiLlama reports $1.43 trillion in total trading volume for September, up ~50% MoM and the first month above $1 trillion. |

| Top performers (> $100B) | Aster: $672.43B; Hyperliquid: $281.44B; Lighter: $170.12B (after moving Layer 2 mainnet to public). |

| Notable others | EdgeX: $97.83B (barely misses $100B); Jupiter: $22.15B. |

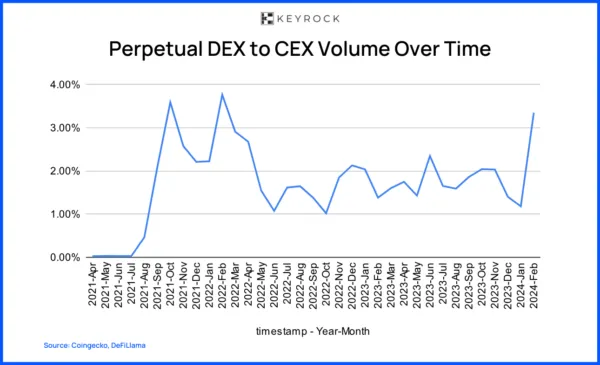

| Market drivers | Retail trader participation and institutional momentum; DEXs for perpetual futures gaining as CEXs face regulatory scrutiny. |

| Market dynamics | Aster’s leadership highlights a shift toward specialized, high-frequency, decentralized platforms; growing appetite for decentralized, verifiable alternatives to centralized venues. |

| Outlook | Decentralized perpetuals are on pace to rival large centralized derivatives markets, signaling a new phase of scale and competition in crypto-native trading infrastructure. |