eCash Pre-Consensus marks a significant advancement in the realm of blockchain technology, particularly in enhancing transaction efficiency. Announced by eCash founder Amaury Séchet at the Electronic Cash Conference in Barcelona, this feature is set to activate on November 15 as part of the eCash upgrade. By integrating Avalanche consensus mechanisms, eCash Pre-Consensus is poised to deliver instant finality on a proof-of-work (PoW) blockchain, enabling transaction confirmations in as little as three seconds. This innovative approach not only streamlines the payment process but also reduces reliance on traditional probabilistic settlement methods. With support from major exchanges like Binance and Upbit, the eCash Pre-Consensus initiative is a game-changer for digital cash, demonstrating the potential of combining established technologies with groundbreaking enhancements.

The upcoming implementation of eCash Pre-Consensus is a transformative step for digital currency, leveraging Avalanche-like consensus to revolutionize transaction verification. This feature is designed to provide instantaneous settlement for transactions, significantly expediting processes that previously required waiting for multiple blocks to confirm. With insights from blockchain innovator Amaury Séchet, this upgrade reflects a commitment to enhancing the overall utility and efficiency of eCash. The strategic layering of Avalanche protocols over a proof-of-work foundation marks a unique solution in the cryptocurrency landscape, aligning with the growing demands for quicker and more reliable financial transactions. As eCash continues to evolve, the introduction of pre-consensus showcases an impressive melding of speed and security, setting a new standard for future blockchain developments.

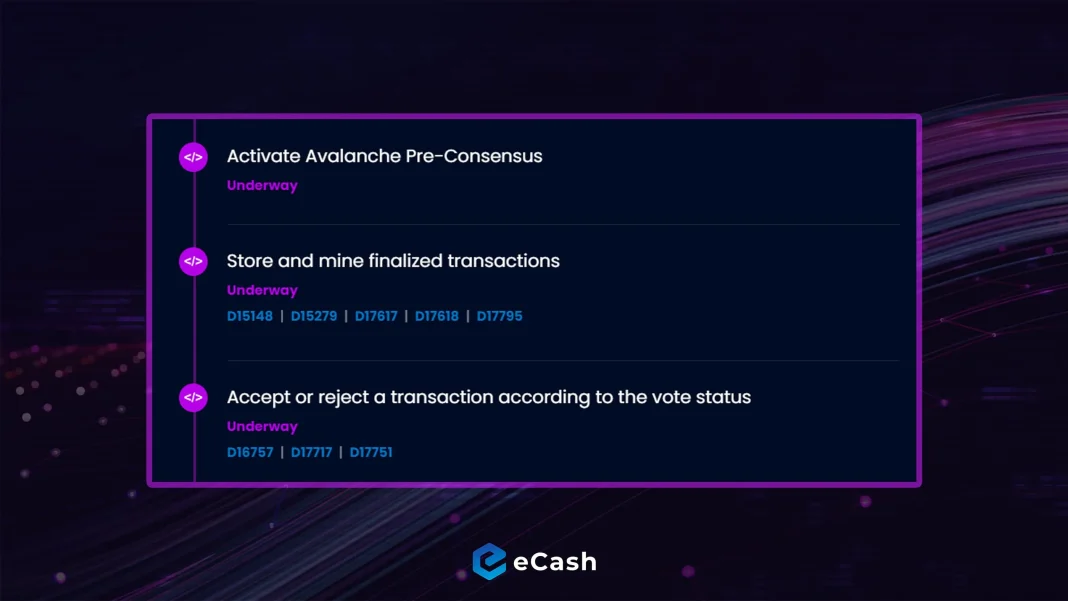

Understanding eCash Pre-Consensus and Its Significance

eCash Pre-Consensus marks a remarkable advancement in the realm of digital cash technology, enabling faster and more efficient payments through its innovative consensus mechanism. This feature, activated as part of the Nov. 15 network upgrade, leverages Avalanche-style consensus to achieve instant transaction finality—an essential aspect for users and service providers alike. By ensuring that transactions are confirmed within an unprecedented three seconds, eCash aims to revolutionize the way cash transactions are processed on the blockchain.

The significance of this upgrade goes beyond mere speed; it represents a fundamental shift in how a proof-of-work blockchain can operate. With the integration of Pre-Consensus, eCash sets itself apart from traditional payment methods by reducing the reliance on probabilistic settlement. For merchants and exchanges, this means that deposits can be credited instantly, enhancing user experience and trust in the platform. Amaury Séchet, as the founder, emphasizes that this development positions eCash as a frontrunner in digital currency innovation and efficiency.

The Role of Avalanche Consensus in eCash’s Evolution

Avalanche Consensus significantly influences the protocol’s enhancements in eCash by combining the strengths of Nakamoto consensus with rapid settlement capabilities. This hybrid approach allows for secure, fast, and reliable transaction processing, which is essential for users who expect instant confirmation when transacting online. The adaptation of Avalanche-style consensus within a proof-of-work framework is particularly noteworthy, as it showcases the potential of traditional blockchain principles being updated with modern technological advancements.

As eCash aims to create a seamless digital cash solution, the use of Avalanche brings a layer of certainty and assurance to users accustomed to higher transaction times on traditional PoW blockchains. The eCash upgrade, featuring this consensus mechanism, not only addresses longstanding inefficiencies but also positions the platform favorably against other cryptocurrencies competing in the instant finality space. By focusing on swift and secure transactions, eCash can attract a broader range of users looking for a reliable digital cash alternative.

How eCash Upgrade Enhances User Experience

The upcoming eCash upgrade, slated for November 15, promises to enhance user experience significantly by implementing Avalanche Pre-Consensus, allowing for instant transaction confirmations. Current blockchain systems often require several confirmations to secure a transaction fully, leading to delays that can frustrate users and service providers. With this new feature, transactions can be guaranteed within seconds, thus streamlining operations for both merchants and customers.

By reducing the ordinary delays associated with wait times for confirmations, eCash becomes more attractive to users and exchanges, which are crucial in facilitating real-time payments. Notable exchanges like Binance and Upbit already support this upgrade, highlighting its potential appeal to a vast audience. This efficiency not only develops user loyalty but also paves the way for broader adoption of eCash as a reliable and convenient digital currency.

The Vision of Amaury Séchet on Digital Cash Technologies

Amaury Séchet, the visionary behind eCash, has been instrumental in shaping the future of digital cash technologies. His insights shared at the Electronic Cash Conference in Barcelona shed light on the strategic direction of eCash, particularly with the upcoming integration of Avalanche Pre-Consensus. Séchet envisions a world where digital cash operates flawlessly, contributing to a vibrant financial ecosystem that encompasses instantaneous transactions and robust user privacy.

Séchet’s commitment to innovation is clear as he articulates the broader implications of the eCash upgrade. His leadership reflects a desire not only to advance eCash but to also set a standard for how other cryptocurrencies can integrate modern technologies to address common issues in blockchain, particularly in transaction finality. As the industry shifts toward faster and more reliable payment solutions, Séchet’s role becomes increasingly vital in pioneering these changes.

Implications for Proof of Work Blockchains

The integration of Avalanche Pre-Consensus into eCash serves as a critical turning point for proof-of-work (PoW) blockchains. Traditionally, PoW systems have been criticized for their slower transaction times due to the nature of block confirmations. However, with the introduction of Pre-Consensus, eCash demonstrates that PoW can adapt and evolve by embracing new technologies that enhance efficiency.

This breakthrough could inspire other PoW projects to explore similar integrations, highlighting a growing trend toward improving transaction speeds without compromising on security. As the eCash upgrade approaches, it presents an example for the blockchain community on how to leverage hybrid consensus models, potentially leading to a new era of fast, reliable, and scalable PoW solutions.

Collaboration and Support within the Blockchain Ecosystem

As eCash prepares for the launch of its Pre-Consensus feature, the support from major exchanges and blockchain entities is vital for a successful rollout. Collaborations with firms like Binance, Bithumb, and Coinex showcase an encouraging trend among cryptocurrency exchanges to support technological advancements that enhance user experience. This partnership strategy not only boosts the credibility of eCash but also provides a networking effect that benefits the entire blockchain ecosystem.

Such collaborations help establish a reliable infrastructure for the deployment of instant finality, allowing exchanges to process transactions with minimal delays. This collective effort is expected to cultivate trust and facilitate greater adoption of eCash as a preferred digital payment option, ultimately allowing it to resonate with a wider audience while enriching the blockchain landscape.

Monitoring and Adapting to the Evolution of Instant Finality

The implementation of instant finality through eCash Pre-Consensus brings a new layer of complexity to blockchain operations, necessitating continuous monitoring and adaptation. As users and service providers adjust to this model, it becomes crucial for the eCash development team to observe transaction behaviors and overall network performance. Utilizing feedback from exchanges and users will ensure that any necessary adjustments or improvements can be made quickly, maintaining the platform’s integrity and efficiency.

Moreover, as instant finality gains traction in the blockchain community, it sets the stage for other projects to explore similar advancements, thereby transforming the industry dynamics. By leading this charge, eCash aims to stay ahead of emerging trends while cementing its status as a pioneer in digital cash technology. The commitment to optimizing user experience through rapid updates and improvements to the Pre-Consensus mechanism will be critical in addressing the evolving needs of the marketplace.

The Future of Digital Cash with eCash Innovations

As eCash moves forward with its innovative Pre-Consensus feature, the future of digital cash looks brighter than ever. The combination of Avalanche-style consensus with the traditional proof-of-work system signals a new era where speed and security are prioritized, catering to the demands of a fast-paced digital economy. This forward-thinking approach places eCash at the forefront of blockchain technology, potentially influencing the development trajectories of other cryptocurrencies.

With the impending activation of Pre-Consensus, eCash is poised to redefine user expectations around transaction finality. As new features are rolled out, engagement with the community and adaptability to feedback will remain essential to foster an environment of trust and transparency. The evolution of digital cash, spearheaded by eCash and motivated by leaders like Amaury Séchet, indicates that the cryptocurrency sector is gearing up for transformative changes that will enhance financial interactions globally.

Tracking Integrations and Community Engagement for eCash

In the wake of the eCash upgrade, an important aspect of its success will be the tracking of integrations and community engagement. The introduction of a public scorecard to monitor exchanges and services that support Pre-Consensus reflects a commitment to transparency and accountability within the eCash project. This functionality will not only inform users but will also encourage other platforms to adopt similar practices, amplifying the growth of the eCash ecosystem.

By actively sharing updates and engaging with the community, eCash acknowledges the essential role that users play in its success. The vibrant ecosystem around cryptocurrency thrives on collaboration and support, and as eCash implements further iterations of its technology, the feedback loop between developers and users will be invaluable in shaping future enhancements. Monitoring these dynamics will ensure that eCash remains responsive and relevant in an ever-evolving digital finance landscape.

Frequently Asked Questions

What is eCash Pre-Consensus and how does it work?

eCash Pre-Consensus is a significant upgrade that integrates Avalanche-style consensus mechanics into the eCash (XEC) blockchain, enabling instant finality for transactions prior to block confirmation. This means that transactions can be confirmed within about three seconds, enhancing the overall transaction speed and reliability of eCash.

How does eCash Pre-Consensus provide instant finality?

eCash Pre-Consensus utilizes Avalanche consensus to achieve instant finality on a Proof of Work (PoW) blockchain. By implementing this mechanism, transactions can be decided swiftly, thus eliminating the need for multiple block confirmations and allowing for routine payments to be confirmed almost instantly.

When will eCash Pre-Consensus be activated on the network?

eCash Pre-Consensus is scheduled to activate on the mainnet as part of the eCash upgrade on November 15. This upgrade will formally implement the discussed capabilities of Avalanche-style consensus, marking a new milestone in digital cash technology.

What are the benefits of eCash Pre-Consensus for exchanges and services?

For exchanges and services, eCash Pre-Consensus means that deposits can be credited immediately without the traditional waiting period for multiple block confirmations. This enhancement will streamline transactions, making eCash more efficient for users and service providers alike.

Who is the founder of eCash, and what did they say about Pre-Consensus?

Amaury Séchet, the founder of eCash, highlighted the importance of Pre-Consensus at the Electronic Cash Conference in Barcelona, stating that it represents a critical milestone for both eCash and the broader digital cash ecosystem. He emphasized its role in advancing transaction speed and finality.

What differentiates eCash’s Avalanche implementation from the AVAX network?

eCash’s Avalanche implementation is specifically designed for the eCash (XEC) blockchain and is developed by the Bitcoin ABC team. It operates independently from the AVAX network, tailored to enhance eCash’s Proof of Work system with accelerated transaction settlement through Pre-Consensus.

Will current services supporting eCash be ready for the Pre-Consensus upgrade?

Yes, several current service providers, including major exchanges like Binance, Upbit, and Bithumb, are expected to support eCash’s Avalanche finality feature. A public scorecard will track integrations and the rolling out of this upgrade across compatible services.

How can users find more information about instant finality and eCash Pre-Consensus?

Users can access additional information about instant finality and the integration of Avalanche consensus in eCash through the project’s website. The site also features a scorecard that monitors service support and updates on the Pre-Consensus upgrade.

| Key Point | Details |

|---|---|

| Announcement | eCash founder Amaury Séchet announced the launch timeline for Pre-Consensus at the Electronic Cash Conference in Barcelona. |

| Launch Date | Pre-Consensus will go live on Nov. 15 as part of the eCash network upgrade. |

| Functionality | It integrates Avalanche-style consensus for fast transaction finality before block production. |

| Confirmation Time | Targets transaction confirmation within three seconds, reducing the need for multiple block confirmations in routine payments. |

| Milestone Statement | Séchet described Pre-Consensus as a significant milestone for both eCash and digital cash technology. |

| Support from Exchanges | Supported by exchanges including Binance, Upbit, Bithumb, HTX, and Coinex, which will allow immediate deposits without waiting for confirmations. |

| Development Team | Developed by the Bitcoin ABC team, the Avalanche integration is distinct from the AVAX network and maintains proof-of-work. |

| Status | The activation is pending execution across compatible nodes. |

Summary

eCash Pre-Consensus marks a transformative step in blockchain technology by introducing instant finality on a proof-of-work network. This upcoming feature promises to enhance transaction efficiency, allowing users to experience near-instant transaction confirmations by November 15. With the integration of Avalanche-style consensus, eCash aims to reduce settlement times significantly, positioning itself as a robust alternative in the digital currency landscape. As digital cash technology evolves, eCash Pre-Consensus is set to redefine user expectations for transaction speed and reliability.