The Bitcoin premium in South Korea has surged once again, as local crypto traders eagerly pay a premium for BTC. In recent weeks, as the Bitcoin price in South Korea has flirted with historical highs, this premium has not just reemerged but has thrived for the last 20 days, making headlines in the global crypto market. This sustained price discrepancy, where Bitcoin is traded at a rate significantly higher than the global average, reflects the ongoing enthusiasm among South Korea’s investors. With a combination of heightened demand and strict regulations, the South Korean cryptocurrency market exhibits a fascinating ecosystem where patterns of premium pricing persist. For those looking to understand Bitcoin price analysis in this region, it’s evident that the local fervor for Bitcoin remains unabated, driving costs significantly above global benchmarks.

In the heart of South Korea’s vibrant cryptocurrency landscape, the allure of a Bitcoin premium continues to captivate traders. As the digital asset climbs to unprecedented heights, the localized pricing gap showcases the dynamic nature of the South Korean market. Factors such as regulatory constraints and a robust interest in Bitcoin fuel ongoing price fluctuations, creating a unique trading environment. The phenomenon of crypto traders paying extra for BTC is not merely a passing trend but reflects a deeper demand for cryptocurrencies that remains consistent across South Korean exchanges. This persistent premium not only highlights the significant Bitcoin price fluctuations in South Korea but also underlines the distinctive characteristics of the country’s crypto trading practices.

Understanding Bitcoin Premium in South Korea

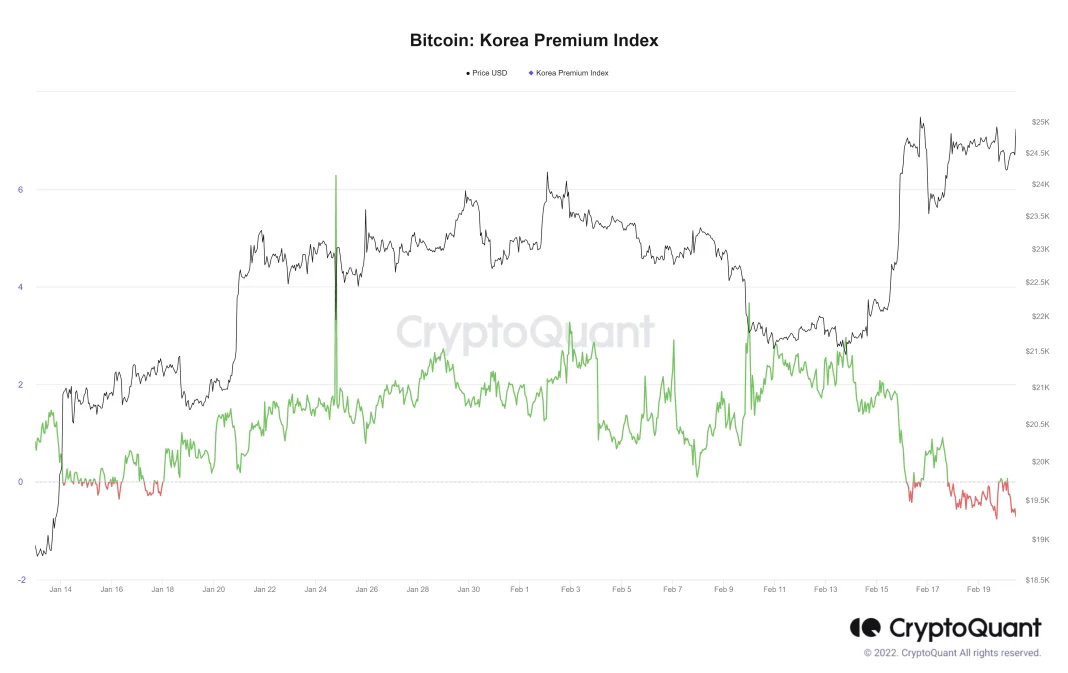

The concept of Bitcoin premium in South Korea has become a major point of discussion among crypto traders and enthusiasts alike. As the global Bitcoin price fluctuates, South Korean traders find themselves often paying more for their Bitcoin (BTC), leading to a consistently high premium over the global averages. Recent data shows that this premium has persisted for weeks, with Bitcoin trading well above the international price. This occurs not only due to local market conditions but also because of stringent regulations that prevent more fluid exchanges between digital assets and fiat currency.

Moreover, this ongoing premium reflects broader behavioral trends among South Korean cryptocurrency investors. Unlike many countries where arbitrage opportunities quickly normalize price differences, South Korea’s unique market dynamics create an environment in which these premiums can thrive. Factors like the difficulty in arbitrage due to regulatory restrictions and heightened demand among local traders bolster this phenomenon. In essence, the sustained Bitcoin premium serves as a barometer of South Korea’s vibrant and often volatile cryptocurrency landscape.

Bitcoin Price Discrepancy: Causes and Implications

Several factors contribute to the notable Bitcoin price discrepancy observed in South Korea. One significant cause is the stringent capital controls in place, creating barriers for easy cross-border transfers of digital currencies. Due to these regulations, funds cannot seamlessly flow between domestic and foreign markets, preventing arbitrage opportunities that could otherwise equalize Bitcoin prices. As a result, South Korean investors often find themselves paying a premium for their BTC, particularly during bull runs or market surges.

Additionally, the cultural affinity towards cryptocurrency in South Korea plays a vital role. The local market is characterized by a substantial retail investor base that actively engages in trading, coupled with limited access to international exchanges. This high demand among domestic traders amplifies price inequalities, especially during price spikes. Understanding these dynamics not only provides insights into the South Korean crypto traders’ mentality but also signals potential investment strategies for those looking to benefit from Bitcoin’s price fluctuations.

How South Korean Regulations Impact Bitcoin Pricing

The regulatory environment in South Korea significantly influences Bitcoin pricing and trading behavior in the country. Strict financial regulations restrict the flow of capital, making it challenging for traders to cash in on international price averages. As a consequence, when global Bitcoin prices surge, local prices often climb at a faster rate, resulting in higher premiums for South Korean traders. This has been evident in recent weeks, where Bitcoin prices in South Korea reflected substantial gains compared to global counterparts.

Furthermore, these regulations not only impact the immediate market conditions but also shape the long-term outlook for Bitcoin’s presence in South Korea. As local exchanges adapt to regulatory requirements, the need for transparency and compliance continues to influence trading practices. This unique regulatory landscape creates a complex interplay between price, demand, and accessibility, highlighting South Korea’s pivotal role in the global cryptocurrency ecosystem.

Analyzing Recent Trends in Bitcoin Prices

As Bitcoin pricing trends continue to evolve, analysis of the recent surges provides valuable insights into the market’s behavior. In the past few weeks, we’ve observed an exceptional increase in BTC prices, particularly within the South Korean market. Fluctuations such as the transition from premium to discount and back to premium indicate high volatility often driven by trader sentiment and market speculation. This has been crucial for local crypto traders navigating a market that is as unpredictable as it is lucrative.

Moreover, these trends signal a potential for further price analysis as more data becomes available. With South Korea establishing itself as a key player in crypto trading, understanding the contributing factors to these dynamic price shifts will aid traders in making informed decisions. Patterns such as premium fluctuations and trading volumes can provide insights, making BTC price analysis a vital tool for both local and international investors.

The Role of Retail Investors in South Korea’s Crypto Market

Retail investors play an instrumental role in the dynamics of South Korea’s cryptocurrency market, particularly when it comes to Bitcoin trading. The surge in participation from everyday investors has been a driving force behind the rising premiums observed. Unlike institutional investors, retail traders are often motivated by a mix of sentiment and market trends, leading to high demands that can outpace supply, further contributing to price discrepancies against global averages.

This unique phenomenon showcases the power of the retail market in shaping cryptocurrency prices in South Korea. The willingness of South Korean investors to pay a premium for Bitcoin reflects not only their bullish outlook on the digital asset but also their increasing confidence in the market. As more retail investors engage with cryptocurrency, understanding their influence becomes paramount for all market participants looking to navigate this rapidly evolving landscape.

Cryptocurrency Demand Surges Amid Market Volatility

The recent volatility in cryptocurrency markets has led to a notable surge in demand, particularly for Bitcoin in South Korea. As Bitcoin prices flirt with historical highs, local traders are becoming increasingly proactive in acquiring BTC, often at a premium over international prices. This trend suggests that South Korean traders are not shying away from market fluctuations but are instead embracing them, believing in the long-term value of their investments.

Moreover, this increase in demand exemplifies how market sentiment can greatly influence trading behavior. When Bitcoin experiences sharp price movements, traders often respond by hastily buying up available assets, which further propels the market upwards. The combination of high volatility and robust demand shows how interconnected the South Korean trading environment is, and serves as a reminder of the risks and opportunities present in the cryptocurrency landscape.

South Korea Crypto Traders: Strategies to Navigate Premiums

Navigating the complexities of South Korea’s Bitcoin premiums requires strategic foresight and adaptability. For traders, understanding the underlying causes of price discrepancies presents opportunities for smarter investments. By leveraging tools such as comprehensive market analysis and keeping abreast of regulatory changes, crypto traders can optimize their buying and selling strategies to offset the added costs associated with premiums.

Additionally, employing risk management strategies becomes imperative in this unique trading environment. With market fluctuations being commonplace, traders must remain vigilant, utilizing resources that can help them anticipate price movements and adjust their strategies accordingly. Such proactive measures can aid South Korean crypto traders in capitalizing on market opportunities even amidst the prevailing premiums.

The Future Outlook for Bitcoin in South Korea

The future of Bitcoin in South Korea looks promising as both institutional and retail interest continues to grow. With ongoing advancements in blockchain technology and an increasing number of local exchanges, the potential for Bitcoin adoption across various sectors is substantial. As South Korea continues to adapt to global cryptocurrency trends, the persistent premium may evolve, reflecting changes in demand and regulatory landscapes.

Furthermore, it will be fascinating to observe how Bitcoin pricing evolves in tandem with the changing financial ecosystem. With regulations likely to shift, and capital controls challenged, traders might begin to see a reduction in price discrepancies. In essence, the continued interest in Bitcoin positions South Korea as a significant player in the global cryptocurrency arena, with the potential for growth and innovation in the financial sector.

Cryptocurrency Regulatory Trends in South Korea

Regulatory trends in South Korea are poised to influence the future landscape of Bitcoin and other cryptocurrencies significantly. With regulators continuously working to adapt to the evolving digital asset space, upcoming changes may affect how local traders approach the market. As authorities strive for greater clarity and transparency, adjustments in regulation could ease the constraints that currently lead to high premiums.

In this climate of regulatory evolution, it is crucial for traders to stay informed and anticipate changes that might impact pricing and market access. Observing international trends can provide valuable insights for South Korean regulators, potentially paving the way for a more competitive global trading environment. The interplay between regulations and market dynamics ultimately shapes investor confidence and can create new opportunities for growth in the South Korean cryptocurrency market.

Frequently Asked Questions

What is the current Bitcoin premium in South Korea?

As of late October 2023, Bitcoin has been trading at a premium in South Korea, with recent data showing a price discrepancy of around 1.88% above the global average. This premium has been a consistent trend, reflecting high demand and specific market conditions in South Korea.

Why is there a Bitcoin price discrepancy in South Korea?

The Bitcoin price discrepancy in South Korea is attributed to strict financial regulations and capital controls that limit money flow between domestic and international markets. This creates a market environment where local demand drives prices higher, resulting in a premium for Bitcoin compared to global prices.

How do South Korea’s cryptocurrency regulations impact Bitcoin prices?

South Korea’s stringent cryptocurrency regulations create barriers that restrict arbitrage opportunities, leading to persistent Bitcoin premiums. These regulations, coupled with strong local demand for crypto assets, mean that Bitcoin prices can remain elevated compared to the global market.

Is the Bitcoin premium in South Korea a common occurrence?

Yes, the Bitcoin premium in South Korea is a common and recurring phenomenon. Historical trends reveal that South Korean traders often pay more for Bitcoin due to high demand and a unique regulatory environment that supports price discrepancies.

What factors contribute to the Bitcoin price in South Korea being higher than in other countries?

Factors contributing to the higher Bitcoin price in South Korea include stringent government regulations that limit market liquidity, a strong domestic demand for cryptocurrencies, and the overall trading culture in South Korea that encourages purchasing at a premium.

How does South Korea’s Bitcoin price impact crypto traders globally?

The Bitcoin price in South Korea can significantly influence global crypto traders by creating opportunities for arbitrage, although the persistent premium means traders often pay more for BTC in South Korea compared to other markets. This dichotomy presents both challenges and opportunities for traders in different regions.

Where can I find the latest Bitcoin price in South Korea?

To find the latest Bitcoin price in South Korea, traders can check cryptocurrency exchanges like Upbit or Coinmarketcap, which provide real-time data on BTC prices and any premiums compared to global market averages.

What is the historical trend of Bitcoin prices in South Korea?

Historically, Bitcoin prices in South Korea have shown significant premiums during bullish markets, often reflecting local trading dynamics and demand shifts. Recent trends highlight a premium that peaked at 3.27% in late September 2023, indicating ongoing price discrepancies in the market.

| Key Feature | Details |

|---|---|

| Bitcoin Price Surge | Bitcoin is reaching all-time highs, creating significant interest among traders. |

| South Korea’s Bitcoin Premium | For 20 days now, Bitcoin has traded at a premium compared to global averages. |

| Price Fluctuations | The premium peaked at 3.27% on September 25 and is currently around 1.88%. |

| Regulatory Factors | Tight financial regulations in South Korea create lasting price discrepancies. |

| Market Dynamics | Demand for Bitcoin and altcoins fuels the premium, making it a consistent feature. |

Summary

Bitcoin premium South Korea continues to be a fascinating aspect of the crypto landscape. The unique circumstances of stringent regulations and a high demand for digital currencies ensure that South Korea remains a lucrative market for Bitcoin traders. As evident from the recent price surges, local traders are willing to pay significantly above the global average, which keeps the premium alive and well. This trend not only highlights the distinctive behavior of cryptocurrency trading in South Korea but also indicates the potential for continued profitability for savvy investors.