XRP’s market cap pressure is becoming increasingly prominent as the cryptocurrency maintains a valuation of $167 billion, while facing significant challenges. Recent trading activity shows that XRP fluctuated between $2.79 and $2.80, with a trading volume of $5.24 billion in the past 24 hours. This market environment reflects a broader bearish trend in XRP, evident as the price persistently struggles to surpass critical resistance levels. The combination of technical analysis and market sentiment reveals that traders are cautious, focusing on XRP price predictions amidst rising selling pressures. As consolidation continues, understanding the dynamics of XRP trading volumes becomes essential for gauging potential price movements.

The pressure exerted on XRP’s market capitalization illustrates the underlying complexities of the cryptocurrency landscape. Currently hovering around $167 billion, XRP’s recent trading patterns indicate fluctuating prices and a challenging trading volume of $5.24 billion. Analysts are closely monitoring XRP’s resistance levels, which have proven somewhat elusive in light of bearish market trends. With hints of a potential reversal being considered, effective cryptocurrency market analysis is crucial for anticipating XRP’s future trajectory. As traders analyze the technical indicators of XRP, the focus remains on navigating this unpredictable environment.

XRP Market Cap Pressure: What It Means for Traders

XRP’s current market cap of $167 billion indicates its significant presence in the cryptocurrency landscape. However, this valuation comes under pressure as the asset settles into a bearish trading pattern. Investors and traders alike are keenly observing the price fluctuations surrounding this market cap, as it could dictate future price movements and impact overall trading strategy. With the 24-hour trading volume hovering around $5.24 billion, the liquidity remains solid, yet the persistent short-term consolidation raises eyebrows regarding XRP’s resilience against broader market trends.

Understanding the pressures surrounding XRP’s market cap is crucial for effective trading. The recent price action—oscillating between $2.77 and $2.91—signals a critical phase where traders must assess the possibility of a bearish continuation or an unexpected reversal. The interplay between current market dynamics and XRP’s substantial market cap not only affects short-term trading decisions but also plays into long-term investment strategies. For market analysts, the key takeaway remains clear: a breakdown below pivotal support levels could jeopardize XRP’s market cap standing.

Current XRP Trading Volume: Analyzing Market Dynamics

The trading volume for XRP consistently nearing $5.24 billion over 24 hours presents a robust trading environment characterized by significant investor activity. High trading volume often correlates with increased volatility, suggesting that XRP price movements might follow suit. Market practitioners emphasize that monitoring fluctuations in trading volume can provide insights into potential price reversals or continuation patterns. Therefore, as XRP experiences fluctuations within its price range of $2.79 to $2.80, understanding the implications of trading volume becomes paramount for optimizing trading strategies.

Moreover, higher trading volumes accompanying price consolidations might indicate accumulation phases or strength among buyers, reflecting traders’ sentiment towards a potential bullish forecast. Conversely, diminished trading volumes alongside price declines could signify a waning interest among market participants, reinforcing the bearish trend. It becomes evident that the analysis of XRP’s trading volume must be integrated with technical indicators to provide clearer insights into future price actions and possible pivot points.

XRP Price Prediction: Technical Indicators to Watch

Analyzing XRP’s price action through technical indicators can enhance price prediction models significantly. The ongoing consolidation around the $2.77 level reflects bearish sentiments, especially as intraday price movements demonstrate rejections at higher levels such as $2.925. This continued pressure emphasizes the importance of observing key levels and patterns in predicting the potential outcomes for XRP’s future prices. Analyzing the 4-hour chart reveals a consistent trend of lower highs and lows, substantiating the bearish outlook that may guide traders in their decision-making processes.

The relative strength index (RSI) nearing oversold conditions should not go unnoticed in this analysis. If XRP creates a bullish reversal pattern with a surge in volume, confirmation could lead to a potential rally beyond critical resistance levels around $2.90 to $3.10. For many traders, this defines the essential criteria for entering bullish positions. Therefore, careful observation of these technical indicators and understanding their contexts is crucial as traders navigate the complexities of XRP’s market movements.

Exploring Bearish Trends in XRP: Key Insights

The prevailing bearish trend in XRP illustrates the challenges faced by traders in a fluctuating cryptocurrency market. With recent price frames consistently rejecting significant resistance levels, it is essential to assess the market for any further signs of weakness. For instance, XRP has struggled to hold its ground, with heightened selling volumes underscoring the bearish market sentiment. The anticipated consequences of this bearish behavior entail potential price declines, particularly if the asset fails to retain above critical support levels, such as the $2.70 mark.

Market analysts caution against overlooking the long-term implications of these bearish cycles. Prolonged bearish trends can erode investor confidence, diminishing buying interest and increasing the risk of substantial retracements. Thus, understanding these dynamics is essential as traders prepare to navigate potentially challenging scenarios. Effectively, continuous analysis of bearish indicators, accompanied by real-time market developments, helps investors formulate sound strategies amid the ongoing downward pressure.

XRP Technical Analysis: Navigating Price Movements

Diving deeper into XRP’s technical analysis reveals numerous layers of complexity that traders must consider. With the moving averages across various periods indicating a consistent downward trend, it is vital for traders to recognize the implications of these signals. The consistent lingering below the moving averages suggests a bearish market sentiment that further complicates the bullish outlook. Monitoring the interplay between short-term and long-term moving averages might provide a clearer picture of possible future price actions.

Furthermore, oscillators and other indicators acting in bearish territory accentuate the need to assess any potential divergence. As XRP navigates this turbulent terrain, traders should remain alert to any bullish signals, such as a sustained rally above key resistance levels or a shift in volume patterns. Keeping abreast of these technical components allows traders to better position themselves for potential upswings while safeguarding against the risks posed by continuous bearish tendencies.

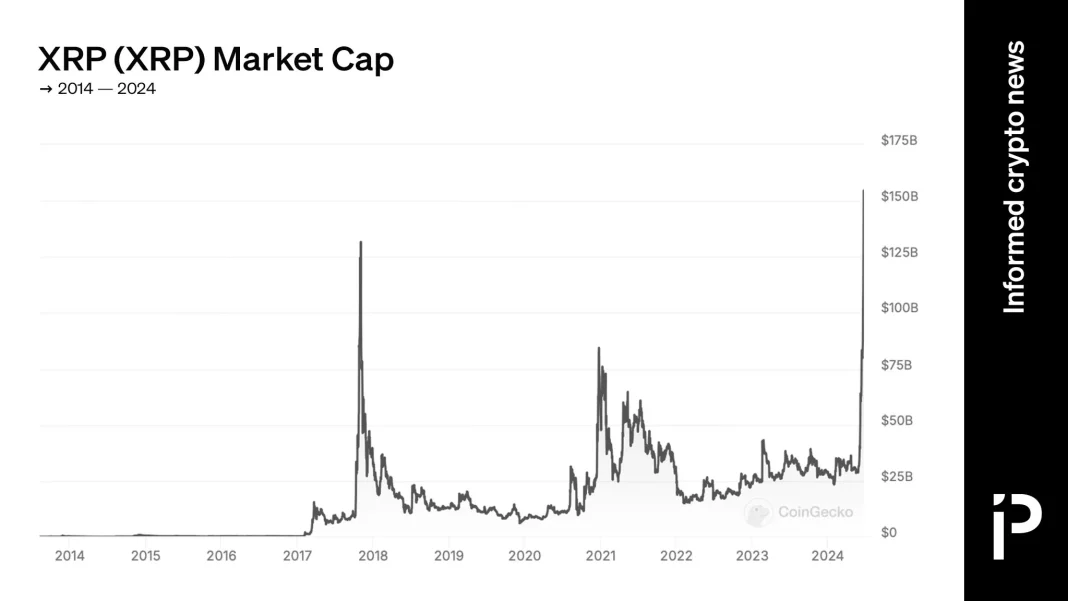

Analyzing XRP’s Price Action: Historical Context

Understanding XRP’s price action in the context of historical trends can significantly enrich current market analysis. Observing how XRP has responded to similar bearish conditions in the past can inform better trading strategies in the present. Historical highs and lows can serve as crucial reference points, guiding traders to identify potential support or resistance levels. For instance, the recent high of $3.183 is now a critical resistance level that traders must take into consideration as they assess the current bearish trend.

Additionally, examining past consolidation periods can provide critical insight into the likelihood of future market movements. Recognizing patterns of prior price recovery after consolidation phases can prepare traders for possibilities of bullish reversals, despite the current bearish imprints. With this historical context, traders can cultivate a more nuanced approach, empowering them to make informed decisions that align with their investment goals amid XRP’s fluctuating market conditions.

Market Sentiment and XRP: Factors Influencing Trends

Market sentiment plays a pivotal role in determining XRP’s price movements. As sentiment shifts, influenced by broader market trends and investor psychology, traders should remain attuned to the indicators signaling changes in mood. For instance, fluctuating trading volumes, negative news cycles, or macroeconomic factors can prompt shifts in sentiment, often preceding significant price changes. The current bearish trend in XRP is heavily influenced by these negative sentiments, suggesting that traders are increasingly cautious about their positions.

Conversely, if positive developments arise—such as regulatory clarity or improved market conditions—the sentiment could swiftly pivot, affecting XRP price prospects. Monitoring news and external market stimuli therefore becomes essential in providing a comprehensive understanding of trading dynamics. As market sentiment pivots, the ability to adapt swiftly could mean the difference between seizing trading opportunities and falling victim to broader market pressures.

Liquidity Analysis in the XRP Market

Liquidity is a fundamental aspect driving XRP’s trading dynamics. Currently, with a 24-hour trading volume of $5.24 billion, XRP retains strong liquidity, facilitating swift transactions and potentially minimizing price manipulation. High liquidity tends to provide stability, while low liquidity environments can exacerbate volatility. As XPR faces bearish pressure amid significant trading volumes, understanding liquidity’s role is crucial for both short-term trades and long-term positions.

Moreover, analyzing liquidity trends alongside market cap pressures can uncover deeper insights into XRP’s performance. Sustained liquidity during bearish trends may indicate broker interest or accumulation phases. To capitalize on this environment, traders must ensure their strategies align with these liquidity conditions, especially as resistance and support levels fluctuate. Ultimately, comprehending liquidity dynamics equips traders with the tools needed to make informed decisions in a constantly evolving market landscape.

Future Outlook for XRP in a Bearish Market

Considering the current bearish market conditions, the future outlook for XRP hinges on a few pivotal factors. While the immediate sentiment remains cautious, potential reversals could be on the horizon should key resistance levels be surpassed. The critical support at $2.70 acts as a fulcrum in this scenario, where any sustained movement above could draw in bullish players, seeking to capitalize on market sentiment. Traders need to remain vigilant in watching key price indicators that could signal a recovery or further decline.

In light of this analysis, it is pertinent for investors to balance risk management strategies as they navigate the murky waters of the XRP market. The interplay of market cap, trading volume, and changing technical indicators can provide clues that greatly influence XRP’s price trajectory. For those looking at long-term investments, the potential for bullish recovery remains, contingent on breaking through current bearish constraints and re-establishing trust among market participants in the XRP ecosystem. The coming days and weeks will be critical.

Frequently Asked Questions

How does XRP market cap pressure influence XRP price predictions?

XRP market cap pressure can significantly affect price predictions as a larger market cap typically indicates greater trading volume and investor confidence. When market cap pressures build, it may suggest an impending change in direction for XRP’s price, either up or down, depending on market conditions. Analysts consider these dynamics when forecasting future price movements.

What role does XRP trading volume play in assessing market cap pressure?

XRP trading volume is a critical factor in assessing market cap pressure. High trading volumes often correlate with significant price movements and can signal strong market interest or sentiment changes. Conversely, low trading volumes may indicate a weakening market cap, often leading to bearish trends in XRP prices.

What insights can cryptocurrency market analysis provide about XRP’s market cap pressure?

Cryptocurrency market analysis can reveal trends and patterns in XRP’s market cap pressure by examining trading behaviour, investor sentiment, and price movements. This analysis helps identify potential bullish or bearish trends, allowing traders to make more informed decisions regarding XRP investments.

How do technical analysis indicators reflect XRP market cap pressure?

Technical analysis indicators, such as moving averages and relative strength index (RSI), help traders gauge market cap pressure on XRP. For instance, if indicators show consistent lower highs and lows, it reflects strong bearish market sentiment, suggesting decreased market cap pressure and potential price decline.

Can a bearish trend in XRP affect overall market cap pressure?

Yes, a bearish trend in XRP can contribute to overall market cap pressure by driving down the asset’s value and reducing investor confidence. As prices decline, market cap declines as well, creating a self-reinforcing cycle where negative sentiment leads to further sell-offs and price drops.

| Key Metrics | Value |

|---|---|

| Current Price Range | $2.77 – $2.91 |

| Market Cap | $167 Billion |

| 24-Hour Trading Volume | $5.24 Billion |

| Recent Price Action | Downtrend with lower highs and lows |

| Support Level | $2.70 |

| Resistance Level | $3.10 – $3.18 |

Summary

XRP market cap pressure continues to weigh heavily on the asset as it remains susceptible to more bearish trends. With a current market cap of $167 billion, significant trading activity and previous price action suggest that short-term consolidation amidst selling pressure could lead to further declines if critical support levels are breached. Investors are advised to monitor key resistance and support levels closely, as they will play a critical role in determining XRP’s future price trajectory.