Bitcoin miners earnings have witnessed a significant downturn recently, reflecting troubling trends in Bitcoin mining revenue. The recent five-month low in these earnings signals the struggles miners face as the crypto landscape evolves, complicated further by the current Bitcoin difficulty. As the hashrate performance fluctuates, miners find themselves grappling with diminishing rewards due to an increased number of competing miners. With the stark decline in revenues, many are left questioning their strategies amidst changing crypto investment trends. As they wait for potential recovery through difficulty adjustments, the quest for profitability in this high-stakes environment becomes more pressing than ever.

The financial returns for those engaged in cryptocurrency mining are currently on a steep decline, as evidenced by the latest figures indicating a drop in Bitcoin miners’ compensation. This downturn is exacerbated by the rising mining difficulty, which challenges miners to maintain efficiency and output in an increasingly competitive field. With the hashrate performance trending upwards, miners are forced to confront the harsh economic realities of lower earnings, impacting their operational viability. As the ecosystem shifts and crypto investment trends fluctuate, miners are left in a precarious position, striving to adapt while navigating a landscape riddled with challenges.

Current Bitcoin Mining Revenue Trends

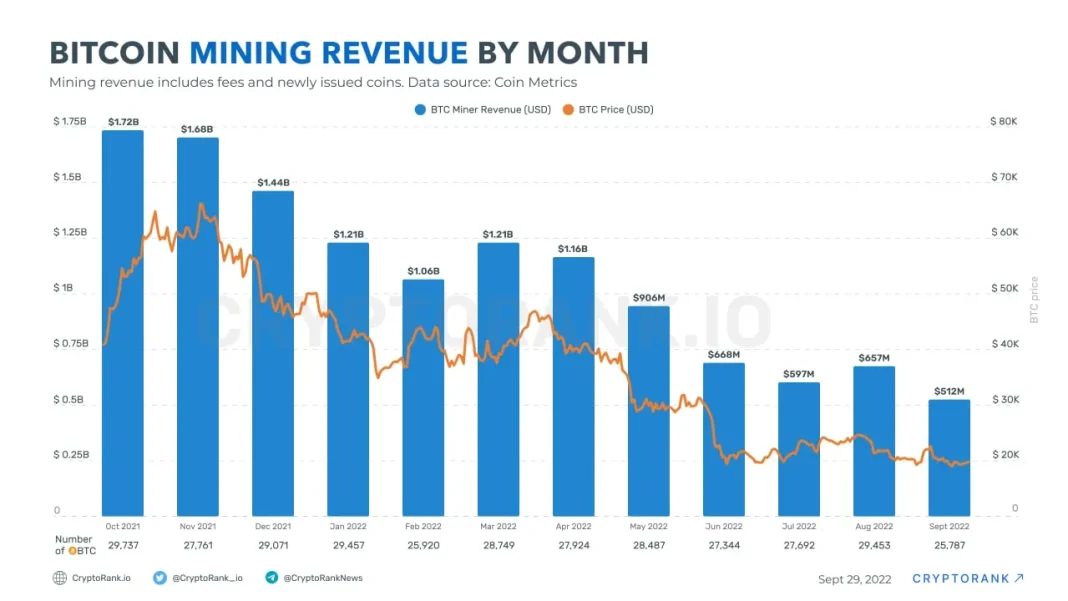

As of now, Bitcoin mining revenues have experienced a staggering decrease, dropping by 27% in the last five months. This decline is primarily attributed to the falling hashprice, which has plummeted from $63.92 to $46.92 per petahash per second (PH/s). This reduction is significant and reflects a broader trend impacting the profitability of mining operations as many miners struggle to cover their operational costs in a highly competitive environment.

The recent figures highlight a critical point for Bitcoin miners: managing expenses during downturns in revenue is becoming increasingly challenging. With the current Bitcoin mining difficulty reaching an all-time high of 150.84 trillion, any minor fluctuations in market conditions can drastically affect miners’ earnings. This current scenario emphasizes the importance of efficiency at scale, as miners who cannot adapt may find themselves increasingly unable to compete.

Challenges Faced by Bitcoin Miners

Bitcoin miners are currently facing numerous challenges that affect their earnings and long-term sustainability. A significant factor is the increasing current Bitcoin difficulty, which has reached an unprecedented level. This high difficulty means that miners require more computational power to successfully mine each block of Bitcoin, which in turn leads to higher electricity bills and reduced profit margins.

Moreover, the hashrate performance has also played a critical role in these struggles. Despite maintaining a robust hashrate above 1,000 exahash per second, the recent slowdown in block intervals reflects that the network is becoming congested, further complicating the revenue landscape for miners. With increased competition and diminishing returns, mining operations must innovate and optimize their processes to remain viable in this harsh economic climate.

The Future of Bitcoin Mining Amidst High Difficulty

As Bitcoin mining faces unprecedented challenges, many miners are left pondering what the future holds. The upcoming difficulty adjustment on October 16 could offer some respite with potential estimates indicating a reduction of up to 5.84%. However, this drop alone may not be sufficient to reverse the damage inflicted by months of high difficulty and declining earnings. Robust management strategies and efficiency measures will be essential for miners navigating this landscape.

In light of current crypto investment trends shifting towards more sustainable practices, Bitcoin miners must also consider their energy consumption and environmental impact. As more investors turn towards green solutions, those who prioritize energy efficiency and sustainability may find themselves better positioned in a market that increasingly values eco-friendly practices. The path forward will undoubtedly require adaptability and innovation.

Examining Bitcoin Miners’ Earnings Crater Impact

With Bitcoin miners’ earnings hitting a five-month low, the implications stretch beyond just their profitability. The ripple effect of such a substantial drop can impact the broader cryptocurrency ecosystem, as miners play a crucial role in transaction validation and network security. If mining operations continue to face diminishing returns, we might witness a significant reduction in the overall hashrate, potentially leading to slower transaction times and increased fees.

The situation has led to a rising concern among crypto investors regarding the viability of Bitcoin mining as an investment. As miners struggle to maintain operational viability, the dynamics of supply and demand could lead to volatility in Bitcoin prices. Hence, understanding miners’ earnings, which are closely linked to hashprice and mining difficulty, becomes crucial for anticipating market behavior and making informed investment decisions in the future.

Hashrate Performance: A Key Indicator for Miners

Hashrate performance is a vital metric for Bitcoin miners, representing the total computational power used in the mining process. As of this writing, Bitcoin’s hashrate remains strong, hovering above the 1,000 exahash per second mark. However, despite this impressive figure, the values are deceptive when paired with increasing difficulty and falling revenues. It poses a critical question: can miners sustain their operations amid these challenging conditions?

Comparing hashrate performance trends with Bitcoin miners’ earnings provides essential insights into the health of the mining ecosystem. If the hashrate continues to rise but earnings plummet, it indicates an oversupply of computational power relative to demand—potentially leading to increased difficulty and further earnings declines. As miners strategize around these metrics, it becomes imperative for them to not only enhance their operational efficiency but also keep a close eye on market dynamics.

Bitcoin Miners’ Struggles with Current Conditions

The struggle of Bitcoin miners has become increasingly pronounced in recent months, marked by a harsh economic reality accompanied by persistent operational challenges. As the crypto market fluctuates and regulatory scrutiny grows, many miners find their strategies under pressure. With their earnings dropping significantly, miners must grapple with the dilemma of investing in better technology to remain competitive or risking operational inefficiency.

This mitigation of risks may involve an analysis of energy consumption patterns, as electricity costs have seen upward trends in many regions. As a result, miners are compelled to seek out cheaper energy sources or invest in renewable energy technologies to stabilize their profit margins. The ongoing struggle underscores the inherent risks associated with Bitcoin mining in today’s volatile environment, making adaptability and resilience key traits for survival.

Navigating the Challenges of Bitcoin Mining

In the current landscape of Bitcoin mining, navigating numerous challenges is of utmost importance for miners aiming to preserve their profitability. These challenges stem not only from high mining difficulty but also from the volatile crypto market, impacting earnings on multiple fronts. To effectively respond to these challenges, it is crucial for miners to adopt forward-thinking strategies and engage in innovative practices that can mitigate operating risks.

Moreover, a keen understanding of mining metrics and industry trends is invaluable. For instance, analyzing the current Bitcoin difficulty alongside hashrate performance can provide insights into the competitiveness of mining operations. Miners who proactively adapt their strategies based on these metrics will likely foster a competitive edge, enabling them to withstand the pressures that define today’s mining landscape while keeping their revenues more stable.

The Significance of Upcoming Difficulty Adjustments

The pending difficulty adjustment on October 16 represents a pivotal moment for Bitcoin miners currently grappling with low earnings. A potential reduction in difficulty could allow miners some breathing room, helping alleviate the strain of sustained operational losses. This forthcoming adjustment is eagerly anticipated, as it has the potential to influence overall mining competitiveness and shape miners’ future strategies.

However, while the prospects of an easier mining environment are appealing, miners must also recognize that market prices for Bitcoin will continue to play a critical role in determining revenue. By maintaining a balanced approach to both operational efficiency and market positioning, miners can better prepare for this adjustment and work toward a more profitable and sustainable mining operation.

Implications of Bitcoin Price Volatility for Miners

Bitcoin price volatility is an ever-present reality for miners, significantly influencing their gross earnings and operational strategies. With Bitcoin’s value fluctuating such that miners’ earnings can drastically change within short periods, staying attuned to market trends has become a necessity. Miners must consistently analyze price movements, adjusting their operations accordingly to maximize profitability.

Furthermore, Bitcoin miners’ financial health can often act as a barometer for broader cryptocurrency market conditions. As mining revenues decline amid price drops, so too does miners’ ability to reinvest in operations, which can lead to reduced network security over time. This interconnectedness establishes that miners must navigate both internal operational challenges and external market pressures to maintain their economic viability.

Frequently Asked Questions

Why are Bitcoin miners’ earnings dropping significantly?

Bitcoin miners’ earnings are experiencing a significant drop due to the latest hashprice statistics, which fell by **26.58%** in the past five months, combined with record-high mining difficulty. Miners are currently earning less per petahash due to these adverse market conditions.

What is the current Bitcoin mining revenue trend?

The current Bitcoin mining revenue trend shows a decline, with earnings per petahash decreasing from **$63.92 to $46.92** over the last few months. This represents the lowest revenue levels bitcoin miners have faced in five months.

How does the current Bitcoin difficulty affect miners’ earnings?

The current Bitcoin difficulty impacts miners’ earnings negatively, as it is at an all-time high of **150.84 trillion**. This heightened difficulty means that miners are facing tougher competition, leading to reduced earnings despite maintaining strong hashrate performance.

What are the factors contributing to Bitcoin miners’ struggles lately?

Bitcoin miners are struggling due to a combination of falling hashprices and high mining difficulty, which results in decreased revenues. Additionally, the recent price fluctuations of Bitcoin further complicate their earnings, making profitability a challenge.

How does Bitcoin miners’ hashrate performance influence their earnings?

Bitcoin miners’ hashrate performance, currently above **1,000 exahash per second (EH/s)**, indicates strong computational capacity. However, even with high hashrate performance, earnings are still hampered by low hashprices and high mining difficulty, which affects overall profitability.

When can Bitcoin miners expect a change in mining difficulty?

Bitcoin miners can expect the next mining difficulty adjustment on **Oct. 16**, with a predicted **5.84%** reduction. If this adjustment occurs as projected, it could provide some relief and improve miners’ earnings potential.

| Key Point | Details |

|---|---|

| Earnings Drop | Bitcoin miners have experienced a 27% decrease in revenues over the last five months. |

| Current Hashprice | The hashprice has fallen from $63.92 to $46.92 per petahash per second (PH/s). |

| Bitcoin Price as of October 6 | Bitcoin was priced at $126,272, but the hashprice lagged at $52.77, down 17.45% since July. |

| Mining Difficulty | Bitcoin mining difficulty currently stands at an all-time high of 150.84 trillion, making it one of the toughest periods for miners. |

| Next Difficulty Adjustment | A potential 5.84% decrease in difficulty is projected for October 16, providing hope for miners. |

Summary

Bitcoin miners earnings have seen a significant downturn, dropping 27% over the past five months due to a combination of decreasing hashprices and record-high network difficulty. With current mining conditions being one of the toughest in recent months, miners are hopeful that the upcoming difficulty adjustment on October 16 will provide some relief and help in bouncing back from these challenges.