The Crypto Fear and Greed Index (CFGI) serves as a crucial barometer for assessing the emotional temperature of the cryptocurrency market. Recently, it has plunged into the “extreme fear” category with a striking score of 24 out of 100, indicating heightened apprehension among investors. This dip in sentiment underscores the ongoing struggles within the crypto community, reflecting broader concerns about market stability and investor psychology. A deeper look into the Crypto market sentiment reveals that while fear can signal caution, it also presents potential buying opportunities for savvy traders. As the volatility continues, understanding the nuances of these indicators can fortify crypto investment strategies and enhance market confidence.

Known primarily as a sentiment gauge for digital currencies, the Fear and Greed Index provides insights into the prevailing attitudes of investors. This tool can be likened to a mood gauge, capturing the psychological aspects of crypto trading, ranging from unshakeable fear to irrational exuberance. Recent readings indicate a significant level of concern among traders, with the Crypto Fear and Greed Index reflecting caution in what has been a tumultuous financial landscape. The differing scores between alternative platforms highlight the variance in market assessments, encapsulating the intricate relationship between emotional responses and financial decisions. As investors navigate these fluctuations, leveraging insights from such sentiment metrics becomes essential for formulating effective trading strategies.

Understanding the Crypto Fear and Greed Index

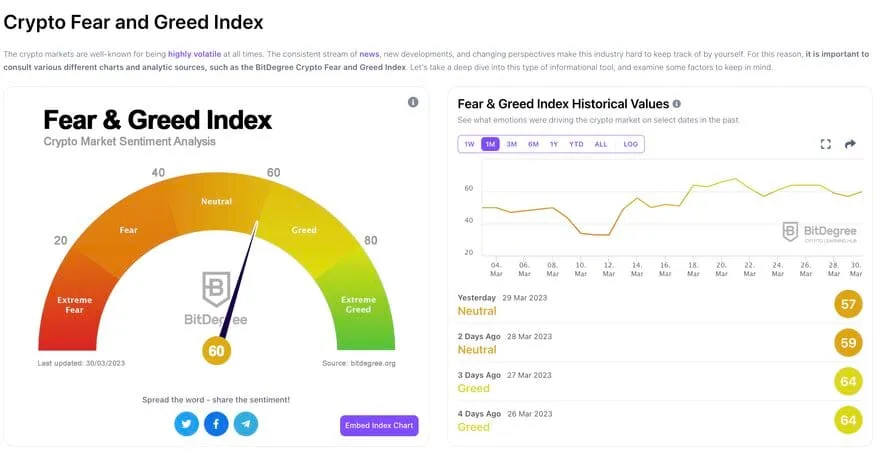

The Crypto Fear and Greed Index (CFGI) is an essential tool for understanding the emotional landscape of the cryptocurrency markets. This index quantitatively measures the fear or greed sentiment prevalent among investors, providing a snapshot of market confidence on a scale from 0 to 100. A lower CFGI score indicates heightened fear and uncertainty, while higher scores suggest optimism and greed among market participants. For instance, with the CFGI currently resting at 24, it’s indicative of a period steeped in extreme fear, a sentiment that is often reflective of a cautious approach by investors.

Using the CFGI effectively requires an understanding of its implications on market psychology. In an ecosystem characterized by volatility, the index serves as a barometer for investor sentiment—shaping trading behaviors and strategies. When the CFGI plunges into the ‘extreme fear’ zone, experienced investors may interpret this as a buying opportunity, recognizing that market overreactions can precede recoveries. Thus, the CFGI does not merely serve as a measure of current psychological states but also provides cues about possible future market movements.

The Implications of Fear and Greed in Crypto Trading

Understanding the emotions captured by the Fear and Greed Index is crucial for crafting successful crypto investment strategies. Fear typically leads investors to sell their holdings, potentially driving prices down further, which can create opportunities for those willing to take calculated risks. Conversely, greed often inflates asset prices, which may prompt wise investors to sell and capitalize on gains, anticipating a correction. This dynamic shows just how critical market sentiment is and how it interplays with trading decisions and overall market confidence.

When fear permeates the market, it can create an atmosphere of anxiety where investors hesitate to enter trades or hold onto assets. This hesitance often leads to decreased market liquidity, compounding the challenges faced by traders. However, these moments of fear can also set the stage for ‘buy low, sell high’ strategies if investors can navigate the landscape wisely and identify undervalued opportunities. Keeping track of fear and greed sentiment can greatly enhance an investor’s ability to make informed decisions.

Examining the Divergence Between CMC FGI and CFGI Scores

The divergences seen between the CMC Fear and Greed Index and the Crypto Fear and Greed Index highlight the complexities of crypto investor psychology. While both indices aim to provide insights into market sentiment, variations in their scoring—31 on the CMC FGI against 24 on the CFGI—point to different interpretations of current market conditions. This discrepancy can prompt investors to consider multiple perspectives when evaluating market trends. It emphasizes the importance of comprehensive analysis and understanding that emotions can drive different outcomes even within similar time frames.

Such variation can also serve as a warning sign for investors. For example, if the CFGI indicates extreme fear while the CMC FGI remains in the fear zone, it could suggest that the market sentiment is fractured. Investors who observe this divergence should proceed with caution, as it may indicate an unstable market ripe for either correction or unexpected rollercoaster movements. Thus, these indices are crucial for informed decision-making in an unpredictable environment.

Frequently Asked Questions

What does the Crypto Fear and Greed Index (CFGI) represent in crypto market sentiment?

The Crypto Fear and Greed Index (CFGI) is designed to gauge the emotional sentiment of crypto investors by measuring levels of fear and greed on a scale from 0 to 100. It helps identify market trends and trader psychology, indicating whether the market is overly fearful or speculative.

How does the CFGI influence crypto investment strategies?

The CFGI serves as a crucial tool in shaping crypto investment strategies. When the index indicates extreme fear, it may present a buying opportunity, as investors often perceive the market as oversold. Conversely, high levels of greed can signal potential market corrections.

Why is the CFGI significant for understanding crypto investor psychology?

The CFGI is significant for understanding crypto investor psychology because it reflects collective emotions that can influence trading behavior. A high level of fear may dampen investor participation, while excessive greed can lead to speculative bubbles, both of which impact market dynamics.

What’s the difference between the Crypto Fear and Greed Index (CFGI) and Coinmarketcap’s CMC Fear and Greed Index?

The main difference lies in their data sources and calculation methods. The CFGI and Coinmarketcap’s CMC Fear and Greed Index may produce varied scores due to differing assessments of market sentiment, providing diverse perspectives to traders.

How can traders interpret a score of 24 on the Crypto Fear and Greed Index (CFGI)?

A score of 24 on the CFGI indicates ‘extreme fear,’ which suggests that traders are very cautious. This level of pessimism often signifies potential buying opportunities, as it may indicate the market is undervalued.

What potential outcomes can result from a low Crypto Fear and Greed Index score?

A low Crypto Fear and Greed Index score can lead to opportunities for contrarian investors looking to buy at a discount when market sentiment is at its worst. However, it also underscores the risks of continued market volatility and uncertainty.

How often should investors check the Crypto Fear and Greed Index to refine their strategies?

Investors should regularly check the Crypto Fear and Greed Index, ideally daily or weekly, to stay informed about shifts in market sentiment that could impact their investment strategies and timing.

Can the Crypto Fear and Greed Index predict market movements?

While the Crypto Fear and Greed Index can indicate prevailing sentiment and potential turning points, it is not a guaranteed predictor of market movements. Investors should use it in conjunction with other analyses to make informed decisions.

What implications does the Fear and Greed Index have on overall market confidence?

The Fear and Greed Index directly impacts overall market confidence. High fear may discourage new investments, leading to lower market activity, while increased greed can drive speculative behavior, affecting the stability of crypto markets.

| Key Points |

|---|

| The Crypto Fear and Greed Index (CFGI) has dropped to a score of 24, indicating ‘extreme fear’. |

| Coinmarketcap’s Fear and Greed Index (CMC FGI) shows a value of 31, still indicating ‘fear’ but less severe than the CFGI. |

| The total cryptocurrency market cap is currently valued at $3.84 trillion, just shy of the $4 trillion mark. |

| Indices act as mood rings for the crypto market, revealing investor sentiments and potential market movements. |

| Low CFGI and CMC FGI indicate traders’ hesitance, reflecting an uncertain market environment despite some recovery signs. |

| Fear can alert investors to oversold conditions, signaling potential opportunities for recovery in the market. |

| Market sentiment can shift unpredictably; caution is advised as emotional factors heavily influence price movements in crypto. |

Summary

The Crypto Fear and Greed Index serves as a vital indicator of market sentiment, reflecting the emotional climate within the cryptocurrency investment community. As the CFGI has registered a low score of 24, indicating extreme fear, and the CMC FGI sits at 31, it is evident that investors are grappling with caution in a market that is not yet fully recovering. Understanding these indices allows traders to navigate the crypto landscape more strategically, especially in times of heightened uncertainty.