Pig butchering scams have emerged as a significant threat in the realm of online fraud, drawing the attention of the U.S. Treasury as they target unsuspecting individuals seeking investment opportunities. These elaborate schemes, often orchestrated through fake relationships, have fleeced American citizens out of billions, leading to recent actions aimed at their dismantlement. Central to these efforts is the seizure of a staggering 127,271 bitcoins, valued at approximately $12 billion, which authorities associate with Chen Zhi and his Cambodia-based Prince Group. This crackdown not only seeks to obstruct their operations but also highlights the intersection of transnational crime and cryptocurrency, as law enforcement aims to safeguard consumers. As the pig butchering scam epidemic reveals new depths of deception, understanding its mechanics is crucial for anyone navigating the investment landscape.

Also known as relationship scams or romance fraud, the methods used in these deceitful schemes often involve cultivating trust over time before exploiting victims financially. These operations frequently unfold across borders, further complicating the efforts of law enforcement agencies to track down those responsible. Recently, the U.S. Treasury has intensified its focus on such fraudulent activities, particularly in connection with high-profile entities like the Prince Group, which has been accused of numerous offenses including human trafficking. The alarming fusion of digital currencies like bitcoin with these fraudulent practices has prompted a reevaluation of regulatory approaches to combat such transnational criminal enterprises. As these methods evolve, ongoing vigilance and education about potential warning signs become increasingly important for investors.

Understanding Pig Butchering Scams

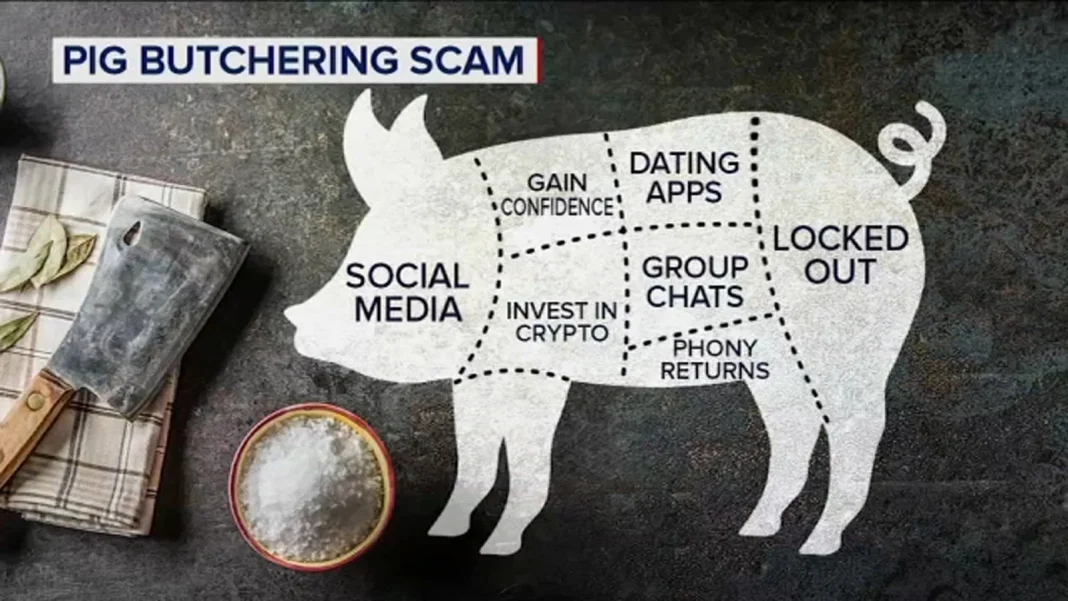

Pig butchering scams are an insidious form of online fraud that typically involves long-term relationship-building between scam operators and their victims, often leading to substantial financial losses. This term derives from the notion of fattening up a pig before it is butchered, symbolizing how scammers manipulate victims into investing large sums of money under false pretenses before disappearing with their funds. These scams have significantly evolved in recent years, with many originating from Southeast Asia, particularly Cambodia, where organized criminal networks have become adept at employing these tactics.

One notorious player in the landscape of pig butchering scams is the Prince Group, led by Chinese national Chen Zhi. The U.S. Department of the Treasury has linked the organization’s activities to large-scale fraud that targets unsuspecting investors. Following the recent sanctions announced by the Treasury, it becomes clear that the implications of such scams reach far beyond individual financial losses; they represent a significant threat to the integrity of global financial systems.

Frequently Asked Questions

What are pig butchering scams and how do they operate?

Pig butchering scams are fraudulent schemes where scammers build relationships with victims to gain their trust, only to lead them into fake investment opportunities, ultimately stealing their money. These scams often target individuals through fake online platforms, enticing them with high returns on investments, similar to methods employed by the Prince Group.

How is the U.S. Treasury responding to pig butchering scams?

The U.S. Treasury is implementing extensive sanctions and seizure actions against entities involved in pig butchering scams, like the Prince Group, which is accused of defrauding U.S. citizens out of billions. The seizure of 127,271 bitcoin is part of a broader effort to dismantle these transnational criminal networks.

What link does Chen Zhi have to pig butchering scams?

Chen Zhi, the leader of the Prince Group, is implicated in orchestrating large-scale pig butchering scams, where victims are lured through long-term relationships into investing in bogus opportunities, leading to significant financial losses and exploitation.

What measures are being taken against the Prince Group for pig butchering scams?

The U.S. Treasury and other financial enforcement agencies have sanctioned the Prince Group, blocking their access to the U.S. financial system and targeting their assets. This includes warm sanctions and the seizure of bitcoin laundering proceeds linked to their fraudulent activities.

Why is the seizure of bitcoin important in tackling pig butchering scams?

Seizing the 127,271 bitcoin linked to pig butchering scams is crucial for disrupting the financial infrastructure of these criminal organizations, like the Prince Group, and recovering illicit funds from scams that have defrauded billions from U.S. citizens.

What other crimes are associated with pig butchering scams?

Pig butchering scams often intertwine with other serious crimes such as human trafficking and forced labor. The Prince Group is particularly noted for running scam compounds in Cambodia, where forced labor and exploitation occur alongside fraudulent investment operations.

What role does Huione Group play in pig butchering scams?

Huione Group is a Cambodia-based conglomerate accused of laundering over $4 billion in proceeds related to pig butchering scams and other illicit activities, linking it directly to the financial operations of transnational crime networks.

How can victims of pig butchering scams seek help?

Victims of pig butchering scams should report their experiences to local law enforcement and relevant financial regulatory bodies, such as FinCEN or the U.S. Treasury, to assist in investigations and recovery efforts.

| Key Points | Details |

|---|---|

| Sanctions Announcement | The U.S. Treasury announced extensive sanctions against organizations involved in ‘pig butchering’ scams. |

| Bitcoin Seizure | 127,271 BTC worth approximately $12 billion linked to Chen Zhi of the Prince Group were targeted. |

| Prince Group Designation | Designated as a transnational criminal organization by OFAC and FinCEN. |

| Fraud and Human Trafficking | The Prince Group is accused of large-scale online investment fraud and human trafficking in Southeast Asia. |

| Victim Losses | U.S. citizens lost over $16 billion to online scams recently; $10 billion lost in 2024 alone. |

| FinCEN Actions | FinCEN also blocked Huione Group, noted for laundering over $4 billion in illicit proceeds. |

| Chen Zhi’s Role | Chen Zhi is identified as the leader of the Prince Group involved in scams and forced labor. |

| Scam Compounds | Chen’s network runs scam compounds in Cambodia that use coercion for fraud. |

| High-End Investments | Chen’s group is linked to real estate and banking ventures to conceal crime proceeds. |

| Coordinated Crackdown | The U.S. and U.K. are blocking entities related to the Prince Group to dismantle their networks. |

Summary

Pig butchering scams are a significant threat, as demonstrated by the recent extensive sanctions and investigations initiated by the U.S. Treasury. These scams involve the manipulation of victims through long-term relationships, targeting individuals with fraudulent investment schemes, often resulting in massive financial losses. The crackdown on organizations like the Prince Group highlights the urgency for international cooperation to address these criminal activities effectively.