Crypto ETF outflows have taken the spotlight this week, as both Bitcoin and Ether exchange-traded funds experienced a staggering $756 million in losses after weeks of positive momentum. This abrupt shift highlights the fragility of the current crypto market, prompting many investors to liquidate their holdings and lock in profits. The Bitcoin ETF selloff alone accounted for $327 million, with Grayscale’s Bitcoin Trust (GBTC) leading the charge in redemptions. Ether ETFs were not spared either, facing a hefty loss of $429 million as investors reacted to the evolving crypto market trends. As market participants grapple with this volatility, understanding the underlying dynamics of ETFs net outflows becomes crucial for navigating these turbulent times.

Recent trends in the cryptocurrency arena reveal a notable downturn in exchange-traded funds (ETFs), spotlighting the significant withdrawals from both Bitcoin and Ether funds. The recent selloff, reflecting broader crypto market dynamics, underscores the importance of monitoring these financial instruments that allow investors to gain exposure to digital assets. With high-profile funds like the Grayscale Bitcoin Trust at the forefront of these fluctuations, the momentum shifts can often signal broader market sentiments. As investors react to shifting trends, the impact on assets under management is profound, illustrating a crucial phase in the evolving landscape of crypto investments. Keeping a close eye on these developments is essential for anyone engaged in the crypto market.

Understanding the Recent Crypto ETF Outflows

The recent outflows from crypto exchange-traded funds (ETFs) highlight the ongoing volatility and unpredictable nature of the cryptocurrency market. After two weeks of positive inflows, totaling a significant surge in investments, both Bitcoin and Ether ETFs faced a stark reversal at the start of the week. In just a matter of days, these funds recorded net outflows of $756 million, with investors reacting swiftly to the shifting market dynamics. This selloff serves as a reminder that while the crypto landscape can thrive, it is equally susceptible to rapid changes as sentiment fluctuates.

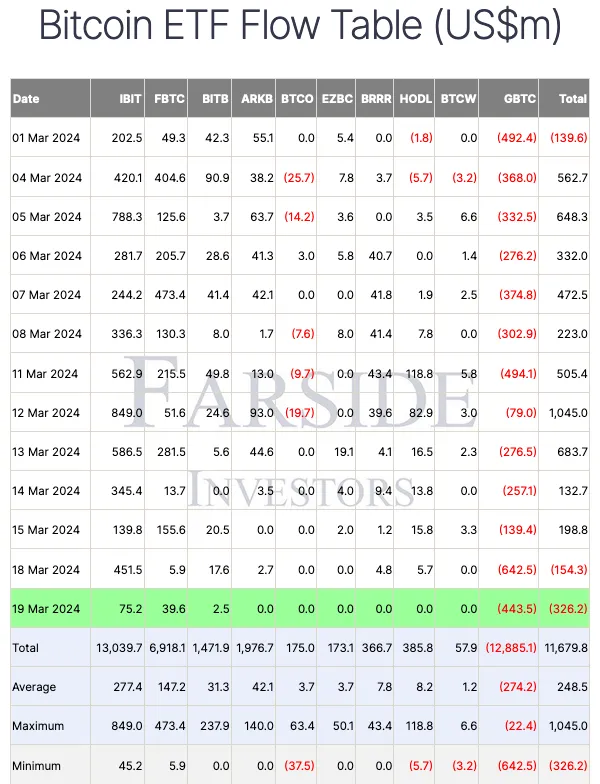

The combined outflows of Bitcoin and Ether ETFs reveal a complex interplay of investor behavior. Bitcoin ETFs specifically saw $327 million in withdrawals, with major players like Grayscale’s GBTC leading the charge with sizable redemptions. This shift not only affects individual investor portfolios but also signals to the broader market about potential liquidity issues and changing demand trends. Understanding these outflows can provide insights into future market movements, particularly how they relate to cumulative trends in cryptocurrency and investor sentiment.

Impact of Bitcoin ETF Selloff on Market Sentiments

The Bitcoin ETF selloff, particularly the significant withdrawals from Grayscale’s Bitcoin Trust, has created ripples throughout the crypto trading ecosystem. Such movements induce a psychological impact on traders and investors alike, often leading to increased caution in the market. Investors are likely to reassess their positions when faced with substantial outflows, typically driven by profit-taking after previous bullish trends. This behavior can influence overall market sentiment, leading to further declines or consolidations as traders react to the adverse news.

Market analysts closely monitor these trends, as fluctuations in Bitcoin ETF outflows can correlate with broader market behaviors. The recent $327 million exodus indicates a possible shift in confidence among institutional investors, especially those who have backed these ETFs during profitable phases. As we navigate this uncertain terrain, observing how subsequent market movements align with these outflows will be essential for predicting future performance, not just for Bitcoin but for the entire spectrum of cryptocurrencies.

Ether ETF Losses and Their Broader Implications

Ether ETFs have also faced significant setbacks, with withdrawals totaling $429 million across various funds. The predominant outflows stem from major players like Blackrock’s ETHA, which alone accounted for a substantial portion of these losses. The decreasing net asset values of Ether ETFs, currently at $28.75 billion, reflect a broader trend in the crypto market influenced by falling investor confidence. This can deter potential investors and complicate future capital inflow strategies as other players weigh their participation in a market characterized by such volatility.

The implications of these Ether ETF losses extend beyond immediate financial metrics. They serve as a crucial barometer for investor sentiment towards Ethereum and, by extension, the DeFi ecosystem. As these funds struggle, there’s a potential spillover effect that could slow down Ether’s development and adoption, particularly within decentralized applications. By analyzing the reasons behind the outflows, stakeholders can address the root causes of investor hesitancy, potentially strategizing better ways to bolster confidence in Ether and its associated financial products.

Trends in ETFs Net Outflows and Their Significance

The broader landscape of ETFs reflects shifting trends in investor behavior, particularly in the cryptocurrency sector. Recent net outflows signal a pivotal moment where investors are recalibrating their risk exposures after a period of aggressive buying. Understanding the magnitude of these net outflows is crucial as it often correlates with macroeconomic factors influencing investor decisions. The reported $756 million exit from Bitcoin and Ether ETFs provides insight into not just the individual environments of these currencies, but also the overall appetite for risk in the finance sector.

Market watchers utilize these outflow trends to gauge investor sentiment, which can serve as a predictive tool for future movements. Such shifts typically indicate caution as traders navigate the duality of potential gains against the backdrop of considerable risk, particularly highlighted after weeks of strong inflows. The relative scale of these ETFs net outflows emphasizes the importance of adaptive strategies for investors and fund managers aiming to maintain liquidity and investor interest in a fluctuating market.

The Role of Grayscale Bitcoin Trust in ETF Performance

The Grayscale Bitcoin Trust (GBTC) has become a significant player in the cryptocurrency exchange-traded funds ecosystem, often serving as a bellwether for market trends. Its recent outflows, which reached approximately $145 million, spotlight the trust’s influence on Bitcoin’s overall performance within ETFs. This level of redemption indicates that even a robustly performing trust can experience challenges amidst turning market conditions, reflecting the inherent volatility of cryptocurrencies.

GBTC’s role extends beyond its financial implications; it also shapes investor perceptions about how Bitcoin and the cryptocurrency market are evolving. As the largest Bitcoin fund, GBTC sets standards for other ETFs, and its outflows may raise concerns about overall investor sentiment. Understanding these fluctuations helps investors identify patterns that can inform future strategies, particularly regarding how they balance risk and opportunity in an increasingly competitive market.

Market Trading Volume and Its Relationship with ETF Outflows

Despite the considerable outflows observed in Bitcoin and Ether ETFs, trading activity remains robust, with a significant trading volume recorded at $6.63 billion for Bitcoin and $2.82 billion for Ether. This paradox of higher trading volumes amidst outflows indicates a level of investor engagement that suggests a keen interest in navigating the market’s volatility. The relationship between trading volume and ETF outflows can often provide insights into potential recovery phases or further declines, as high volumes can reflect either panic selling or strategic buying.

The current trading dynamics highlight a delicate balance where active trading may occur in response to fluctuating prices driven by market sentiment and ETF outflows. Investors might take advantage of abrupt price changes, either to secure profits or to capitalize on perceived undervalued assets. The continued observation of these trading volumes in relation to growing ETFs net outflows will be essential in understanding how investors choose to engage with the market amidst unpredictability.

Future Outlook: Will Crypto ETFs Recover?

As the dust settles from recent crypto ETF outflows, the question on the minds of many investors is whether the market will recover. Although the sharp decreases in Bitcoin and Ether ETFs are concerning, historical patterns within the crypto market suggest turbulence is often followed by recovery periods. Investors will be watching closely for potential signs of stabilization and renewed inflows, which can signal a turnaround in sentiment. The resilience of crypto markets often hinges on external factors such as regulatory developments and broader financial trends.

Going forward, the potential for a resurgence exists, particularly if investors perceive current price corrections as opportunities. The crypto market, while experiencing a momentary setback, has exhibited a tendency to rebound strongly from previous sell-offs. Engaging with indicators such as future trading volumes and changes in ETF net flows will be crucial for gauging the outlook of Bitcoin and Ether ETFs in the months to come.

Investor Strategies in Response to ETF Movements

In light of the recent ETF outflows, investors are prompted to revisit their strategies in the cryptocurrency market. The situation reiterates the necessity for adaptive approaches amid rapid market changes. Many traders may implement diversified strategies, including holding a mix of long and short positions, to hedge against potential losses while positioning themselves for future gains. By analyzing historical outflows and understanding market signals, investors can develop more informed decisions that align with their risk tolerance.

Consideration of key factors such as profit-taking, market sentiment, and external financial influences will play a vital role in shaping these strategies. Investors should also remain aware of the potential for sudden market reversals, taking advantage of buying opportunities created by temporary price drops. As the cryptocurrency landscape continues to evolve, staying informed on ETF movements and their implications will be critical in navigating the complexities of the market.

Frequently Asked Questions

What caused the crypto ETF selloff and how much was lost?

The recent crypto ETF selloff resulted in total outflows of $756 million, primarily driven by profit-taking from investors after two weeks of strong inflows. Bitcoin ETFs lost approximately $327 million, while Ether ETFs faced heavier losses of about $429 million.

Which specific crypto ETFs were significantly impacted by outflows?

Bitcoin ETFs like Grayscale’s GBTC and Bitwise’s BITB experienced the largest outflows, with Grayscale losing $145 million and Bitwise $115 million. Ether ETFs were also heavily affected, with Blackrock’s ETHA seeing a significant exit of $310 million.

What trends are we observing in crypto ETF net outflows?

The recent crypto ETF net outflows indicate a trend where investors are cashing out profits after substantial gains. The selloff highlights a volatile aspect of crypto market trends, which can shift quickly even after bullish periods.

How do Grayscale Bitcoin Trust outflows compare to other bitcoin ETFs?

Grayscale Bitcoin Trust (GBTC) experienced significant outflows of $145 million, making it one of the hardest hit compared to other bitcoin ETFs, such as Bitwise’s BITB and Fidelity’s FBTC, which saw $115 million and $93 million in withdrawals respectively.

What is the trading volume surrounding the recent crypto ETF outflows?

Despite the $756 million in total outflows, the trading activity around these crypto ETFs remained robust, with a trading volume of $6.63 billion for bitcoin ETFs and $2.82 billion for ether ETFs, indicating continued investor interest.

How did Ether ETFs perform compared to Bitcoin ETFs during the outflow period?

During the recent outflow period, Ether ETFs faced a larger impact with $429 million in losses compared to Bitcoin ETFs, which saw $327 million. This highlights the heightened volatility in Ether-related investment vehicles.

What lessons can investors learn from the recent crypto ETF outflows?

Investors should recognize the importance of market volatility and remain cautious. The significant outflows serve as a reminder that while crypto ETFs can see robust inflows, they are also subject to rapid sell-offs, indicating an unpredictable market environment.

Are there any successful crypto ETFs amidst the recent selloff?

Yes, despite the overall crypto ETF selloff, Blackrock’s IBIT ETF recorded inflows of $60 million, providing a positive counterpoint to the broader trend of net outflows witnessed by other crypto investment vehicles.

| Crypto ETF | Outflow Amount (in million $) | Factors | Notable Funds |

|---|---|---|---|

| Bitcoin ETFs | 326.52 | Profit-taking after significant inflows | Grayscale’s GBTC (-145.39), Bitwise’s BITB (-115.64), Fidelity’s FBTC (-93.28) |

| Ether ETFs | 428.52 | Increased profit-taking pressure | Blackrock’s ETHA (-310.13), Grayscale’s Ether Mini Trust (-49.67) |

Summary

Crypto ETF outflows this week highlight the impactful nature of market volatility, as bitcoin and ether ETFs saw a combined total of $756 million exit following two weeks of solid inflows. The selloff was primarily driven by profit-taking, demonstrating that even in a bullish market, investors are quick to capitalize on gains. Notably, while some funds like Blackrock’s IBIT managed to attract new investments, the overall trend reflected a cautious sentiment among investors as they navigated through substantial market shifts.