Bitcoin mining difficulty is a crucial metric that directly influences the profitability and sustainability of Bitcoin mining operations. Recently, at block height 919,296, miners experienced a rare moment of relief as the mining difficulty eased by 2.73%, reducing the strain on their efforts to solve complex mathematical problems. For weeks, Bitcoin miners faced mounting challenges as the difficulty escalated to record levels, straining their resources and impacting mining revenue. The latest adjustment, although a welcome change, comes amidst a backdrop of fluctuating hashrate levels and disappointing Bitcoin prices. As the cryptocurrency landscape evolves, understanding these dynamics remains essential for miners striving to navigate this volatile market.

In the world of cryptocurrency, the concept of mining difficulty plays a pivotal role in determining the ease or difficulty of generating new Bitcoin blocks. With the latest adjustments to the mining parameters, miners found some respite, particularly after enduring a prolonged period of increasing computational demands. This recent drop not only affects the profitability of these digital miners but also impacts the overall hashrate across the Bitcoin network. As we delve deeper into the fluctuations of these metrics, it’s vital to recognize how they interplay with market conditions, influencing everything from mining revenue to operational strategies. Ultimately, the quest for understanding mining efficiency will become ever more significant as Bitcoin’s blockchain continues to mature.

Understanding Bitcoin Mining Difficulty and Its Impact

Bitcoin mining difficulty is a critical metric that determines how challenging it is for miners to validate transactions and add new blocks to the blockchain. At block height 919,296, this difficulty saw a 2.73% decrease, marking a significant relief for miners who have been struggling with soaring difficulty levels that peaked at 150.84 trillion. This reduction signifies that it has become slightly easier for Bitcoin miners to secure rewards by validating transactions, which encourages more participation in the network and can potentially enhance mining revenue during tough market conditions.

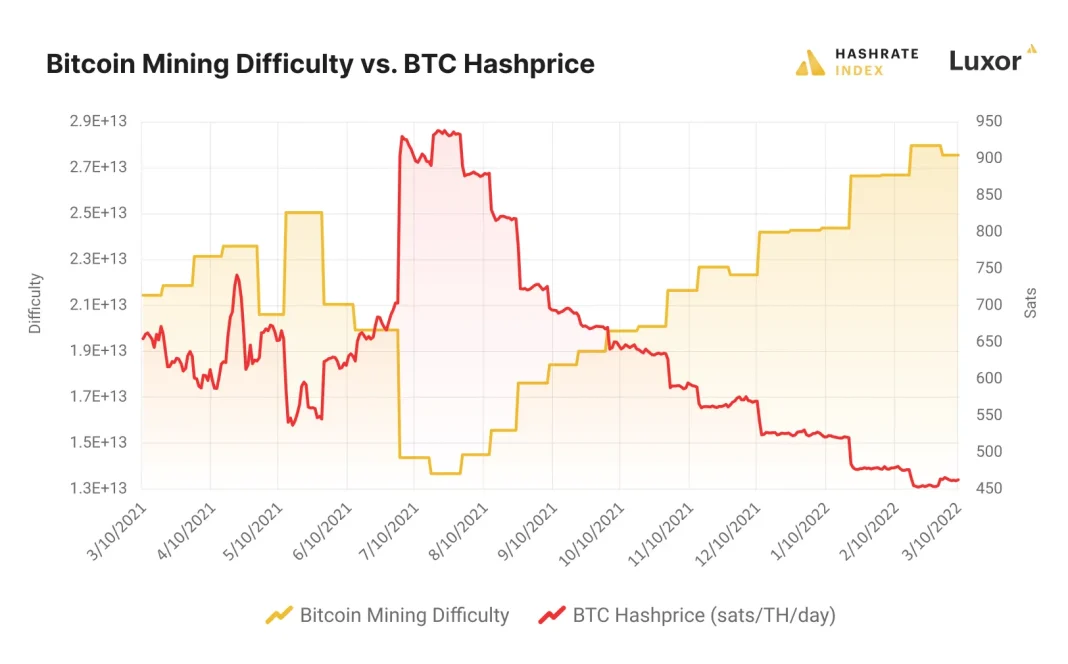

The dynamic nature of Bitcoin’s mining difficulty is designed to maintain a stable block generation time of approximately every 10 minutes. However, varied conditions such as rapid fluctuations in hashrate and network participation can lead to adjustments in difficulty. The latest adjustment showcases how responsive the Bitcoin network is to the overall mining environment. As miners adapt to these changes, understanding how difficulty impacts their operations and profitability becomes paramount, especially when faced with erratic price movements.

Frequently Asked Questions

What is Bitcoin mining difficulty and why is it important?

Bitcoin mining difficulty is a measure of how challenging it is for Bitcoin miners to find new blocks. It adjusts approximately every two weeks to ensure that blocks are mined roughly every 10 minutes, regardless of the total hashrate of the network. This adjustment is crucial as it influences mining revenue and profitability for Bitcoin miners.

What contributed to the recent drop in Bitcoin mining difficulty?

The recent drop in Bitcoin mining difficulty was due to a 2.73% decrease at block height 919,296, which provided miners with a brief respite after a series of increases that made mining more challenging.

How does a decrease in Bitcoin mining difficulty affect mining revenue?

A decrease in Bitcoin mining difficulty can lead to an increase in mining revenue for miners, as it becomes easier to solve cryptographic puzzles and earn Bitcoin. However, if the price of Bitcoin also declines, it may offset these gains.

What is the relationship between Bitcoin miners’ hashrate and mining difficulty?

The hashrate represents the total computational power of Bitcoin miners. When the hashrate increases, mining difficulty typically rises to maintain the target block time of around 10 minutes. Conversely, if the hashrate decreases, mining difficulty will lower to help maintain this schedule.

When will the next Bitcoin mining difficulty adjustment occur?

The next Bitcoin mining difficulty adjustment is expected on Oct. 30, 2025. Predictions suggest it may increase by approximately 3.39% if current mining rates persist.

What is the significance of block height in relation to Bitcoin mining difficulty?

Block height refers to the total number of blocks mined on the Bitcoin blockchain. It is significant because it marks the points at which difficulty adjustments are scheduled, affecting how Bitcoin miners operate and earn rewards.

How does the current Bitcoin hashprice impact miners?

As of Oct. 16, 2025, Bitcoin’s hashprice is around $47.92 per petahash per second (PH/s). This pricing metric directly impacts miners’ profitability; a lower hashprice indicates that miners earn less for their efforts, especially when coupled with high mining difficulty.

What challenges do Bitcoin miners face with increasing difficulty?

When Bitcoin mining difficulty increases, miners face heightened computational demands, potentially leading to higher operational costs and lower profitability unless Bitcoin prices rise to compensate for these challenges.

| Key Point | Details |

|---|---|

| Mining Difficulty Adjustment | Bitcoin mining difficulty decreased by 2.73% at block height 919,296, the first reduction since June. |

| Current Difficulty Level | The current mining difficulty is 146.72 trillion. |

| Effect of Difficulty Decrease | The decrease means it’s 2.73% easier for miners to find a block compared to recent months. |

| Miners’ Revenue Impact | Despite the difficulty drop, miners’ revenue has decreased from $53.85 to $47.92 per PH/s over the last month. |

| Current Hashrate | The network hashrate is at 1,104.55 EH/s, close to its all-time high. |

| Projected Future Difficulty | The next difficulty adjustment is expected to potentially increase by 3.39% on Oct. 30, 2025. |

Summary

Bitcoin mining difficulty has seen a reduction after several challenging months for miners. With the latest adjustment of 2.73%, miners can enjoy a temporary reprieve, allowing for slightly easier block discovery. However, as other market factors such as hashprice and hashrate continue to fluctuate, the situation remains dynamic. It’s important for miners to stay vigilant as further adjustments loom, and profitability may still fluctuate significantly moving forward.